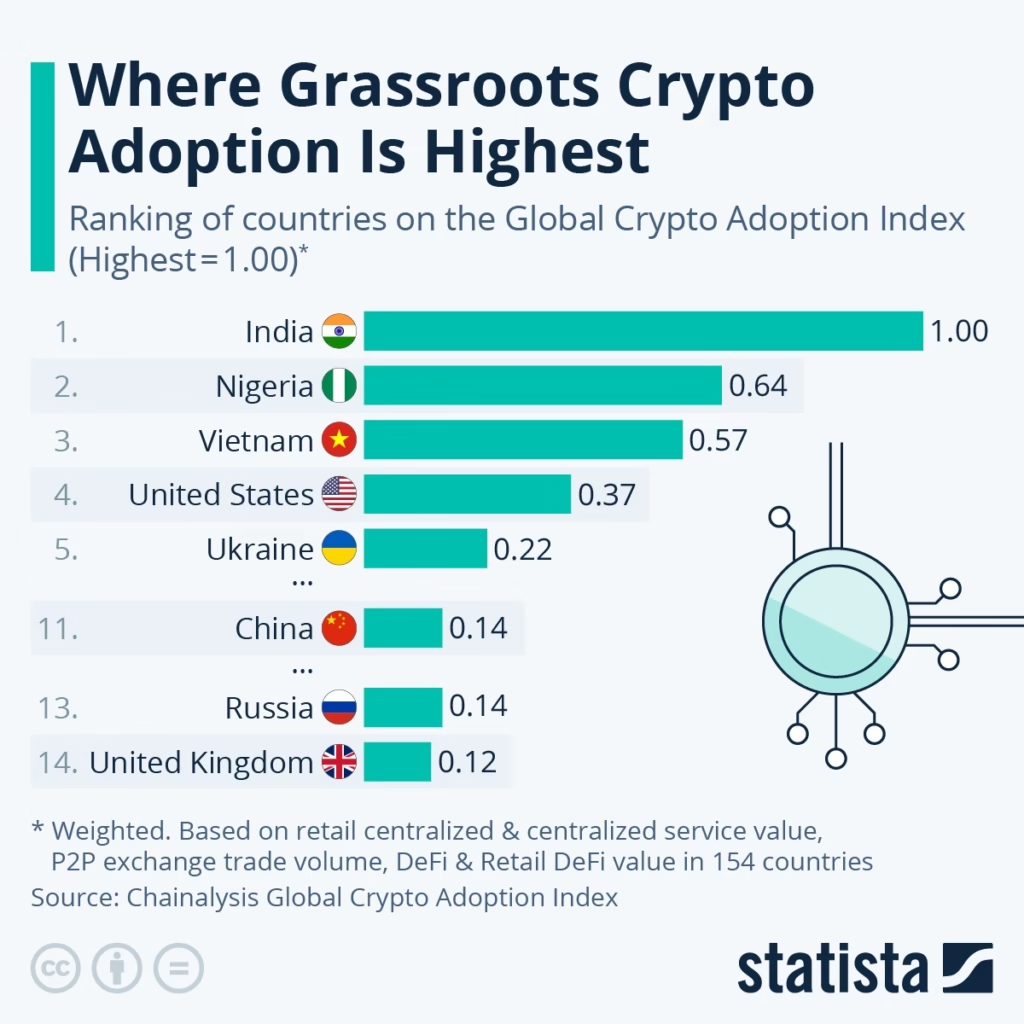

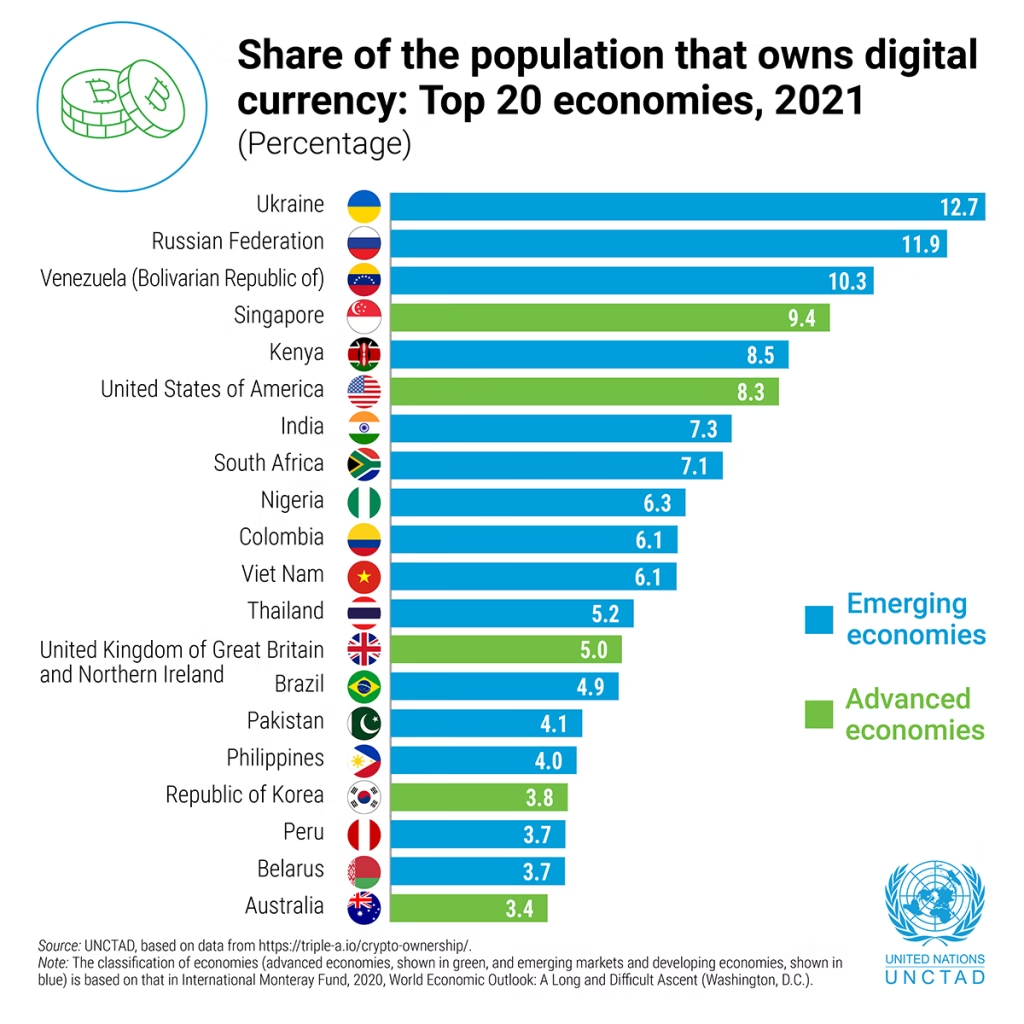

In many developed economies, cryptocurrency is seen primarily as an investment vehicle, a volatile asset for traders or a frontier for tech enthusiasts. But in developing countries, the story is fundamentally different. Crypto is not just a speculative tool; it’s a lifeline. It’s providing access where traditional systems have failed, offering economic empowerment, financial inclusion, and new ways for individuals and communities to reclaim control over their money and future.

As we move deeper into 2025, the transformative power of crypto is becoming most evident not in Silicon Valley or London, but in regions long underserved by global financial infrastructure.

