Vietnam launches revolutionary $379 million crypto pilot program, setting new global standards for institutional cryptocurrency regulation and adoption

The Weekend That Changed Everything

While crypto traders enjoyed their Saturday morning coffee, Vietnam quietly detonated a regulatory bomb that’s reshaping global cryptocurrency standards. The Southeast Asian nation’s $379 million minimum capital requirement for crypto exchanges—launched this week as part of a groundbreaking 5-year pilot program—has created the world’s strictest crypto regulatory framework just as markets crossed the psychological $4 trillion threshold. This perfect storm of regulatory legitimacy and market momentum has triggered explosive altcoin season dynamics, with the Altcoin Season Index hitting a 2025 high of 80 while stablecoin supply surges to record $287 billion levels.

Vietnam launches world’s strictest crypto framework requiring $379M minimum capital, setting unprecedented global standards for institutional cryptocurrency regulation

Market Reality Check:

- Vietnam Regulation: $379M minimum capital (291x higher than Hong Kong’s $1.3M requirement)

- Market Milestone: $4.07 trillion total crypto market cap achieved

- Altcoin Explosion: Season Index at 80/100, highest 2025 reading

- Bitcoin Weekend: $115,985 (-0.11%) consolidating above key support

- Stablecoin Tsunami: $287B supply with $17B Ethereum growth in August alone

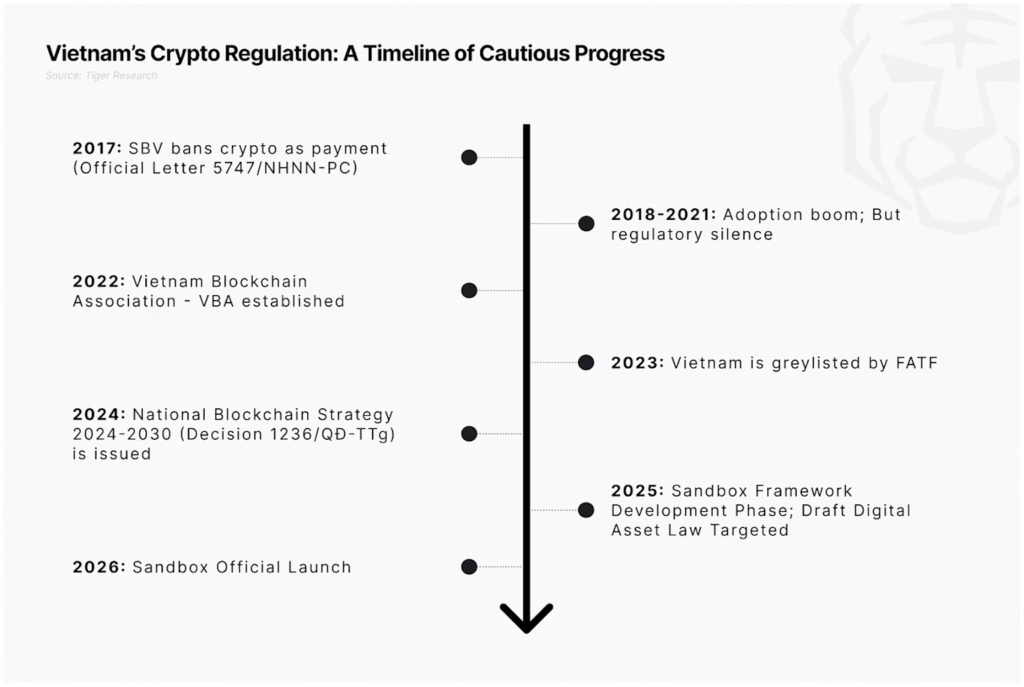

Timeline of Vietnam’s cautious progress in cryptocurrency regulation from 2017 to 2026 reports.tiger-research

Vietnam’s $379 Million Crypto Earthquake

Vietnam has just redefined what serious cryptocurrency regulation looks like. The nation’s 5-year pilot program, officially launched September 9, requires crypto exchanges to maintain 10 trillion Vietnamese dong ($379 million USD) in minimum capital a requirement that makes other global frameworks look like regulatory suggestions rather than serious policy.

