The cryptocurrency landscape experienced pivotal developments on September 4, 2025, as Solana’s groundbreaking Alpenglow upgrade secured overwhelming 98% community approval to deliver 150-millisecond transaction finality, while Bitcoin confronted traditional September weakness that could drive prices toward the $93,000-$95,000 support zone. The convergence of Solana’s technical revolution, Bitcoin’s seasonal patterns, and institutional adoption milestones—including Galaxy Digital’s historic stock tokenization and Pineapple Financial’s $100 million Injective treasury highlighted both the maturation and volatility risks facing digital asset markets.

Bitcoin faces traditional September weakness as historical patterns suggest potential correction to $93K support before Q4 rally

Solana’s Alpenglow Revolution: 85x Speed Improvement Approved

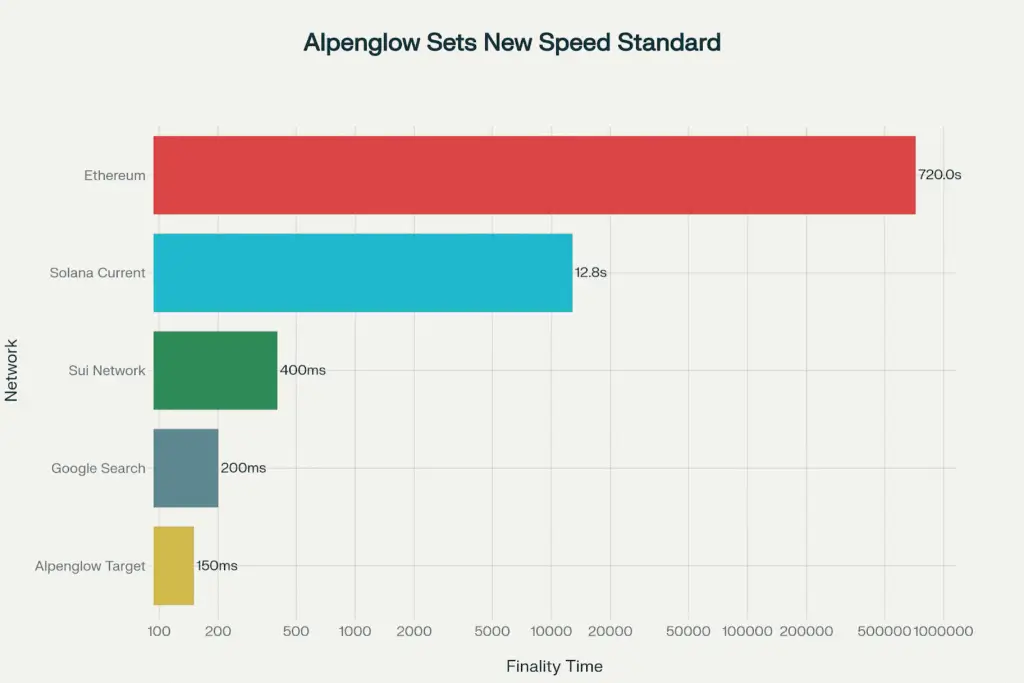

The Solana community delivered a resounding endorsement of the network’s most significant technical transformation since launch, approving the Alpenglow upgrade with 98.27% support in a decisive governance vote that concluded September 2. The revolutionary protocol promises to reduce transaction finality from the current 12.8 seconds to just 150 milliseconds an 85-fold improvement that would position Solana as faster than Google search queries.

Solana’s 98% approved Alpenglow upgrade promises 150ms finality—85x faster than current speeds—targeting $250 price as institutional adoption surges

Source: Solana Status Official Vote Results, CurrencyAnalytics Technical Analysis, CryptoNews Speed Comparisons, Blockhead Infrastructure Assessment

The Alpenglow upgrade represents a complete overhaul of Solana’s consensus mechanism, replacing the existing Proof-of-History and TowerBFT systems with two new components: Votor for block voting and finalization, and Rotor for data dissemination. Developed by Anza the research firm spun out from Solana Labs—the upgrade aims to process over 107,000 transactions per second with sub-second settlement, matching the performance of traditional payment processors like Visa and Mastercard.

