Breaking: Blockchain Crosses the Institutional Rubicon

In a watershed moment for cryptocurrency legitimacy, Figure Technologies completed Wall Street’s largest blockchain company IPO today, raising $787.5 million at a stunning $5.29 billion valuation exceeding all targets and proving institutional appetite for regulated crypto businesses. The historic debut coincides with Avalanche Foundation’s audacious $1 billion treasury strategy involving crypto industry heavyweights Hivemind Capital and Dragonfly Capital, creating a perfect storm of institutional validation hours before critical inflation data that could trigger explosive market moves.

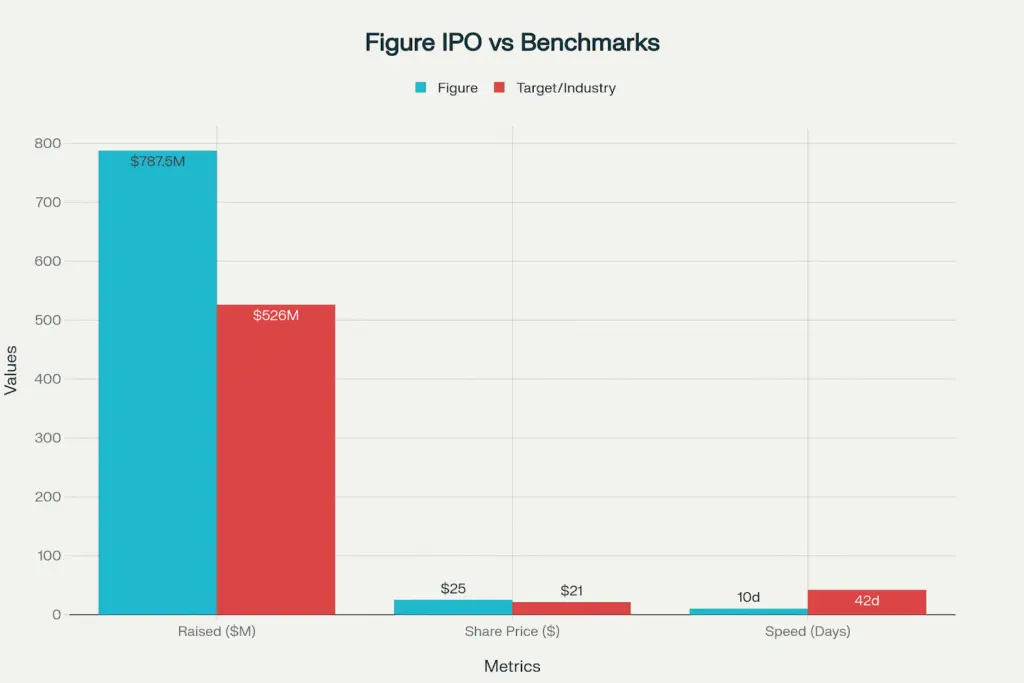

Figure Technologies raises $787.5M in successful blockchain lending IPO at $25/share, achieving $5.29B valuation as crypto meets traditional finance

Market-Moving Headlines:

- Figure Technologies: Nasdaq debut (FIGR) at $25/share, 50% above initial range

- Avalanche Treasury: Two $500M vehicles target largest Layer-1 institutional adoption

- CPI Countdown: 8:30 AM ET inflation data could spark Fed rate cut acceleration

- Bitcoin: $114,370 (+2.39%) testing resistance as institutions position aggressively

- Institutional Tsunami: $741M Bitcoin ETF daily inflows signal major positioning

coingape

The Figure Phenomenon: Blockchain Lending Conquers Wall Street

Figure Technologies has shattered every expectation, raising $787.5 million in what represents the most successful blockchain company IPO in financial history. Led by Goldman Sachs, Jefferies, and Bank of America Securities, the offering priced at $25 per share significantly above the recently increased $20-$22 range while expanding total shares from 26 million to 31.5 million due to overwhelming institutional demand.

Revolutionary Business Validation:

Founded by SoFi co-founder Mike Cagney in 2018, Figure has originated over $16 billion in home equity loans using proprietary blockchain technology that reduces processing time from the industry standard 42 days to just 10 days. This 76% efficiency improvement, applied to the $4.5 trillion addressable home equity market, attracted institutional investors seeking exposure to blockchain’s practical applications rather than speculative trading.

Wall Street’s Blockchain Embrace:

The SEC’s approval and premium pricing establish crucial precedent for blockchain-based financial services companies. Figure’s position as the largest non-bank home equity provider demonstrates scalability that convinced traditional investment banks to lead the offering, marking blockchain’s definitive acceptance in regulated financial markets.

