Introduction

As the cryptocurrency market continues to expand, so does the sophistication and prevalence of scams targeting investors. In 2024 alone, crypto-related scams accounted for over $9.3 billion in losses, marking a 66% increase from the previous year . Understanding these scams is crucial for anyone involved in the crypto space.

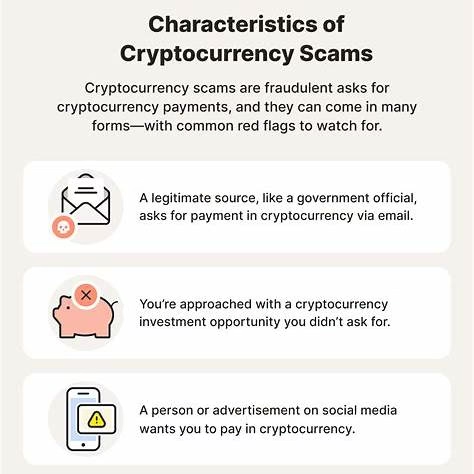

Image source: “How to Stay Safe from Crypto Scams” infographic.

Understanding the Psychology Behind Crypto Scams

Cryptocurrency scams don’t just rely on clever code, they exploit human psychology. The promise of overnight wealth taps into our greed and reward-seeking instincts, making offers like “double your BTC in 24 hours” or “1000% returns” seem tempting, even when they defy logic. Scammers fuel this allure with urgency and FOMO (Fear of Missing Out), using limited-time offers, fake countdowns, and hype-driven social media campaigns to push victims into snap decisions. This emotional rush short-circuits critical thinking, making even cautious investors act impulsively.

These schemes also lean heavily on authority bias and social proof. Scammers impersonate influencers, exchange executives, or even public figures like Elon Musk to gain trust. They also build fake communities, pack them with bots or testimonials, and create the illusion that “everyone else is in.” Compounding the risk, crypto’s complex jargon like “smart contracts” or “DAOs” creates a false sense of legitimacy. Users who don’t fully understand the tech may still trust it blindly, mistaking complexity for credibility. When technical fatigue sets in, mental shortcuts take over, making users more susceptible to phishing, approval scams, or wallet drainers.

Image source: Characteristics of cryptocurrency scams (infographic).

Emotional manipulation is another powerful weapon. In romance scams or long-term “pig butchering” cons, scammers build trust slowly, using love or friendship as the bait. Victims don’t fall for the crypto, they fall for the person. And once money is invested, confirmation bias takes hold: people seek validation rather than question their decision, often reinvesting even after red flags appear. In the end, scammers don’t just steal funds, they exploit trust, emotion, and the innate desire to belong or succeed quickly. Awareness of these psychological tactics is critical to staying safe in a space where technology may be neutral, but manipulation is deeply human.

1. Rug Pulls

A rug pull occurs when developers abandon a project and run away with investors’ funds.

Real Case: In February 2024, BitForex executed a suspected rug pull, withdrawing about $56.5 million in cryptocurrency before going dark.

Red Flags:

- Anonymous or unverified team members

- Lack of transparency and documentation

- Unrealistic promises of high returns

Image source: “What is a Rug Pull?”,explanatory chart and data.

Prevention Tips:

- Research the development team and project history

- Look for third-party audits of smart contracts

- Be cautious of projects with sudden hype and no clear roadmap

2. Phishing Attacks

Phishing involves tricking individuals into revealing sensitive information through fake websites or communications.

Real Case: Cybercriminals targeted Mac users by distributing fake Ledger Live apps designed to steal cryptocurrency wallet seed phrases.

Red Flags:

- Unsolicited emails or messages requesting personal information

- Websites with slight misspellings or unusual URLs

- Requests for seed phrases or private keys

Image source: Types of cryptocurrency scams

Prevention Tips:

- Always verify the URL of websites before entering sensitive information

- Use two-factor authentication (2FA) on all accounts

- Never share your seed phrase or private keys

3. Fake Airdrops and Giveaways

Scammers promise free tokens or returns in exchange for sending cryptocurrency.

