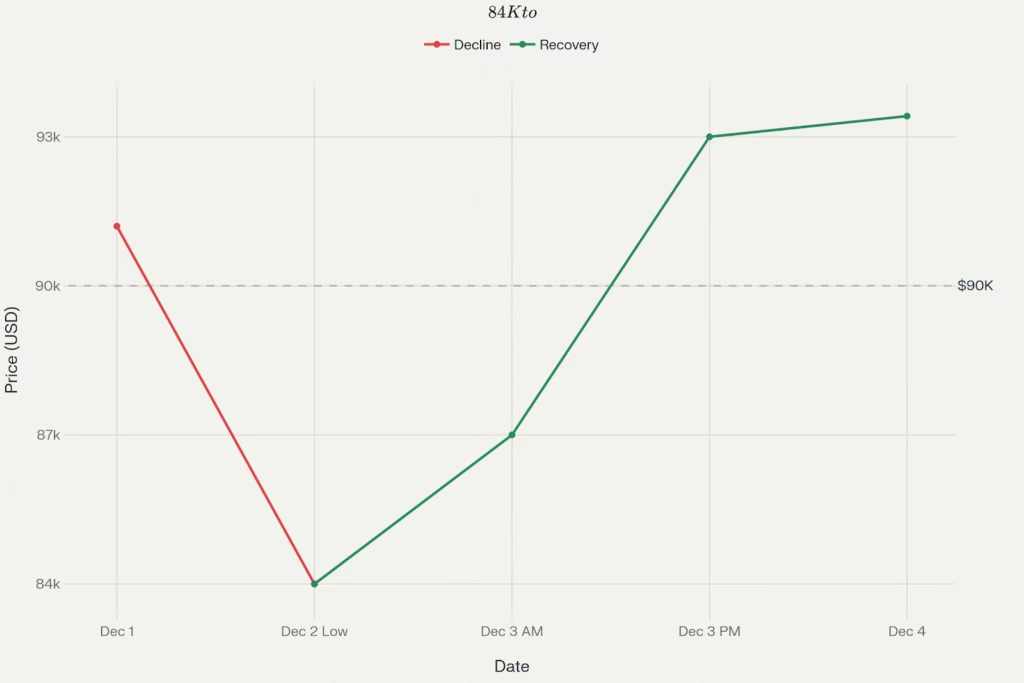

Bitcoin surged back toward $93,416 by Thursday morning after plummeting below $84,000 during Monday’s December opening, marking an 11.2% recovery within 48 hours despite lingering market fragility. The volatile opening week reveals the fundamental tension characterizing cryptocurrency markets in early December: severe short term selling pressure from forced liquidations and macro uncertainty versus unprecedented institutional accumulation from professional allocators treating depressed valuations as strategic entry opportunities.

