A Cycle-Proof Framework for Surviving Volatility and Compounding Long Term

Crypto markets don’t reward prediction. They reward preparation.

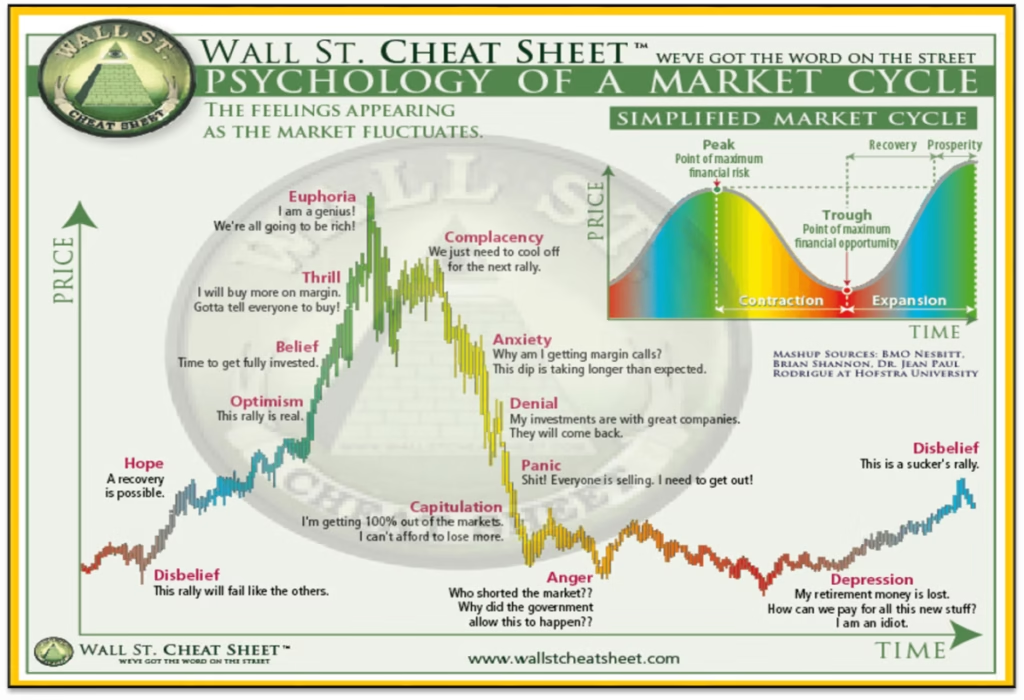

Most investors don’t lose money because they picked the “wrong” coin. They lose money because their portfolio was designed for only one type of market. When conditions flipped from greed to fear, from expansion to contraction their strategy collapsed.

By 2025, crypto has matured enough that this mistake is no longer excusable. We now have multiple full market cycles to study, thousands of post-mortems to learn from, and clear patterns that separate portfolios that survive from those that evaporate.

A balanced crypto portfolio is not neutral. It is adaptive. It is built to bend without breaking whether the market is euphoric or brutal.

Stop Treating Bull and Bear Markets as Different Games

Most people approach bull and bear markets as if they require entirely different identities.

In a bull market, they become gamblers.

In a bear market, they become monks.

This split personality is expensive.

The truth is simpler and more uncomfortable: your portfolio should already be prepared for both. You don’t rebalance your philosophy when prices move you rebalance your exposure.

Bull markets expose greed.

Bear markets expose fragility.

A well-built portfolio anticipates both, without needing emotional reinvention every 18 months.

Define the Job of Your Portfolio Before Choosing Assets

Before talking about coins, narratives, or sectors, you need to answer a more important question:

What is this portfolio supposed to do for you?

Not emotionally. Functionally.

Some portfolios are built to:

- Preserve purchasing power

- Outperform traditional markets over years

- Generate yield without liquidation

- Capture asymmetric upside with controlled risk

Trying to make one portfolio do all of this at once is how people end up with incoherent allocations.

In 2025, clarity of intent matters more than asset selection. Two people can hold the same tokens and experience radically different outcomes depending on why they hold them.

The Core-Satellite Model Still Wins

Every durable investment system traditional or crypto eventually converges on the same logic: separate survival from speculation.

Your core is not where you seek excitement.

Your satellites are not where you seek safety.

In crypto terms:

The core exists to:

- Anchor volatility

- Absorb drawdowns

- Maintain conviction during fear

The satellites exist to:

- Capture emerging narratives

- Exploit innovation cycles

- Accept higher failure rates

A portfolio that mixes these roles collapses under stress.