1. Financial Inclusion Where Banks Fall Short

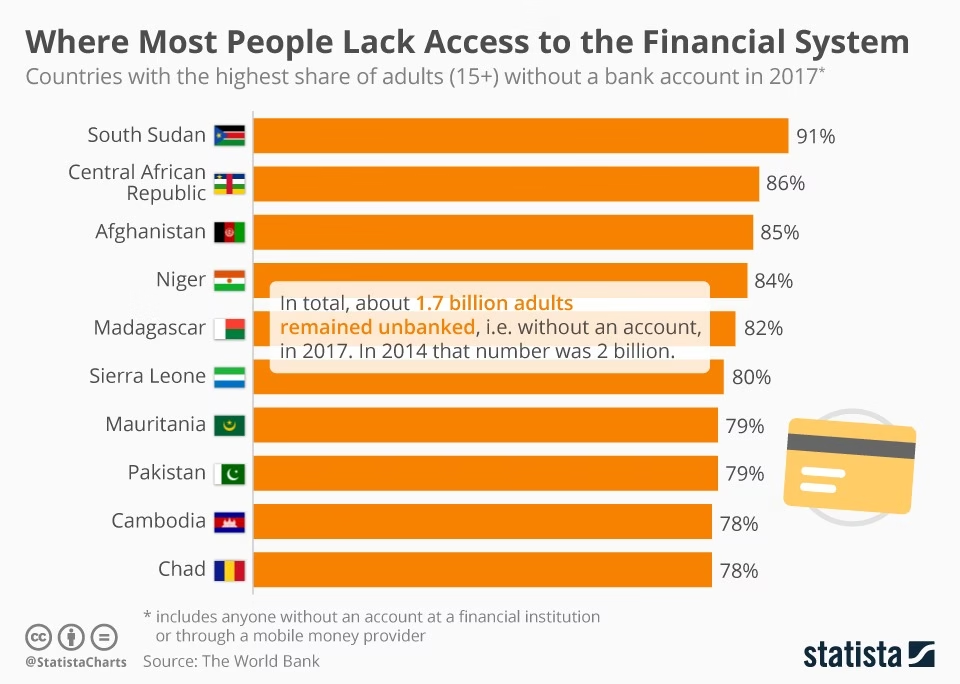

Across Latin America, sub-Saharan Africa, Southeast Asia, and parts of the Middle East, millions remain unbanked. In many regions, opening a bank account is restricted by documentation requirements, distance from branches, or deep mistrust in fragile institutions.

Cryptocurrency changes this equation entirely. With only a smartphone and basic internet access, individuals can create a non-custodial wallet and participate in the global financial system without approval or intermediaries.

Example (2024-2025):

In Kenya, mobile-first crypto wallets integrated with USDT and USDC are increasingly used alongside (and sometimes instead of) traditional mobile money systems. Small traders now store savings in dollar-backed stablecoins to avoid sudden devaluation and mobile-money account freezes.

2. Combating Currency Devaluation and Inflation

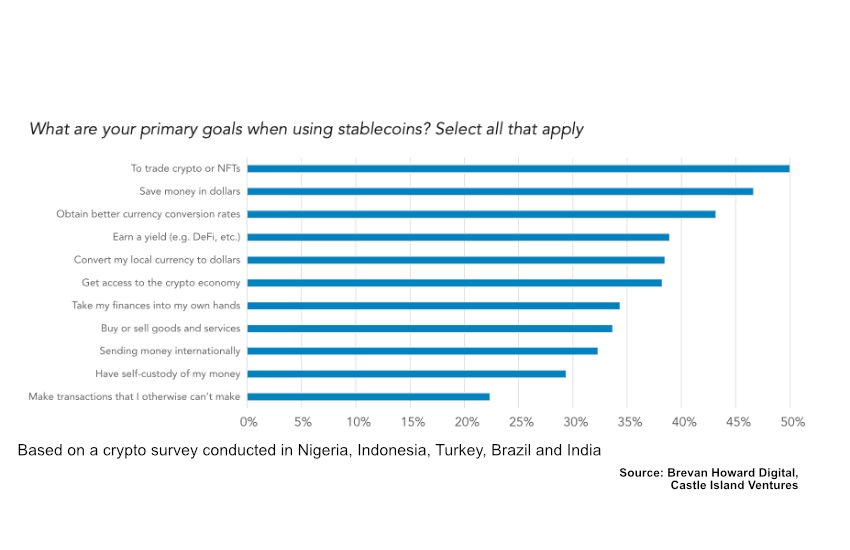

For countries battling chronic inflation, crypto offers something rare: predictability.

Stablecoins pegged to the U.S. dollar have become everyday financial tools in economies where local currencies lose value rapidly.

Updated cases:

- In Lebanon, where banking withdrawals remain restricted years after the financial collapse, families increasingly store savings in stablecoins accessed via decentralized wallets.

- In Egypt, freelancers working for international clients now prefer USDC payments over local currency settlements to protect income from inflationary erosion.

These are not speculative behaviors, they are defensive financial strategies.

3. Cross Border Payments Without Exploitation

Traditional remittance systems continue to impose heavy costs on developing economies. Fees of 5-15% are common, and settlement times can stretch into days.

Crypto-based rails offer a clear alternative: near-instant transfers, transparent fees, and no dependency on correspondent banks.

Impact:

Migrant workers in Saudi Arabia and the UAE are increasingly using crypto-powered payment corridors to send funds to Nepal and Sri Lanka, bypassing agents entirely. Funds often arrive within minutes and can be converted locally through peer-to-peer markets.

