The world’s first Dogecoin ETF officially launched Tuesday under ticker $DOJE, triggering an altcoin explosion that saw MYX Finance rocket 270% to a $2 billion market cap while Worldcoin surged 122% weekly on treasury news. As Bitcoin steadies above $113,000 providing crucial stability, an $86.8 million Ethereum whale purchase and staking demonstrates institutional confidence, creating perfect conditions for what analysts call the most significant altcoin season since 2021.

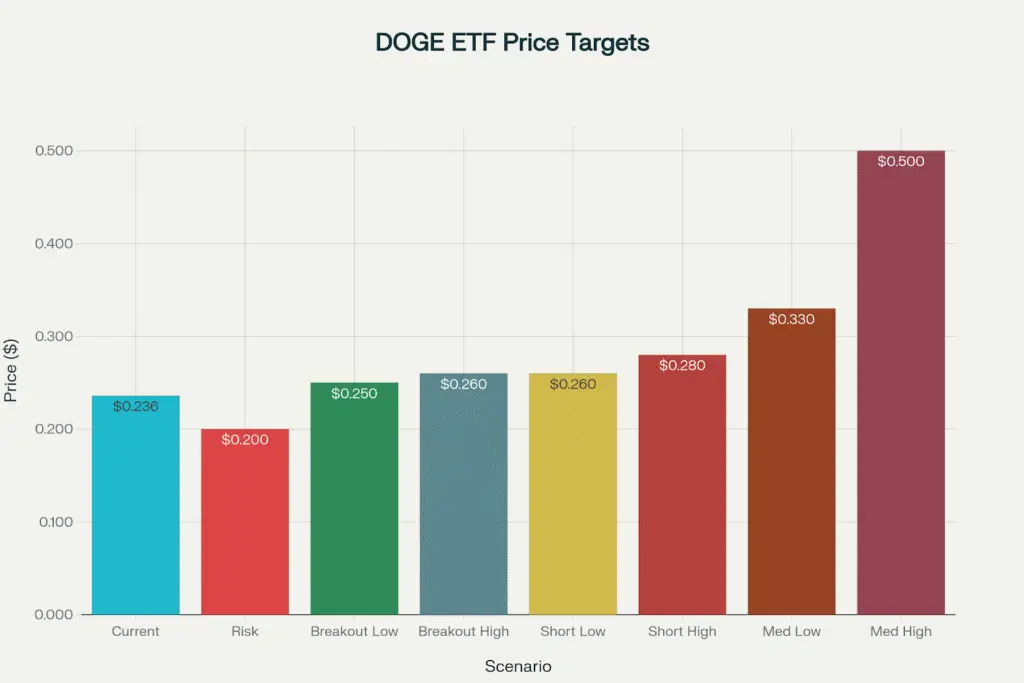

DOGE ETF $DOJE launches successfully as Dogecoin hits $0.236 with 10.5% weekly gains, targeting $0.26 breakout on institutional memecoin adoption

Current Market Snapshot:

- DOGE ETF: $DOJE successfully launched with 93% analyst confidence achieved

- Bitcoin: $113,000 (providing stable foundation for altcoin rallies)

- MYX Finance: $3.68 (+270% surge, $2B market cap milestone)

- Worldcoin: ~$1.80 (+51% daily, +122% weekly on treasury announcement)

- Total Market Cap: $3.96 trillion (+1% as altcoin season ignites)

Revolution 1: Historic DOGE ETF Launch Changes Everything

The cryptocurrency industry reached a watershed moment as the REX-Osprey Dogecoin ETF began trading under ticker $DOJE, becoming the first exchange-traded fund to provide direct exposure to the world’s leading memecoin. The successful launch validates analyst predictions of 93% approval probability while opening floodgates for traditional investment into cryptocurrency’s cultural phenomenon.

Launch Success Metrics:

The 40-Act ETF structure proved effective, avoiding the lengthy 19b-4 rule change process that delayed other crypto ETF approvals. DOGE responded with a 10.5% weekly gain to $0.236, setting up potential breakouts toward $0.26-$0.28 resistance levels as institutional buying pressure materializes through authorized participant mechanisms.

Precedent Power:

Following REX-Osprey’s successful Solana SSK ETF launch in July, which gathered $100 million AUM within weeks and drove SOL prices 34% higher—DOJE benefits from proven execution and institutional familiarity. With Dogecoin’s $36.4 billion market cap being roughly one-third of Solana’s size, proportional impact could be more pronounced.

