How Policy Shifts in the EU, US, India, and Key Global Hubs Are Reshaping the Crypto Economy

Cryptocurrency has crossed the point of being treated as an experimental technology. In 2025, it is firmly recognized by governments as an economic force with implications for financial stability, taxation, capital markets, and national security. As a result, crypto regulation is no longer reactive or fragmented, it is becoming structured, enforceable, and internationally coordinated.

For investors, developers, exchanges, and institutions, regulatory awareness is no longer optional. Compliance now directly affects access to banking rails, market participation, product design, and even geographic viability. This article examines how crypto regulation is evolving across major jurisdictions and what these changes mean for the global digital asset ecosystem.

Why Crypto Regulation Became Inevitable

The regulatory acceleration of the past two years is not ideological, it is structural. Crypto now interacts directly with traditional finance through stablecoins, tokenized treasuries, payment rails, and institutional custody. That interaction forced regulators to act.

Several factors pushed policymakers from observation to enforcement. Exchange collapses exposed systemic custody risks, cross-chain bridges became vectors for large-scale exploits, and tax authorities discovered widespread underreporting of crypto income. At the same time, retail adoption surged in emerging markets, increasing the political cost of regulatory inaction.

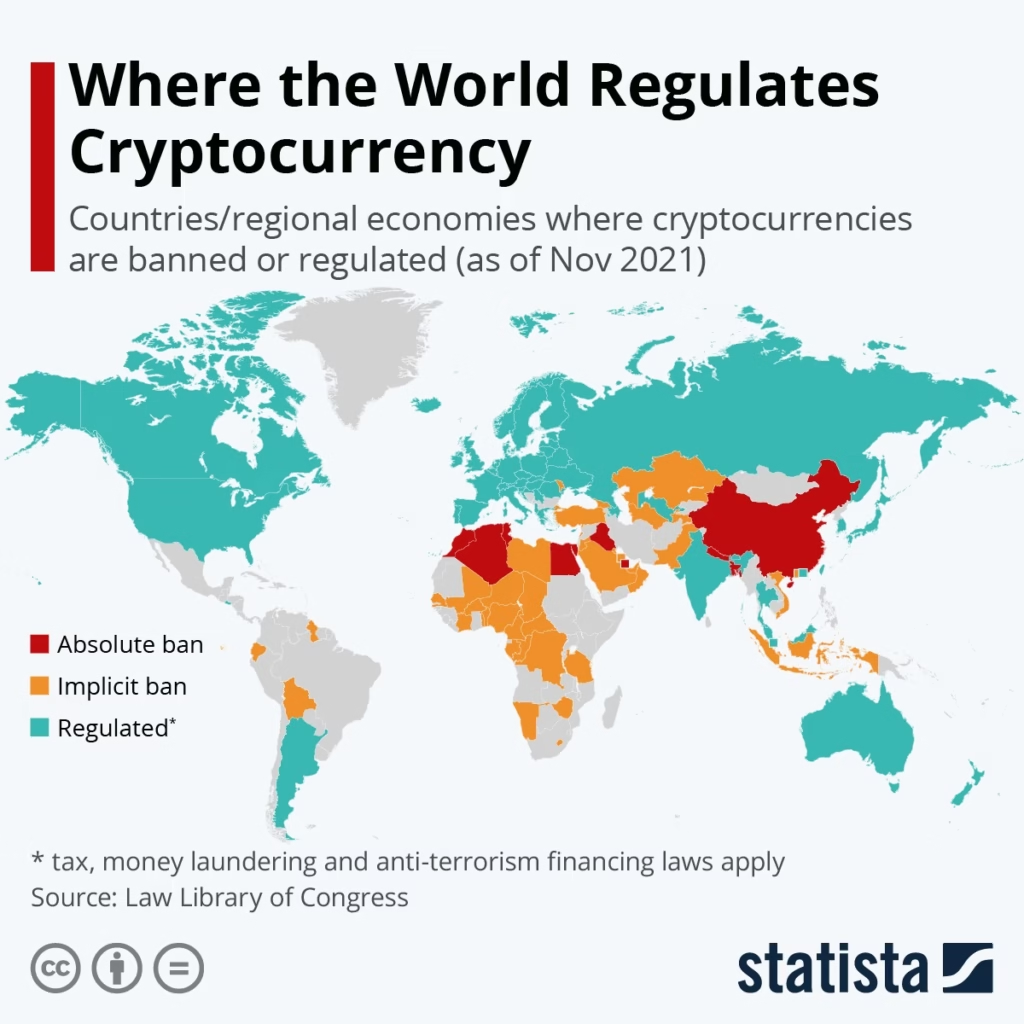

By 2025, the dominant regulatory objective is no longer suppression of crypto, but containment of risk while extracting transparency. This shift explains why most frameworks focus on licensing, disclosures, reserve backing, and reporting, rather than outright bans.

The European Union

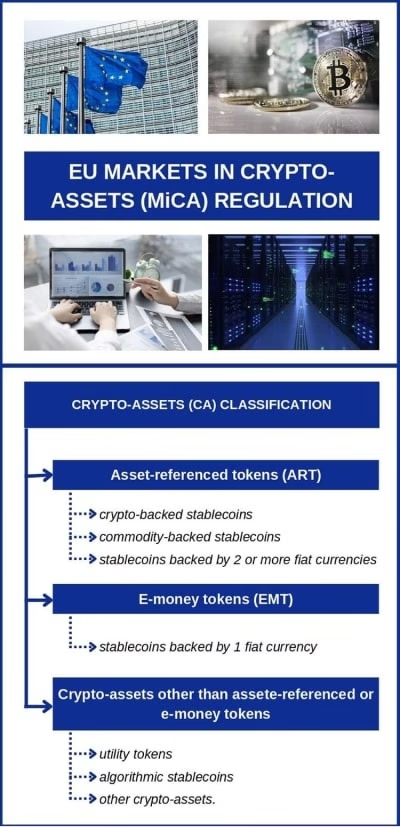

The European Union has taken the most comprehensive regulatory step to date with the implementation of the Markets in Crypto-Assets (MiCA) regulation. Unlike piecemeal national laws, MiCA establishes a single regulatory framework across all EU member states, creating legal certainty for crypto businesses operating within Europe.