The Numbers Don’t Lie:

This capital requirement dwarfs international competitors by staggering margins. Hong Kong requires $1.3 million for crypto licensing. Singapore operates under MAS framework guidelines. Vietnam demands nearly 300 times more capital than Hong Kong, creating an institutional-grade barrier that eliminates all but the most sophisticated operators.

Institutional Control Mandated:

The framework requires 65% of exchange capital come from institutional investors, with at least two major financial institutions banks, securities firms, or fund managers collectively holding over 35% ownership stakes. Foreign participation remains capped at 49%, ensuring domestic control while allowing international expertise and capital.

Market Context Stunning:

Vietnam ranked 4th globally in crypto adoption for 2025, with 17 million citizens actively engaged in cryptocurrency markets totaling over $100 billion in digital assets. The regulatory framework aims to capture this massive gray market activity within legal channels while maintaining the world’s highest operational standards.

Close-up of physical Bitcoin coins representing cryptocurrency and digital trading economictimes

$4 Trillion Milestone: When Markets Make History

The total cryptocurrency market capitalization crossing $4 trillion represents more than a psychological victory—it demonstrates institutional adoption reaching critical mass where crypto commands attention from sovereign wealth funds, pension allocations, and central bank reserves.

Crypto market crosses $4T milestone as altcoin season index hits 80/100 and $287B stablecoin supply surge signals massive institutional capital rotation

Breakthrough Analytics:

The September 9-11 crossing occurred with $259 billion daily trading volume and +1.8% breakthrough gains, indicating genuine institutional buying rather than speculative pumping. After exiting the $4 trillion zone on August 22, markets spent just 21 days below this threshold before mounting a sustained comeback.

Bitcoin Dominance Shift:

Bitcoin’s market share has declined from 66% in mid-2025 to 59.18% currently, dropping below the critical 60% threshold that historically signals altcoin season emergence. This 10% dominance decline creates conditions for explosive alternative cryptocurrency performance.

Volume Migration Evidence:

September data shows altcoins capturing 37.2% of total trading volume, while Bitcoin and Ethereum account for just 30.9% and 31.8% respectively. This volume shift indicates capital rotation from established cryptocurrencies toward higher-beta opportunities.

Chart showing past and predicted altcoin market surges labeled as Altcoin Seasons 1.0, 2.0, and the forecasted 3.0 with increasing multiples of gains compared to Bitcoin cryptodnes

Capital Flow Mechanics:

The classical crypto market cycle shows capital flowing from Bitcoin → Ethereum → Large-cap altcoins → Mid-cap altcoins → Small-cap speculation. Current data suggests markets have entered the large-cap altcoin phase, with potential acceleration toward broader alternative cryptocurrency adoption.

Altcoin Season 3.0: The Numbers Confirm What Traders Feel

The Altcoin Season Index reaching 80/100 represents the highest 2025 reading and confirms what sophisticated traders have sensed for weeks: alternative cryptocurrencies are entering a sustained outperformance period that could rival 2021’s explosive altcoin gains.

Technical Confirmation Signals:

- Altcoin market cap approaching all-time highs

- TOTAL3 (non-BTC, non-ETH market cap) nearing breakout levels

- Cross-asset correlations breaking down as individual tokens find independent momentum

- Ethereum leading with +5% recent gains while Bitcoin consolidates

Sector Rotation Evidence:

DeFi renaissance driven by reduced Ethereum transaction fees, Layer-1 competition intensifying between Solana, Avalanche, and emerging platforms, institutional staking demand supporting governance tokens, and cultural cryptocurrencies like Dogecoin maintaining ETF-driven momentum.

Stylized graphic highlighting a bullish altcoin market surge with rising candlestick and volume charts binance

Historical Pattern Recognition:

Previous altcoin seasons typically lasted 2-4 months during favorable macroeconomic conditions. Current Federal Reserve easing expectations, combined with regulatory clarity improvements globally, suggest conditions for extended alternative cryptocurrency outperformance.