What a Realistic 2025 Allocation Actually Looks Like

A balanced crypto portfolio in 2025 is not maximalist, but it is opinionated.

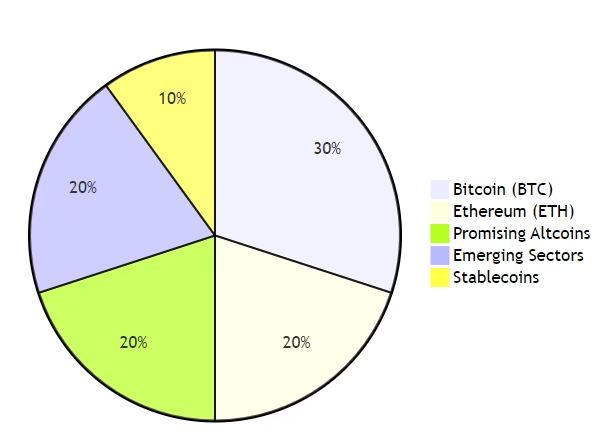

A common institutional-style structure looks like this:

- 35-45% large-cap primitives (BTC, ETH equivalents)

- 20-30% infrastructure layers (L1s, L2s, execution layers)

- 10-15% sector exposure (DeFi, AI-crypto, RWA, Web3 infra)

- 5-10% asymmetric bets (early-stage, high conviction, high risk)

- 5-15% stablecoins (liquidity, yield, optionality)

This isn’t about copying percentages. It’s about understanding why each bucket exists.

When markets crash, the core limits damage.

When markets explode, satellites create upside.

When uncertainty dominates, stablecoins create choice.

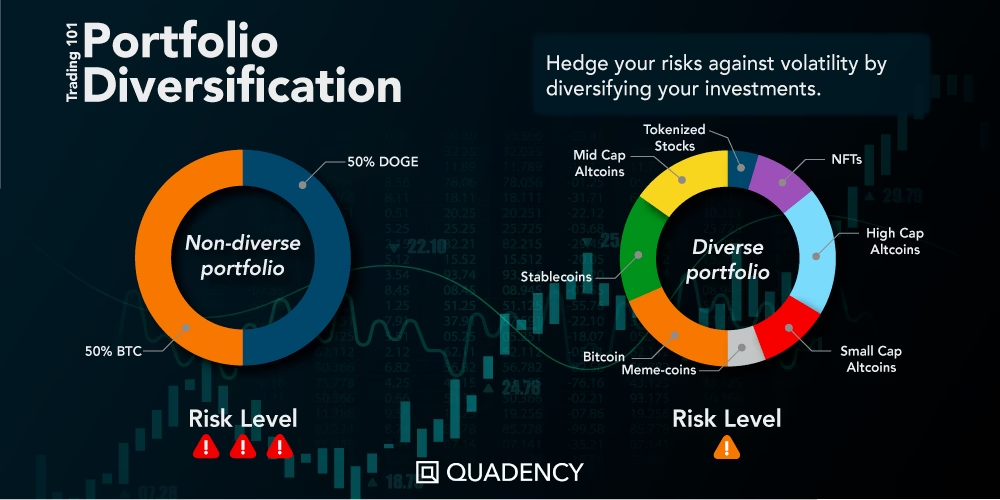

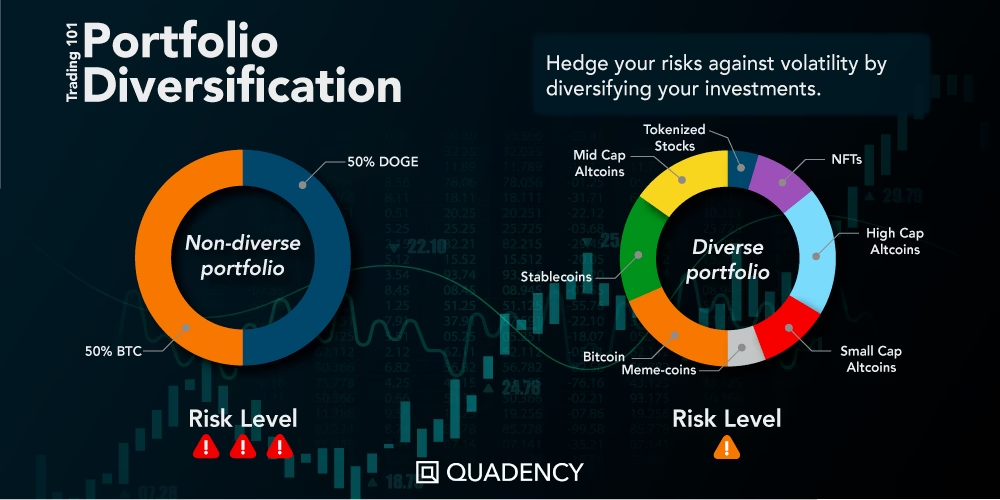

Sector Diversification Is About Failure Containment, Not Trend Chasing

Many portfolios look diversified but aren’t.