MiCA fundamentally treats crypto as a regulated financial activity rather than a technological curiosity. Crypto-asset service providers must now obtain authorization, maintain capital reserves, segregate customer assets, and comply with strict disclosure obligations. Stablecoins are subject to particularly rigorous oversight, including reserve audits and issuance limits tied to systemic risk.

Notably, MiCA currently excludes decentralized protocols and most NFTs, acknowledging the difficulty of regulating fully permissionless systems. However, EU regulators have already signaled that this exclusion is temporary. The next phase of regulation is expected to address DeFi front-ends, governance tokens, and NFT marketplaces.

From an industry perspective, MiCA has made Europe one of the most legally predictable crypto markets at the cost of higher compliance burdens. Firms willing to meet these standards gain passporting rights across the EU, while those that cannot are increasingly excluded.

The United States

The United States presents a contrasting model. Rather than a single legislative framework, crypto regulation in the U.S. has evolved through agency interpretation, court rulings, and targeted legislation. This has produced progress, but also persistent uncertainty.

By 2025, clearer boundaries are emerging between regulatory agencies. The SEC continues to assert jurisdiction over token issuances and yield products it considers securities, while the CFTC oversees derivatives and increasingly spot crypto markets. Meanwhile, the IRS has dramatically expanded reporting requirements, introducing new broker disclosure forms that compel exchanges and custodians to report user activity directly.

Stablecoins have become the focal point of U.S. crypto legislation. Federal proposals now require issuers to hold dollar-equivalent reserves with licensed custodians, effectively integrating stablecoins into the banking system. While this enhances consumer protection, it also raises concerns about innovation barriers and surveillance.