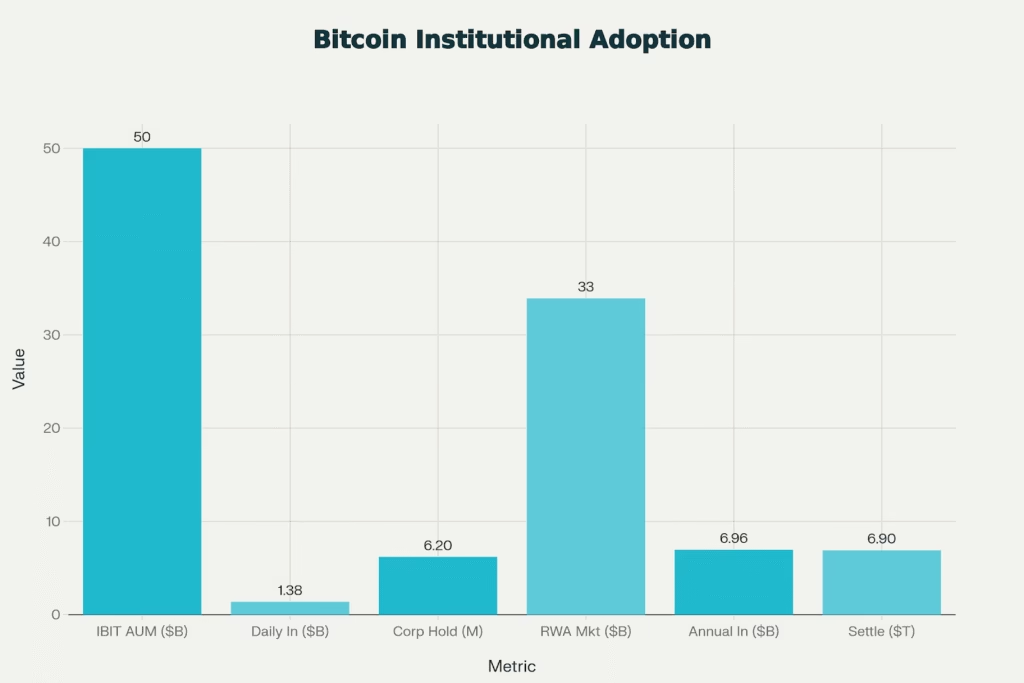

The narrative beneath this weekly volatility deserves far more attention than daily price swings. Institutional adoption metrics reached breaking points suggesting Bitcoin has transitioned from speculative asset toward core portfolio component for major financial institutions. BlackRock’s iShares Bitcoin Trust now manages over $50 billion in assets with record daily inflows hitting $1.38 billion. Corporate treasuries accumulated 6.2 million Bitcoin during 2025 alone. Tokenized real world assets expanded toward $33.91 billion market capitalization. These metrics demonstrate institutionalization velocity that transcends short-term price movements.

Bitcoin recovers 11.2% from Monday’s $84K crash to $93.4K within 48 hours as institutional buyers deploy capital

The December Shock That Revealed Institutional Discipline

Monday’s crash to $84,000 represented a coordinated liquidation event where both retail traders and overleveraged positions experienced forced selling. The $200 billion market capitalization decline occurred within hours as Asian trading opened December, the classic timing for year-end position squaring when fund managers finalize annual reports and allocators deploy strategic capital.

What separated Monday’s selling from November’s panic crash was the presence of institutional buyers stepping in immediately during weakness rather than chasing prices higher. Exchange data showed 1.8 million Bitcoin net withdrawals within 24 hours, the largest single-day institutional accumulation signal since November. This contrasts sharply with October when Bitcoin peaked at $126,500 and institutional inflows remained modest. Current positioning suggests professional capital waited for capitulation conditions before deploying fresh allocations.

Tuesday’s stabilization near $87,000 provided breathing room for technical recovery. By Wednesday, Bitcoin surged past $93,000 as institutions continued systematic accumulation. This V-shaped recovery pattern mirrors previous capitulation bottoms more than temporary technical bounces. The speed and magnitude of recovery, 11.2% in 48 hours typically occurs when forced selling exhausts available supply and natural buyers resume activity.

Ethereum outperformed Bitcoin during the recovery with 9.1% daily gains reaching $3,055, while smaller altcoins posted 10-17% advances. This breadth expansion signals genuine institutional demand returning across multiple asset classes rather than isolated Bitcoin strength. When the entire cryptocurrency market strengthens simultaneously following capitulation events, it typically indicates that buying represents allocation decisions rather than short covering rallies.

Institutional Infrastructure Reaches Mainstream Scale

Bitcoin attracts record institutional capital with BlackRock IBIT holding $50B and daily inflows hitting $1.38B

The institutional transformation became quantifiable through Glassnode and Fasanara Capital’s Q4 2025 report, which documented unprecedented professional participation metrics. Bitcoin attracted $732 billion in fresh capital during the current cycle exceeding all previous cycles combined, while settlement volume reached $6.9 trillion annually, rivaling established payment networks.

