Decentralized finance was never meant to remain a closed economy. In its early years, DeFi thrived on self-referential value tokens backed by other tokens, yield funded by emissions, and liquidity driven largely by speculation. That phase unlocked innovation, but it also revealed a ceiling. By 2025, the industry has reached a clear conclusion: sustainable scale requires real economic inputs, not just internal incentives.

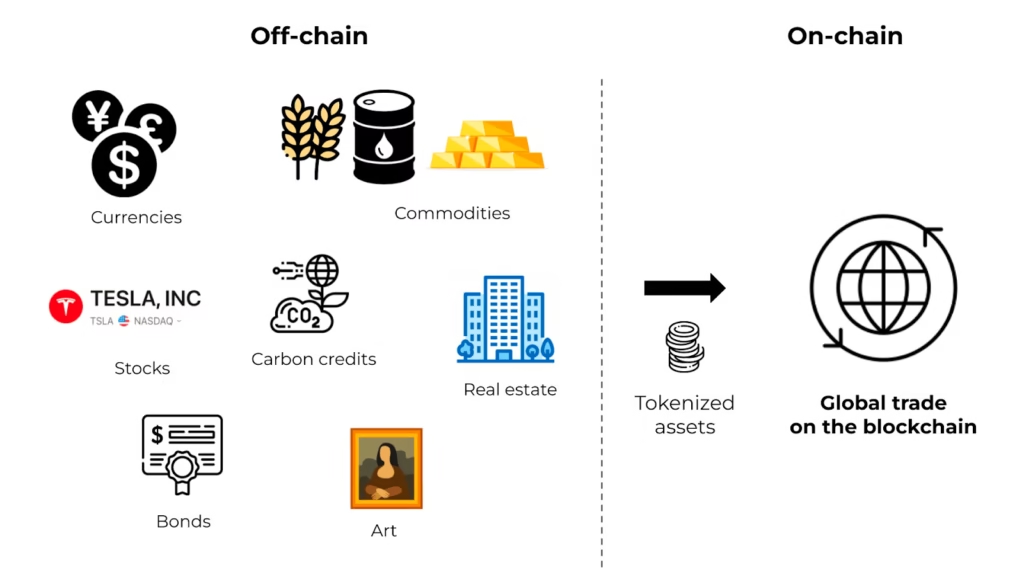

This is where Real World Asset (RWA) tokenization enters as a structural evolution rather than a passing narrative. RWAs represent the deliberate integration of off chain assets such as sovereign debt, real estate, commodities, and private credit into blockchain-native financial systems. Unlike earlier experiments, today’s RWA frameworks are being built with regulatory awareness, institutional grade custody, and legal enforceability at their core.

What is happening now is not crypto “adopting TradFi,” nor TradFi “colonizing DeFi.” It is a convergence, one that is slowly redefining how capital moves, settles, and earns yield on a global scale.

Understanding RWA Tokenization at a Structural Level

RWA tokenization is often oversimplified as “putting assets on the blockchain.” In reality, it is the translation of real-world economic rights into programmable financial instruments, without breaking the legal chain of ownership.

At the heart of every legitimate RWA token lies a binding legal claim. The blockchain component does not replace courts, contracts, or custodians, it complements them by automating execution, transparency, and settlement. The token functions as a cryptographic wrapper around enforceable rights, not as a substitute for them.

This distinction matters. A token without legal grounding is speculative. A token with enforceable claims becomes financial infrastructure.

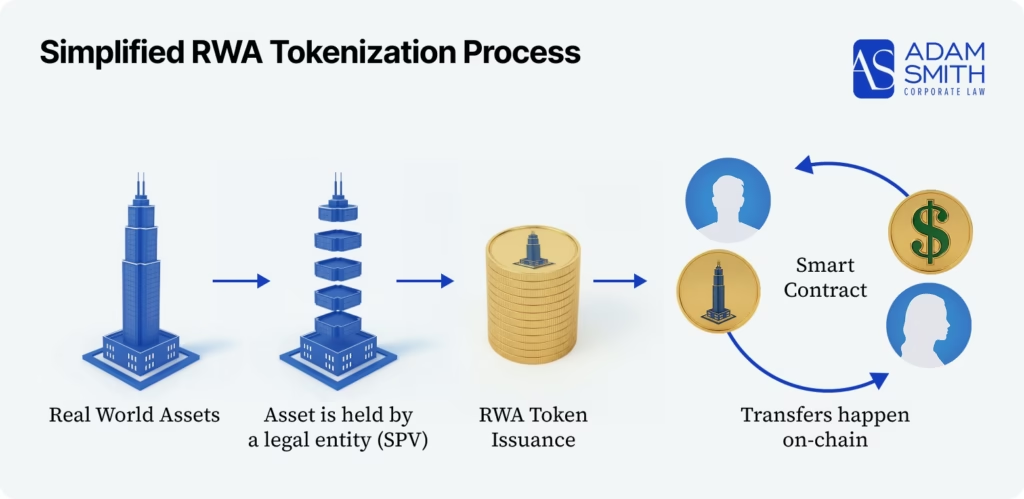

The Full Lifecycle of Tokenizing a Real-World Asset

Tokenization is a multi-layered process involving finance, law, and technology operating in parallel.