Digital rendering of the Solana blockchain coin coingape

The technical implications extend far beyond raw performance metrics. Max Resnick, Lead Economist at Anza, explained that users will immediately experience “a reduction in confirmation latency to approximately 150-200ms,” representing at least a 5x improvement from current optimistic confirmations served in about one second. This enhancement enables applications requiring instant confirmation, including real-time trading, gaming, and payment systems that demand Web2-level responsiveness.

The upgrade’s economic benefits prove equally compelling. Validator costs will plummet from approximately $60,000 annually to just $1,000 under the new fee structure, democratizing network participation while introducing a 1.6 SOL per-epoch fee that burns tokens to create deflationary supply pressure. This dual mechanism of reduced barriers to entry and enhanced tokenomics could significantly increase network decentralization.

Market analysts immediately recognized Alpenglow’s transformative potential. MEXC Research Chief Analyst Shawn Yang projected SOL could reach $250 by year-end, driven by institutional recognition of Solana as “not a speculative, highly volatile instrument, but as a long-term reserve or infrastructure asset.” With public companies already accumulating over $1.7 billion in SOL holdings and rising ETF approval odds, the technical upgrade provides fundamental justification for sustained institutional adoption.

The implementation timeline targets testnet deployment by the December 2025 Breakpoint conference, followed by mainnet launch in Q1 2026. Multicoin Capital Managing Partner Kyle Samani described Alpenglow as “the most significant rewrite of the Solana protocol to date,” positioning it as a crucial milestone toward achieving one million transactions per second.

Bitcoin September Effect: Historical Pattern Points to $93K Floor

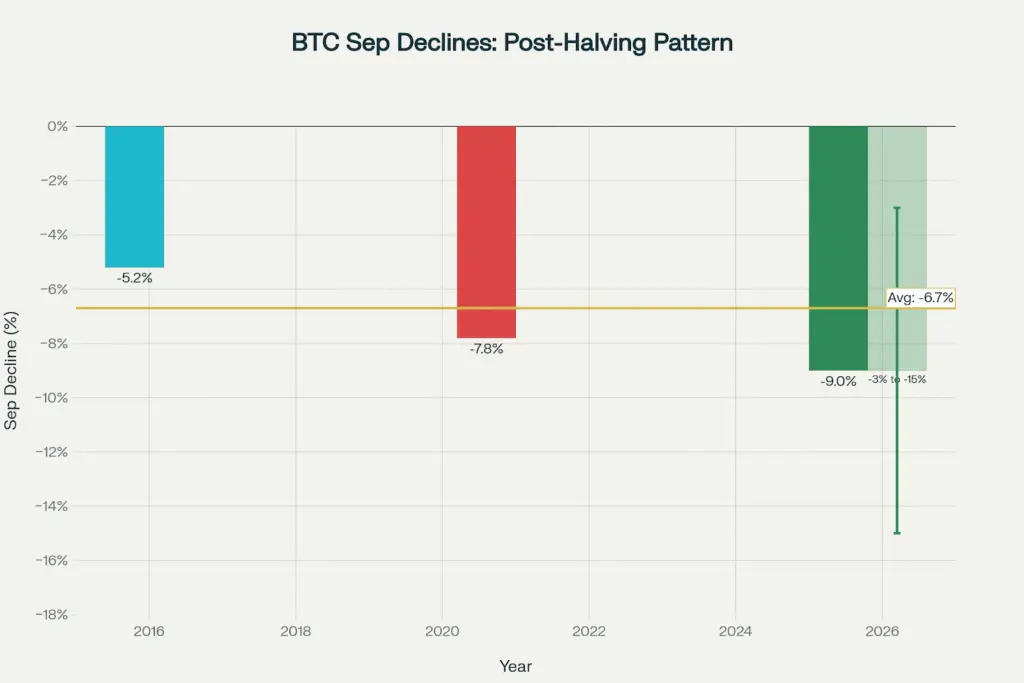

While Solana celebrated technical breakthroughs, Bitcoin confronted the notorious “September Effect” a historical pattern of weakness during the ninth month that has persisted across multiple market cycles. Trading at $110,536 with a modest 0.93% decline, Bitcoin maintained its established range between $104,000-$116,000, but technical indicators and historical precedent suggested deeper correction potential ahead.

