Bitcoin navigates post-Fed terrain as markets digest the 25bps rate cut and Powell’s measured approach to monetary easing amid institutional positioning

Markets Digest Fed’s Measured Approach

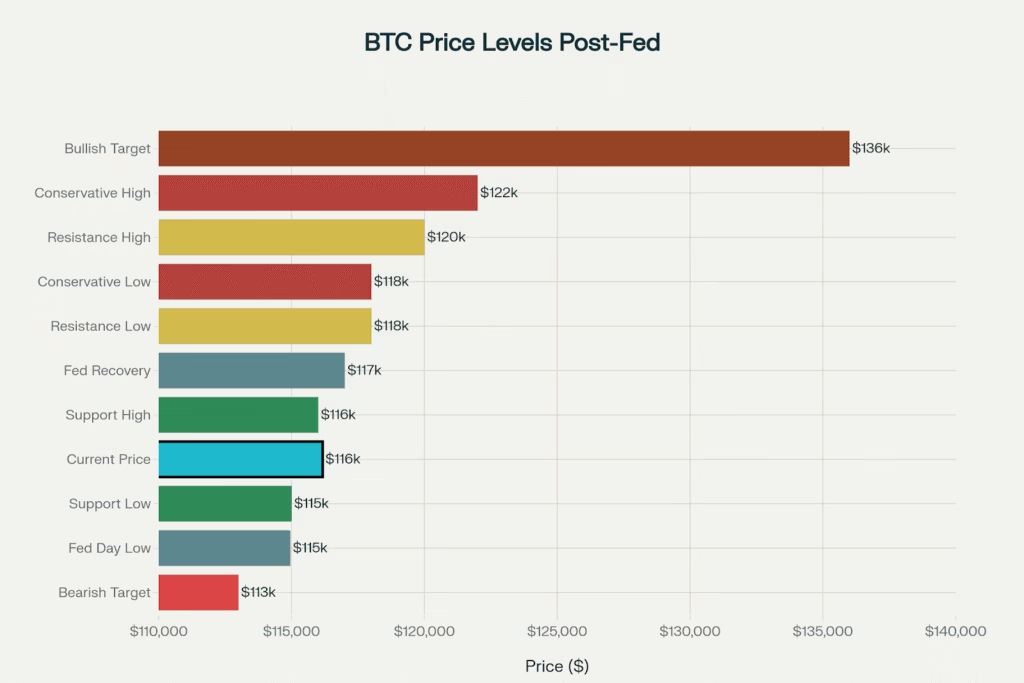

Bitcoin trades at $116,174 Thursday evening, down 0.31% as cryptocurrency markets continue processing Wednesday’s Federal Reserve decision. The measured response reflects institutional sophistication in distinguishing between widely anticipated events and genuine policy surprises, with Chairman Jerome Powell’s characterization of the 25 basis point cut as “risk management” tempering expectations for aggressive easing.

The immediate Fed aftermath saw Bitcoin briefly dip to $114,950 before recovering above $117,000 a classic “sell the news” pattern that demonstrated the rate cut was largely priced in. Current consolidation suggests markets are positioning for Powell’s longer-term policy trajectory rather than trading individual meeting outcomes.

Bitcoin maintains $116K level following Fed’s 25bps cut, showing measured response as markets digest Powell’s dovish pivot and position for potential October easing

Market Status:

- Bitcoin: $116,174 (consolidating in $115K-$117K range)

- Fed Decision: 25bps cut delivered, dovish guidance for year-end

- Institutional Response: $260M Bitcoin ETF inflows post-decision

- Technical Outlook: Triangle formation with $118K resistance ahead

Powell’s “Risk Management” Framework

Chairman Powell’s careful language during Wednesday’s press conference has significant implications for cryptocurrency positioning. Describing the cut as “risk management” rather than crisis response signals the Fed’s confidence in underlying economic conditions while acknowledging evolving labor market dynamics.

The 11-1 committee vote, with Governor Stephen Miran dissenting for a 50bps cut, demonstrated preference for measured policy adjustments despite external pressure. This disciplined approach reassures institutional investors that policy remains data-dependent rather than politically driven.

Key Fed Signals:

- Two additional cuts possible by year-end based on conditions

- Labor market showing “different risk picture” than earlier 2025

- Strong commitment to maintaining Fed independence

- Measured approach to policy normalization preferred

The dot plot revealed internal division, with ten of nineteen participants forecasting two more cuts while nine projected fewer or none. This split suggests future decisions will be heavily data-dependent, making economic releases more market-significant.

Technical Analysis Shows Maturation

Bitcoin’s response demonstrates evolving relationship with traditional monetary policy. The 2% initial drop followed by recovery represents normal institutional repositioning rather than emotional trading, indicating market maturation.

Current consolidation around $116,174 occurs within well-defined technical boundaries. Support at $115,000-$116,000 represents institutional accumulation zones where buying interest consistently emerges. This level combines psychological significance with technical retracement patterns.

Technical Framework:

- Support: $115,000-$116,000 (institutional buying zone)

- Resistance: $118,000-$120,000 (next major test)

- Pattern: Consolidation triangle suggesting coiled energy

- RSI: Neutral at 52, room for upward movement

The triangle formation indicates markets are preparing for significant moves, likely triggered by Fed communication or economic data clarifying the easing trajectory. Historical precedent suggests such patterns resolve in the direction of prevailing trends, which remains upward for Bitcoin.

Institutional Flows Continue Despite Consolidation

Post-Fed Bitcoin ETF inflows reached $260 million, demonstrating that professional investors view dovish Fed policy as validating Bitcoin’s portfolio role during monetary accommodation periods. This institutional activity contrasts with modest price action, suggesting longterm positioning over short-term trading.

