Exchanges are convenient but risky. Learn why “not your keys, not your coins” matters, how to move to self-custody safely, custody options (hot, cold, multisig), inheritance planning, and WordPress/Google-Docs-ready images.

Quick summary

Exchanges are useful for trading, but they are centralized custodians that control your private keys. History shows they fail, by hacks, insolvency, mismanagement, or regulatory intervention. Self-custody (controlling your own private keys) restores ownership and reduces single-point-of-failure risk. This guide explains why exchange custody is risky, how to migrate safely, custody options (and trade-offs), and operational practices for long-term security, plus ready-to-use images and HTML for WordPress and Google Docs.

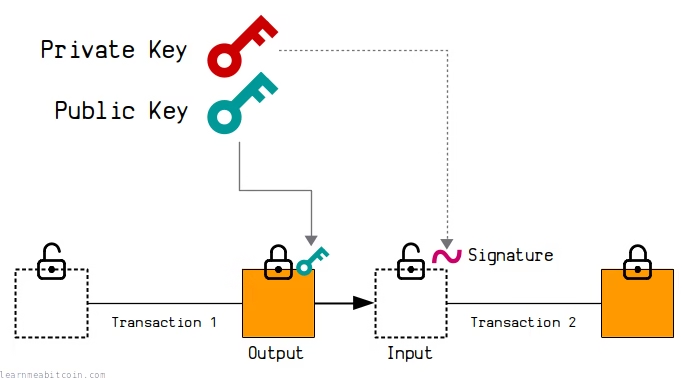

1. The fundamental problem: you don’t own your keys on exchanges

When you deposit crypto on an exchange you are effectively giving the exchange custody of your assets. Legally and technically:

- The exchange controls the private keys.

- Your account is an IOU on the platform, not direct ownership of coins on-chain.

- If the exchange freezes withdrawals, is hacked, or collapses, your access is at the mercy of operators, courts, or hackers.

That’s the difference between owning an on-chain UTXO/account and owning a balance on a centralized ledger.

Figure 1 – Custody comparison: Exchange (custodial) vs Self-custody (you control keys).

Source: Original educational diagram showing who controls keys and risks (for use in articles and guides).

2. A brief (painful) history of exchange failures

Exchanges concentrate risk, large balances, internal ledgers, and high-value targets. Famous failures include Mt. Gox, QuadrigaCX, and FTX. Common failure modes:

- External hack – attackers steal private keys or hot-wallet funds.

- Insider theft – operators move user funds off-platform.

- Operational insolvency – risky business practices, leverage, or poor reserves.

- Regulatory seizure or freeze – accounts locked by court orders or government actions.

- Software bugs & misconfiguration – lost or corrupted private keys.

These events show the structural vulnerability of centralized custody.

3. Self-custody: options, trade-offs, and when to use each

Self-custody means you or a trusted scheme holds the keys. Options vary by security, convenience, and cost.

a) Hot wallets (software/mobile)

- What: Wallet apps (MetaMask, Trust Wallet, Exodus).

- Use for: Small balances, everyday spending, DeFi interaction.

- Pros: Fast, convenient, integrated with dApps.

- Cons: Online attack surface (phishing, malware).

b) Hardware wallets (cold storage)

- What: Devices that sign transactions offline (Ledger, Trezor, Coldcard).

- Use for: Long-term storage, large balances.

- Pros: Strong protection from remote hacks; seed can be backed up physically.

- Cons: Cost, user learning curve, safe-keeping of seed required.