Bitcoin September Effect shows historical -6.7% average decline in post-halving years, with $93K floor possible before traditional Q4 cycle peak rally

Source: Blockonomi Historical Analysis, CoinDesk Market Structure, Bitfinex Research Reports, MEXC Technical Assessment

Historical data reveals September’s challenging nature for Bitcoin, particularly in post-halving years. The cryptocurrency declined 5.2% in September 2017 following the 2016 halving and dropped 7.8% in September 2021 after the 2020 halving, establishing an average September decline of 6.7% during these critical cycle phases. The pattern reflects institutional portfolio rebalancing, reduced retail activity after summer months, and cautious positioning ahead of fourth-quarter volatility.

Bitfinex analysts identified the current correction as approaching historical precedent, with Bitcoin already declining 13% from its August all-time high of $124,496. Bull market corrections typically average 17% peak-to-trough, suggesting the market nears the typical limit of drawdowns before potential reversal. However, the risk of deeper correction remains present if key support levels fail.

The critical technical level to monitor is the Short-Term Holder Realized Price near $108,900, representing the cost basis of newer investors. A breakdown below this level could trigger cascading liquidations and open the path toward the $93,000-$95,000 range, where Bitfinex analysts expect “dense supply clusters” to provide durable support before potential rebounds.

Cryptocurrency analyst Benjamin Cowen noted that Bitcoin “historically finds a low in September of the post-halving year, and then bounces off of it into the market cycle top that occurs in Q4.” This seasonal pattern, if maintained, suggests current weakness may establish the foundation for year-end rallies that could propel Bitcoin toward new all-time highs above $130,000.

However, additional headwinds complicate the recovery narrative. Capital continues flowing out of Bitcoin ETFs while Ethereum-based investment products attract increased institutional interest, reflecting a strategic rotation toward assets with staking yields and smart contract capabilities. The shift demonstrates evolving institutional preferences beyond pure store-of-value plays.

