Bitcoin crashes below $113K as $1.5 billion liquidation cascade triggers the largest crypto sell-off since March, sending shockwaves through digital asset markets.

The $1.5 Billion Reckoning

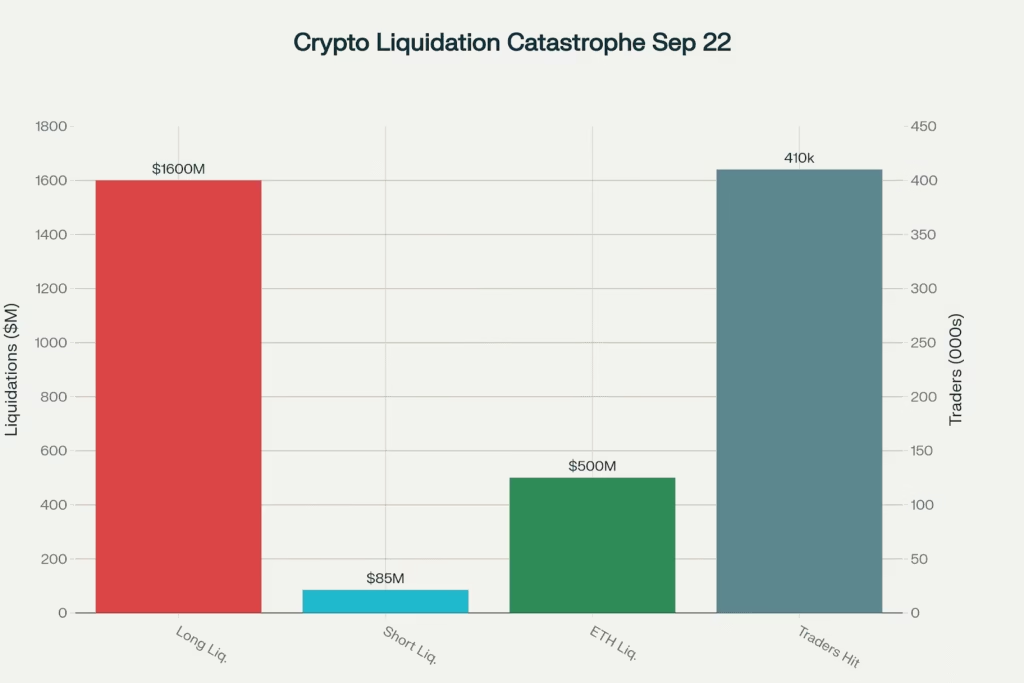

Monday, September 22nd will be remembered as one of cryptocurrency’s darkest days in 2025, as over $1.5 billion in leveraged positions were obliterated in the largest liquidation cascade since March. Bitcoin crashed below $113,000 to $112,597, while Ethereum led the carnage with a brutal 6.7% plunge to $4,166 as nearly $500 million in ETH positions alone were wiped from existence.

The crypto market capitalization hemorrhaged $200 billion, collapsing from $4.14 trillion to $3.97 trillion in a matter of hours. What makes this crash particularly devastating is the sheer scale of overleveraged positions that were systematically destroyed 410,000 traders saw their positions liquidated, with the largest single liquidation being a $12.74 million Bitcoin contract on OKX.

Historic $1.5B liquidation cascade sends Bitcoin crashing to $112K while gold soars to $3,721, marking crypto’s largest sell-off since March 2025

Liquidation Apocalypse Numbers:

- Total Liquidations: $1.5-1.7 billion (largest since March 2025)

- Ethereum Destruction: $500 million in ETH positions vaporized

- Traders Eliminated: 410,000 positions liquidated in 24 hours

- Long vs Short Bias: 94% bulls destroyed, only 6% bears caught

- Market Cap Loss: $200 billion wiped from total crypto market

Crypto market charts displaying a broad selloff highlighting the theme of a maturing market’s volatility youtube

The Anatomy of a Liquidation Massacre

The carnage began in Asian trading hours as Bitcoin failed to hold weekend support above $115,000, triggering an avalanche of automated selling from overleveraged positions. What started as modest profit-taking quickly escalated into a full-blown liquidation cascade as margin calls forced the closure of billions in leveraged bets.

