Why DeFi Lending Is Attracting So Much Attention

Passive income has always been the holy grail of personal finance. In the DeFi world, lending offers one of the most straightforward ways to earn yield without constant trading. Instead of letting crypto sit idle in your wallet, DeFi lending allows you to earn interest automatically, governed by transparent smart contracts rather than banks.

But higher freedom comes with higher responsibility. Understanding how DeFi lending works is the difference between steady returns and painful mistakes.

What Is DeFi Lending?

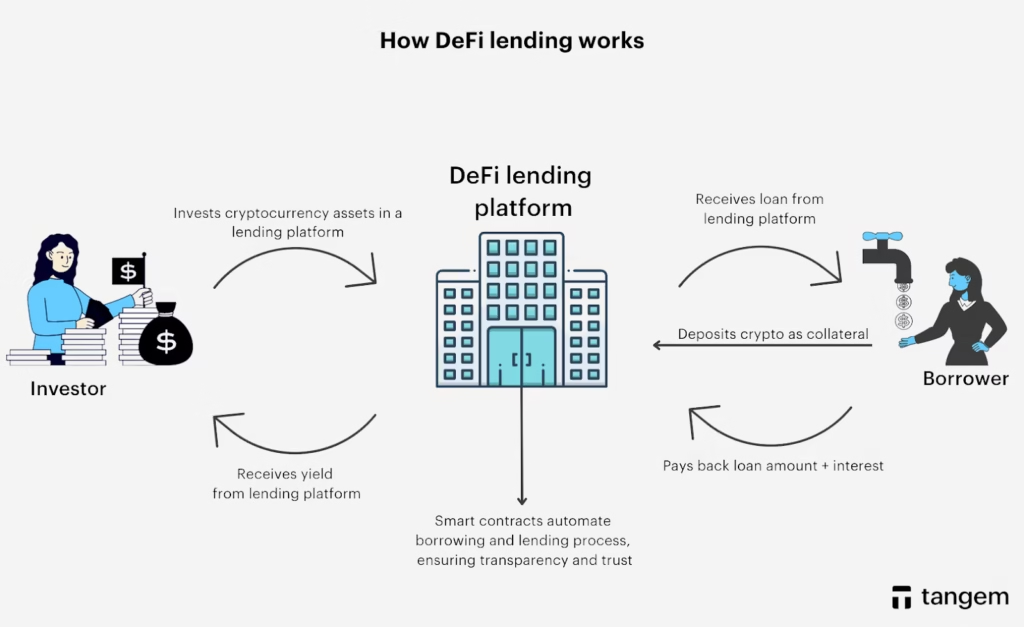

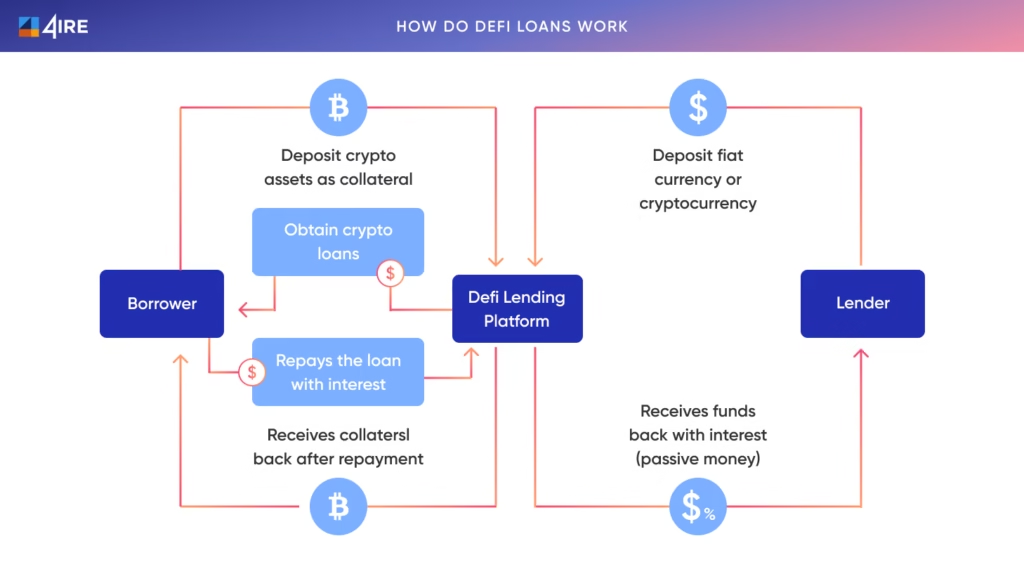

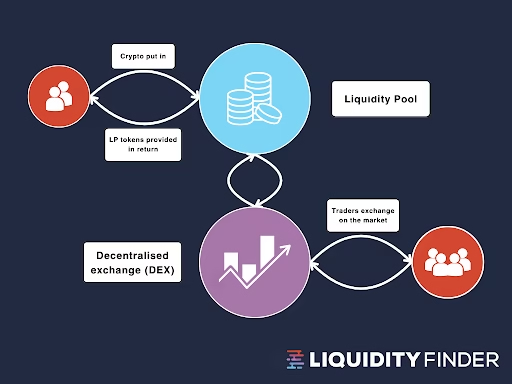

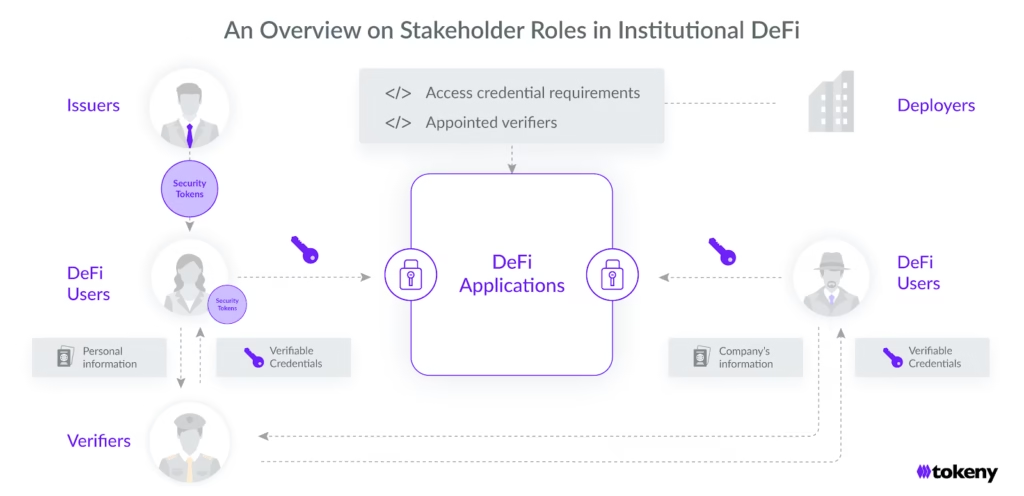

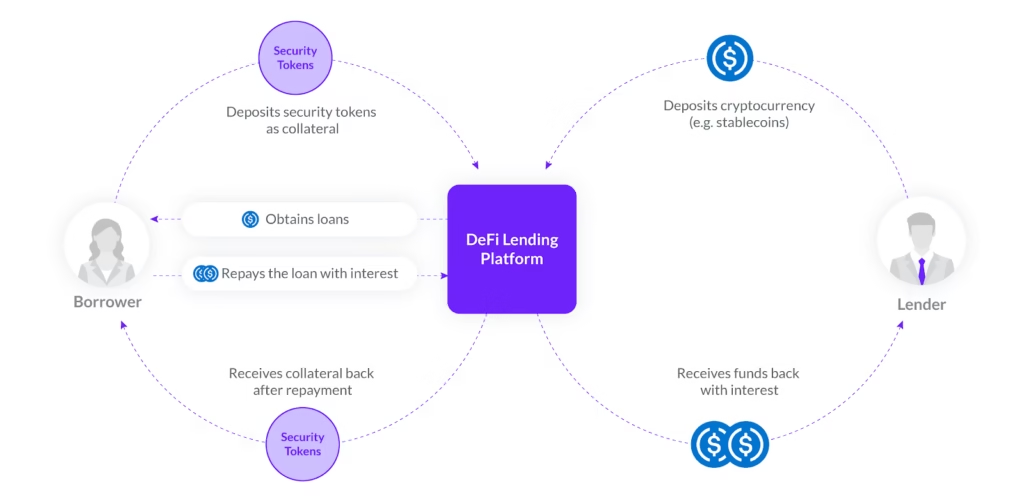

DeFi lending is a blockchain-based alternative to traditional savings and loans. Instead of depositing money into a bank, you supply crypto to a decentralized protocol. Borrowers access those funds by locking collateral, and interest is distributed automatically to lenders.

