Clear, practical guide to crypto taxation: what events are taxable, how gains are calculated, country-specific rules, tools to automate reporting, step-by-step filing workflow, and legal ways to plan.

The bottom line in 60 seconds

Tax authorities worldwide now treat crypto seriously. If you bought, sold, swapped, spent, mined, staked, or received crypto as income, you probably have reporting obligations. The good news: once you understand what counts as a taxable event, how to compute cost basis and gains, and which tools to use, filing becomes a routine administrative task, not a crisis.

Why do tax agencies tax crypto gains?

Most countries treat crypto as property, an asset, or income, not as currency. That means when you change the ownership or form of that asset (sell for fiat, trade for another token, spend it), you may trigger a capital gain or loss. Rules vary on timing and rates, but the underlying idea is consistent: gain = disposal price-cost basis.

Image source: Public tax-agency and financial-education infographics (used for educational context).

What usually counts as a taxable event

While local details differ, the common taxable events are:

- Selling crypto for fiat (e.g., BTC → INR/USD/EUR)

- Trading crypto for crypto (ETH → SOL), treated as disposal in many countries

- Spending crypto to buy goods/services (merchant transactions)

- Receiving crypto as payment for work, freelance gigs, or business income

- Staking rewards, mining, airdrops, often taxed as income when received

- Gifts and inheritance, taxed depending on donation/gift tax rules locally

If the transaction changes the economic ownership or produces value you can measure in fiat, assume it may be taxable.

How to calculate gains

Basic formula:

Capital gain = Proceeds (on disposal) – Cost basis (what you paid + allowable fees)

Example:

- Bought 1 BTC at ₹16,00,000 (cost basis)

- Sold for ₹24,00,000 → capital gain = ₹8,00,000

If you received BTC as salary: you owe income tax on the market value when received; later, when you sell, any further change is a capital gain (or loss).

Short-term vs long-term: timing matters

Many countries tax short-term gains (assets held < threshold) at ordinary income rates and long-term gains at preferential rates. Examples:

| Country | How crypto is treated | Notes |

| India | Virtual Digital Asset (VDA) | 30% flat tax on gains; 1% TDS on transfers (2024 rules) |

| UK | Property | Capital gains rules apply; allowances may exist |

| Australia | CGT asset | Apply capital gains/losses on disposal |

| Canada | Commodity | Capital gains / business income depending on activity |

| Germany | Private asset | Gains tax-free if held >1 year (personal sales) |

| UAE | Individual ,tax-free | No personal income tax (subject to change) |

Always verify with local guidance, laws change fast.

