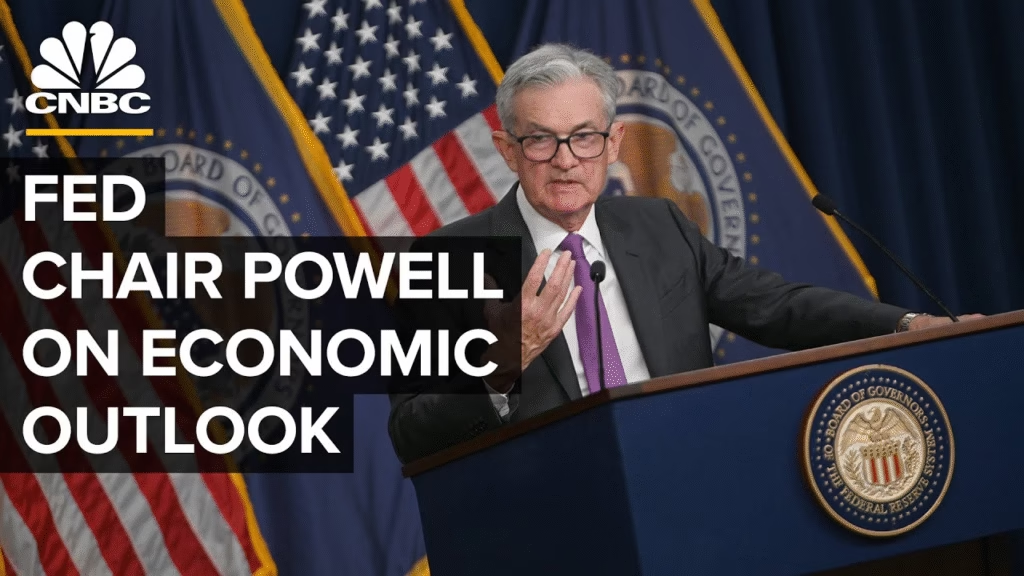

The Federal Reserve stands at the center of global attention as Bitcoin markets await Jerome Powell’s pivotal rate decision that could reshape crypto’s trajectory

The Moment of Truth Approaches for Crypto Markets

Bitcoin is trading steadily at $115,290 Tuesday evening, displaying remarkable composure as global markets enter the final hours before the Federal Reserve’s most anticipated policy decision of 2025. With a modest 0.44% daily decline, the cryptocurrency appears to be consolidating within a narrow $114,600-$116,200 range, reflecting the cautious positioning that typically precedes major monetary policy announcements.

The stakes could hardly be higher. After months of speculation and market positioning, the Federal Open Market Committee’s September 16-17 meeting is expected to deliver the first rate cut of the year, with 94% probability assigned to a 25 basis point reduction. However, as seasoned traders understand, the magnitude of the cut may prove less important than Chairman Jerome Powell’s accompanying commentary and forward guidance.

Bitcoin holds steady at $115K as markets position for tomorrow’s Fed decision, with technical indicators suggesting potential for significant moves in either direction

Current Market Positioning:

- Bitcoin: $115,290 (consolidating ahead of Fed decision)

- Total Crypto Market: $4.11 trillion (down 0.5% as markets await clarity)

- Fed Meeting: September 16-17 (decision announcement Wednesday at 2 PM ET)

- Rate Cut Probability: 94% for 25bps, 6% for surprise 50bps cut

- Institutional Activity: $2.6B Bitcoin ETF inflows over past week signal confidence

Engraved Federal Reserve sign on the marble facade of the institution’s building investopedia

Understanding the Fed’s Balancing Act

The Federal Reserve finds itself navigating particularly complex economic conditions as it approaches this decision. Recent inflation data shows consumer prices rising 2.9% annually in August, still above the central bank’s 2% target, while producer prices increased 2.6% year-over-year. These figures present a delicate balancing act between supporting economic growth and maintaining price stability.

Chairman Powell faces additional external pressure, with former President Trump recently calling for “larger” rate cuts to support the housing market. However, the Fed’s independence and data-driven approach suggest such political considerations will have minimal impact on the committee’s deliberations.

The current federal funds rate of 4.25-4.50% is widely viewed as restrictive relative to economic conditions, particularly given softening labor market indicators and reduced inflationary pressures compared to 2023 peaks. A 25 basis point reduction would bring rates to the 4.00-4.25% range, providing modest economic stimulus while maintaining the Fed’s optionality for future decisions.

