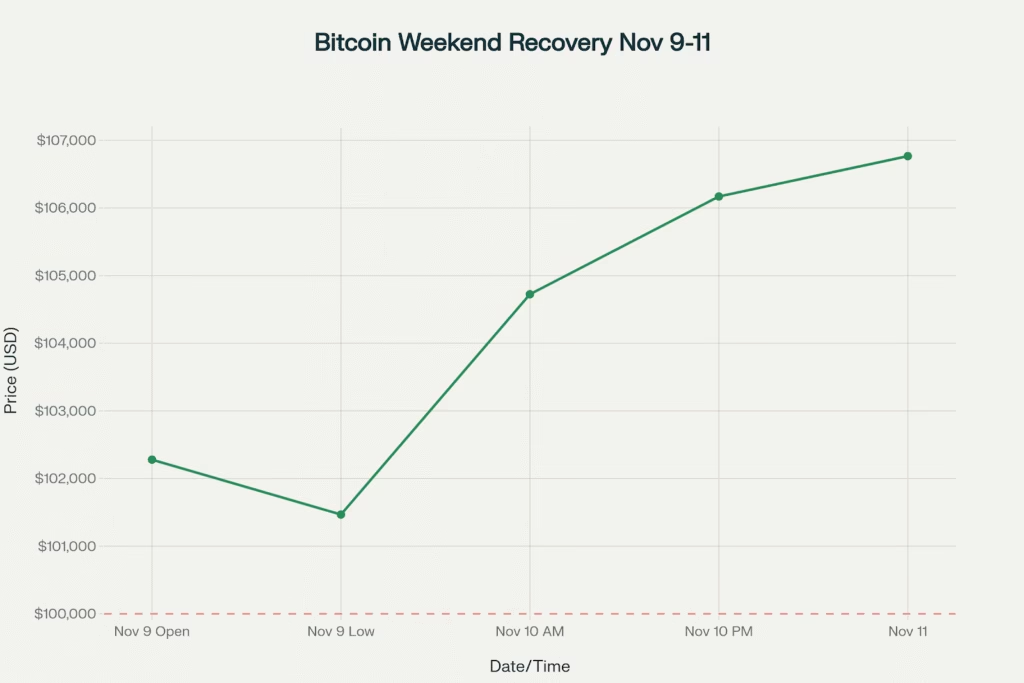

Bitcoin recovers 5.2% from weekend low as $2,000 stimulus checks and Senate shutdown vote trigger broad market bounce; privacy coins lead with Zcash +15%, altcoins rally across board

The cryptocurrency market staged a powerful Monday rally on November 11, 2025, with Bitcoin surging 4.14% to $106,767 and the global market capitalization jumping 4.07% to $3.58 trillion following two major catalysts: President Donald Trump’s announcement of $2,000 stimulus payments and the U.S. Senate’s vote to advance legislation ending the prolonged government shutdown.

The dramatic reversal erased much of last week’s losses, with Bitcoin rebounding $5,299 (5.2%) from its weekend low of $101,468 as risk appetite returned across financial markets. Ethereum outperformed with a 5.46% gain to $3,608, while XRP led major cryptocurrencies with an 8.62% surge to $2.48.

Bitcoin surges 5.2% from weekend low of $101K to $106.8K following Trump stimulus announcement and Senate shutdown resolution vote

Trump Stimulus Announcement Ignites Rally

President Trump’s Sunday evening announcement that his administration plans to distribute $2,000 direct payments to most Americans funded from tariff revenue triggered immediate bullish momentum across cryptocurrency markets. The proposed stimulus package, estimated to cost between $300-600 billion depending on eligibility criteria, evoked memories of 2020-2021 Covid relief checks that coincided with Bitcoin’s historic rally from $10,000 to over $60,000.

