Cryptocurrency markets faced an unprecedented convergence of volatility catalysts on August 29, 2025, as the largest options expiry in history—worth $14.6 billion across Bitcoin and Ethereum—coincided with MicroStrategy’s mounting financial crisis and the US government’s revolutionary decision to publish GDP data on nine public blockchains. The extraordinary day highlighted both crypto’s institutional maturation through government adoption and its persistent risks as leveraged strategies face extreme market pressure.

Historic $14.6 billion options expiry creates unprecedented volatility as Bitcoin bears dominate positioning ahead of critical test

Historic $14.6 Billion Options Expiry Creates Perfect Storm

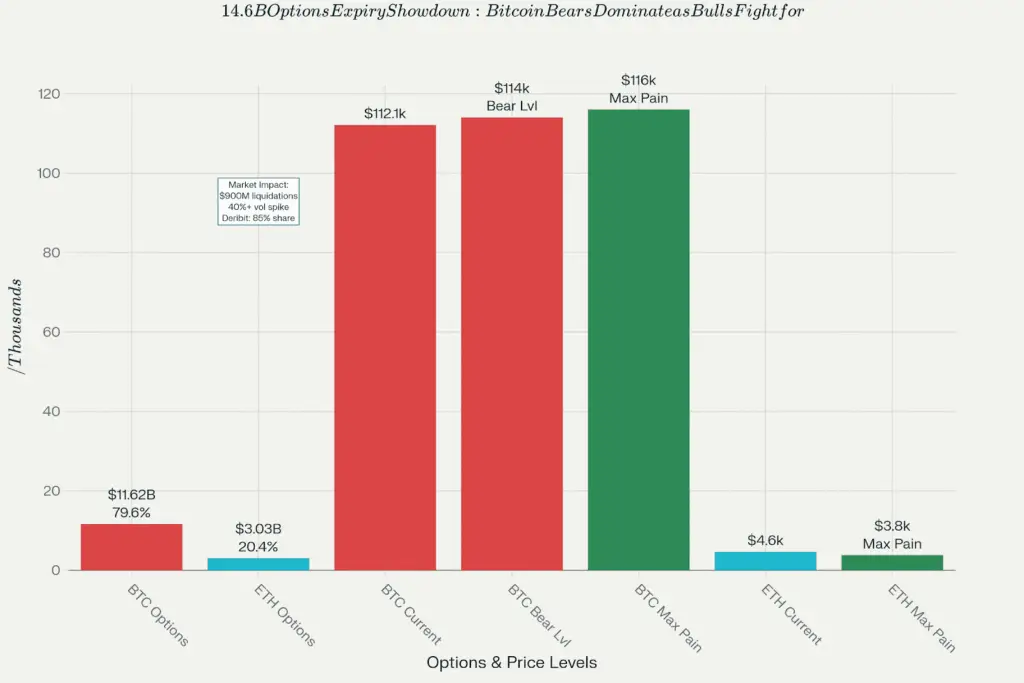

The cryptocurrency derivatives market faced its most significant stress test as $14.6 billion worth of Bitcoin and Ethereum options expired on Deribit, representing the largest notional value expiry in cryptocurrency history. The massive event, comprising $11.62 billion in Bitcoin contracts and $3.03 billion in Ethereum positions, created extreme volatility conditions that exposed the fragility of overleveraged market participants.

Massive $14.6B options expiry creates critical test as Bitcoin bears dominate positioning while bulls must defend $116K for survival

Source: CoinDesk Options Analysis, Deribit Official Data, AInvest Market Intelligence, CoinTribune Technical Assessment

The options positioning revealed stark market sentiment divergence. Bitcoin showed heavy bearish bias with massive put clusters concentrated between $108,000-$112,000 dangerously close to the cryptocurrency’s current trading level near $112,100. Only 12% of call options were positioned at $115,000 or below, leaving the vast majority of bullish strategies vulnerable to worthlessness at expiry.