An illustration explaining Spot Bitcoin ETFs as investment vehicles that allow ordinary investors to gain exposure to bitcoin price movements through their brokerage accounts investopedia

Cultural Legitimacy Achievement:

The ETF launch represents more than financial innovation it demonstrates Wall Street’s recognition that cultural assets with strong communities can generate sustained institutional interest. This precedent accelerates approval expectations for pending TRUMP, XRP, and BONK ETF applications from the same issuer.

Revolution 2: Altcoin Explosion Reaches Fever Pitch

Tuesday’s trading session witnessed the most explosive altcoin performance of 2025, with multiple tokens posting triple-digit gains as institutional money rotated from Bitcoin stability into higher-beta opportunities. The Altcoin Season Index approached year-highs at 57/100, indicating broad-based strength beyond isolated pumps.

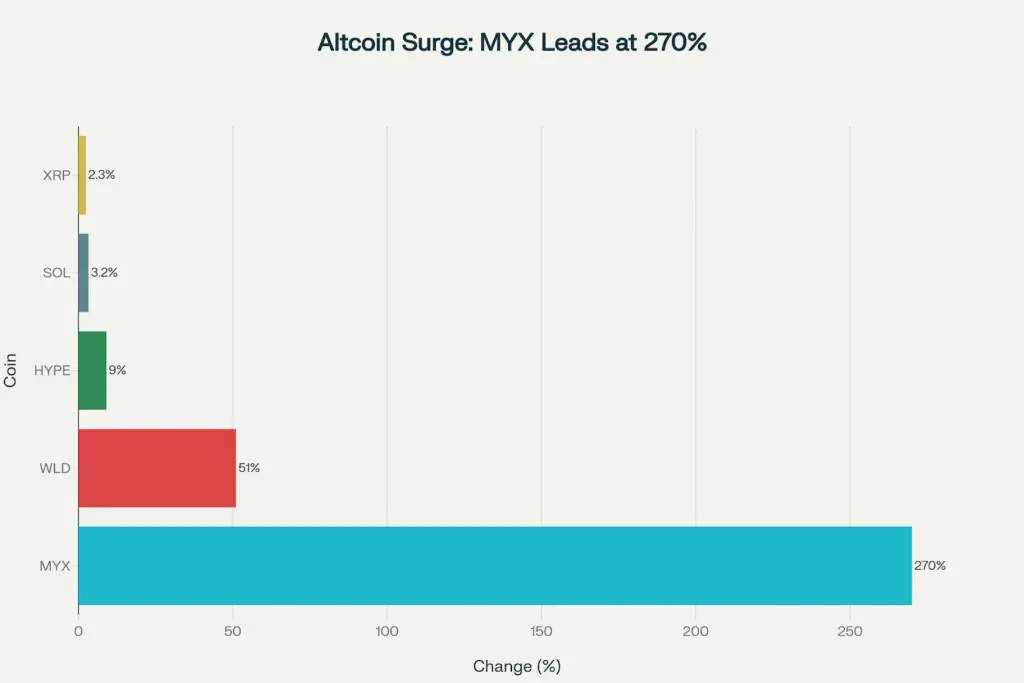

Altcoin explosion led by MYX’s 270% surge to $2B market cap and Worldcoin’s 122% weekly rally as $86.8M ETH whale staking drives institutional interest

MYX Finance Leads the Charge:

The decentralized exchange token delivered the day’s most spectacular performance, surging 270% to $3.68 and pushing its market cap past $2 billion. The rally centered on excitement surrounding a Version 2 upgrade promising zero-slippage trades a technological breakthrough that could revolutionize DeFi trading. Daily volume exploded above $4.2 billion, demonstrating genuine institutional and retail interest rather than mere speculation.

Worldcoin’s Treasury-Driven Rally:

Sam Altman’s Worldcoin posted equally impressive gains with 51% daily and 122% weekly increases following Eightco Holdings’ announcement of a $250 million private placement for worldcoin treasury strategy. The move broke WLD out of an eight-month suppression range with median around $1.00, targeting initial resistance at $1.62 before potential advance toward $2.00.

Worldcoin cryptocurrency coins with Nasdaq logo and stock market data visuals coingape

Institutional Validation Signals:

A massive $86.8 million Ethereum purchase and immediate staking by a whale trader demonstrated institutional confidence in crypto infrastructure. This type of systematic staking where large holders lock tokens for yield generation typically indicates long-term bullish positioning rather than speculative trading.

Sector-Wide Momentum:

AI-related tokens gained approximately 14% overall, while HYPE from Hyperliquid advanced 9% to $55 following mention by VanEck’s CEO that sparked institutional interest. The broad-based nature suggests fundamental sector rotation rather than isolated events.