No paperwork.

No bank approval.

No human middlemen.

Everything runs on code.

Image source: Open-license DeFi educational diagrams used across blockchain learning platforms.

What You Need Before You Start

Getting started doesn’t require technical skills, but preparation matters.

Essentials Checklist

| Requirement | Why It Matters |

| Non-custodial wallet | You control your funds (MetaMask, Trust Wallet) |

| Stablecoins | Reduce volatility risk (USDC, DAI) |

| Secure device | Prevent malware & phishing |

| Seed phrase backup | Permanent access to funds |

| Small test capital | Learn safely before scaling |

Beginner rule: If you don’t understand where your seed phrase is stored, you are not ready to lend yet.

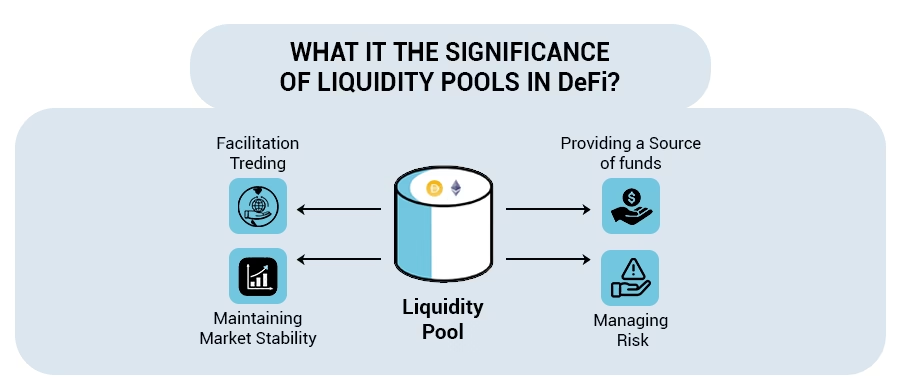

How DeFi Lending Works

Here’s what actually happens after you click “Deposit”:

- You deposit crypto into a shared liquidity pool

- Borrowers take loans by locking excess collateral

- Smart contracts manage interest and liquidations

- Interest flows back to lenders automatically

There is no banker deciding rates, supply and demand to do that in real time.

How Much Can You Earn?

| Asset Type | Typical APY (2025) |

| Stablecoins (USDC, DAI) | 4% – 10% |

| ETH / WBTC | 1% – 5% |

| Riskier DeFi tokens | 8% – 20%+ |

Returns vary by asset type and market conditions.

Important: APYs are variable. They rise when borrowing demand increases and fall when many users lend.

Trusted DeFi Lending Platforms (2025)

Not all platforms are equal. Stick to battle-tested protocols.

| Platform | Best For | Risk Level |

| Aave | Multichain, advanced features | Medium |

| Compound | Simplicity & reliability | Low–Medium |

| Spark Protocol | DAI-based savings | Medium |

| Venus | BNB Chain, higher yields | Higher |

Avoid new protocols promising extreme yields without audits, those are often traps.

Understanding the Risks

DeFi lending is not risk-free.