Physical Bitcoin and Ethereum coins in front of a candlestick trading chart illustrating cryptocurrency market volatility coingape

The max pain theory indicating price levels causing maximum losses to option holders—pointed to $116,000 for Bitcoin and $3,800 for Ethereum. These levels represented critical battlegrounds where market makers and large position holders would fight to influence settlement prices in their favor.

Deribit’s 85% market share concentration amplified the potential impact, as the vast majority of global crypto options activity focused on a single platform. The exchange processed record volume in the days leading up to expiry, with institutional and retail traders alike scrambling to adjust positions ahead of the 8:00 AM UTC settlement deadline.

The timing proved particularly challenging as Bitcoin had just hit six-week lows, intensifying bearish momentum precisely when bulls needed strength to defend their positions. The $900 million in liquidations recorded during the previous week demonstrated how quickly leveraged positions could unwind under pressure, setting the stage for potentially explosive price movements around the expiry.

MicroStrategy’s Perfect Storm: Stock Plunges 15% Amid Funding Crisis

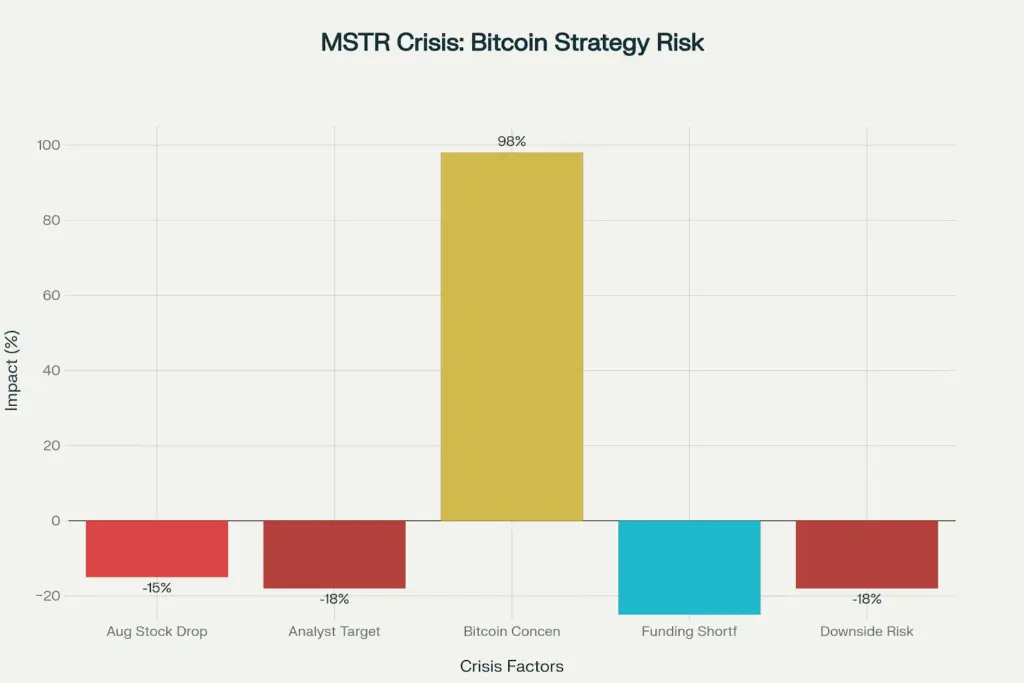

While crypto markets grappled with derivatives volatility, MicroStrategy faced its most severe crisis since adopting Bitcoin as its primary treasury strategy. The company’s stock plummeted 15% in August 2025, erasing billions in market value as investors lost confidence in the sustainability of its leveraged Bitcoin accumulation model.