First, the asset itself must be legally isolated, often inside a special purpose vehicle (SPV) or trust. This ensures that the asset is bankruptcy-remote and protected from the issuer’s operational risks. The SPV becomes the legal anchor that links token holders to the underlying value.

Next comes custody and verification. A regulated custodian, trustee, or licensed asset manager safeguards the asset or its cash-flow rights. Independent auditors and valuation agents periodically attest to its existence, value, and performance.

Only after these layers are in place does blockchain issuance occur. Smart contracts mint tokens that encode economic rights income distribution, redemption rules, collateralization thresholds. Oracles bridge real-world events (interest payments, defaults, valuation updates) into on-chain logic. The result is a hybrid instrument: legally enforceable off-chain, automatically executed on-chain.

Why DeFi Needs RWAs to Mature

Purely crypto-native DeFi is inherently cyclical. When market sentiment weakens, liquidity dries up, yields collapse, and capital exits. RWAs change this dynamic by importing exogenous cash flows returns generated outside the crypto ecosystem. This has three long-term effects:

First, RWAs stabilize yield. Treasury bills, rent, and invoice payments do not depend on token price appreciation. They anchor DeFi returns to real economic activity.

Second, RWAs lower systemic reflexivity. DeFi protocols become less dependent on their own token prices to function, reducing cascading liquidations during downturns.

Third, RWAs unlock institutional participation. Pension funds, insurers, and corporates require predictable risk profiles and legal clarity conditions RWAs are uniquely positioned to satisfy.

In short, RWAs are not an add-on. They are becoming the foundation layer for sustainable DeFi.

Major RWA Classes Driving Adoption in 2025

Sovereign Debt and Money Market Instruments

Tokenized short-term government debt has emerged as the dominant RWA category. These instruments offer low volatility, high liquidity, and predictable yield qualities that make them ideal collateral and treasury assets for DAOs.

On-chain treasuries increasingly resemble traditional money markets, but with continuous settlement, transparent reserves, and programmable allocation logic.

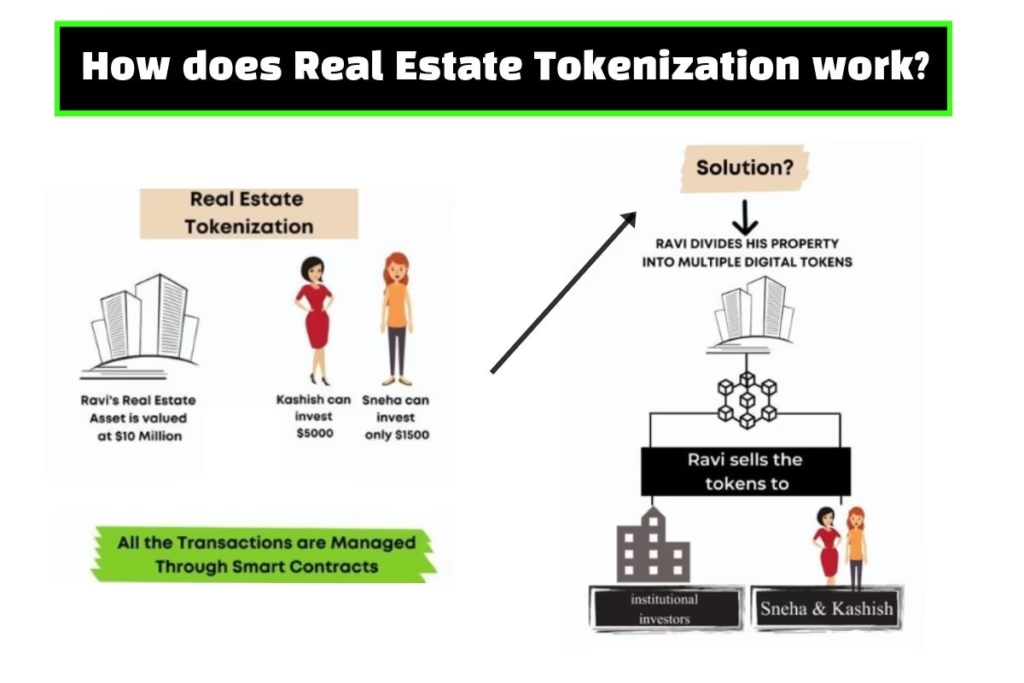

Real Estate and Infrastructure Assets

Modern real estate tokenization focuses less on speculative ownership and more on income streams. Rental income, maintenance costs, and net operating income are automated through smart contracts, allowing investors to receive proportional payouts without operational involvement.

Private Credit and Trade Finance

Invoice financing and private credit represent one of the most transformative RWA use cases. Businesses tokenize receivables to access liquidity in days rather than months, while investors gain exposure to short-duration, yield-bearing instruments previously locked behind banking infrastructure.