Federal Reserve Chair Jerome Powell youtube

Economic Context Driving the Decision:

- Inflation remains above target but trending lower

- Labor market showing signs of cooling without collapse

- Financial conditions have tightened despite recent market gains

- Global economic uncertainty supporting cautious approach

Bitcoin’s Technical Setup Points to Potential Volatility

From a technical analysis perspective, Bitcoin presents an intriguing setup entering the Fed decision. The cryptocurrency recently formed a golden cross on the four-hour chart, with the 50-period moving average crossing above the 200 period moving average historically a bullish signal that has preceded rallies exceeding 25%.

However, technical patterns suggest this bullish development may include a near-term test of support levels. Historical precedent shows that Bitcoin has consistently retested its 200 period moving average after similar golden cross formations, potentially targeting the $113,600 level before resuming upward momentum.

The broader technical picture remains constructive, with Bitcoin maintaining its position within an ascending channel structure that has defined the trend since early summer lows. Key resistance levels at $117,000-$118,000 represent the immediate challenge for bulls, while support at $114,000 and $111,500 provides defensive levels for current positions.

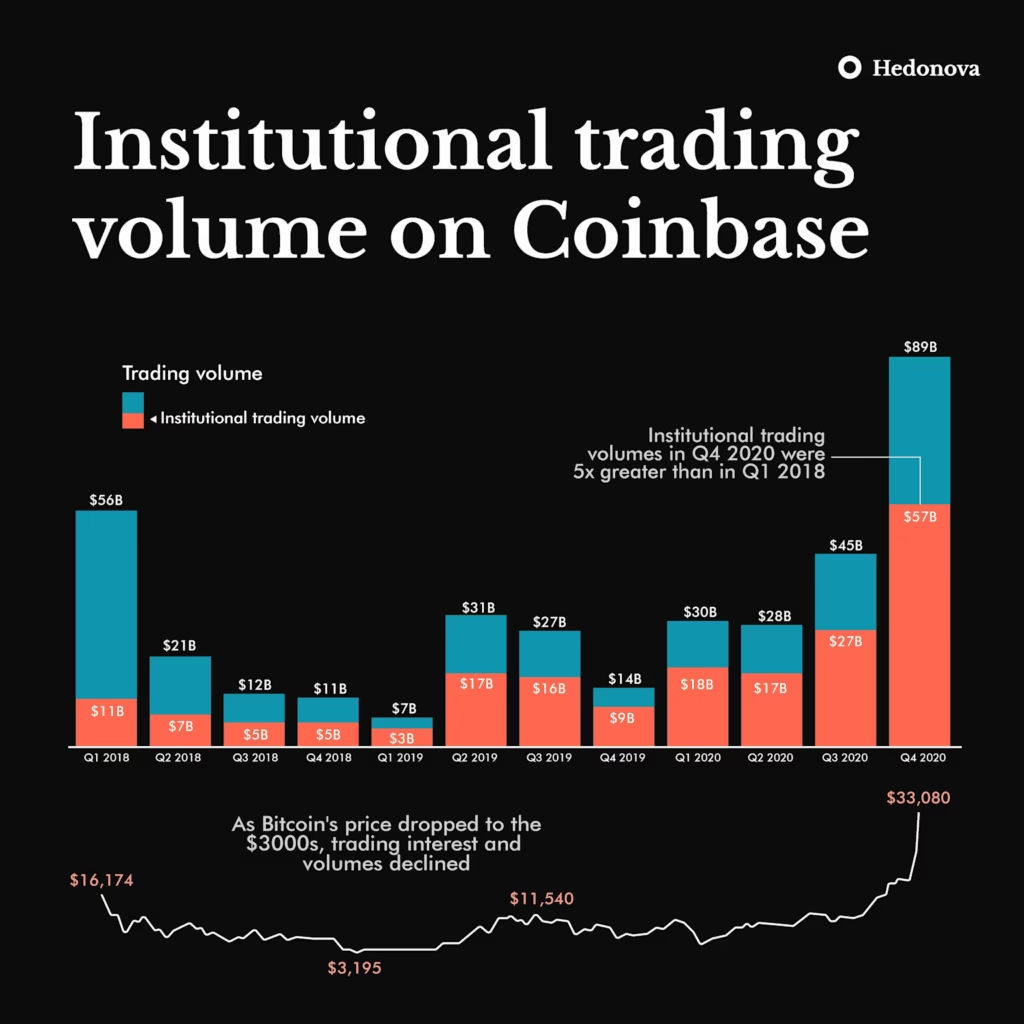

Institutional trading volume on Coinbase increased significantly from 2018 to 2020, correlating with Bitcoin’s price trends shown below reddit