MicroStrategy faces mounting crisis as 15% stock drop and funding failures expose extreme vulnerability to Bitcoin volatility amid analyst warnings

Source: Economic Times Analysis, Bloomberg Market Data, Ripple CTO Warnings, Monness Crespi Research

The crisis crystallized around MicroStrategy’s deteriorating funding dynamics. A recent preferred stock offering raised only $47 million far below expectations forcing the company to return to diluting common shareholders despite previous pledges to avoid such moves at low valuations. On August 25, MicroStrategy sold nearly 900,000 new shares, triggering investor accusations of broken promises and strategic inconsistency.

Man in suit with Bitcoin coin on a digital circuit background representing cryptocurrency investment by MicroStrategy’s Michael Saylor coingape

Ripple CTO David Schwartz’s warnings proved prescient as he had cautioned that MicroStrategy’s strategy represented “essentially a leveraged long position” on Bitcoin that would “not turn out well if Bitcoin trends downward.” His analysis highlighted how the company’s 98% concentration in Bitcoin currently holding 632,457 BTC at an average cost of $73,527 created extreme vulnerability to cryptocurrency volatility.

The accounting impact amplified the crisis through ASU 2023-08, which requires Bitcoin to be marked to market on the balance sheet. This accounting rule directly ties MicroStrategy’s earnings to Bitcoin price movements, creating feedback loops where Bitcoin declines trigger both asset write-downs and reduced earnings capacity—precisely the dynamic driving current investor concerns.

Monness, Crespi, Hardt & Co. analyst Gus Gala’s downgrade to “Sell” with a $220 price target implying 18% downside captured growing institutional skepticism. Gala warned that the convertible bond issuance strategy appeared “likely tapped,” forcing reliance on more expensive financing methods that could challenge the entire Bitcoin accumulation model.

The crisis extended beyond immediate funding concerns to fundamental questions about leveraged cryptocurrency strategies. With Bitcoin requiring defense above $116,000 to avoid triggering additional institutional selling, MicroStrategy’s fate became inextricably linked to the broader market’s ability to absorb volatility during the historic options expiry.