4. Empowering Local Businesses and Entrepreneurs

Crypto has quietly become a gateway to global commerce for small businesses that were previously locked out.

Freelancers, exporters, and digital creators in developing regions now receive payments directly in crypto, avoiding:

- Payment processor bans

- Currency conversion losses

- Delayed settlements

Example:

In Bangladesh, small software studios working for European clients increasingly invoice in stablecoins. This eliminates dependency on intermediaries that often block accounts or delay international transfers for weeks.

DeFi lending protocols also provide limited but growing access to capital where traditional credit markets do not exist.

5. Supporting Humanitarian Aid and Crisis Relief

Blockchain-based aid delivery is gaining momentum due to its transparency and speed.

Cases:

- Following the 2024 floods in Pakistan, relief organizations experimented with crypto vouchers distributed via mobile wallets, allowing families to purchase essentials without relying on disrupted banking systems.

- In Sudan, humanitarian groups have tested blockchain rails to route donations to local aid partners amid severe banking instability.

Crypto does not replace aid infrastructure, but it increasingly supplements it where traditional rails fail.

6. Education and Digital Empowerment

Beyond finance, crypto is accelerating digital skill development.

Young people in developing countries are learning:

- Blockchain fundamentals

- Smart contract development

- DAO coordination

- Digital asset management

Initiatives:

- Web3 education hubs in Nigeria and Ghana now partner with global DAOs to train contributors in design, moderation, and development.

- In Vietnam, grassroots blockchain communities have helped students secure remote Web3 jobs without formal degrees.

Crypto is becoming an entry point into the global digital economy.