This category is especially impactful in emerging markets, where access to credit is structurally constrained.

Commodities and Environmental Assets

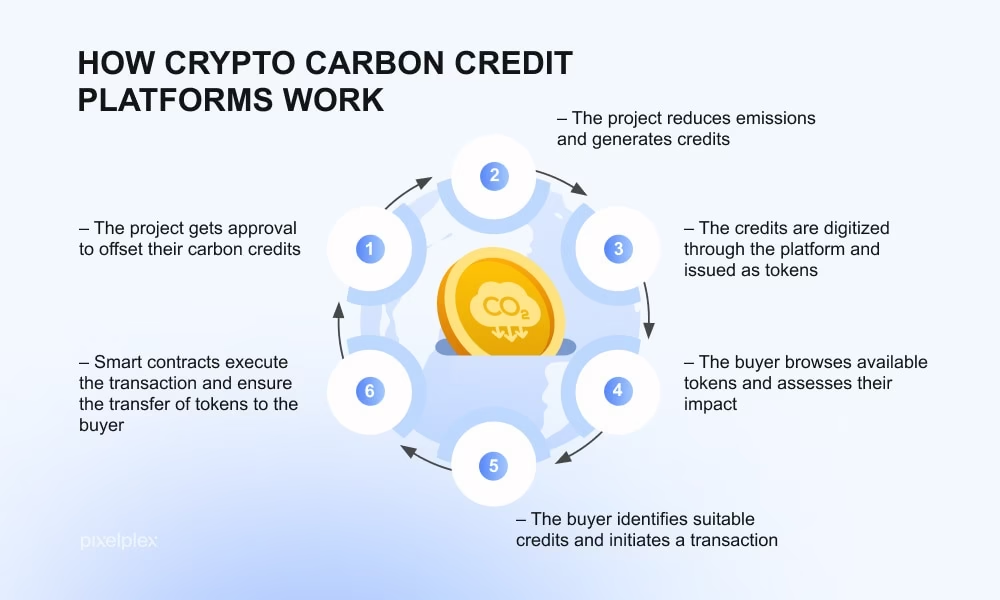

Tokenized gold, energy credits, and carbon offsets are gaining traction as collateral assets. Blockchain adds traceability and real-time settlement to markets traditionally plagued by opacity and delayed reconciliation.

The Real Risks: Legal, Custodial, and Oracle Dependencies

While smart contract risk is often highlighted, the most serious vulnerabilities in RWA systems lie elsewhere. Custodial failure is the primary threat. If the entity holding the underlying asset becomes insolvent or mismanages funds, token holders may face lengthy legal battles regardless of on-chain transparency. Legal enforceability is the second risk. Jurisdictional mismatches, unclear investor rights, or poorly drafted offering documents can render token claims difficult to assert across borders.

Oracle integrity is the third pillar. Real-world data feeds valuation updates, payment confirmations must be resilient to manipulation. A broken oracle can undermine an otherwise sound structure. True RWA resilience depends on institutional discipline, not just code quality.

Regulation as an Enabler, Not an Obstacle

By 2025, regulatory clarity has become a competitive advantage rather than a constraint. Jurisdictions offering clear tokenization frameworks are attracting both capital and talent.

Regulation does three critical things for RWAs:

- Establishes investor rights

- Standardizes disclosure and reporting

- Enables institutional onboarding

While this raises entry barriers, it also eliminates fragile, opaque models that defined earlier crypto cycles. The result is slower, but far more durable growth.

The Next Phase: RWAs as DeFi’s Economic Backbone

Looking forward, RWAs are poised to redefine DeFi’s architecture rather than merely expand its asset list.

We are moving toward:

- Stablecoins backed predominantly by tokenized government debt

- Lending protocols priced off real-world interest curves

- Cross-chain RWA liquidity spanning Ethereum L2s and modular chains

- Automated compliance embedded directly into smart contracts

When these pieces converge, DeFi stops being an alternative financial system. It becomes financial infrastructure.

Final Assessment

RWA tokenization represents DeFi’s transition from experimentation to integration with the real economy. It replaces circular value creation with productive capital flows, speculation with structure, and opacity with enforceable transparency.

The opportunity is vast, but so is the responsibility. Projects that respect legal reality, custodial rigor, and economic substance will define the next decade. Those that treat RWAs as marketing narratives will not survive the first serious stress test. DeFi does not need less reality. It needs more of it, on-chain.

Related Articles

- Your investor rights in crypto: custody disputes, exchange failures, and the legal protections you need to know

- Blockchain interoperability 101: how cross‑chain bridges actually work and why they’re critical for crypto’s future

- Global crypto regulations in 2025: what’s changing in the EU, US, India, and other key markets

- Gas fees explained: how rollups slash Ethereum transaction costs without sacrificing security

- Best Layer‑2 networks in 2025: Arbitrum, Optimism, zkSync and how they really compare