Bitcoin’s dramatic market crash below $110K amid historic options expiry and fear-driven selling.

The Perfect Storm

Friday, September 26th has delivered the brutal climax to September’s crypto carnage, as Bitcoin crashed below the critical $110,000 threshold amid the largest options expiry in cryptocurrency history. With $22 billion worth of Bitcoin and Ethereum derivatives set to expire at 08:00 UTC, the convergence of technical pressure, institutional selling, and seasonal weakness has created a perfect storm that’s pushed markets into capitulation territory.

Bitcoin currently trades at $109,027, representing a 2.1% daily decline and a devastating 6.6% weekly loss that has officially erased all of September’s gains. The Fear & Greed Index has plummeted to just 28 the lowest reading since April as panic selling accelerates and longterm holders begin taking profits totaling $3.4 million in realized gains.

Bitcoin plunges below $110K as historic $22 billion options expiry creates unprecedented volatility with Fear & Greed Index hitting lowest levels since April

Market Devastation Snapshot:

- Bitcoin: $109,027 (-2.1% daily, -6.6% weekly, September gains wiped)

- Options Pressure: $22B historic expiry creating unprecedented volatility

- Market Sentiment: Fear & Greed Index crashes to 28 (lowest since April)

- ETF Exodus: $509.66M combined outflows from Bitcoin and Ethereum ETFs

- Market Cap: $3.83T (-2.2% daily) as 9 of top 10 cryptos turn red

The cycle of market emotions showing key investor sentiments during market fluctuations and points of maximum financial risk and opportunity 99bitcoins

Options Expiry Apocalypse: $22 Billion Comes Due

The scale of today’s options expiry cannot be overstated $17 billion in Bitcoin options and $5 billion in Ethereum derivatives represent the largest quarterly expiry in crypto history. This massive unwinding coincides with Q3’s end, creating a confluence of technical pressure that’s systematically destroying support levels.

According to Deribit data, Bitcoin’s “max pain” level sits around $110,000, meaning option sellers gain maximum advantage if Bitcoin closes below this psychological barrier. With current prices testing $108,700 support, bears are positioned to extract over $1 billion in value from expiring put options while crushing bullish sentiment.

Options Expiry Breakdown:

- Bitcoin Options: $17B notional value expiring 08:00 UTC

- Ethereum Options: $5B additional pressure concentrated around $3,800-$4,000

- Max Pain Impact: $1B+ advantage to sellers if BTC closes below $110K

- Volatility Spike: Expected massive price swings through expiry resolution

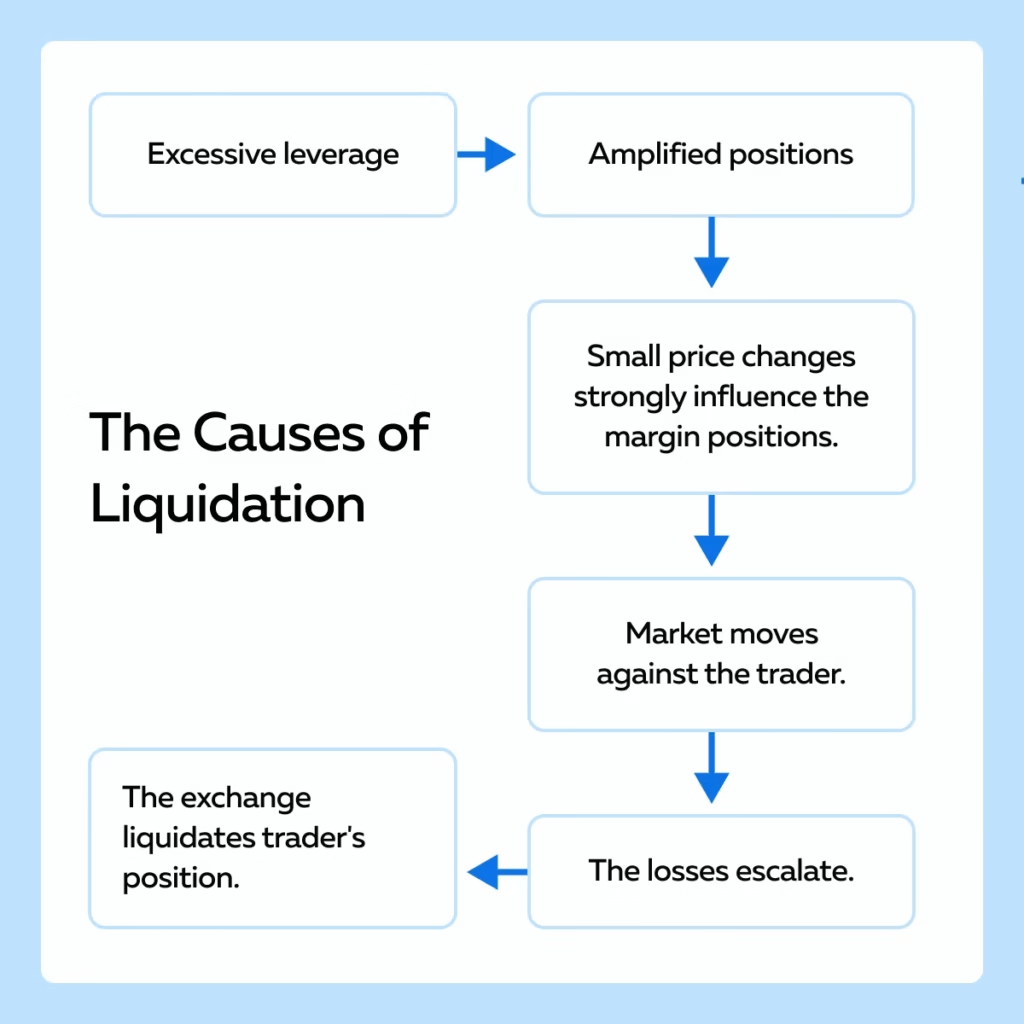

Flowchart illustrating the step-by-step causes of trader liquidation in leveraged trading positions bookmap

The mechanics behind options-driven selling are particularly brutal. As underlying prices drop, market makers who sold call options must sell the underlying assets to remain hedged, creating additional downward pressure in a feedback loop that accelerates declines.

Technical Breakdown

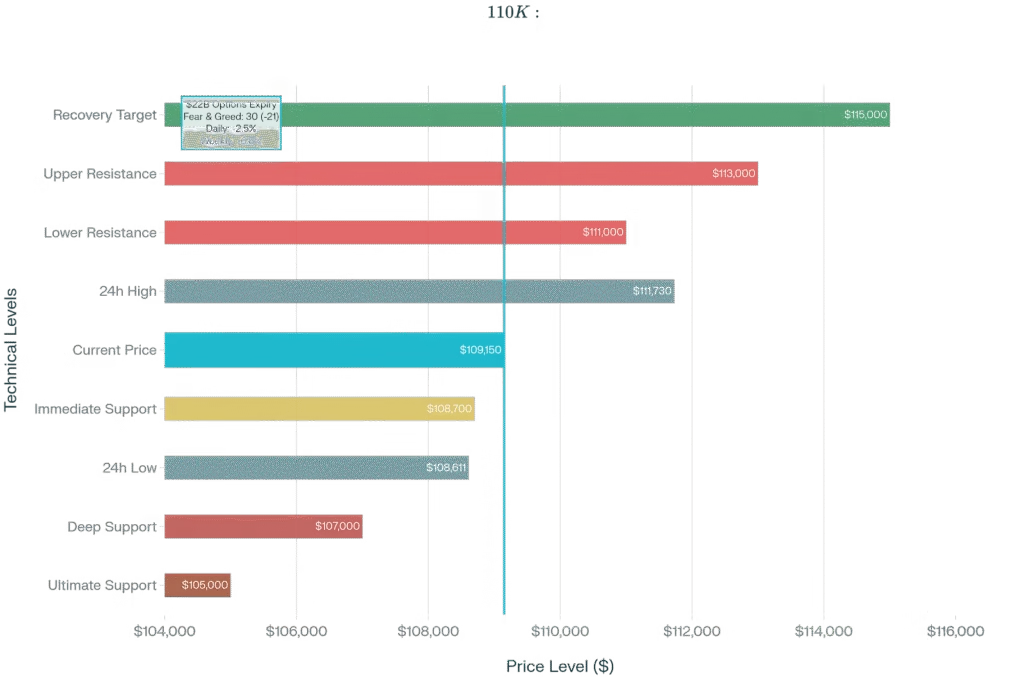

From a technical perspective, Bitcoin’s break below $110,000 represents a decisive failure of support that had held for most of September. The cryptocurrency now faces critical support at $108,700, with deeper levels at $107,000 (major liquidity cluster) and $105,000 representing potential downside targets if current support fails.

The 24 hour trading range of $108,611 to $111,730 illustrates the violent volatility gripping markets, with institutional algorithms and retail panic creating chaotic price action. Volume has spiked to $237.1 billion across all cryptocurrencies, reflecting the urgent repositioning occurring ahead of month-end.