Ethereum bore the brunt of the destruction, with $500 million in long positions obliterated as the cryptocurrency plummeted from above $4,400 to touch $4,075 at its lowest point. The severity of ETH’s decline nearly 9% at one point demonstrates how overleveraged the recent rally had become following the Federal Reserve’s rate cut just five days earlier.

The Liquidation Breakdown:

- Long Liquidations: $1.6 billion (94% of total destruction)

- Short Liquidations: Only $85 million (bears were right)

- Peak Liquidation Hour: $966 million destroyed in single hour

- Exchange Concentration: OKX, Binance led liquidation activity

Ethereum and Bitcoin prices crash amid crypto market sell-off, indicated by downward trending coingape

The data reveals a market that had become dangerously overleveraged on the bullish side, with futures trading volume running 8-10 times higher than spot markets in recent weeks. This leverage imbalance created perfect conditions for a liquidation spiral once key support levels broke.

Gold Soars While Bitcoin Burns: The Great Safe Haven Rotation

In a dramatic display of changing investor sentiment, gold reached a new all-time high of $3,721 while Bitcoin crashed a stark divergence that highlights the flight to traditional safe havens. Gold’s 1% surge on Monday extended its 2025 gains to an impressive 43%, while Bitcoin’s year to date performance now sits at a modest 17%.

Silver joined the precious metals rally, climbing 1.5% near $44 and notching 50% gains for the year. This precious metals surge occurred precisely as crypto markets imploded, suggesting institutional capital rotation from digital assets back to traditional monetary hedges.

Gold bars and Bitcoin coin symbolize the comparison between traditional and digital safe-haven assets amid market fluctuations economictimes

The Divergence That Tells the Story:

- Gold Performance: New ATH $3,721 (+1% daily, +43% YTD)

- Bitcoin Performance: Crash to $112K (-2.7% daily, +17% YTD)

- Silver Rally: Near $44 (+1.5% daily, +50% YTD)

- Capital Flight: Clear rotation from crypto to traditional safe havens

The U.S. Dollar Index climbing 1% to 97.5% and rising Treasury yields (10 year at 4.125%) created additional headwinds for risk assets like cryptocurrencies while supporting traditional safe havens.

Major Altcoins in Freefall: No Shelter from the Storm

The crash extended far beyond Bitcoin and Ethereum, with major altcoins experiencing devastating declines that wiped out weeks of gains. XRP, despite weekend whale movements totaling $800 million, plummeted 7.74% to $2.77, giving back most of its recent breakthrough above $3.00.

Dogecoin led meme coin losses with an 11.14% crash to $0.239, while other popular tokens saw double digit declines across the board. Only Solana managed to show green among major cryptocurrencies, posting a modest 0.32% gain to $222.35 a remarkable display of relative strength during the broader massacre.

Altcoin Carnage Report:

- XRP: $2.77 (-7.74% despite $800M whale activity)

- Dogecoin: $0.239 (-11.14% meme coin destruction)

- Cardano, Litecoin: Down 7-8% each

- Solana: $222.35 (+0.32% only major survivor)

Illustration of a crypto market crash with Bitcoin coins falling as the market graph collapses dailycoin

The broad based nature of the decline indicates this wasn’t isolated to any single token or sector overleveraged positions across the entire cryptocurrency ecosystem were systematically eliminated.

The $23 Billion Options Time Bomb

Adding pressure to an already volatile situation, cryptocurrency markets face a historic $23 billion options expiry this Friday the largest in crypto history. Bitcoin options worth $17.5 billion and Ethereum options valued at $5.5 billion are set to expire, with “max pain” levels significantly below current prices.

