An expanded, original explainer: how DeFi works, real use cases, risks, and practical steps for anyone who wants to participate wisely.

Quick orientation

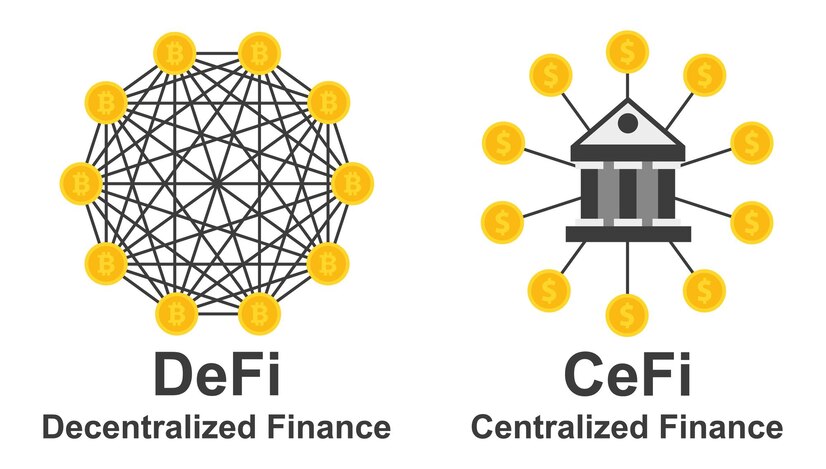

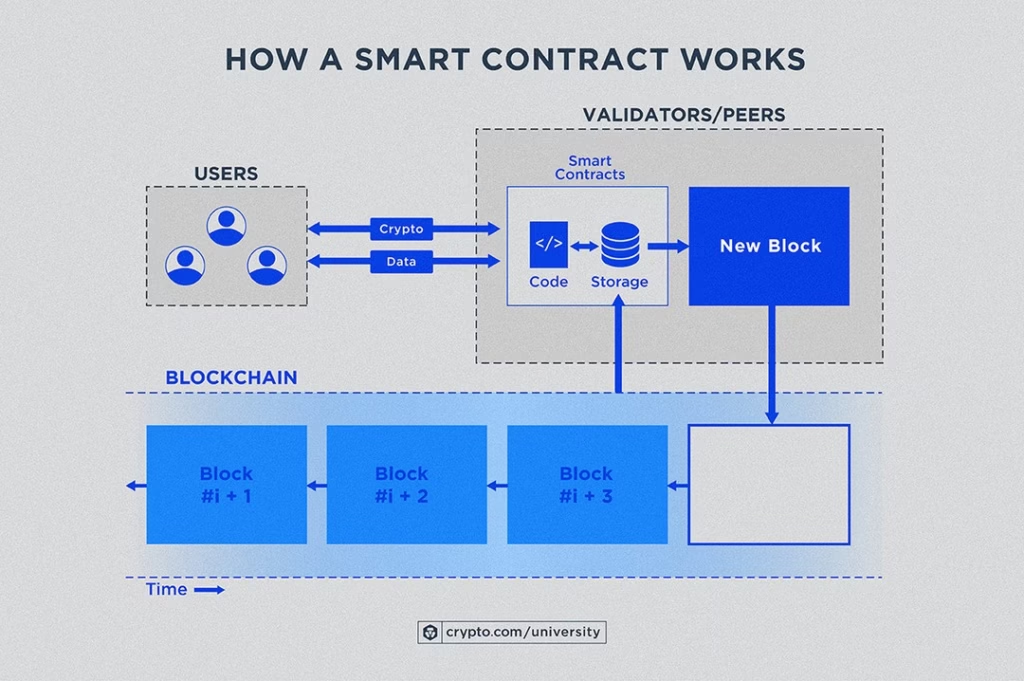

Decentralized Finance (DeFi) is a new stack of financial services built on blockchains. Instead of banks, brokers, and custodians, you interact with smart contracts, code that executes financial logic automatically and transparently. That lets people lend, borrow, trade, insure, and earn yield directly from their wallets. DeFi is powerful, composable (protocols can be combined like Lego), and global, but it’s also experimental and carries distinct technical and regulatory risks. (Investopedia)

DeFi

Imagine you could:

- lend your savings and earn interest without a bank,

- borrow instantly using on-chain collateral,

- swap tokens any time without a central exchange,

- or earn yield by providing liquidity, all from your wallet, 24/7.