Technical Analysis Framework:

- Immediate Resistance: $117,000-$118,000 zone

- Key Support: $114,000 (immediate), $111,500 (major)

- Pattern: Golden cross formation suggests bullish momentum

- Risk Consideration: May retest $113,600 before advancing

- Volume: Elevated at $159 billion indicates institutional engagement

Institutional Positioning Reveals Market Confidence

The institutional cryptocurrency landscape has evolved dramatically, with sophisticated investors demonstrating sustained confidence through significant capital allocation ahead of the Fed decision. Bitcoin ETF inflows reached $2.6 billion over the past week, while Ethereum ETFs attracted $359 million during the same period evidence of strategic positioning rather than speculative trading.

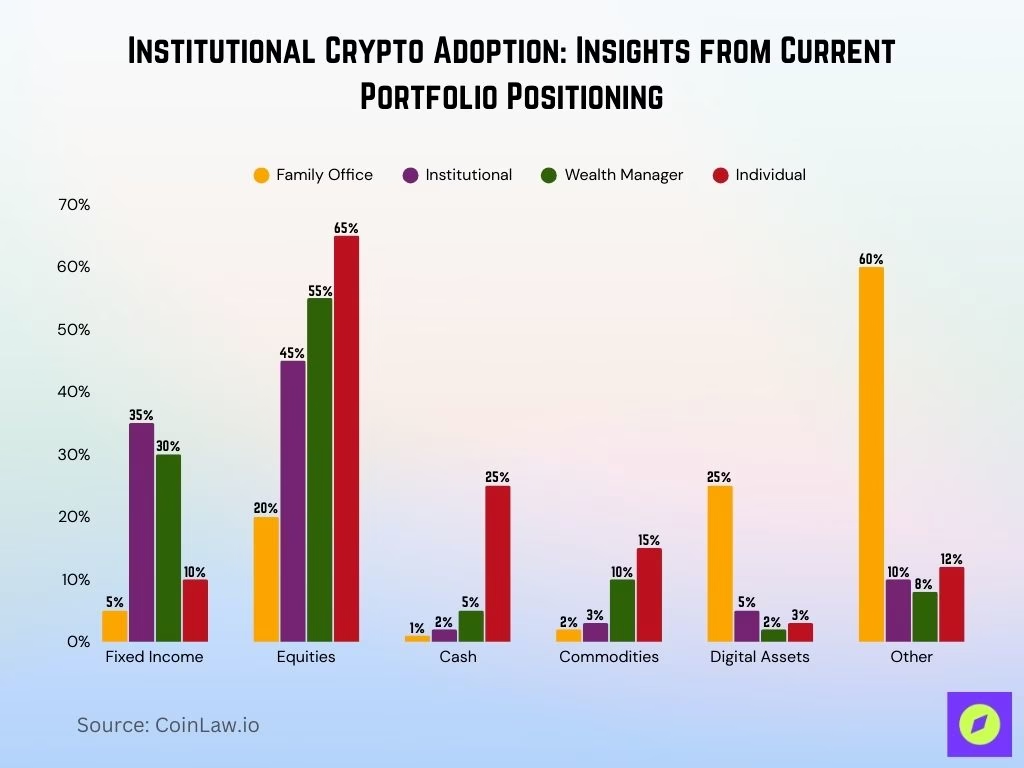

This institutional activity occurs against a backdrop of broader crypto market adoption, with professional portfolio managers increasingly viewing digital assets as legitimate portfolio diversifiers. The Bitcoin Risk Index currently sits at just 23%, indicating low probability of sharp corrections and suggesting institutional risk management systems view current conditions favorably.

MicroStrategy’s continued accumulation strategy exemplifies the corporate treasury adoption trend, with the business intelligence company maintaining its aggressive Bitcoin acquisition program despite near-term price volatility. This institutional conviction provides important context for understanding current market dynamics.