Sustained ETF demand during consolidation indicates institutional conviction about Bitcoin’s prospects under easing policy regimes. The disconnect between measured price movement and strong flows often precedes significant moves as professional positioning reaches critical mass.

Institutional Indicators:

- Bitcoin ETF inflows: $260M over two post-Fed trading days

- Corporate treasury activity: Continued accumulation strategies

- Professional sentiment: Cautiously optimistic on easing cycle

- Risk management: Measured position sizing reflecting uncertainty

Altcoin Outperformance Signals Risk Rotation

Alternative cryptocurrencies showed stronger post Fed performance, suggesting broader risk asset rotation. Ethereum gained 1.97% to $4,587, outpacing Bitcoin on DeFi optimism, while Solana advanced 3.19% to $243.91 reflecting blockchain infrastructure strength.

Avalanche’s notable 8.96% surge coincides with institutional treasury developments, while Dogecoin’s 3.41% gain continues ETF-driven momentum. This divergent performance altcoins outpacing Bitcoin typically occurs during early monetary accommodation stages when institutional capital rotates toward higher-beta opportunities.

Altcoin Performance:

- Ethereum: $4,587 (+1.97%, DeFi strength)

- Solana: $243.91 (+3.19%, infrastructure focus)

- Avalanche: +8.96% (treasury developments)

- Market Breadth: 60% of top 100 coins positive

Macro Environment Turns Supportive

Fed easing triggered meaningful dollar weakness, with DXY declining 2.1% since Wednesday’s decision. This creates structurally supportive conditions for alternative assets including cryptocurrencies and gold, which reached new all-time highs above $2,625.

Treasury yields declined from 4.1% to 3.8% on the 10-year, improving risk asset valuations. The convergence of dollar weakness, declining yields, and Fed accommodation historically favors cryptocurrency performance, with institutional investors increasingly recognizing these correlations.

Supportive Macro Factors:

- Dollar weakness reducing alternative asset headwinds

- Yield decline improving growth asset appeal

- Gold at all-time highs validating alternative monetary assets

- Risk asset rotation as lower rates benefit growth

Forward Outlook and Risk Management

Bitcoin’s trajectory appears increasingly tied to Fed policy evolution, with October’s FOMC meeting carrying particular significance. Fed funds futures assign 65% probability to another 25bps October cut, creating near-term catalyst potential.

Powell’s emphasis on data dependent decisions means employment reports and inflation data will carry heightened market significance through year-end. The September employment report represents a critical October data point that could validate or challenge the easing trajectory.

Key Q4 Catalysts:

- October 30-31 FOMC meeting (65% additional cut probability)

- September employment report (early October)

- Q3 earnings (Bitcoin treasury updates)

- Regulatory developments (framework clarity)

Risk Factors:

- Core inflation above 2% Fed target creating policy risk

- 2026 political uncertainty affecting Fed appointments

- Geopolitical developments impacting risk appetite

- Labor market data potentially altering easing pace

Investment Strategy Evolution

Current conditions reward strategic positioning over speculative trading around individual Fed decisions. Bitcoin’s consolidation reflects markets moving beyond event-driven approaches toward longer-term monetary policy positioning.

Institutional investors apply traditional asset allocation principles to cryptocurrency, viewing Fed easing as supportive for portfolio diversification rather than trading opportunities. This evolution suggests cryptocurrency markets are maturing beyond historical speculative characteristics toward mainstream financial integration.

Success requires synthesizing macroeconomic analysis with crypto-native factors including adoption trends, regulatory developments, and technological advancement. Time horizons are extending beyond immediate volatility toward policy trajectory implications.

Preparation for Next Phase

Bitcoin’s measured post-Fed response demonstrates cryptocurrency market evolution toward sophisticated institutional positioning. Current consolidation around $116,174, accompanied by continued ETF inflows and professional adoption, suggests underlying structural demand remains strong despite modest immediate price action.

The path forward depends more on Fed policy trajectory than individual meeting outcomes. With potential additional cuts forecasted and institutional positioning continuing, Bitcoin appears positioned for the next monetary accommodation phase.

As markets digest Powell’s measured easing approach, the cryptocurrency ecosystem shows increasing correlation with traditional risk assets while maintaining portfolio diversification characteristics. Sustained institutional flows during consolidation suggest Bitcoin’s integration into professional portfolio management continues expanding regardless of short-term price fluctuations.

The Fed’s return to easing represents a structural shift typically benefiting alternative assets over extended periods. Bitcoin’s ability to hold above $116,000 while maintaining institutional interest during this transition suggests continued long-term development beyond individual policy announcements.

Market Summary:

- Bitcoin: $116,174 (post-Fed consolidation, -0.31% daily)

- Fed Policy: 25bps cut, two more potential by year-end

- Institutional Activity: $260M Bitcoin ETF inflows post-decision

- Technical Status: Triangle formation, $118K resistance target

- Macro Environment: Dollar weakness supporting risk assets

Tags: Bitcoin Federal Reserve rate cut September 2025, Jerome Powell risk management monetary policy, Bitcoin $116K institutional positioning, cryptocurrency Fed policy dovish pivot, crypto market post-Fed analysis

Related Coverage:

- Fed Delivers First 2025 Rate Cut in Risk Management Move

- Expert Consensus: Bitcoin to Hit $175K-$180K by Year-End as Political and Institutional Forces Align

- $4.8B Options Expiry Shakes Crypto Markets as BNB Hits $900 ATH and Whale Rotates $75M to Ethereum

- CPI Data Could Determine Crypto’s $4 Trillion Milestone