Trump Stimulus Details:

- Payment Amount: $2,000 per recipient

- Funding Source: Tariff revenue collection

- Recipients: Most Americans (150-300M estimated)

- Total Cost: $300-600 billion program

- Historical Precedent: 2020 Covid checks preceded 10x Bitcoin rally

- Market Expectation: Portion of stimulus flows into crypto purchases

“The crypto market is on fire today,” noted analyst commentary on X (formerly Twitter). “People are calling the $2,000 payment ‘free money for Bitcoin.’ Even if only a small part goes into crypto, prices could explode”. Social media sentiment turned overwhelmingly bullish within hours of the announcement, with traders drawing parallels to how previous stimulus measures fueled cryptocurrency adoption and price appreciation.

Current Market Snapshot (November 11, 08:30 UTC):

- Bitcoin: $106,767 (+4.14% daily, +1.4% weekly)

- Ethereum: $3,608 (+5.46% daily, +0.6% weekly)

- XRP: $2.48 (+8.62% daily, +7.2% weekly)

- Solana: $167.11 (+4.92% daily, +4.9% weekly)

- Global Market Cap: $3.58T (+4.07% in 24h)

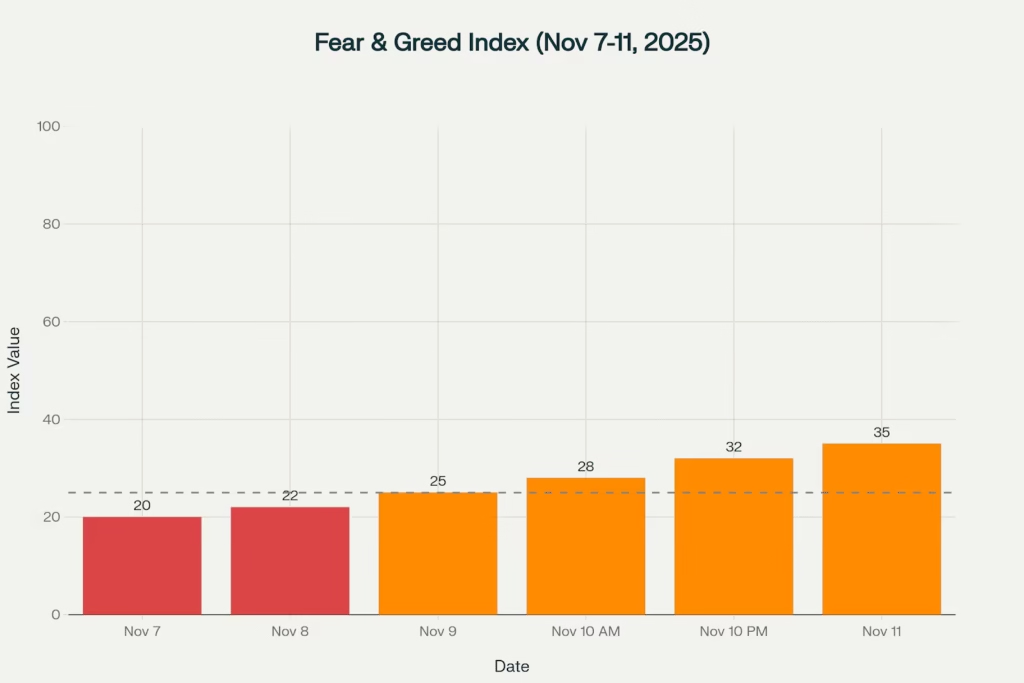

- Fear & Greed: 35 (Fear, improved from 20)