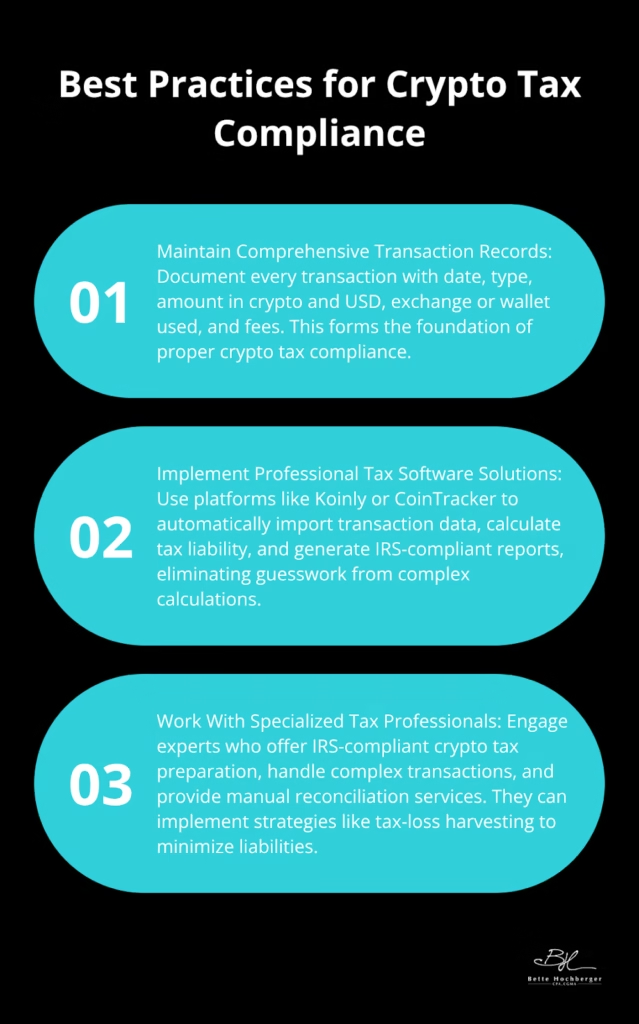

Tools that make filing manageable

Manual bookkeeping for dozens or thousands of on-chain events is error-prone. Use modern crypto tax platforms that import from exchanges and wallets, de-duplicate transfers, and calculate gains by accepted accounting methods (FIFO, LIFO, Specific ID where supported).

Popular options: Koinly, CoinTracker, CoinLedger, Accointing, CryptoTaxCalculator.

These tools export reports formatted for accountants and many include direct country-specific tax forms.

Practical tip: export CSVs and keep your raw exchange/wallet history for audits.

Step-by-step filing workflow (copy this checklist)

| Step | Action |

| 1 | Connect sources-link exchanges, wallets, and chain addresses; import CSVs. |

| 2 | Classify transactions-trades, income (staking/mining), gifts, fees. |

| 3 | Reconcile transfers-mark internal transfers between your wallets as non-taxable movements. |

| 4 | Choose accounting method-FIFO, LIFO, or Specific ID where allowed. |

| 5 | Compute gains & income-review capital gains, business income, and reportable airdrops. |

| 6 | Generate reports-produce capital gains summary and income schedules. |

| 7 | File-upload to tax portal or hand to your accountant. |

| 8 | Archive backup-retain reports, exchange statements, and wallet addresses for 6+ years. |

Smart, legal tax planning moves (not evasion)

You can plan to reduce tax legally,not hide income. Consider:

- Hold for long-term if your jurisdiction rewards longer holding periods.

- Harvest losses in a down market to offset gains (tax-loss harvesting).

- Track fees and gas, many jurisdictions allow allowable expenses to reduce gains.

- Donate appreciated crypto to qualified charities in jurisdictions that permit deductions.

- Use Specific ID (if available) to choose which lots you sell, optimizing tax impact.

Always document the rationale and keep records; voluntary disclosure is better than being audited.

If you never reported, what to do now

Don’t ignore it. Many revenue agencies run voluntary disclosure programs with reduced penalties. Steps:

- Gather transaction history and calculate unpaid tax.

- Consider voluntary disclosure to the tax authority or consult a specialist tax attorney.

- Pay assessed amounts and negotiate penalties where possible.

Regulators have blockchain analytics on hand; coming forward often reduces long-term pain.

Common pitfalls to avoid

- Treating wallet-to-wallet transfers as disposals (they’re typically not if same ownership).

- Forgetting to include staking/mining as income when received.

- Using sloppy CSVs, duplicates and missing fees produce incorrect gains.

- Assuming exchanges will report everything correctly, you are ultimately responsible.

Closing: make taxes part of the system, not the drama

Tax compliance is now part of modern crypto practice. The best outcome is procedural: set up the right imports and automation, choose an accounting approach, generate your report, file, and move on. Treat the first filing as setup work that pays dividends in clarity and confidence every year after.

Related Articles

- Cryptocurrency 101: a beginner’s guide to how digital money really works

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level safety tips

- Top 5 crypto wallets every new investor should consider in 2025

- DeFi explained: how decentralized finance is reshaping the future of money and traditional banking

- Ethereum vs Solana: which smart contract platform really wins on speed, cost, and ecosystem strength?