Key Risks You Must Understand

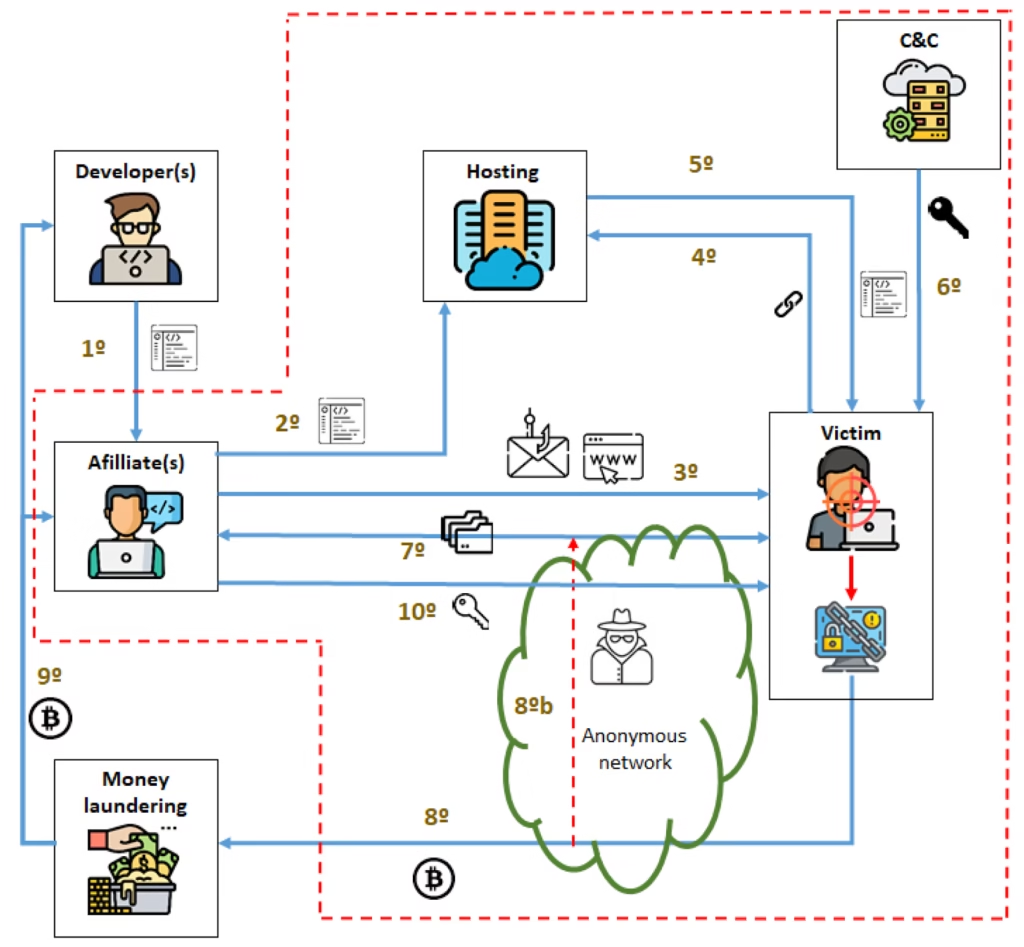

- Smart contract bugs – code can fail

- Protocol hacks – even audited platforms can be exploited

- Stablecoin depegs – rare but catastrophic

- Regulatory uncertainty – rules may change

- Liquidity crunches– withdrawals may pause briefly

Risk management isn’t optional, it’s the price of permissionless finance.

Smart Strategies for Safer Passive Income

Follow these principles and you dramatically reduce mistakes:

- Start with $50–$100, not your full stack

- Lend stablecoins first, not volatile assets

- Use multiple platforms, not one

- Bookmark official protocol URLs

- Ignore “guaranteed” APY claims

If yield feels exciting, slow down.

If it feels boring, you’re probably doing it right.

What’s Next for DeFi Lending?

The future isn’t just higher yield, it’s deeper integration.

Expect:

- Lending backed by real-world assets

- Cross-chain collateral models

- On-chain credit reputation systems

- Lower fees via Layer 2 scaling

DeFi lending is evolving from speculation into infrastructure.

Is DeFi Lending Worth It?

If you want:

- Passive income without trading

- Full control over your assets

- Transparent, programmable finance

Then DeFi lending is one of the best entry points into decentralized finance.

But it rewards patience, discipline, and learning, not shortcuts.

Bottom Line

DeFi lending isn’t magic money.

It’s code replacing banks and code doesn’t forgive ignorance.

Learn first. Start small. Scale carefully.

Related Articles

- Cryptocurrency 101: a beginner’s guide to how digital money really works

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level safety tips

- Top 5 crypto wallets every new investor should consider in 2025

- DeFi explained: how decentralized finance is reshaping the future of money and traditional banking

- Ethereum vs Solana: which smart contract platform really wins on speed, cost, and ecosystem strength?