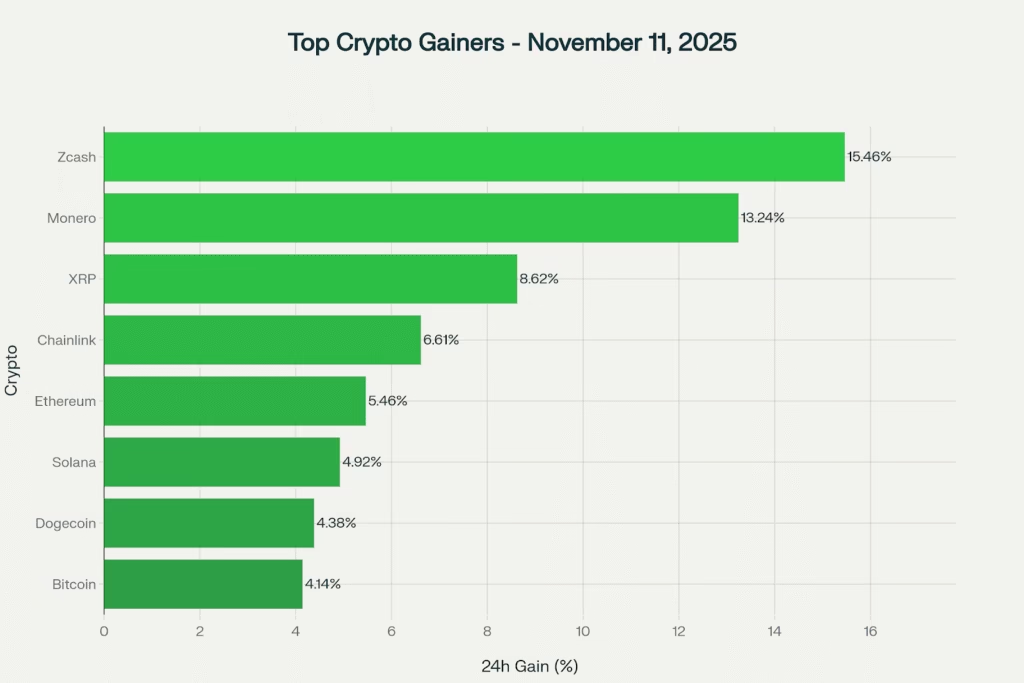

Privacy coins lead Monday’s crypto rally with Zcash +15.5% and Monero +13.2% as broader market posts gains across all major assets

Senate Vote Ends Government Shutdown Gridlock

The rally gained additional momentum late Sunday when eight Senate Democrats joined Republicans to advance a House-passed short term funding measure, marking the first significant progress toward ending the government shutdown that has frozen economic operations for six weeks. The House is expected to vote Tuesday, November 12, with bipartisan support suggesting passage is likely.

The shutdown resolution carries significant implications for cryptocurrency markets beyond general risk-on sentiment. With normal government operations resuming, the Securities and Exchange Commission (SEC) can return to processing cryptocurrency ETF applications and regulatory approvals that were paused during the funding freeze. This regulatory clarity removes a major overhang that had contributed to recent market weakness.

“Less political drama means the SEC can work normally again and approve crypto ETFs faster. Everyone feels safer to buy,” one market observer noted, highlighting how the shutdown’s end removes regulatory uncertainty that had kept institutional participants sidelined.

Fear & Greed Index improves from 20 (Extreme Fear) to 35 (Fear) as stimulus announcement and shutdown resolution boost market sentiment