Real Case: Scammers used deepfake videos of celebrities to promote fake giveaways, convincing victims to send cryptocurrency with the promise of receiving more in return.

Red Flags:

- Requests to send cryptocurrency to receive more

- Unverified social media accounts promoting giveaways

- Time-sensitive offers creating urgency

Prevention Tips:

- Avoid sending cryptocurrency to unknown addresses

- Verify promotions through official channels

- Be skeptical of offers that seem too good to be true

4. Ponzi Schemes and High-Yield Investment Programs (HYIPs)

These schemes promise high returns with little risk, paying earlier investors with funds from new investors.

Real Case: In 2024, high-yield investment scams accounted for over 50% of crypto fraud cases.

Red Flags:

- Guaranteed returns with no risk

- Pressure to recruit new investors

- Lack of transparency about investment strategies

Prevention Tips:

- Conduct thorough research before investing

- Be wary of schemes that rely on continuous recruitment

- Understand the investment model and where returns are generated

5. Pump-and-Dump Schemes

Coordinated efforts to inflate the price of a cryptocurrency before selling off, leaving other investors with losses.

Real Case: In 2024, numerous pump-and-dump schemes were orchestrated through social media platforms, leading to significant investor losses.

Red Flags:

- Sudden spikes in price without news or developments

- Promotion by unverified influencers

- Lack of fundamental value or utility in the project

Prevention Tips:

- Avoid making investment decisions based solely on social media hype

- Research the project’s fundamentals and use cases

- Be cautious of low-volume tokens with sudden price increases

6. Fake Exchanges and Wallets

Scammers create counterfeit platforms to steal users’ funds and personal information.

Real Case: Fake versions of popular wallets like Ledger Live have been used to steal seed phrases from unsuspecting users.

Red Flags:

- Applications not found on official app stores

- Websites with slight misspellings or unusual domains

- Requests for sensitive information upon installation

Prevention Tips:

- Download software only from official websites or verified app stores

- Verify the authenticity of platforms before entering personal information

- Use hardware wallets for added security

7. Impersonation Scams

Scammers pose as trusted individuals or entities to deceive victims into sending funds or revealing information.

Real Case: In 2024, scammers impersonated celebrities and influencers to promote fake investment opportunities, leading to significant losses.

Red Flags:

- Unsolicited messages from individuals claiming to be public figures

- Requests for money or personal information

- Poor grammar or unusual communication styles

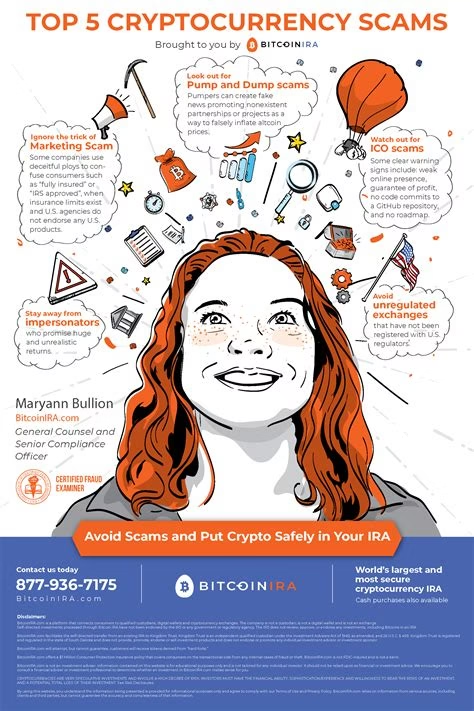

Image source: Top 5 cryptocurrency scams infographic

Prevention Tips:

- Verify identities through official channels

- Be skeptical of unsolicited messages requesting funds

- Report suspicious activity to relevant authorities

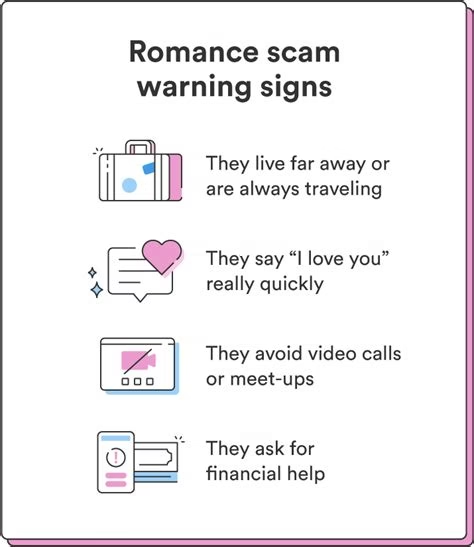

8. Romance and Pig Butchering Scams

Scammers build fake romantic relationships to manipulate victims into sending cryptocurrency.

Real Case: In 2024, romance scams resulted in over $1.6 billion in losses among individuals aged 60 and older.

Red Flags:

- Rapid escalation of online relationships

- Requests for financial assistance

- Reluctance to meet in person or via video calls

Image source: Romance scam warning signs

Prevention Tips:

- Be cautious of online relationships that progress quickly

- Avoid sending money to individuals you haven’t met in person

- Consult with friends or family before making financial decisions

9. NFT Scams

Fraudulent activities involving non-fungible tokens (NFTs), including fake marketplaces and counterfeit art.

Real Case: Scammers created fake NFT marketplaces to steal funds from unsuspecting buyers and sellers.

Red Flags:

- Unverified marketplaces or platforms

- Offers that seem too good to be true

- Lack of information about the creator or project

Prevention Tips:

- Use reputable NFT marketplaces

- Verify the authenticity of NFTs and their creators

- Be cautious of unsolicited offers or promotions

10. Malware and Wallet Drainers

Malicious software designed to steal cryptocurrency by gaining unauthorized access to wallets.

Real Case: In 2024, malware attacks targeting cryptocurrency users increased significantly, leading to substantial losses.

Red Flags:

- Unexpected prompts to enter seed phrases

- Installation of unknown software or browser extensions

- Unusual activity in cryptocurrency wallets

Prevention Tips:

- Keep software and antivirus programs up to date

- Avoid downloading software from unverified sources

- Regularly monitor wallet activity for unauthorized transactions

Pro Tips to Stay Safe in Crypto

How the pros actually protect their funds in a space full of traps

The crypto world is a bit like the Wild West- exciting, full of promise, but also swarming with outlaws. If you want to play smart and stay protected, here are five field-tested tips that experienced crypto users live by. These aren’t just nice-to-haves, they’re non-negotiables in today’s landscape.

1. Lock the Front Door: Use 2FA on Everything

Your password alone won’t cut it anymore. Turn on Two-Factor Authentication (2FA) on all your crypto exchanges and wallets. And don’t rely on SMS codes, those can be hijacked. Instead, use an app like Google Authenticator or Authy for better security. This is your digital seatbelt, basic, but it saves lives.

2. Don’t Store Fortunes in Hot Wallets

Trading wallet? Fine. Storing your life savings on an exchange? Bad idea. Cold wallets, like Ledger or Trezor, keep your crypto offline, where hackers can’t touch it. Think of it as storing gold bars in a private vault instead of leaving them in your glovebox. If it’s not something you use every day, lock it down offline.

3. Bookmark Official Sites

Most phishing scams don’t start with hacking, they start with you clicking the wrong link. Always bookmark the real URLs of the exchanges, wallets, and dApps you use. Never rely on Google search or random Telegram links. One wrong letter in a domain name could cost you everything.