Nasdaq logo banner reuters

Immediate Market Impact:

Figure’s success validates the thesis that blockchain creates defensible competitive advantages in traditional finance. The company begins trading on Nasdaq under ticker FIGR, providing institutional and retail investors direct exposure to a profitable blockchain business model with clear revenue streams from loan origination and servicing fees.

Avalanche’s Billion-Dollar Gambit: Rewriting Institutional Crypto Playbooks

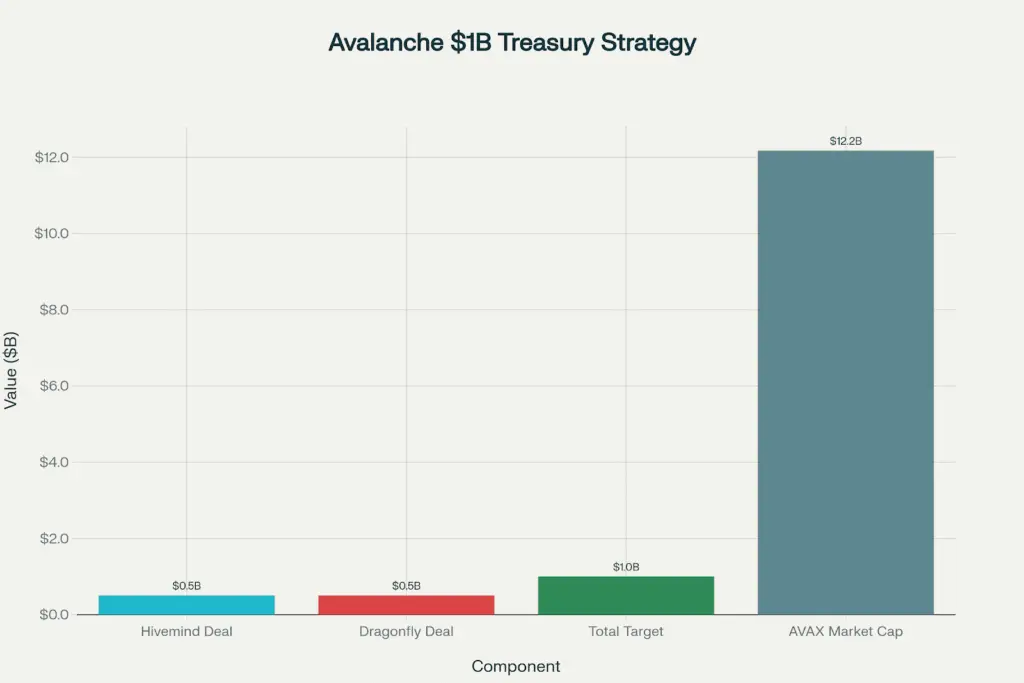

While Figure conquered traditional finance, Avalanche Foundation unveiled the most ambitious Layer-1 institutional adoption strategy ever attempted a $1 billion fundraising initiative through two sophisticated treasury vehicles that could establish new templates for crypto ecosystem financing.

Avalanche Foundation launches $1B treasury strategy with Hivemind and Dragonfly Capital leading two $500M vehicles for discounted AVAX acquisition

The Master Strategy Unveiled:

The comprehensive approach involves two separate $500 million raises led by crypto’s most sophisticated institutional players. Hivemind Capital leads the first initiative through a private placement in an existing Nasdaq-listed company, while Dragonfly Capital spearheads the second via a Special Purpose Acquisition Company (SPAC) structure targeting closure by October 2025.

Heavy-Hitter Validation:

Anthony Scaramucci’s involvement as advisor brings Wall Street credibility and political connections that could accelerate mainstream adoption. Dragonfly Capital’s participation demonstrates venture capital confidence in the treasury strategy model, following successful precedents like MicroStrategy’s Bitcoin accumulation approach.

Market Mathematics:

AVAX surged 8% to $28.84 on the announcement, with the token’s $12.17 billion market cap providing sufficient liquidity for institutional-scale purchases. The foundation’s discounted token sales create aligned incentives institutions gain below-market entry while the foundation secures capital for ecosystem development.

Avalanche (AVAX) logo in front of a classical institutional building with financial market charts, symbolizing institutional investment and treasury strategy financefeeds

Strategic Innovation:

The dual-vehicle structure addresses different institutional preferences: direct equity exposure through Nasdaq listing versus flexibility through SPAC mechanisms. This comprehensive approach could template institutional crypto adoption for other Layer-1 platforms seeking capital while maintaining token economics balance.