The Stablecoin Tsunami: $287 Billion Liquidity Engine

Behind every major crypto rally lies stablecoin supply expansion, and current numbers indicate the largest liquidity injection in cryptocurrency history. Total stablecoin supply reaching $287 billion represents real fiat capital entering crypto markets, not speculative trading creating artificial volume.

Ethereum Domination:

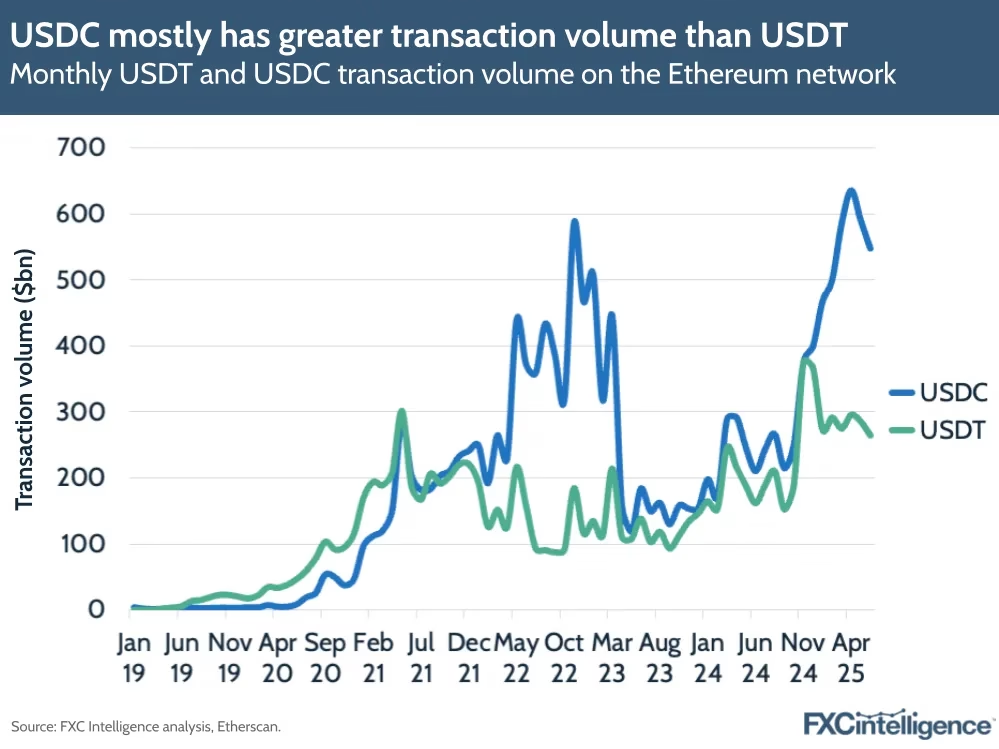

August alone saw $17 billion stablecoin supply growth on Ethereum, more than all other blockchains combined. USDC led this expansion with $9.4 billion supply increases, boosting its DeFi dominance from 55% to 58% as institutional preference shifts toward regulated stablecoin issuers.

Monthly transaction volumes on Ethereum show USDC surpassing USDT since mid-2021, with USDC transaction volume reaching over $600 billion by early 2025 fxcintel

Capital Flow Implications:

Every newly minted stablecoin represents corresponding fiat inflow into crypto markets. Current expansion rates suggest institutional and retail capital positioning for major cryptocurrency purchases, creating systematic buying pressure across Bitcoin, Ethereum, and altcoin markets.

Strategic Positioning:

Analysts describe current conditions as “stablecoin season” periods where massive capital inflows precede sustained crypto rallies. The $287 billion supply provides liquidity foundation supporting $4 trillion market cap levels and potential expansion toward $4.5 trillion resistance.

Weekend Crypto: Consolidation Before Expansion

Saturday trading around $115,985 for Bitcoin demonstrates healthy consolidation after major breakthroughs, with markets digesting regulatory developments while positioning for next week’s potential catalysts.