Galaxy Digital’s Historic Tokenization Milestone

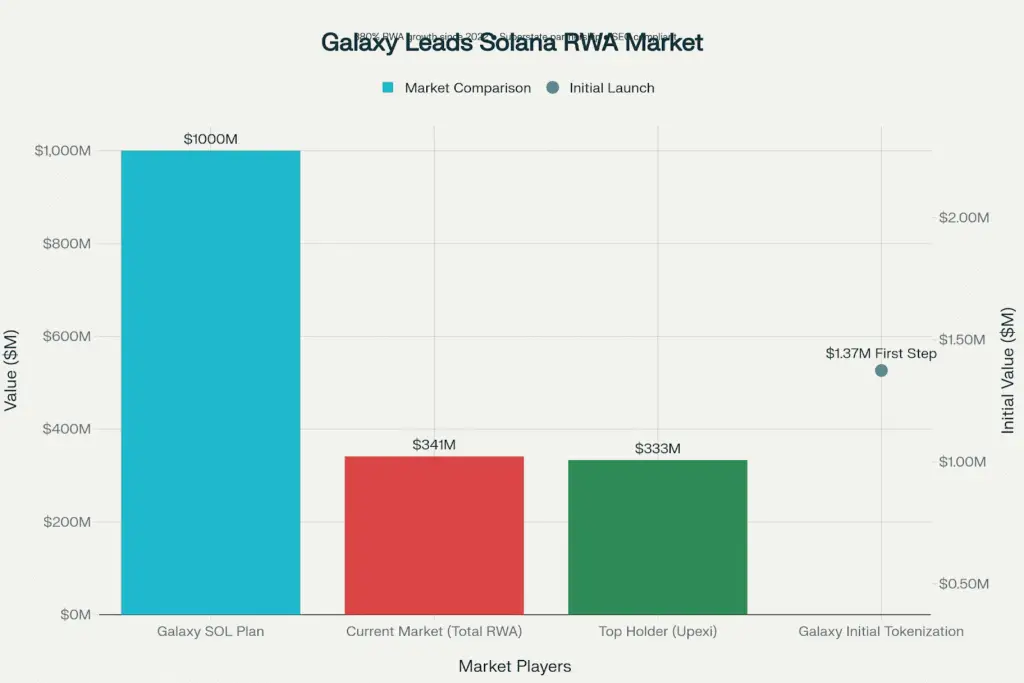

Amid market turbulence, Galaxy Digital achieved a watershed moment for traditional finance by becoming the first Nasdaq-listed company to tokenize its SEC-registered equity directly on a major blockchain. Through partnership with fintech firm Superstate, Galaxy’s Class A common shares are now available as tokens on the Solana blockchain, preserving full shareholder rights while enabling on-chain ownership and transfer.

Galaxy Digital pioneers blockchain equity tokenization as first Nasdaq company on Solana, bridging traditional finance with DeFi innovation

Source: Galaxy Digital Official Announcement, MEXC News Coverage, CoinMarketCap Academy Analysis, CoinDesk Business Integration

The tokenization initiative distinguishes itself from synthetic or wrapped alternatives by maintaining direct issuer participation. Superstate, functioning as an SEC-registered transfer agent, updates the official shareholder registry in real-time as tokens move between verified KYC’d wallets. This approach ensures that tokenized shares retain identical legal status to traditional equity holdings.

Galaxy Digital uses Solana blockchain to tokenize shares visible alongside the Nasdaq logo coingape

Galaxy CEO Mike Novogratz emphasized the strategic vision: “Our goal is a tokenized equity that brings the best of crypto—transparency, programmability and composability—into the traditional world.” The initiative aims to bridge traditional equity compliance with blockchain benefits including fast settlement, 24/7 availability, and automated market maker integration.

Initial adoption proved modest but significant, with 21 investors tokenizing a cumulative $1,374 through Superstate’s Opening Bell platform. While early uptake reflects the KYC requirements and institutional focus, the precedent establishes a framework for broader tokenized equity adoption that could transform public market infrastructure.

The timing coincides with Galaxy’s ambitious $1 billion Solana treasury strategy, positioning the company as approximately three times larger than current top SOL holder Upexi. This concentration creates a natural correlation between Galaxy’s stock performance and Solana’s price action, effectively providing traditional investors with regulated exposure to SOL through equity markets.

Robert Leshner, CEO of Superstate, highlighted the broader implications: “This marks the first time a Nasdaq-listed company has been tokenized on a significant public blockchain. Financial markets are undergoing a substantial upgrade with Superstate.” The development validates real-world asset tokenization trends that have accelerated 380% since 2022, reaching approximately $341 million in total tokenized stock value.

Pineapple Financial’s $100 Million Injective Treasury Strategy

The institutional cryptocurrency adoption narrative gained additional momentum as Pineapple Financial announced the creation of a $100 million Injective (INJ) treasury, becoming the first publicly traded company to hold significant positions in the DeFi-focused blockchain protocol. The initiative, revealed at Singapore’s Sonic Summit 2025, positions Pineapple as the largest institutional INJ holder while providing traditional investors with direct exposure to decentralized finance infrastructure.

Injective Protocol logo representing its brand identity in the DeFi and financial innovation space xangle

The $100 million allocation represents approximately 10% of INJ’s $1 billion market capitalization, creating potential price impact through systematic accumulation over the coming months. Prominent investors including FalconX, Kraken, Blockchain.com, and the Injective Foundation participated in the private placement, demonstrating broad institutional confidence in both Pineapple’s strategy and Injective’s long-term potential.

Pineapple expects approximately 12% passive yield through INJ staking rewards—among the highest returns available across major blockchain networks. This yield generation capability distinguishes the strategy from pure speculative plays, providing sustainable income streams that support the treasury’s long-term viability independent of price appreciation.