Portfolio allocation percentages by investor type across asset categories showing crypto adoption trends among institutional and individual investors coinlaw

Institutional Indicators:

- Record ETF inflows demonstrate professional confidence

- Low Risk Index readings suggest stable market conditions

- Corporate treasury adoption continues despite volatility

- Professional sentiment remains cautiously optimistic

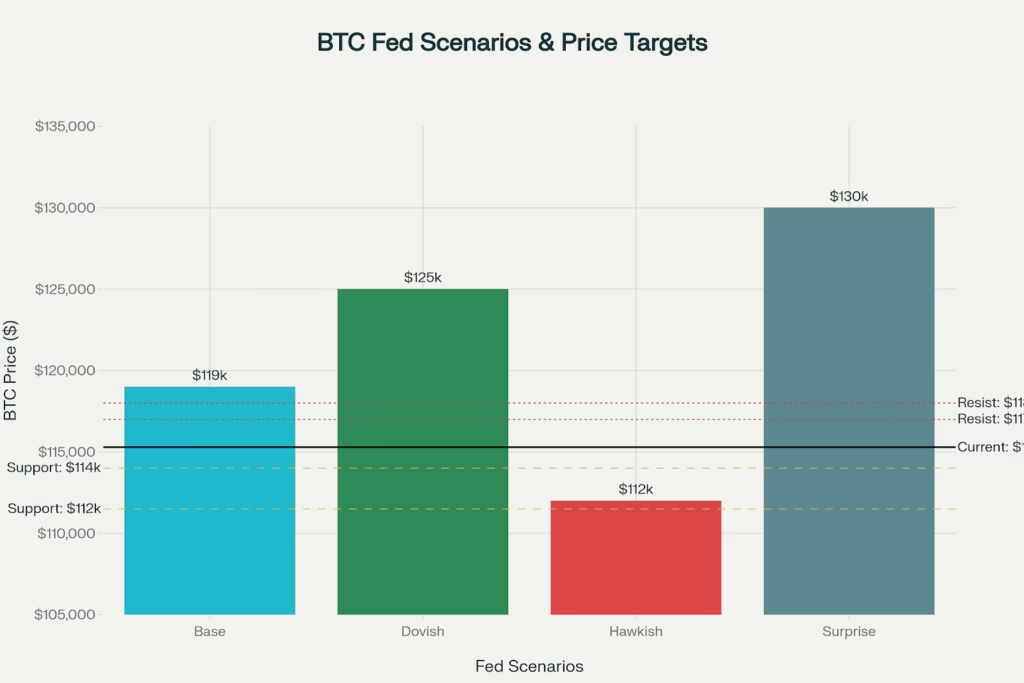

Scenario Planning for Post-Fed Market Dynamics

Market participants are preparing for multiple potential outcomes from Wednesday’s announcement, each carrying distinct implications for cryptocurrency valuations. The base case scenario envisions a 25 basis point cut accompanied by neutral commentary, likely supporting a Bitcoin rally toward $118,000-$120,000 as lower borrowing costs enhance the appeal of risk assets.

A more dovish outcome, featuring the expected rate cut plus hints of future easing, could trigger more aggressive upside momentum. Such a scenario might propel Bitcoin toward $125,000 or higher as investors price in an extended period of accommodative monetary policy favorable to alternative assets.

Conversely, a hawkish surprise where the Fed cuts rates but emphasizes this as a measured response rather than the beginning of an easing cycle could disappoint markets positioned for more aggressive policy shifts. This outcome might drive Bitcoin back toward $111,000-$113,000 as risk assets retreat on tighter-than-expected future policy.

Definition and explanation of the Federal Funds Rate with a bank and money illustration investopedia

Scenario Analysis:

- Base Case (25bps + neutral): Rally to $118,000-$120,000 range

- Dovish Case (25bps + easing hints): Breakout potential to $125,000+

- Hawkish Case (25bps + cautious language): Pullback to $111,000-$113,000

- Surprise Case (50bps cut): Explosive upside potentially reaching $130,000

The probability of a 50 basis point surprise remains low at approximately 6%, but such an outcome would likely trigger significant market volatility across all asset classes, with Bitcoin potentially benefiting from aggressive policy accommodation.

Market Sentiment and Social Indicators

Current market sentiment reflects the uncertainty preceding major policy announcements, with the Fear & Greed Index holding steady at 51 firmly in neutral territory. However, social sentiment analysis reveals a more optimistic picture, with 64% of Bitcoin related commentary showing bullish sentiment according to Santiment data.