That’s DeFi. The plumbing is smart contracts on a public blockchain (most DeFi activity still concentrates on Ethereum), which automate custody, settlement, and enforcement. Because the rules are code, transactions are visible to everyone and (in principle) don’t require trust in human intermediaries. (Bank for International Settlements)

Image source (DeFi ecosystem): DeFi ecosystem diagram showing lending, DEXs, stablecoins and more.

The building blocks of DeFi

DeFi is not one thing, it’s a stack of primitives:

- Stablecoins: on-chain currencies pegged to fiat, used for price stability and settlement.

- Lending protocols: pools where suppliers earn interest and borrowers post collateral (e.g., Aave, Compound). (aave.com)

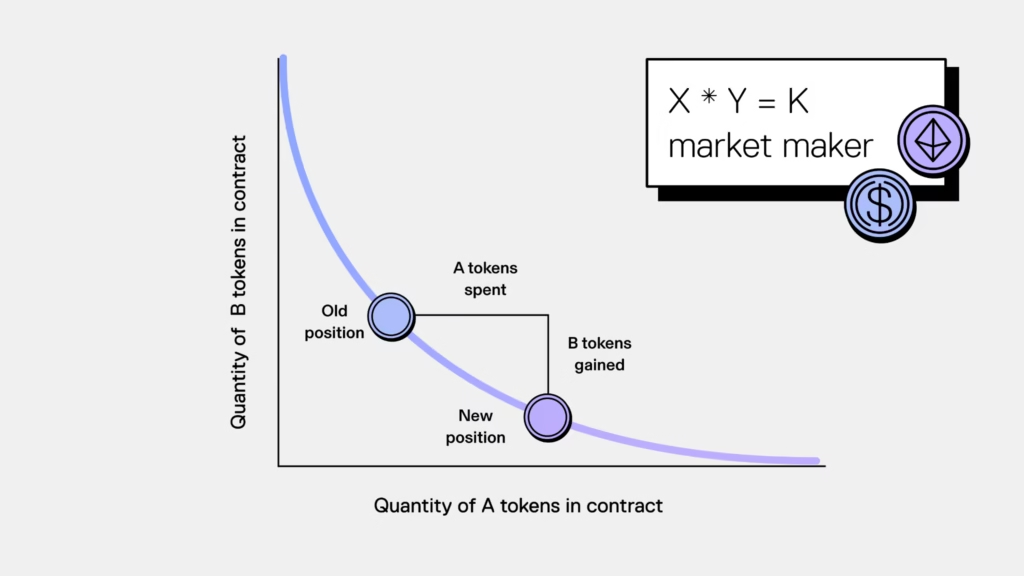

- Automated Market Makers (AMMs): DEXs where liquidity pools and algorithms price trades (e.g., Uniswap). (Uniswap Labs)

- Derivatives & synthetics: tokenized exposure to stocks, commodities, or indices.

- Yield aggregators / vaults: tools that automatically route capital to the highest-return strategies.

- Oracles & infrastructure: services that feed real-world prices into smart contracts.

These primitives are highly composable: a lending protocol can accept LP (liquidity provider) tokens from an AMM as collateral, while a yield optimizer may rotate liquidity across pools, creating entirely new financial products on-chain.

Image source (AMM diagram): Visual illustrating the constant-product AMM (x*y=k).

A very short walk-through: what happens when you lend on Aave

- You deposit a stablecoin into Aave’s pool.

- The smart contract mints aTokens that represent your share and start accruing interest.

- Borrowers post over-collateralized assets to pull loans from the pool.

