Weekend crypto markets show divergent signals as XRP rockets into top-100 global assets while liquidation risks mount to record levels

The Weekend That Could Reshape Crypto Rankings

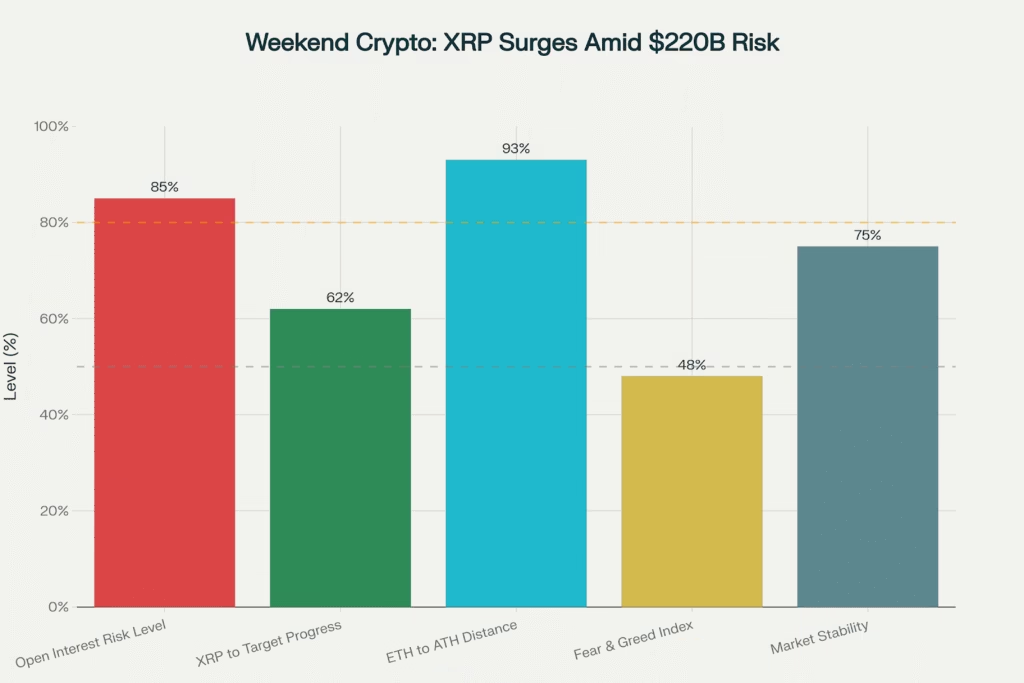

As Saturday trading unfolds, cryptocurrency markets face a tale of two extremes: XRP’s triumphant surge into the top-100 global assets at $3.10, while simultaneously confronting the most dangerous liquidation environment in crypto history with open interest hitting a staggering $220 billion. This weekend’s developments, amplified by major PayPal and Google integrations, create conditions where fortunes could shift dramatically before Monday’s opening bells.

The convergence of bullish breakthrough momentum and extreme leverage risks epitomizes crypto’s perpetual balance between explosive opportunity and catastrophic downside. With futures volume running 8-10 times spot trading volume, even modest price movements could trigger cascading liquidations across the ecosystem.

Weekend crypto markets face dual pressures as XRP breaks into top-100 global assets while record $220B open interest creates massive liquidation risk

Weekend Market Snapshot:

- XRP Breakthrough: $3.10 (+surge into 94th largest global asset)

- Liquidation Risk: $220B open interest at record monthly highs

- Bitcoin: $116,400 (holding weekend support above $116K)

- Major Integrations: PayPal P2P crypto, Google AI payments protocol

- Market Cap: $4.14T (consolidating during reduced weekend volume)

XRP cryptocurrency displaying a strong price surge with a green upward trend arrow coingape

XRP’s Historic Ascent Into Elite Global Asset Status

Ripple’s XRP has achieved a remarkable milestone, surging to $3.10 and securing its position as the 94th largest global asset by market capitalization at $185 billion. This breakthrough places XRP alongside major traditional assets, marking a significant validation of cryptocurrency’s growing institutional relevance.