Technical Foundation:

Bitcoin’s ability to hold $115,000+ levels during traditionally weak weekend trading suggests institutional support remains strong. The -0.11% weekend decline appears more like profit-taking than bearish reversal, especially considering +93.34% annual gains maintained.

Altcoin Momentum Sustained:

Despite Bitcoin’s weekend consolidation, alternative cryptocurrencies continue showing relative strength. Ethereum near $4,650, Solana maintaining institutional interest, and DeFi tokens benefiting from reduced gas fees suggest altcoin momentum remains intact regardless of short-term Bitcoin fluctuations.

Monday Implications:

Historical analysis shows weekend consolidation often precedes weekday expansion when institutional traders return to active positioning. Current technical setups suggest Monday could bring renewed momentum across both Bitcoin and alternative cryptocurrencies.

Market Psychology: When Regulation Meets Revolution

The convergence of Vietnam’s institutional-grade regulatory framework with explosive market momentum creates unprecedented conditions where traditional finance legitimacy meets revolutionary cryptocurrency potential.

Regulatory Validation:

Vietnam’s $379 million capital requirements demonstrate governments taking cryptocurrency infrastructure seriously enough to demand bank-level operational standards. This institutional validation removes regulatory uncertainty that historically pressured crypto valuations.

Capital Allocation Evolution:

The $4 trillion milestone positions cryptocurrency markets among major global asset classes, potentially triggering sovereign wealth fund and pension allocation mandates. Many institutional investors can’t allocate to asset classes below certain size thresholds $4 trillion removes these barriers.

Innovation Balance:

Vietnam’s framework allows innovation while ensuring stability permitting crypto trading while requiring institutional-grade operators. This balanced approach could template global regulatory development, reducing uncertainty while enabling continued growth.

Looking Ahead: The New Crypto Landscape

September 13, 2025 represents a inflection point where regulatory maturity meets market momentum, creating conditions for sustained institutional adoption beyond speculative cycles.

Immediate Catalysts:

Next week brings Federal Reserve meeting expectations, continued altcoin season momentum, stablecoin supply expansion, and potential additional regulatory clarity from other major economies following Vietnam’s leadership.

Strategic Implications:

Vietnam’s regulatory framework may pressure other nations toward similar institutional standards, creating global race toward crypto legitimacy rather than prohibition. Markets above $4 trillion suggest permanent cryptocurrency integration into global finance rather than cyclical speculation.

Investment Evolution:

Success increasingly requires understanding both traditional institutional dynamics and crypto-native innovation Vietnamese banks evaluating $379 million crypto exchange investments represents this convergence perfectly.

The weekend’s quiet $115,985 Bitcoin price masks revolutionary regulatory and market developments that could define cryptocurrency’s next growth phase. Vietnam’s $379 million crypto earthquake, combined with $4 trillion market milestone and altcoin season acceleration, suggests we’re witnessing cryptocurrency’s definitive transition from alternative investment to essential financial infrastructure.

Key Statistics:

- Vietnam Regulation: $379M minimum capital (291x higher than global competitors)

- Market Milestone: $4.07T total crypto market cap, $259B daily volume

- Altcoin Season: Index at 80/100 (2025 high), dominance shifts accelerating

- Stablecoin Surge: $287B supply (+$17B Ethereum growth in August)

- Weekend Bitcoin: $115,985 consolidation above key institutional support levels

Other Articles:

- Bitcoin Storms to $121,946, Just $1,145 Away from All-Time High Record

- Solo Bitcoin Miner Defies 650,000-to-1 Odds for $371K Jackpot as Critical Week Looms

- Expert Consensus: Bitcoin to Hit $175K-$180K by Year-End as Political and Institutional Forces Align

- $4.8B Options Expiry Shakes Crypto Markets as BNB Hits $900 ATH and Whale Rotates $75M to Ethereum

- CPI Data Could Determine Crypto’s $4 Trillion Milestone