The U.S. approach remains enforcement-heavy, which has driven some innovation offshore. At the same time, institutional participation continues to grow, suggesting that regulatory friction has not diminished crypto’s strategic importance within American finance.

India: Taxation as a Regulatory Tool

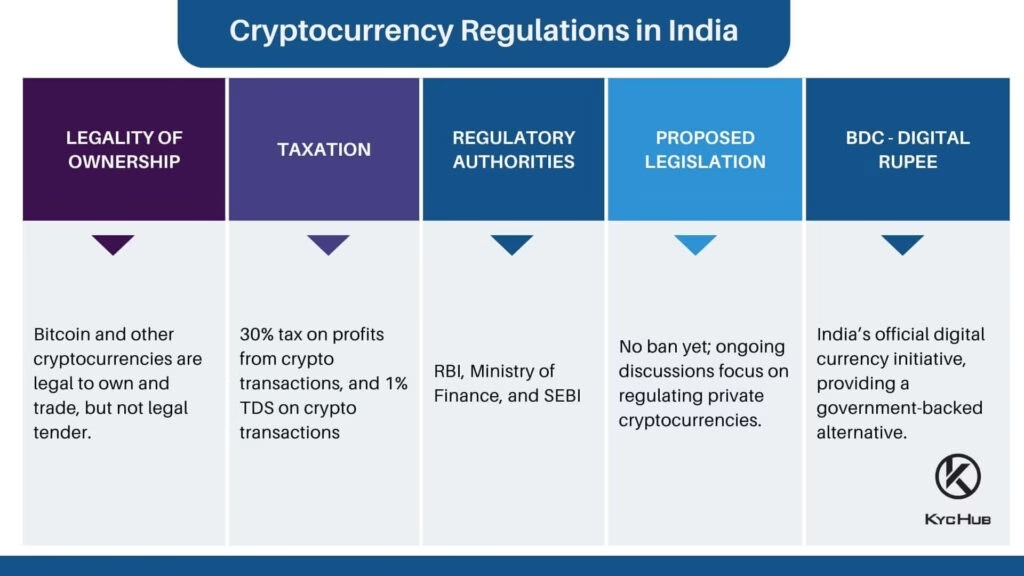

India has adopted one of the most restrictive crypto environments among major economies, not through bans, but through taxation and transaction friction. The government’s policy stance treats crypto primarily as a speculative activity rather than a financial innovation.

A flat capital gains tax on crypto profits, combined with transaction-level tax deductions, has significantly reduced retail trading volumes on domestic exchanges. Unlike many jurisdictions, India does not allow losses to offset gains, nor does it provide legal recognition to crypto as a financial asset.

However, India’s posture is not static. Participation in global regulatory forums such as the G20 and FATF has pushed policymakers toward harmonization rather than isolation. In 2025, the introduction of blockchain sandboxes and pilot programs for tokenization suggests a gradual shift toward controlled experimentation.

India’s regulatory trajectory reflects a broader pattern seen in emerging economies: caution toward speculative excess, paired with selective openness to underlying blockchain infrastructure.

Other Key Jurisdictions Shaping the Landscape

Beyond the EU, U.S., and India, several jurisdictions are playing outsized roles in shaping global crypto norms.