Critical Technical Levels:

- Immediate Support: $108,700 (must hold to prevent further cascading)

- Major Support: $107,000 (deepest liquidity according to on-chain data)

- Capitulation Level: $105,000 (analysts’ worst-case scenario)

- Recovery Target: $115,000 needed to shift momentum back to bulls

Bitcoin daily price chart showing a significant bearish crash of nearly 30% over a week followed by a partial recovery thecryptobasic

Ethereum’s decline proves even more severe, with the second-largest cryptocurrency falling 5.65% to $3,922 dangerously close to breaking below the psychologically crucial $3,900 level. ETH’s weekly decline of 13.9% demonstrates how altcoins amplify Bitcoin’s weakness during market stress.

Institutional Panic: ETF Outflows Accelerate

Perhaps most concerning for long-term adoption narratives is the acceleration of institutional selling through spot ETFs. Bitcoin ETFs recorded $258.46 million in outflows on September 25, while Ethereum ETFs posted an additional $251.20 million exodus combining for over half a billion in single-day institutional redemptions.

This institutional retreat represents a dramatic reversal from the $2+ billion weekly inflows witnessed just two weeks ago following the Federal Reserve’s initial rate cut. The speed of this reversal suggests professional investors are reassessing cryptocurrency’s role as both an inflation hedge and risk asset.

ETF Outflow Crisis:

- Bitcoin ETF Outflows: $258.46M (September 25)

- Ethereum ETF Outflows: $251.20M same day

- Weekly Combined: Over $1B in institutional exits

- Remaining AUM: $25.59B (5.46% of Bitcoin’s market cap)

- Trend Signal: Institutional confidence severely damaged

The sustained institutional selling creates persistent overhead pressure that makes any meaningful recovery extremely difficult without a fundamental shift in professional investor sentiment.

Market Psychology: Fear Takes Control

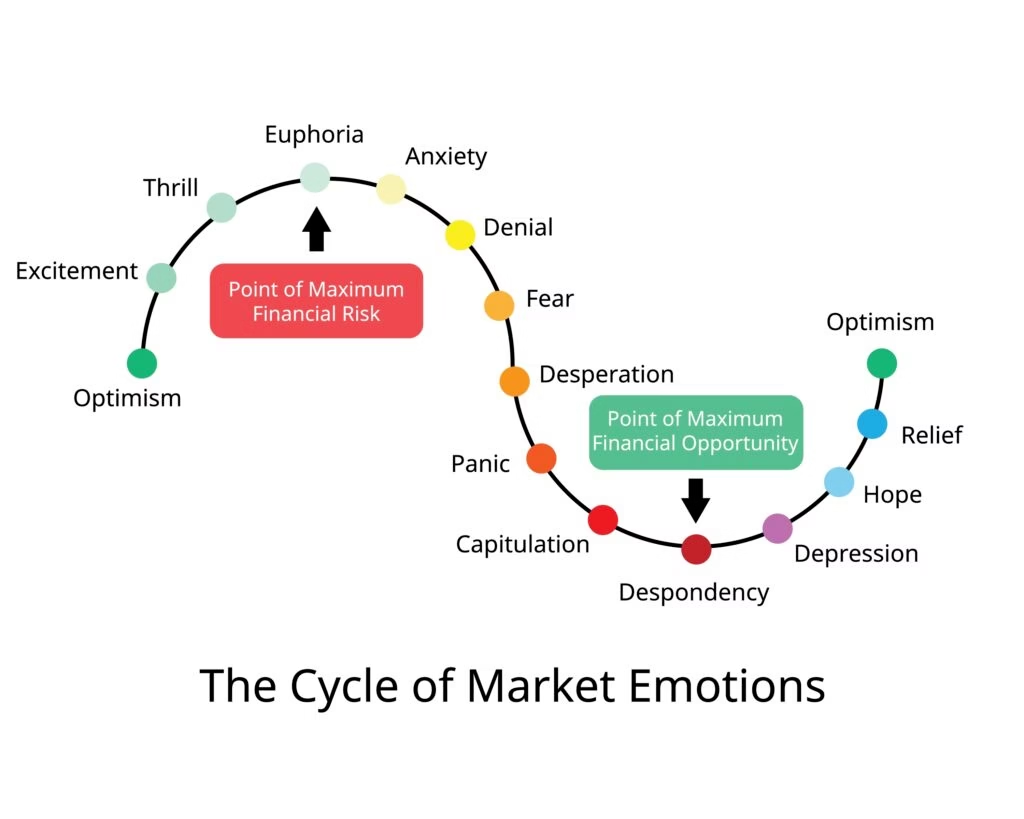

The collapse in market sentiment is perhaps most dramatically illustrated by the Fear & Greed Index’s 21 point plunge from 51 (neutral) to just 28 (extreme fear) in a matter of days. This reading represents the lowest level since April’s market correction and suggests many investors are approaching capitulation.