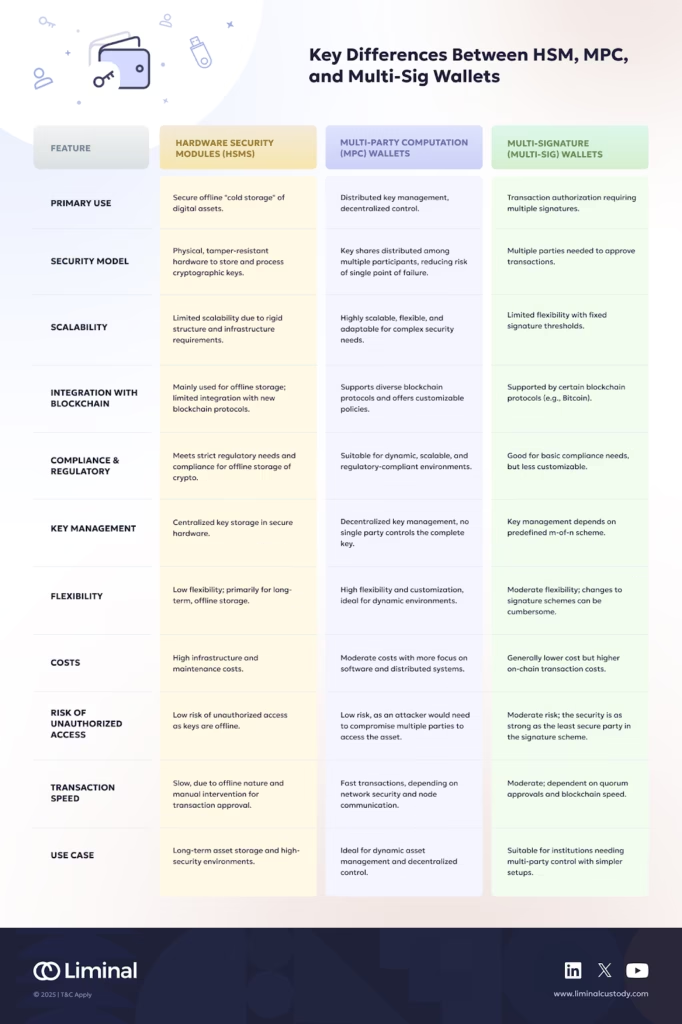

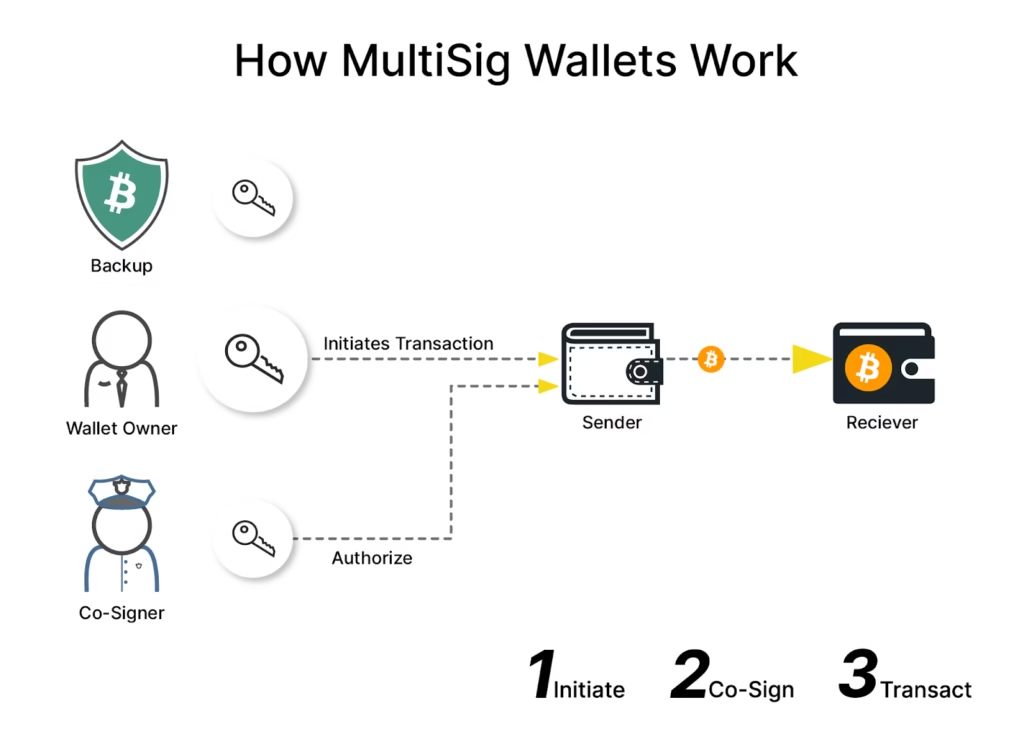

c) Multisignature (multisig) wallets

- What: Wallets requiring multiple keys to approve transactions (e.g., 2-of-3).