US Government Revolutionary Blockchain Adoption: GDP Goes Live on 9 Networks

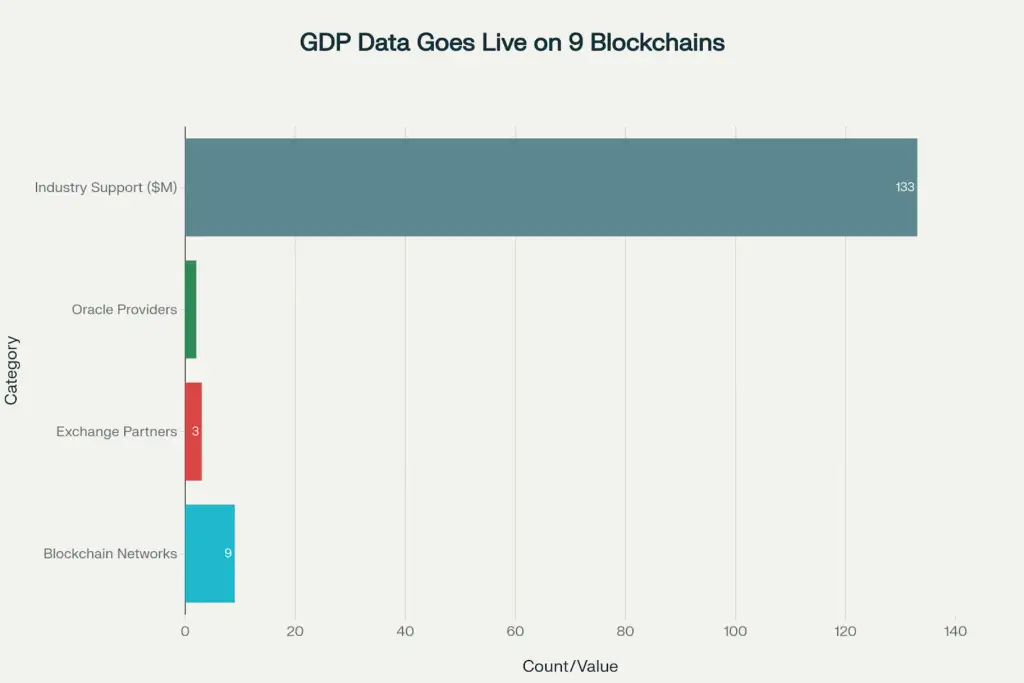

Amid market turmoil, the US government delivered cryptocurrency’s most significant legitimacy milestone by becoming the first G7 economy to publish official economic data on public blockchains. Commerce Secretary Howard Lutnick led the groundbreaking initiative that distributed Q2 2025 GDP figures across nine blockchain networks, marking a historic convergence of traditional government operations and decentralized technology.

US Government revolutionizes data distribution by publishing GDP figures on 9 blockchains, establishing America as global blockchain leadership pioneer

Source: US Commerce Department Official Release, CoinDesk Policy Coverage, Chainlink Partnership Announcement, Kraken Government Relations

The multi-blockchain approach demonstrated unprecedented technical sophistication and political commitment. The Commerce Department published official GDP data hashes and topline numbers across Bitcoin, Ethereum, Solana, TRON, Stellar, Avalanche, Arbitrum One, Polygon PoS, and Optimism creating immutable, globally accessible records of critical economic information.

U.S. Department of Commerce using blockchain technology to release GDP data, symbolizing government adoption of blockchain for economic reporting icobench

President Trump personally celebrated the initiative during a White House meeting, reinforcing his administration’s commitment to positioning America as the “blockchain capital of the world.” The project represented the culmination of extensive collaboration between government agencies and cryptocurrency infrastructure providers, including exchanges Coinbase, Kraken, and Gemini that helped procure necessary tokens for transaction fees.

Chainlink and Pyth Network served as oracle providers, creating automated data feeds that enable smart contracts to access US economic information in real-time. This infrastructure opens possibilities for automated trading strategies, prediction markets, inflation-linked financial products, and DeFi protocols that adjust parameters based on macroeconomic conditions.

The strategic significance extended far beyond technical implementation. Mike Cahill, CEO of Douro Labs who worked with the Commerce Department for two months on the project, emphasized the transformational impact: “With today’s announcement we are now in a world where government data lives on blockchains, and market participants can participate in real time.”

Commerce officials confirmed plans to expand the initiative government-wide, with Secretary Lutnick telling federal agency heads: “We are going to put our GDP on the blockchain, so people can use the blockchain for data distribution, and then we’re going to make that available to the entire government, so all of you can do it.”

Web3 Gaming Revolution: KuCoin Pay Partners with 2Game Digital

Adding to cryptocurrency’s mainstream adoption momentum, KuCoin Pay announced a strategic partnership with 2Game Digital that brings seamless cryptocurrency payments to global gaming audiences. The collaboration, launching promotional offers on August 29, represents a significant step toward Web3 integration in the rapidly expanding gaming market projected to reach $124 billion.

The partnership enables gamers to use cryptocurrencies including Bitcoin, Ethereum, Solana, USDT, USDC, and Dogecoin for purchases across 2Game Digital’s ecosystem. The integration covers 2Game.com’s ecommerce platform, 2Game Esports competitive gaming, and 2Game Pro’s play-to-earn mechanics, creating comprehensive cryptocurrency utility for gaming communities.

KuCoin Pay and 2Game partnership announced to expand Web3 utility in gaming with cryptocurrency payments, dated August 29, 2025 stocktitan

2Game Digital’s parent company GCL Global Holdings (NASDAQ: GCL) brings significant scale and legitimacy to the partnership. The collaboration includes development of the 2Game Token a blockchain-based utility token designed to power loyalty programs, competitive play, and token-gated rewards for gamers worldwide.