Holding five tokens that all depend on the same narrative, say NFTs or memecoins is not diversification. It’s concentrated risk wearing different logos.

True diversification spreads exposure across failure modes:

- Financial (DeFi)

- Computational (AI + crypto)

- Infrastructure (L1/L2 scaling)

- Economic abstraction (RWA, stablecoins)

- Social coordination (DAOs, Web3 identity)

When one narrative collapses, another often survives or even benefits. Balanced portfolios are built around this asymmetry.

Stablecoins Are Not “Dead Weight”: They Are Strategic Ammunition

Stablecoins are misunderstood because they don’t produce dopamine.

But in both bull and bear markets, they quietly outperform emotional capital.

In bull markets:

- They allow disciplined dip-buying

- They fund rotation without liquidation

- They enable yield without price risk

In bear markets:

- They preserve capital

- They reduce forced selling

- They provide psychological stability

Many investors ride assets down simply because they never built exits into their system. Stablecoins are not pessimism, they are optionality.

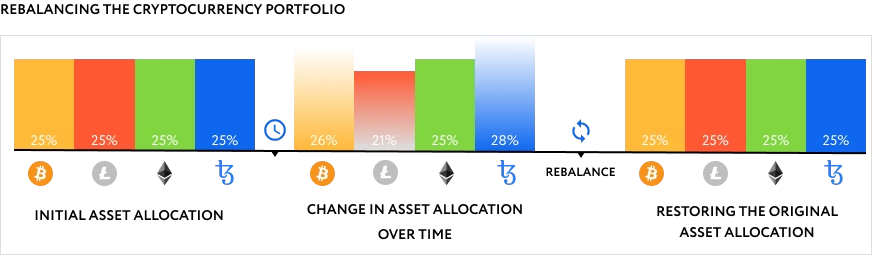

Rebalancing Is a Discipline, Not a Reaction

Rebalancing is where most investors betray their own plans.

They rebalance emotionally:

- Selling losers out of frustration

- Holding winners out of attachment

Effective rebalancing is mechanical.

In bull markets, it means trimming winners before they dominate your risk profile.

In bear markets, it means consolidating into assets with the highest survival probability.

The goal is not to maximize upside in a single cycle. The goal is to stay solvent across multiple ones.

Yield Is a Tool, Not a Salvation

Yield can enhance a portfolio, but it can also mask risk.

Sustainable yield comes from:

- Real demand for capital

- Conservative leverage

- Transparent mechanisms

Unsustainable yield comes from:

- Token inflation

- Circular incentives

- Liquidity illusion

In bear markets especially, yield should compensate for risk, not create new ones. If yield feels exciting, it’s usually dangerous.

The Real Edge Is Behavioral, Not Technical

Every cycle produces new tools, new narratives, and new buzzwords. What doesn’t change is human behavior.

The portfolios that survive are built by people who:

- Define rules before emotions appear

- Accept that missing upside is not failure

- Respect risk even during euphoria

Most catastrophic losses happen after success, not before it. Discipline matters most when confidence is highest.

Build for Longevity, Not Brilliance

Crypto does not reward brilliance consistently. It rewards endurance.

A balanced portfolio is not impressive on social media. It doesn’t produce daily adrenaline. It doesn’t promise overnight transformation.

What it does is stay alive long enough for compounding to work.

Whether the market in front of you is euphoric or brutal, your edge comes from structure, not sentiment. From preparation, not prediction.

In a market defined by extremes, balance is not weakness.

It is strategy.

Related Articles

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level

- CBDCs vs Crypto: can government digital currencies really kill decentralized money?

- Beginner’s guide: how to earn real passive income from DeFi lending without blowing up your capital

- 10 common crypto scams and exactly how to avoid losing your money to them

- Web3 decoded: what it is, why it matters, and how you can start participating today

- Ethereum vs Solana: which smart contract platform really wins on speed, cost, and ecosystem strength?