Bitcoin’s max pain sits at $110,000-$2,600 below current levels while Ethereum’s max pain at $3,700 represents a potential 11% further decline. These levels represent the prices that would cause maximum losses to option holders and could act as magnets for additional downward pressure.

Options Expiry Pressure:

- Bitcoin Options: $17.5 billion expiring Friday

- Ethereum Options: $5.5 billion additional pressure

- Max Pain Targets: BTC $110K, ETH $3,700 (both below current)

- Historic Scale: Largest options expiry in crypto history

Technical Breakdown: Key Levels Shattered

From a technical perspective, Monday’s crash represents a decisive breakdown of critical support levels that had held for weeks. Bitcoin’s failure to maintain $115,000 opened the door to the current $112,000-$113,000 testing zone, with major support now at $110,000-$111,000.

Ethereum’s break below $4,200 has brought the $4,000 psychological level into play, while resistance has moved up to the $4,500-$4,600 range. The speed and volume of the breakdown suggest further weakness could be ahead unless these levels hold firmly.

Critical Technical Levels:

- Bitcoin Support: $110K-$111K (major test coming)

- Bitcoin Resistance: $117K-$118K (now significant overhead)

- Ethereum Support: $3,900-$4,000 (psychological importance)

- Ethereum Resistance: $4,500-$4,600 (heavy selling zone)

ETF Resilience Amid Chaos: Institutional Conviction Tested

Despite the market carnage, U.S. Bitcoin spot ETFs demonstrated resilience with $222.62 million in net inflows on September 19th, just before the crash. BlackRock’s IBIT led with $246.11 million in inflows, while Grayscale’s GBTC saw modest $23 million outflows.

This institutional flow data, recorded before Monday’s crash, will be crucial to monitor this week. If ETF outflows accelerate following the liquidation event, it could signal deeper institutional concern about crypto’s near-term prospects.

ETF Activity Pre-Crash:

- Bitcoin ETF Inflows: $222.62M (September 19th)

- BlackRock Leadership: $246.11M inflows from IBIT

- Total AUM: $152.31 billion across all Bitcoin ETFs

- Market Share: 6.63% of Bitcoin’s total market cap

The Path Forward: Recovery or Deeper Decline?

As crypto markets assess the damage from Monday’s liquidation apocalypse, several factors will determine whether this represents a healthy deleveraging or the start of a deeper correction. The historic options expiry Friday could provide additional volatility, while macroeconomic factors including Fed policy uncertainty continue pressuring risk assets.

The $1.5 billion liquidation event has essentially reset leverage levels across the market, potentially creating conditions for more sustainable price action. However, with key technical levels broken and sentiment dramatically shifted, recovery may require time and genuine positive catalysts rather than just oversold bounces.

Recovery Requirements:

- Stabilization above key support levels ($112K BTC, $4,000 ETH)

- Reduction in leverage and futures dominance

- Improved macroeconomic conditions or Fed dovishness

- Institutional ETF flows remaining positive despite volatility

Monday’s crypto apocalypse serves as a brutal reminder that leverage cuts both ways in digital asset markets. While the $1.5 billion liquidation represents massive destruction of capital, it also clears overcrowded positions that had made markets vulnerable to exactly this type of cascade event.

Crash Statistics:

- Bitcoin: $112,597 (-2.7% daily, crashed from $117K weekend highs)

- Ethereum: $4,166 (-6.7% daily, $500M in liquidations)

- Total Liquidations: $1.5B largest since March 2025

- Market Cap Loss: $200B wiped from $4.14T peak

- Traders Destroyed: 410,000 positions liquidated in 24 hours

Related Coverage:

- $4.8B Options Expiry Shakes Crypto Markets as BNB Hits $900 ATH and Whale Rotates $75M to Ethereum

- CPI Data Could Determine Crypto’s $4 Trillion Milestone

- PayPal Expands P2P Payments With Bitcoin and Ethereum

- Weekend Crypto Alert: XRP Rockets Into Top-100 Global Assets as Record $220B Liquidation Risk Threatens Markets