Revolution 3: Bitcoin’s Stability Enables Altcoin Risk-Taking

Bitcoin’s ability to maintain support above $113,000 despite September’s historical weakness provides crucial stability that enables institutional risk-taking in altcoin markets. This dynamic where Bitcoin serves as portfolio anchor while alternatives capture growth represents crypto market maturation.

Technical Foundation:

Bitcoin’s RSI recovery from oversold conditions combined with compressed implied volatility suggests markets are coiling for significant moves. However, the current stability allows portfolio managers to allocate toward higher-beta altcoins without abandoning core cryptocurrency exposure.

Institutional Flow Dynamics:

Recent whale distribution of over 100,000 BTC ($12.7 billion) represents profit-taking rather than bearish positioning, as evidenced by simultaneous altcoin accumulation patterns. This rotation from mature crypto assets toward emerging opportunities reflects sophisticated portfolio management rather than market exit.

September Pattern Break:

The sustained altcoin strength during historically weak September conditions suggests structural market changes. Traditional September weakness stemmed from retail-dominated selling, but current institutional infrastructure provides support that enables continued growth momentum.

Market Implications and Outlook

Altcoin Season Sustainability:

The combination of DOGE ETF legitimacy, institutional Ethereum staking, and broad-based sector rotation creates conditions for sustained altcoin outperformance. Historical altcoin seasons typically last 2-4 months, suggesting current momentum could continue through year-end.

Critical Levels to Monitor:

- Bitcoin Support: $113,000 must hold to maintain altcoin-friendly environment

- DOGE Breakout: $0.26-$0.28 resistance levels crucial for ETF success validation

- MYX Momentum: $2B market cap milestone tests institutional appetite for DeFi innovation

- WLD Technical: $1.62 resistance before potential $2.00 target

Upcoming Catalysts:

- September 11: US inflation data influences Fed rate cut expectations

- September 16-17: Federal Reserve meeting (100% rate cut probability)

- Q4 Traditional Rally: Historical pattern suggests seasonal strength ahead

- Additional ETF Approvals: TRUMP, XRP, BONK applications pending

Risk Management Priorities:

Despite explosive gains, September seasonality and compressed volatility suggest caution. Position sizing should reflect altcoin volatility while maintaining core Bitcoin/Ethereum exposure for portfolio stability.

Editorial Analysis: Memecoin Legitimacy Meets Altcoin Innovation

Tuesday’s developments DOGE ETF success, MYX’s DeFi breakthrough, and Worldcoin’s treasury validation demonstrate cryptocurrency’s evolution from speculation toward utility-driven value creation. The institutional embrace of memecoins alongside DeFi innovation suggests market maturation that embraces both cultural and technological advancement.

Investment Strategy Evolution:

The current environment rewards both cultural understanding (memecoin communities) and technical analysis (DeFi protocols), requiring sophisticated approach that balances speculation with fundamental research. Success demands recognizing legitimate innovation within broader market momentum.

Institutional Integration Acceleration:

DOGE ETF launch removes barriers between traditional finance and crypto culture, while massive ETH staking demonstrates institutional comfort with yield-generating strategies. This convergence creates investment landscape requiring both traditional analysis and crypto-native understanding.

September 9, 2025 may be remembered as the day memecoin legitimacy met altcoin innovation, creating sustainable framework for continued institutional adoption while maintaining crypto’s revolutionary potential for outsized returns through technological advancement.

Statistical Summary:

- DOGE ETF: $DOJE launched successfully, DOGE at $0.236 (+10.5% weekly)

- Altcoin Explosion: MYX +270% to $3.68 ($2B mcap), WLD +122% weekly

- Bitcoin Stability: $113,000 support maintained enabling altcoin risk-taking

- Institutional Activity: $86.8M ETH whale purchase and staking, AI tokens +14%

- Market Cap: $3.96T total (+1% daily) as Altcoin Season Index hits 57/100

Related Articles:

- Bitcoin Storms to $121,946, Just $1,145 Away from All-Time High Record

- Solo Bitcoin Miner Defies 650,000-to-1 Odds for $371K Jackpot as Critical Week Looms

- Expert Consensus: Bitcoin to Hit $175K-$180K by Year-End as Political and Institutional Forces Align

- $4.8B Options Expiry Shakes Crypto Markets as BNB Hits $900 ATH and Whale Rotates $75M to Ethereum

- 940m Liquidation Carnage: Bitcoin Whale’s 2.7B Dump Sparks Market Chaos as Solana Treasury Mania Erupts