4. Stop Chasing Hype: FOMO Is a Trap

If a random token is suddenly “pumping” and influencers are screaming “10x soon!”, pause. Breathe. Ask yourself: Do I understand what I’m buying? If not, don’t touch it. FOMO (Fear of Missing Out) is what scammers thrive on. Instead of following hype, follow fundamentals, project utility, audits, team reputation, and tokenomics.

5. Revoke Smart Contract Approvals Every Month

Ever connected your wallet to a sketchy dApp? You might’ve given it permission to spend your tokens, forever. Use tools like Revoke.cash to check and clean up old smart contract approvals. Do this monthly like a crypto hygiene ritual. One click could save your wallet from being drained.

Image source: BBB cryptocurrency scams infographic

Final Word: Stay Sharp, Stay Skeptical

The best defense isn’t just tech, it’s awareness. Scammers prey on emotion, haste, and lack of knowledge. The more proactive you are, the less likely you are to get burned. Keep learning, question everything, and treat security like your net worth depends on it because in crypto, it does.

What to Do If You’ve Been Scammed

Falling victim to a crypto scam can feel overwhelming and isolating, but you’re not alone, and there are steps you can take to minimize damage and protect yourself going forward. Here’s what to do if the worst happens:

1. Stop All Transactions Immediately

The moment you realize something’s wrong, freeze any further movement of funds. Don’t try to recover lost crypto by sending more,scammers often use this trick to drain wallets faster.

2. Document Everything

Keep detailed records of all communications, transaction IDs, wallet addresses, screenshots of suspicious websites, and messages. This information is crucial if you report the scam to authorities or platforms.

3. Report to Exchanges and Wallet Providers

If you sent funds via an exchange, notify their support team right away. Some exchanges have emergency freeze capabilities or can help trace stolen assets. Similarly, alert your wallet provider if you suspect your wallet was compromised.

4. File a Report with Authorities

Depending on your country, report the scam to your local cybercrime unit, financial regulator, or consumer protection agency. While crypto scams can be hard to reverse, law enforcement can investigate, potentially recover funds, and help shut down scam operations.

5. Warn the Community

Sharing your experience on social media, crypto forums, or dedicated scam alert sites helps warn others and creates a collective shield. Transparency helps reduce the scam’s impact and educates others on red flags.

6. Secure Your Accounts and Devices

Change all passwords linked to your crypto accounts, enable 2FA if not already done, and scan your devices for malware or keyloggers. Consider using a dedicated device for crypto activities to minimize future risks.

7. Learn and Recover Your Confidence

Getting scammed hurts, but it doesn’t have to stop your crypto journey. Take it as a hard lesson, double down on security habits, and remember that even experts have been tricked. Crypto success is a marathon, not a sprint.

Conclusion

Cryptocurrency represents a revolutionary financial frontier, full of promise but fraught with pitfalls for the unwary. The rise of crypto scams, fueled by technological innovation and psychological exploitation, demands more than passive awareness; it requires proactive, informed vigilance.

By understanding how scammers operate both through sophisticated technical deceit and emotional manipulation, investors can better protect themselves from losing funds and trust. The detailed identification of scam types, paired with concrete prevention strategies, equips readers with the tools needed to navigate this high-risk environment safely.

Security in crypto isn’t about paranoia, it’s about smart, consistent habits like using two-factor authentication, storing assets offline, and critically assessing hype and promises. And if the unthinkable happens, knowing how to respond swiftly and effectively can reduce damage and help rebuild confidence.

Ultimately, thriving in the crypto space means marrying technological know-how with psychological insight and a community-minded approach. Staying educated, skeptical, and careful transforms potential victims into empowered participants, ready to seize crypto’s opportunities without falling prey to its dangers.

Related Articles

- Cryptocurrency 101: a beginner’s guide to how digital money really works

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level safety tips

- Top 5 crypto wallets every new investor should consider in 2025

- DeFi explained: how decentralized finance is reshaping the future of money and traditional banking

- Ethereum vs Solana: which smart contract platform really wins on speed, cost, and ecosystem strength?