Reclaiming 200-Day EMA

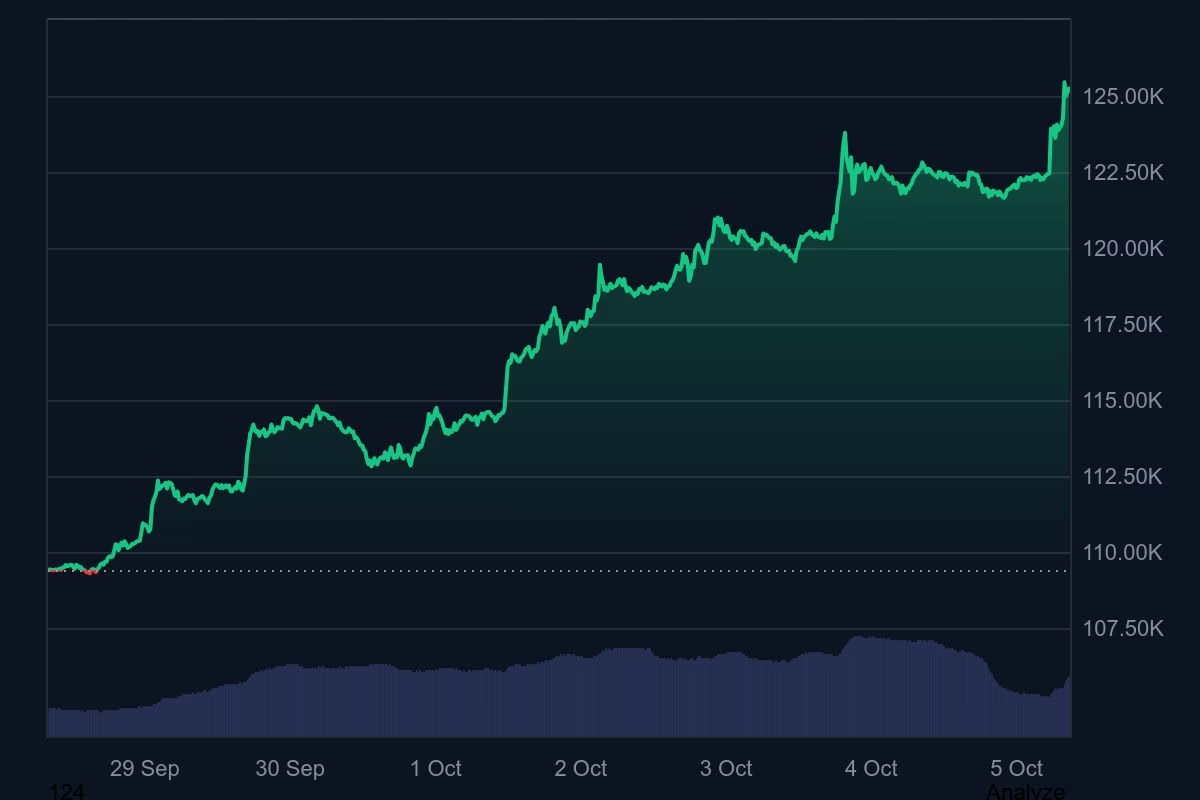

Bitcoin’s recovery pushed prices back toward the critical 200 day exponential moving average near $110,000 a key technical level that has served as the dividing line between bullish and bearish market structure since the 2022 bear market. The cryptocurrency broke below this moving average on November 5 during the initial selloff, triggering additional technical selling.

Key Technical Levels:

- Current Price: $106,767

- 200-Day EMA: $110,000 (key resistance to reclaim)

- Immediate Resistance: $108,000-$109,000

- Support: $101,000 (weekend low, now support)

- Target Above $108K: Momentum resumes toward $111,000+

- Risk Below $101K: Trend invalidated, bearish structure

XTB technical analysts noted that both Bitcoin and Ethereum are “currently attempting to reclaim the 200 day EMA (red line), with Ethereum showing a stronger rebound”. The RSI indicator for both cryptocurrencies is “gradually rising toward 50, suggesting a significant easing of selling pressure”.

If Bitcoin can sustain above $108,000 and reclaim the 200 day EMA with volume, technical analysts project a potential move toward $111,000-$116,000 based on fibonacci retracement levels from the recent selloff. However, failure to hold above $101,000 would invalidate the bullish structure and suggest the correction may have further to run.

Privacy Coins Lead Altcoin Surge

Privacy focused cryptocurrencies extended their November outperformance, with Zcash surging 15.46% to $664.54 and Monero gaining 13.24% to $416.75 ,both significantly outpacing Bitcoin’s gains. The privacy coin rally, which began in late October, has now delivered 700%+ gains for Zcash and 120%+ for Monero year-to-date as traders rotate toward assets emphasizing financial anonymity.