CPI Data Powder Keg: Inflation Numbers Hold Crypto’s $4 Trillion Fate

The 8:30 AM ET Consumer Price Index release represents crypto’s most significant macro catalyst since Jackson Hole, with economists expecting 2.9% annual inflation in a reading that could determine whether Bitcoin explodes toward $120,000 or retreats to $100,000 support levels.

Historical Volatility Patterns:

Previous CPI releases show Bitcoin typically experiences 9-11% moves when inflation significantly deviates from consensus. The current technical setup Bitcoin coiled at $114,370 resistance with compressed volatility suggests potential for dramatic price action given the institutional positioning evident in record ETF inflows.

Fed Policy Crossroads:

Markets price 91.7% probability of rate cuts, but magnitude remains uncertain. Softer inflation could increase 50 basis point cut chances versus 25 basis points, potentially triggering major capital rotation into risk assets. Conversely, hotter inflation could delay easing and pressure crypto significantly.

Wooden blocks spelling CPI next to a Bitcoin coin with US flag and market charts in the background, depicting the impact of inflation data on cryptocurrency markets coingape

Institutional Pre-Positioning:

Record $741 million Bitcoin ETF inflows and $171.5 million Ethereum ETF gains demonstrate sophisticated money positioning ahead of CPI. This institutional confidence suggests expectation of favorable data, but increases reversal risk if inflation disappoints.

$4 Trillion Threshold:

Total crypto market cap approaching this psychological milestone creates both opportunity and vulnerability. Success beyond $4 trillion could trigger additional institutional allocation mandates, while failure might spark broad profit-taking across the ecosystem.

Market Implications: When Legitimacy Meets Opportunity

Revolutionary Convergence:

Today’s developments successful blockchain IPO, billion-dollar treasury strategies, institutional ETF positioning demonstrate crypto markets achieving legitimacy requiring sophisticated analysis combining traditional finance principles with blockchain-native understanding.

Investment Strategy Evolution:

Current conditions reward approaches balancing institutional adoption metrics (IPO success, treasury strategies) with macro positioning (CPI sensitivity, Fed policy). Figure and Avalanche’s success suggests sustainable value creation through technological innovation rather than speculative dynamics.

Critical Levels Ahead:

- Bitcoin: Must hold $113,000 support; break above $116,500 triggers momentum

- Institutional Flows: ETF demand sustainability crucial for continued legitimacy

- CPI Impact: Deviation from 2.9% consensus could spark 10%+ moves either direction

- Market Cap: $4 trillion breakthrough would validate institutional allocation thesis

Risk-Reward Assessment:

The convergence creates complex scenarios where traditional correlation analysis may prove insufficient. Figure’s IPO success and Avalanche’s treasury strategy during Fed policy uncertainty suggest crypto maturation beyond pure speculation toward fundamental value creation.

Looking Forward: The New Institutional Paradigm

September 11, 2025 marks cryptocurrency’s institutional coming-of-age, where Wall Street investment banks validate blockchain business models through major IPO leadership while sophisticated crypto VCs deploy billion-dollar treasury strategies. This convergence, occurring at a critical monetary policy inflection point, creates conditions where patient, research-driven approaches focusing on fundamental blockchain adoption may generate sustained returns transcending traditional crypto market cycles.

The success of both Figure’s traditional finance approach and Avalanche’s crypto-native strategy demonstrates multiple pathways for institutional adoption, suggesting the industry has matured beyond single-solution dependence toward diversified legitimacy requiring both technological innovation and regulatory compliance for sustained success.

Key Statistics:

- Figure IPO: $787.5M at $25/share ($5.29B valuation), Goldman Sachs-led

- Avalanche Strategy: $1B across two vehicles (Hivemind/Dragonfly leadership)

- Market Position: Bitcoin $114,370, approaching $4T total crypto market cap

- Institutional Evidence: $741M BTC ETF inflows, $171.5M ETH ETF gains

- CPI Expectations: 2.9% consensus, 91.7% Fed cut probability

Related Articles:

- Market Meltdown: Trump’s Tariff Bombshell Triggers Historic Crypto Exodus

- Bitcoin Storms to $121,946, Just $1,145 Away from All-Time High Record

- Solo Bitcoin Miner Defies 650,000-to-1 Odds for $371K Jackpot as Critical Week Looms

- Expert Consensus: Bitcoin to Hit $175K-$180K by Year-End as Political and Institutional Forces Align

- $4.8B Options Expiry Shakes Crypto Markets as BNB Hits $900 ATH and Whale Rotates $75M to Ethereum

- CPI Data Could Determine Crypto’s $4 Trillion Milestone