- Interest rates adjust algorithmically based on supply and demand.

No bank teller, no approvals, just code enforcing rules. (Aave’s docs describe this non-custodial liquidity model in detail.) (aave.com)

Why DeFi is gaining traction, 4 real advantages

- Permissionless access: Anyone with a wallet can interact with protocols, no bank account or credit check needed.

- Composability (open innovation): Protocols can be combined to create new products quickly.

- Competitive yields & efficiency: Cutting out intermediaries often pushes returns and UX improvements.

- Transparency: On-chain transactions are auditable, reducing some information asymmetries found in TradFi.

Growth is measurable: Total Value Locked (TVL) and usage metrics though fluctuating, show DeFi has matured from hobbyist code to serious infrastructure on multiple chains. Central banks and regulators are watching closely as the sector scales. (Bank for International Settlements)

Real-world use cases

- Lending & borrowing: Earn interest or borrow without credit checks (Aave, Compound). (aave.com)

- Decentralized trading: Swap tokens instantly on Uniswap or Sushiswap using liquidity pools. (Uniswap Labs)

- Stablecoins for remittance: Move value cheaply across borders without bank rails.

- Synthetic exposure: Gain price exposure to assets (stocks, commodities) via tokenized derivatives.

- Insurance & risk markets: On-chain policies for smart-contract failures and hacks.

Image source (Smart contract flow): Smart contract execution and how on-chain logic triggers state changes.

Risks you must take seriously

DeFi’s promise comes with tangible hazards:

| Risk | What it means | How to reduce it |

| Smart-contract bugs | Code vulnerabilities can be exploited | Prefer well-audited, battle-tested protocols; diversify |

| Rug pulls / governance attacks | Developers or token controllers behave maliciously | Use protocols with transparent teams, timelocks, multisig |

| Impermanent loss | LPs lose value when paired token prices diverge | Understand AMM maths; use stable-stable pools when possible |

| Oracle manipulation | Bad price feeds can trigger wrong liquidations | Favor protocols using multiple reputable oracles |

| Regulatory change | Laws or enforcement can restrict services | Track legal developments; limit exposure where uncertain |

Security incidents remain significant: 2025 reporting shows large, high-profile DeFi hacks and warnings about sector vulnerabilities, a sober reminder that speed of innovation sometimes outpaces security. (Financial Times)

DeFi vs TradFi at a glance

| Feature | DeFi | Traditional Finance |

| Accessibility | Permissionless, global | Requires accounts, KYC, local access |

| Custody | Self-custody or protocol custody | Bank/custodian custody |

| Availability | 24/7 | Business hours, settlement windows |

| Transparency | On-chain audit trails | Often opaque balance sheets |

| Risk profile | Smart-contract & market risk | Counterparty & systemic risk |

Practical starter steps: a safety checklist

- Learn the basics (smart contracts, stablecoins, AMMs). Trusted resources: protocol docs and neutral explainers. (Investopedia)

- Use hardware wallets for significant holdings.

- Start small, experiment with tiny deposits and withdraws first.

- Prefer audited, large-TVL protocols with long operational histories. (TVL is a useful but imperfect signal.) (DeFi Llama)

- Monitor on-chain metrics (active addresses, exchange flows) and follow security alerts.

Cautious optimism

DeFi is not a magic bullet, but it solves real inefficiencies: composability, permissionless access, and programmable money. Institutional interest, tokenization of real-world assets, and cross-chain tooling are likely to expand DeFi’s footprint, provided security and regulation mature in parallel. If the sector survives the inevitable technical disruptions, it could become foundational infrastructure for the next generation of financial products. (Bank for International Settlements)

Where to read next (recommended trustworthy resources)

- Protocol docs: Aave, Uniswap. (aave.com)

- DeFi analytics: DeFiLlama / DeFi Pulse for TVL and protocol metrics. (DeFi Llama)

- Neutral explainers: Investopedia / BIS research for measured overviews. (Investopedia)