“Privacy coins are riding the privacy-meta momentum with huge daily gains,” noted market commentary, attributing the sector’s strength to growing demand for financial privacy amid increasing regulatory scrutiny of transparent blockchain transactions. Chainlink also posted strong gains of 6.61% ahead of its “Rewards Season 1” airdrop launch scheduled for later this week.

Broader altcoin strength suggests improving market breadth after last week’s concentrated selling. Solana gained 4.92%, Cardano rose 6.04%, and even meme coins like Dogecoin posted 4.38% gains indicating the rally extends beyond just large cap assets.

Institutional Flows Reverse After $1.3B Exodus

After hemorrhaging approximately $1.3 billion in combined outflows between October 29 and November 5, U.S. spot Bitcoin and Ethereum ETFs saw renewed buying interest Monday as institutional participants responded to improving macro conditions. BlackRock’s iShares Bitcoin Trust (IBIT) recorded inflows for the first time in over a week, reversing the sustained redemption pattern that had weighed on prices.

Cumulative 2025 inflows into Bitcoin and Ethereum ETFs now total approximately $170 billion, with Ethereum ETF assets under management reaching $20.35 billion alone. The return of institutional buying provides crucial support for Bitcoin above $100,000 and suggests professional investors view recent weakness as an accumulation opportunity rather than the start of a prolonged bear market.

“Institutional money is also coming back strong, with $170 billion flowing into Bitcoin and Ethereum ETFs,” market analysis noted, emphasizing the significance of professional capital returning after the multi week exodus.

Path to $110K and Beyond

Looking ahead, cryptocurrency traders are closely monitoring Bitcoin’s ability to decisively reclaim the $108,000-$110,000 zone and its 200 day EMA on sustained volume. Success would confirm the weekend low as a short-term bottom and open the path toward retesting the $115,000-$120,000 resistance zone that capped prices before the recent correction.

Key catalysts for continued strength include Tuesday’s House vote on the shutdown resolution, any additional details on the Trump stimulus program’s implementation timeline, and whether institutional ETF inflows continue accelerating. Friday’s delayed economic data releases particularly employment and inflation figures frozen during the shutdown will provide crucial insights into Federal Reserve rate cut probabilities that heavily influence risk asset performance.

Bears warn that leverage is building back into the system quickly, with perpetual futures funding rates turning positive and open interest climbing conditions that preceded October’s liquidation cascade. “Just stay careful traders are still adding leverage slowly. If Bitcoin holds $106K, the next stop could be $110K or higher,” one analyst cautioned.

For traders and investors, the current environment presents both opportunity and risk. Historical November seasonality strongly favors Bitcoin with average gains exceeding 40%, though macro headwinds this year have tempered that typical pattern. The combination of stimulus expectations, shutdown resolution, and technical oversold conditions from last week’s selling creates a constructive setup but only if Bitcoin can prove it has truly found support above $100,000.

Monday Summary (November 11, 2025):

- Bitcoin: $106,767 (+4.14% daily, +5.2% from weekend low)

- Ethereum: $3,608 (+5.46% daily), strongest major asset rebound

- XRP: $2.48 (+8.62%), leading large-cap surge

- Privacy Coins: Zcash +15.5%, Monero +13.2%, continuing October rally

- Market Cap: $3.58T (+4.07% daily), broad-based recovery

- Fear & Greed: 35 (Fear), improved 75% from 20 extreme fear

- Catalysts: Trump $2K stimulus + Senate shutdown vote

- Technical: Testing 200-day EMA at $110K, key resistance

Risk Considerations: Cryptocurrency investments carry substantial risk including potential loss of principal. Leverage magnifies both gains and losses. Stimulus driven rallies can reverse quickly if expectations aren’t met. Market participants should conduct due diligence, monitor technical support levels, track institutional flows, and maintain appropriate risk management including position sizing and stop losses.

[…] Discover how Trump’s stimulus and shutdown resolution sparked a $5,000 Bitcoin bounce […]