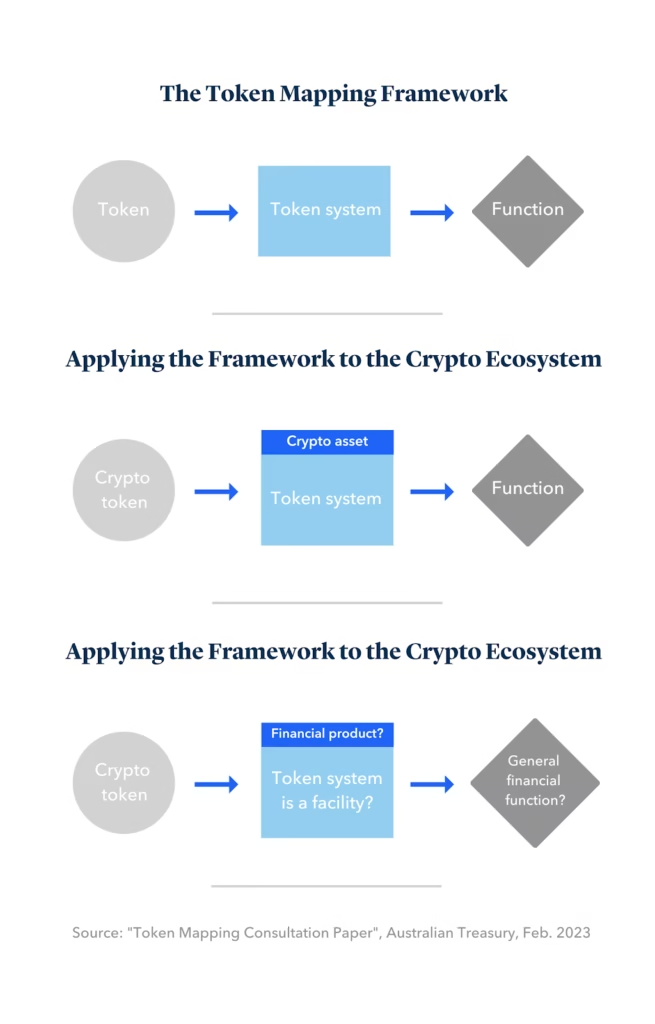

Singapore continues to position itself as a compliance-first innovation hub, emphasizing strict licensing, custody safeguards, and consumer risk disclosures. Japan remains one of the most conservative markets, tightly regulating stablecoins and exchange operations. Australia has expanded crypto tax oversight, particularly around staking and yield products.

In Latin America and Africa, regulatory evolution is driven by adoption realities rather than ideology. Countries like Brazil and Nigeria are crafting frameworks that accommodate crypto usage in payments and remittances, while attempting to maintain monetary control.

These jurisdictions illustrate that crypto regulation is no longer a binary choice between prohibition and permissiveness, it is increasingly tailored to local economic needs.

Converging Global Themes in 2025

Despite regional differences, regulatory convergence is unmistakable. Across jurisdictions, several shared priorities now define crypto oversight:

- Stablecoin reserve transparency and issuer accountability

- Expansion of AML and KYC obligations to crypto intermediaries

- Standardized tax reporting through international frameworks

- Consumer protection rules for disclosures and promotions

- Cross-border cooperation between regulators and tax authorities

The OECD’s Crypto-Asset Reporting Framework has become a cornerstone of this convergence, enabling unprecedented information sharing between tax agencies worldwide.

What This Means for Users and Builders

For individual users, regulation in 2025 means fewer gray areas. Activity that was once invisible staking rewards, cross-chain swaps, stablecoin usage is now increasingly reportable and traceable. Choosing compliant platforms and maintaining accurate records has become essential.

For builders, regulation introduces friction, but also legitimacy. Projects that design with compliance in mind gain access to institutional capital, banking infrastructure, and long-term sustainability. Those that ignore regulation risk exclusion rather than disruption.

Conclusion: Regulation as the New Operating System

Crypto regulation in 2025 is no longer about whether governments will intervene, it is about how intelligently that intervention is executed. While approaches vary, the direction is clear: crypto is being integrated into the global financial system, not replaced by it.

For participants across the ecosystem, the competitive advantage now lies in regulatory literacy. Understanding the rules, anticipating changes, and aligning early will define who thrives as crypto transitions from frontier technology to financial infrastructure.

Related Articles

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level

- Blockchain interoperability 101: how cross‑chain bridges actually work and why they’re critical for crypto’s future

- How to build a balanced crypto portfolio that works in both brutal bear phases and euphoric bull runs (2025 blueprint)

- Gas fees explained: how rollups slash Ethereum transaction costs without sacrificing security

- Best Layer‑2 networks in 2025: Arbitrum, Optimism, zkSync and how they really compare