- Use for: Family or corporate custody, heirs, institutional setups.

- Pros: No single point of failure; great for shared control.

- Cons: More complex to set up; still requires secure key storage.

d) Managed custody (institutional / regulated)

- What: Regulated custodians (e.g., Coinbase Custody, BitGo).

- Use for: Institutions or users who need compliance features.

- Pros: Insurance, compliance, operational support.

- Cons: Still third-party custody, counterparty risk remains.

Table: Custody options at a glance

| Option | Best for | Security | Convenience |

| Hot wallet | Daily use, small balances | Low–Medium | High |

| Hardware wallet | Long-term storage, large balances | High | Medium |

| Multisig | Families, orgs, funds | Very High | Medium–Low |

| Regulated custodian | Institutions | Medium–High (insured) | High |

Figure 2 – Custody options: hot wallet, hardware cold wallet, multisig, and custodial services.

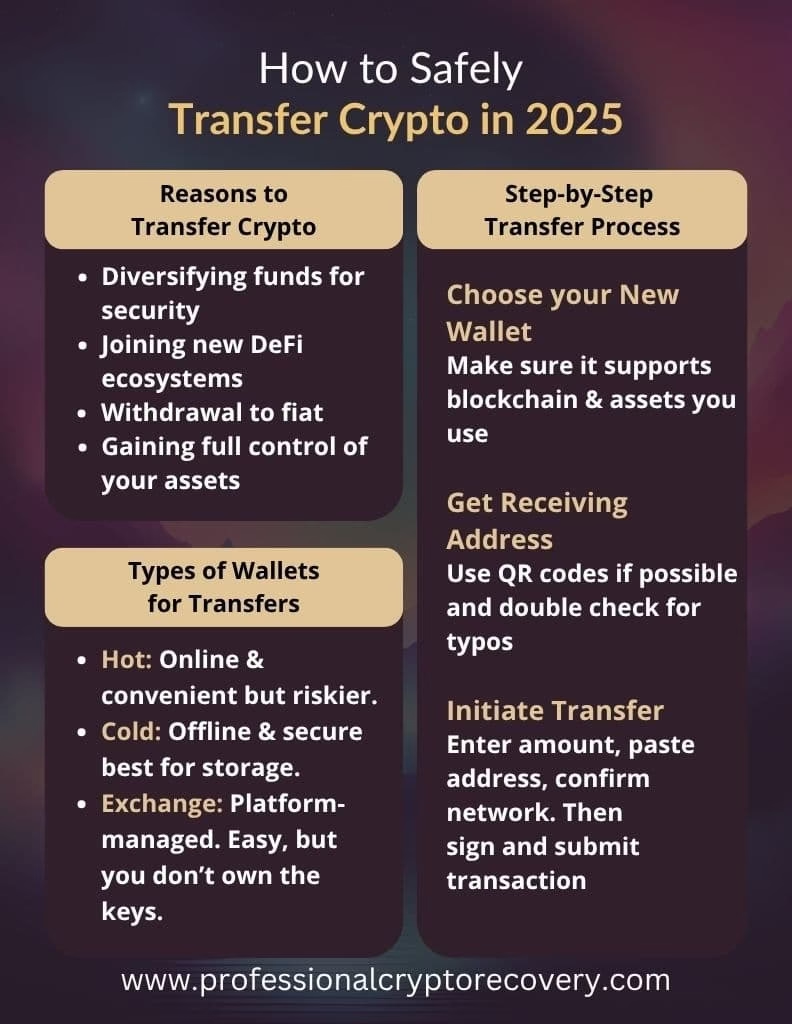

4. Step-by-step: safely migrate assets off an exchange

Follow this process, it’s conservative and repeats industry best practices.