The surge comes without a regulated U.S. spot ETF, making the achievement even more impressive as it demonstrates organic institutional and retail demand. Technical analysis shows XRP breaking through critical resistance at $3.00-$3.10, with analysts projecting potential targets of $5.00 by year-end based on continued institutional adoption patterns.

XRP’s Institutional Momentum:

- Global asset ranking climbs to 94th position worldwide

- Market cap reaches $185 billion without ETF support

- Financial institutions expanding XRP usage for cross-border payments

- ETF speculation building for potential U.S. regulatory approval

Smartphone displaying the XRP cryptocurrency logo against a financial market chart background economictimes

The cryptocurrency’s rise reflects broader institutional recognition of blockchain-based payment solutions, with major banks increasingly adopting XRP for international settlement and custody services. This utility-driven demand contrasts sharply with speculative trading patterns, suggesting sustainable long-term support for current valuations.

Record Liquidation Risk Creates Powder Keg Conditions

While XRP celebrates new highs, the broader crypto market faces unprecedented liquidation risks that could trigger dramatic price swings. Open interest across cryptocurrency derivatives has exploded to $220 billion, representing a record monthly high that signals dangerous overheating in leveraged positions.

CoinGlass data reveals futures trading volumes running 8-10 times higher than spot markets, indicating excessive speculation that historically precedes mass liquidation events. This leverage concentration affects all major assets including Bitcoin, Ethereum, and leading altcoins, creating systemic risks that could cascade across the entire ecosystem.

Illustration of 50x leverage trading and liquidation price risk in cryptocurrency markets featuring Bitcoin, Ethereum, and Tether icons leverage

Liquidation Risk Analysis:

- Open interest hits $220B monthly record

- Futures volume dominance creates instability

- Historical patterns suggest mass liquidation potential

- Small price movements could trigger cascading effects

The concerning aspect of current conditions is how quickly leveraged positions have accumulated ahead of major economic events and seasonal patterns. Short-term traders using high leverage have created a fragile market structure where even modest volatility could force automatic position closures, potentially triggering rapid price declines.

PayPal and Google Accelerate Mainstream Adoption

Weekend developments include major corporate integrations that could fundamentally alter cryptocurrency accessibility. PayPal announced expansion of peer-to-peer payments to include Bitcoin, Ethereum, and its PYUSD stablecoin, with rollout beginning in the U.S. before expanding to the U.K., Italy, and other markets.

The PayPal Links feature enables shareable one-time payment links, positioning crypto transfers as a mainstream payment method rather than investment vehicle. This integration represents a significant step toward mass adoption by leveraging PayPal’s existing user base and merchant network.

PayPal building with floating Bitcoin and Ethereum coins illustrating cryptocurrency integration coingape

PayPal Integration Details:

- Supported assets: Bitcoin, Ethereum, PYUSD stablecoin

- PayPal Links: One-time shareable payment system

- Geographic rollout: U.S. first, then U.K., Italy, others

- Strategic positioning: Part of “PayPal World” ecosystem development

Simultaneously, Google unveiled the Agent Payments Protocol (AP2), developed with over 60 partners including Coinbase, Ethereum Foundation, MetaMask, and Mastercard. The protocol enables AI agents to initiate secure transactions with stablecoins playing a central role in automated commerce.

These institutional adoptions occur precisely as markets face extreme leverage risks, creating interesting dynamics where fundamental adoption accelerates during technical instability periods.

Weekend Altcoin Dynamics and Technical Patterns

Beyond XRP’s surge, weekend trading reveals diverse altcoin patterns that could signal broader market direction. NEAR Protocol emerged as Saturday’s standout performer with 13% gains to $3.20, though RSI readings above 70 suggest potential short term exhaustion.

Ethereum continues approaching its $4,956 all-time high, currently trading at $4,589 and remaining less than 10% from record levels. This proximity to breakthrough territory creates additional weekend focus as reduced volume could enable significant moves in either direction.