Current market psychology mirrors classic late-stage corrections where technical analysis becomes secondary to emotional selling. Social media sentiment analysis shows “buy the dip” mentions decreasing while “cut losses” discussions increase a pattern that typically precedes further declines before eventual exhaustion.

Chart showing emotional phases in the cryptocurrency market cycle from disbelief to depression changelly

Sentiment Indicators:

- Fear & Greed Index: 28 (extreme fear, lowest since April)

- Previous Level: 51 (neutral) just days ago

- Point Drop: -23 points in single session

- Social Metrics: Selling pressure dominating discussions

- Liquidations: Continuing cascade from Monday’s $1.7B destruction

The psychological damage extends beyond Bitcoin to the broader altcoin ecosystem, with Solana down 20.7% weekly to $193.51 and Dogecoin suffering 18.4% losses to $0.2247.

Regulatory Pressure Adds to Woes

Compounding technical and institutional pressures, regulatory agencies are increasing scrutiny of cryptocurrency-related activities. The SEC and FINRA have launched investigations into suspicious stock price movements linked to companies planning crypto treasury strategies, focusing on possible insider trading and selective information sharing before public announcements.

This regulatory overhang creates additional uncertainty precisely when markets can least afford it, with investigations potentially dampening corporate Bitcoin adoption that has been a key institutional narrative.

September Curse

Despite hopes that institutional ETF infrastructure might dampen seasonal volatility, September 2025 has delivered classic “Red September” performance. The month has now officially turned negative after completely erasing early gains that had briefly made it Bitcoin’s second-best September in 13 years.

Historical data shows September typically delivers -4.5% returns for Bitcoin over the past decade, with 2019-2022 averaging brutal -8.74% declines. Current performance aligns perfectly with these patterns, suggesting crypto markets remain subject to seasonal forces despite institutional evolution.

September Seasonality Impact:

- Historical Average: -4.5% September returns

- Current Status: Month officially negative after gains erasure

- Pattern Consistency: 8 of last 11 Septembers have been negative

- Institutional Impact: ETF infrastructure failed to prevent seasonal weakness

Recovery Requirements

For Bitcoin to mount any meaningful recovery from current levels, several critical conditions must be met. First, the $108,700 support zone must hold decisively any breakdown could trigger additional liquidations toward $105,000. Second, the massive options expiry must resolve without further cascading effects.

Third, institutional ETF outflows must slow and eventually reverse, as continued professional selling creates persistent overhead pressure. Finally, market sentiment needs stabilization above 35 on the Fear & Greed Index to indicate exhaustion of panic selling.

Recovery Checklist:

- Hold $108,700 support through options expiry resolution

- ETF outflows must decelerate and reverse direction

- Fear & Greed Index stabilization above extreme fear levels

- Volume confirmation on any bounce attempts from support

- September’s end potentially removing seasonal headwinds

Testing Crypto’s Maturation

Friday’s historic $22 billion options expiry amid Bitcoin’s crash below $110,000 represents a crucial test of cryptocurrency market maturation. The convergence of technical breakdown, institutional selling, and seasonal weakness creates conditions where traditional market dynamics trump adoption narratives.

While the immediate outlook appears challenging with critical support levels under assault, options expiry resolution could remove significant technical pressure. However, restoration of institutional confidence and retail sentiment will likely require time and genuine positive catalysts rather than just oversold bounces.

The September curse has claimed another victim in 2025, but historically strong October performance offers hope for recovery if Bitcoin can survive the current perfect storm of selling pressure without breaking key support levels.

As markets navigate this critical juncture, the resolution of today’s massive options expiry will likely determine whether this represents temporary seasonal weakness or the beginning of a deeper correction that could reshape crypto’s narrative heading into Q4 2025.

Market Crisis Summary:

- Bitcoin: $109,027 (crashed below $110K, -6.6% weekly)

- Historic Expiry: $22B Bitcoin/Ethereum options create unprecedented pressure

- Sentiment Collapse: Fear & Greed Index at 28 (lowest since April)

- Institutional Flight: $509.66M combined ETF outflows signal confidence crisis

- September Curse: Month officially negative, historical patterns confirmed

Related Coverage:

- CPI Data Could Determine Crypto’s $4 Trillion Milestone

- PayPal Expands P2P Payments With Bitcoin and Ethereum

- Weekend Crypto Alert: XRP Rockets Into Top-100 Global Assets as Record $220B Liquidation Risk Threatens Markets

- Bitcoin’s $112K Last Stand: Recovery Battles Record $684M ETF Exodus as September Curse Deepens