- Pick your target custody strategy (hardware wallet + multisig for high value; hot wallet for small amounts).

- Purchase hardware wallet(s) from manufacturer or authorized reseller (avoid third-party sellers).

- Initialize device offline and generate seed phrase in private, write the phrase on paper or steel backup.

- Transfer in small test amounts (e.g., $20) first; verify receipt on-chain.

- Incremental transfers: if the test succeeds, transfer remaining funds in several batches.

- Revoke approvals on exchanges and dApps (use Revoke.cash or wallet settings).

- Store seed backups securely in fire- and water-proof locations; consider a safe deposit box or metal seed plate.

- Document inheritance plan (multisig, legal instructions, encrypted backups).

- Regular audits: check balances, software updates, and firmware versions for devices.

Practical tip: never enter your seed phrase on an internet-connected device, ever.

Figure 3 Stepwise migration flowchart: buy hardware, test-transfer, move in batches, backup seed, revoke approvals.

5. Advanced practices for high-value holders and institutions

- Use multisig for treasury management: (e.g., Gnosis Safe) with distributed signers.

- Air-gapped key generation: generate keys on an offline computer, sign via USB/QR.

- Shamir Secret Sharing (SSS): split seed into parts and store across trusted custodians.

- Layered access: keep a hot wallet for trading, a warm wallet for operational needs, and cold storage for reserves.

- Insure in layers: insurance products can cover certain risks but read policies carefully (they rarely cover governance errors).

- Periodic key rotation & threshold schemes: rotate cosigners and use time-locks for large withdrawals.

6. Inheritance and continuity planning

Self-custody shifts responsibility onto you – so plan. Options include:

- Multisig with trusted co-signers (family member + lawyer + trustee).

- Use a professional custody/inheritance service (Casa, Safe Custody solutions).

- Encrypted legal instructions: store seed access instructions in a lawyer’s escrow under strict conditions.

- Test recovery: walk a trusted proxy through a dry run with small amounts. Never expose full seed during testing.

7. When it’s OK to keep crypto on an exchange

There are legitimate reasons to keep small balances on exchanges:

- Active trading – you need liquidity for arbitrage or high-frequency tactics.

- Coin listing or staking services – some custodians offer features you can’t replicate easily (but understand the counterparty risk).

- Fiat on-ramps – using an exchange for quick conversion to/from fiat.

Rule: keep only what you need for short-term operations on exchanges. Treat everything else as long-term assets to be moved to self-custody.

8. Checklist: secure your crypto (copy-paste for site sidebar)

- Move long-term holdings to cold storage (hardware wallet)

- Keep only short-term trading funds on exchanges

- Use multisig for shared or high-value holdings

- Create at least two offline seed backups (one off-site)

- Revoke dApp approvals after use

- Use app-based 2FA and strong passwords on exchanges

- Verify addresses manually; always test small transfers first

- Plan inheritance (multisig, lawyer, or custody service)

9. Final words: control ≠ carelessness

Self-custody returns control, but control requires discipline. The biggest risk for holders is not a hacker, but human error: losing your seed phrase, mistyping addresses, or falling for phishing. Self-custody is about reclaiming responsibility, not avoiding it. With simple practices (hardware wallets, backups, multisig), you can dramatically reduce the risk that exchanges expose you to.

Takeaway: exchanges are for trading, not for safekeeping. If you believe in crypto’s promise, take custody of your keys, and treat security like a core part of your financial plan.

Related Articles

- Cryptocurrency 101: a beginner’s guide to how digital money really works

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level safety tips

- Top 5 crypto wallets every new investor should consider in 2025

- DeFi explained: how decentralized finance is reshaping the future of money and traditional banking

- Ethereum vs Solana: which smart contract platform really wins on speed, cost, and ecosystem strength?