Weekend Altcoin Watch:

- NEAR Protocol: +13% to $3.20 (RSI overbought zone)

- Ethereum: $4,589 (approaching $4,956 ATH breakthrough)

- Optimism: Token unlock of 116M tokens worth $95.95M

- Market Breadth: Mixed signals with leverage concerns

Key concepts every futures trader should know, including leverage, margin, funding rate, liquidation, and perpetual contracts leverage

Optimism faces a significant test with 116 million token unlock worth nearly $96 million, creating supply pressure that could influence weekend price action. These unlock events often trigger volatility as markets absorb additional circulating supply.

Institutional vs Retail Weekend Patterns

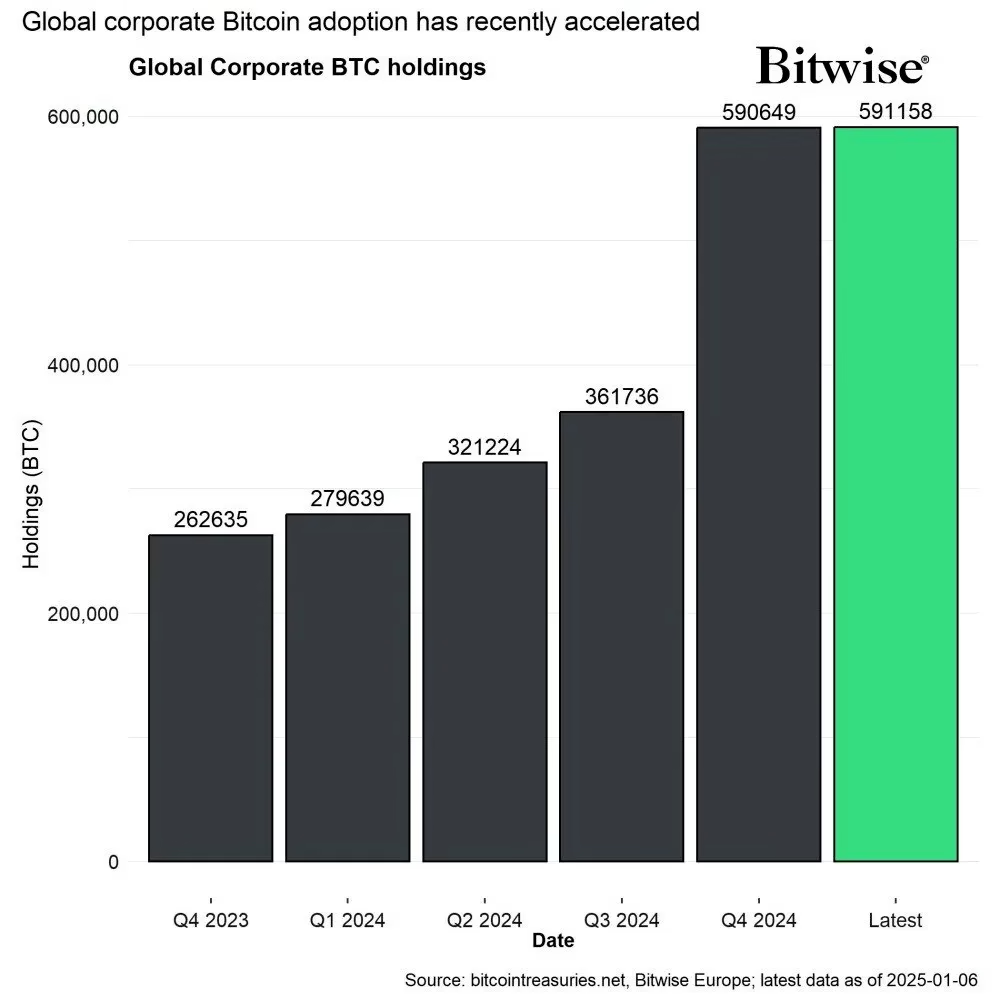

Corporate Bitcoin holdings continue expanding despite weekend volatility, with over $200 billion accumulated across 190 entities. Daily corporate purchasing averages 1,755 BTC, demonstrating institutional conviction that contrasts with retail leverage speculation creating liquidation risks.