Launch promotions demonstrate the practical benefits of cryptocurrency adoption in gaming. KuCoin Pay users receive 20% instant discounts on eligible purchases, new release discounts, biweekly exclusive offers, and early access whitelisting for the highly anticipated 2Game Token ICO. These incentives showcase how cryptocurrency payments can provide tangible advantages over traditional payment methods.

Kumiko Ho, Head of Payment Business at KuCoin, emphasized the strategic importance: “Gaming is one of the most dynamic industries embracing Web3, and by integrating KuCoin Pay into 2Game’s ecosystem, we’re enabling millions of gamers to enjoy a more seamless, secure, and borderless payment experience.”

The partnership reflects broader trends toward Web3 gaming adoption driven by blockchain infrastructure, NFT integration, and play-to-earn models. As traditional gaming increasingly incorporates cryptocurrency mechanics, partnerships like this create practical pathways for mainstream users to experience digital asset utility beyond speculative trading.

Market Structure Evolution Amid Institutional Chaos

The convergence of massive options expiry, corporate funding crises, government blockchain adoption, and Web3 gaming partnerships illustrated cryptocurrency’s complex evolution toward institutional maturation despite persistent volatility risks. Several structural developments emerged from the extraordinary market conditions.

The options market’s $14.6 billion scale demonstrated derivatives’ growing influence over spot price discovery. With Deribit controlling 85% of crypto options volume, the platform’s settlement procedures and market maker positioning increasingly drive short-term price movements a dynamic requiring sophisticated understanding from institutional participants.

MicroStrategy’s crisis highlighted the risks of leveraged cryptocurrency strategies even during generally supportive market conditions. The company’s funding challenges and stock decline occurred despite Bitcoin maintaining levels above $110,000—suggesting that even successful cryptocurrency accumulation requires careful capital structure management and diversification considerations.

Government blockchain adoption represented unqualified validation of cryptocurrency infrastructure’s reliability and strategic importance. The Commerce Department’s multi-blockchain approach demonstrated technical feasibility while political backing from the Trump administration created precedent for expanded government cryptocurrency integration.

However, risks remained elevated across all market segments. The Fear and Greed Index registering neutral levels reflected uncertainty despite positive fundamental developments, while continued high volatility suggested markets remained vulnerable to rapid sentiment shifts.

The Web3 gaming trend provided potential offset to derivatives-driven volatility by creating practical cryptocurrency utility that extends beyond financial speculation. As gaming partnerships expand and play-to-earn mechanics mature, they could provide sustainable demand drivers independent of traditional investment flows.

Looking ahead, the resolution of Bitcoin’s battle around $116,000 during the options expiry, MicroStrategy’s ability to navigate funding challenges, and continued government blockchain expansion will likely determine whether August 29, 2025, represents a temporary volatility spike or the beginning of cryptocurrency’s next evolutionary phase toward mainstream institutional adoption.

The events of this extraordinary day featuring history’s largest options expiry, corporate cryptocurrency strategy crisis, revolutionary government adoption, and practical Web3 integration may be remembered as the moment cryptocurrency definitively transitioned from experimental technology to essential infrastructure despite persistent risks requiring sophisticated risk management approaches.

Related Articles:

- Market Meltdown: Trump’s Tariff Bombshell Triggers Historic Crypto Exodus

- Bitcoin Storms to $121,946, Just $1,145 Away from All-Time High Record

- Solo Bitcoin Miner Defies 650,000-to-1 Odds for $371K Jackpot as Critical Week Looms

- Expert Consensus: Bitcoin to Hit $175K-$180K by Year-End as Political and Institutional Forces Align

- $4.8B Options Expiry Shakes Crypto Markets as BNB Hits $900 ATH and Whale Rotates $75M to Ethereum

- 940m Liquidation Carnage: Bitcoin Whale’s 2.7B Dump Sparks Market Chaos as Solana Treasury Mania Erupts

[…] Historic $14.6B Options Expiry Triggers Crypto Chaos as MicroStrategy Crisis Deepens and US Governme… […]