Injective Co-Founder Eric Chen described the development as “a defining moment for Injective and its ecosystem,” emphasizing the protocol’s role in bridging traditional financial markets with blockchain technology. The partnership positions Injective’s high-throughput infrastructure as institutional-ready, having already processed over $60 billion in transactions while maintaining focus on financial services applications.

The strategic timing aligns with broader real-world asset tokenization trends. McKinsey projects the RWA market could reach $2 trillion by 2030, positioning Injective’s financial infrastructure at the forefront of this transformation. Pineapple’s treasury could accelerate institutional entry into alternative cryptocurrency assets while establishing regulatory precedents for DeFi protocol exposure through traditional investment vehicles.

CEO Shubha Dasgupta emphasized the transformative potential: “INJ represents perhaps the best avenue to enable the entire finance industry to move onto blockchain-based rails.” The company’s commitment extends beyond market speculation toward systematic adoption of decentralized financial infrastructure that could reshape traditional banking and investment management.

Market Structure Evolution and Strategic Implications

The convergence of technical upgrades, seasonal patterns, and institutional adoption strategies illustrated cryptocurrency markets’ continued evolution toward mainstream financial infrastructure while maintaining characteristic volatility risks. Several structural developments emerged from the week’s events that could influence long-term market dynamics.

Solana’s Alpenglow approval demonstrated the cryptocurrency community’s sophisticated approach to technical governance and performance optimization. The overwhelming 98% support reflected stakeholder recognition that ultra-fast finality represents a competitive advantage capable of attracting institutional and enterprise adoption beyond current DeFi and memecoin applications.

The institutional tokenization trend, exemplified by Galaxy Digital’s Solana-based equity tokens and Pineapple’s Injective treasury, signaled growing comfort with blockchain infrastructure among traditional finance participants. These initiatives create practical pathways for regulated exposure to blockchain networks while maintaining compliance with existing securities laws.

However, Bitcoin’s September weakness reminded market participants that seasonal and cyclical patterns remain influential despite institutional adoption progress. The potential for correction toward $93,000-$95,000 support levels demonstrates that even mature cryptocurrency markets retain significant volatility risks requiring sophisticated risk management approaches.

The capital rotation from Bitcoin toward Ethereum and alternative protocols like Solana and Injective reflected evolving institutional preferences for yield-generating and utility-focused digital assets. This shift suggests that pure store-of-value narratives may prove insufficient for sustained institutional interest compared to blockchains offering staking rewards, smart contract capabilities, or specialized financial infrastructure.

Looking ahead, the September 17 Federal Reserve meeting presents a critical catalyst with 92% probability of a 25 basis point rate cut. Reduced interest rates typically benefit risk assets including cryptocurrencies by lowering opportunity costs of holding non-yielding investments and encouraging portfolio diversification toward alternative assets.

The events of September 4, 2025 featuring Solana’s historic speed upgrade approval, Bitcoin’s seasonal correction dynamics, and pioneering institutional tokenization strategies may be remembered as a pivotal moment when cryptocurrency markets demonstrated both their technological maturation and persistent need for sophisticated risk assessment. As digital assets continue integrating with traditional finance through innovative corporate strategies, market participants must navigate the complex interplay between revolutionary technology and established investment cycles that continue shaping cryptocurrency valuations.

Related Articles:

- Bitcoin Storms to $121,946, Just $1,145 Away from All-Time High Record

- Solo Bitcoin Miner Defies 650,000-to-1 Odds for $371K Jackpot as Critical Week Looms

- Expert Consensus: Bitcoin to Hit $175K-$180K by Year-End as Political and Institutional Forces Align

- $4.8B Options Expiry Shakes Crypto Markets as BNB Hits $900 ATH and Whale Rotates $75M to Ethereum

- 940m Liquidation Carnage: Bitcoin Whale’s 2.7B Dump Sparks Market Chaos as Solana Treasury Mania Erupts