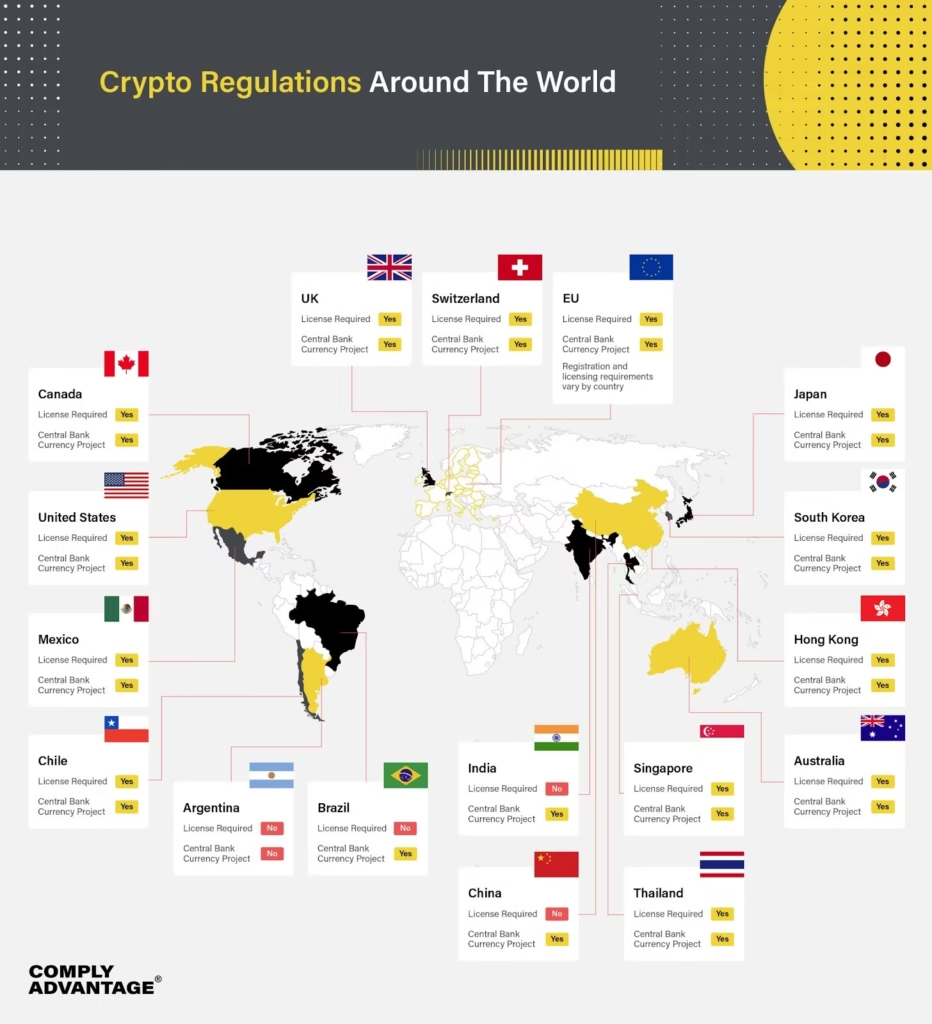

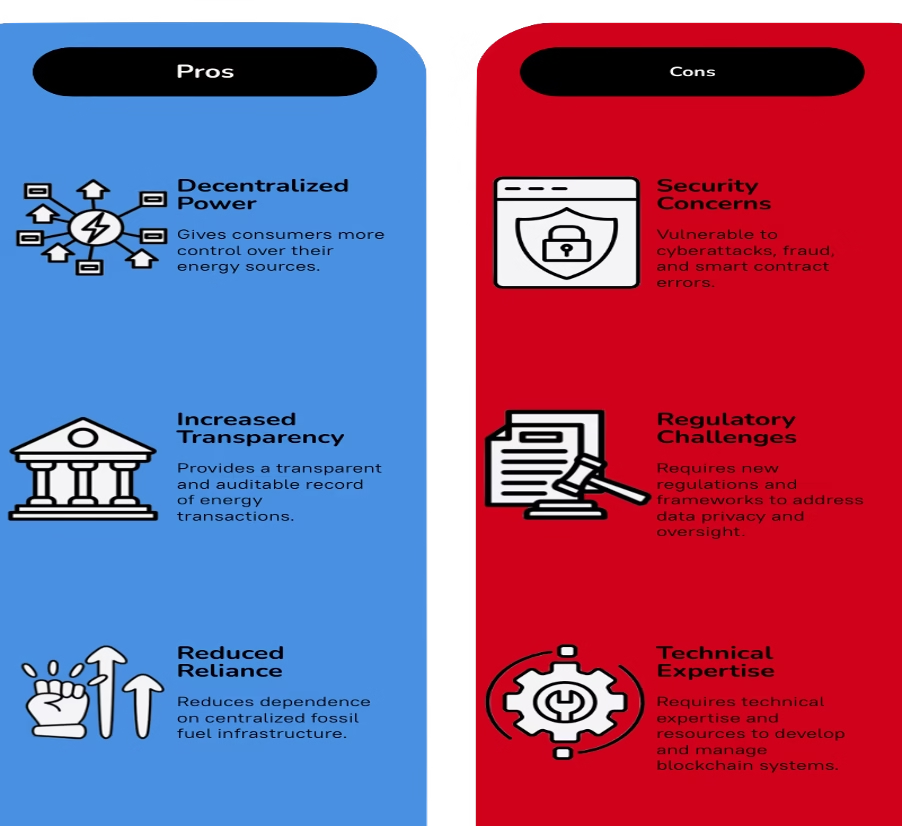

7. Challenges Remain, But Momentum Is Real

The obstacles are real and persistent:

- Uneven internet access

- Limited digital literacy

- Higher exposure to scams

- Regulatory uncertainty

However, what stands out is resilience. Adoption continues not because crypto is perfect, but because alternatives are worse.

Communities are not waiting for ideal conditions. They are adapting tools to real constraints.

A Quiet Revolution Is Underway

While crypto discourse in the developed world often revolves around regulation, ETFs, or institutional adoption, the most profound transformation is happening quietly elsewhere.

For millions across developing nations, crypto is not about speculation, it is about access, dignity, and survival. It offers alternatives to broken systems and creates optionality where none existed.

The future of crypto is not being written only in boardrooms or trading desks.

It is being shaped in small businesses, rural communities, informal markets, and places where financial systems have long failed.

That is where its real value lies.

Related Articles

- Crypto taxes made simple: how to report, calculate, and file your crypto gains without costly mistakes

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level

- Beginner’s guide: how to earn real passive income from DeFi lending without blowing up your capital

- 10 common crypto scams and exactly how to avoid losing your money to them

- Web3 decoded: what it is, why it matters, and how you can start participating today

- Ethereum vs Solana: which smart contract platform really wins on speed, cost, and ecosystem strength?