However, whale activity shows mixed signals, with an 8-year Bitcoin holder recently selling $136 million worth after emerging from dormancy. This type of long-term holder distribution often occurs near cycle peaks, though individual whale behavior doesn’t necessarily indicate broader market trends.

Institutional Activity Indicators:

- Corporate holdings exceed $200B across 190 entities

- Daily institutional buying averages 1,755 BTC

- Whale distribution events increasing in frequency

- ETF flows showing mixed patterns between Bitcoin and Ethereum

Bar chart showing rapid growth of global corporate Bitcoin holdings from Q4 2023 to early 2025 mitrade

The divergence between institutional accumulation and speculative leverage creates complex market dynamics where fundamental adoption continues while technical conditions suggest vulnerability to sharp corrections.

Technical Analysis and Risk Management

Bitcoin maintains weekend consolidation above $116,000, holding within the established $108K-$116K range that has defined recent trading. The ability to defend these levels during reduced weekend volume provides some confidence, though extreme open interest creates conditions where small moves could trigger disproportionate responses.

Weekend volume typically declines as institutional activity reduces, but current leverage levels mean that even modest selling pressure could find limited buying support. Key support zones require monitoring, particularly $115,000 for Bitcoin and $4,500 for Ethereum.

Critical Weekend Levels:

- Bitcoin Support: $115,000-$116,000 zone crucial

- Ethereum Resistance: $4,600-$4,700 before ATH attempt

- XRP Momentum: $3.10 resistance now potential support

- Volume Patterns: Reduced weekend activity amplifies leverage risks

Looking Ahead: Monday Market Implications

Weekend developments create multiple scenarios for Monday’s market opening. XRP’s breakthrough into top-100 global assets could inspire broader altcoin momentum, while record liquidation risks suggest potential for sharp reversals if support levels fail.

The PayPal and Google integrations represent long-term positive developments that may not immediately impact prices but establish infrastructure supporting continued institutional adoption. These fundamental improvements contrast with technical vulnerabilities created by excessive leverage.

Monday Catalysts:

- XRP momentum sustainability test

- Liquidation risk resolution or materialization

- Institutional response to weekend integration announcements

- Volume patterns returning to normal levels

September’s historical weakness for crypto markets adds complexity, though 2025 has shown unusual resilience compared to previous years. The combination of record leverage, institutional adoption, and breakthrough technical levels creates conditions where significant moves appear likely regardless of direction.

Conclusion: Opportunity Meets Danger

This weekend encapsulates cryptocurrency’s essential character: breakthrough achievements like XRP’s top 100 ascension occurring simultaneously with extreme systemic risks from record leverage. The $220 billion open interest creates conditions where even positive developments could trigger liquidations if markets move too quickly.

PayPal and Google’s integrations demonstrate that institutional adoption continues accelerating despite technical market vulnerabilities. This fundamental versus technical divergence often precedes major market inflection points, whether positive or negative.

Investors navigating current conditions require appreciation for both breakthrough potential and liquidation risks. XRP’s success validates cryptocurrency’s growing mainstream recognition, while extreme leverage warns that rapid reversals remain possible.

Weekend trading may determine whether record open interest resolves through gradual position reduction or dramatic liquidation events. Either way, Monday’s market opening promises significant insights into crypto’s evolving institutional adoption trajectory amid persistent speculative excess.

Related Coverage:

- Expert Consensus: Bitcoin to Hit $175K-$180K by Year-End as Political and Institutional Forces Align

- $4.8B Options Expiry Shakes Crypto Markets as BNB Hits $900 ATH and Whale Rotates $75M to Ethereum

- CPI Data Could Determine Crypto’s $4 Trillion Milestone

- PayPal Expands P2P Payments With Bitcoin and Ethereum