This divergence between fear-greed indicators and social sentiment often precedes significant market moves, as retail enthusiasm builds while institutional positions remain measured. Historical analysis suggests markets frequently move contrary to extreme retail sentiment, though current readings appear balanced rather than reaching concerning extremes.

Trading volume remains elevated at $159 billion, reflecting active position management ahead of the Fed decision. This activity level indicates market participants are not simply waiting passively but rather actively positioning for various potential outcomes.

Market Psychology Indicators:

- Fear & Greed Index at neutral 51 level

- Social sentiment shows 64% bullish commentary

- Elevated trading volume indicates active positioning

- Institutional flows continue despite uncertainty

Risk Management Considerations

Professional investors are employing sophisticated risk management strategies as the Fed decision approaches. Position sizing becomes particularly important during periods of expected volatility, with many traders reducing leverage and maintaining adequate liquidity to navigate potential price swings.

Key support levels at $114,000 and $111,500 serve as logical stop loss reference points for long positions, while resistance at $118,000 represents an initial profit-taking zone for traders anticipating positive Fed outcomes. The technical setup suggests a break below $114,000 could accelerate selling toward the $111,500 major support area.

Time horizon considerations also influence positioning strategies. Short-term traders focus on the immediate Fed reaction, while longer term investors may view any post-announcement weakness as strategic accumulation opportunities, particularly if the broader policy trajectory remains supportive of risk assets.

Infographic explaining portfolio management as selecting and overseeing investments to meet financial goals and risk tolerance investopedia

Professional Risk Management Framework:

- Appropriate position sizing for expected volatility

- Clear stop-loss levels at $114,000 and $111,500

- Profit-taking strategies above $118,000 resistance

- Distinction between short-term noise and long-term trend

Looking Beyond the Immediate Decision

While Wednesday’s Fed announcement will dominate near-term market attention, longer-term cryptocurrency trends remain influenced by broader institutional adoption patterns and regulatory developments. The sustained ETF inflows and corporate treasury adoption suggest structural demand factors that transcend individual policy decisions.

The cryptocurrency market’s maturation is evident in its evolving correlation patterns with traditional assets and increasingly sophisticated institutional participation. Rather than trading purely on speculative sentiment, Bitcoin increasingly responds to fundamental macroeconomic drivers similar to other institutional asset classes.

Wednesday’s decision represents another milestone in this evolutionary process, with the market’s reaction providing insights into cryptocurrency’s growing integration with traditional financial markets. Regardless of the immediate price response, the institutional infrastructure supporting digital assets continues strengthening through regulatory clarity and professional adoption.

The Federal Reserve’s decision may set the tone for near-term trading, but the underlying fundamentals supporting cryptocurrency adoption institutional recognition, technological advancement, and portfolio diversification benefits suggest continued long-term development beyond any single policy announcement.

Conclusion: Preparing for Market Definition

As Bitcoin holds steady at $115,290 with the crypto market cap at $4.11 trillion, Wednesday’s Federal Reserve decision approaches as a defining moment for digital asset markets in 2025. The expected 25 basis point rate cut appears largely priced into current valuations, making Chairman Powell’s commentary and forward guidance the critical variables for determining market direction.

The institutional confidence demonstrated through recent ETF inflows, combined with technical indicators suggesting potential for significant moves, creates conditions where Wednesday’s announcement could establish Bitcoin’s trajectory through the remainder of 2025. Professional investors are positioning for multiple scenarios while maintaining appropriate risk management discipline.

Ultimately, the Fed decision represents both immediate catalyst and longer-term trend confirmation for cryptocurrency’s integration into institutional portfolios. As traditional monetary policy increasingly influences digital asset valuations, Bitcoin’s response to Wednesday’s announcement will provide valuable insights into the market’s maturation and future development prospects.

Related Analysis:

- Solo Bitcoin Miner Defies 650,000-to-1 Odds for $371K Jackpot as Critical Week Looms

- Expert Consensus: Bitcoin to Hit $175K-$180K by Year-End as Political and Institutional Forces Align

- $4.8B Options Expiry Shakes Crypto Markets as BNB Hits $900 ATH and Whale Rotates $75M to Ethereum

- CPI Data Could Determine Crypto’s $4 Trillion Milestone