BlackRock’s IBIT product alone surpassed $50 billion in assets under management within just over one year, making it the most successful cryptocurrency ETF launch in history. Daily inflows occasionally exceeded $1.38 billion, demonstrating sustained institutional demand that persists independent of daily price volatility. These flows represent pension funds, endowments, hedge funds, and wealth managers integrating cryptocurrency into core portfolio allocations rather than peripheral positions.

Corporate cryptocurrency treasuries expanded dramatically with MicroStrategy holding 257,000 Bitcoin accumulated during 2024 alone. Emerging participants including pharmaceutical companies and technology firms allocated substantial capital toward crypto holdings, with combined corporate treasury Bitcoin positions exceeding 6.2 million coins. This represents approximately 10% of Bitcoin’s total supply now held by publicly traded corporations, a threshold that historically precedes major appreciation phases as institutional ownership concentrates among committed long-term holders.

JPMorgan, Goldman Sachs , Fidelity , and other traditional finance titans launched cryptocurrency products integrated into their existing infrastructure. These institutional giants wouldn’t commit hundreds of millions developing cryptocurrency services if they viewed digital assets as temporary bubbles. Their participation validates that Bitcoin has evolved from speculative frontier toward a legitimate asset class worthy of professional capital deployment.

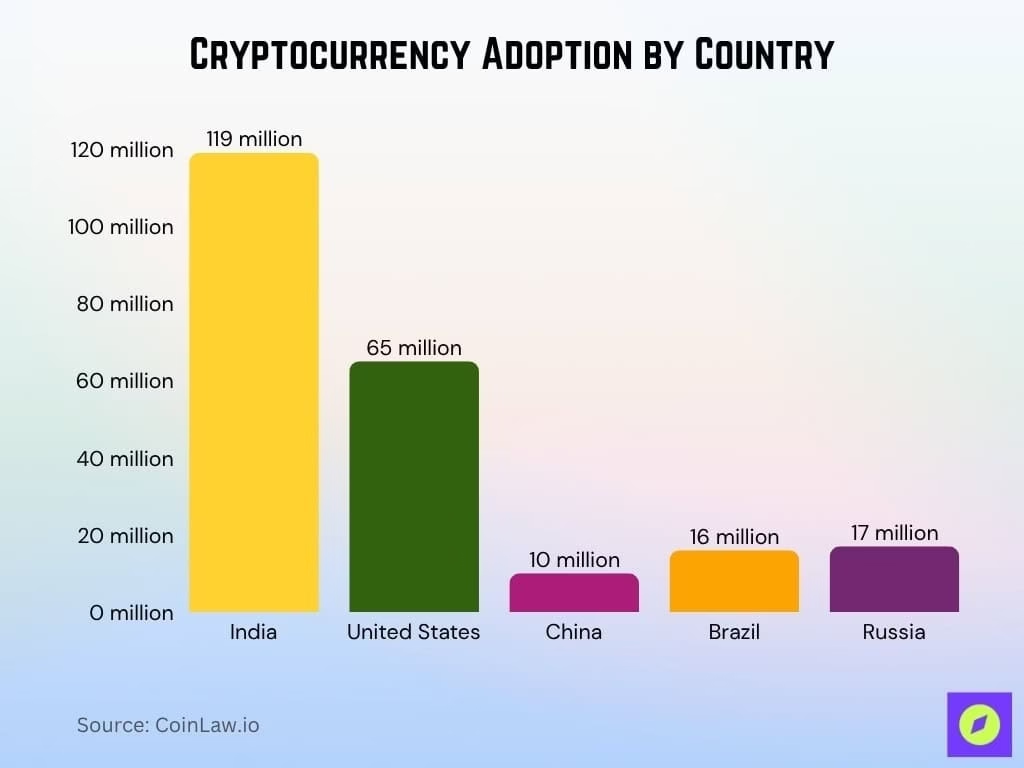

Cryptocurrency Adoption Statistics 2025

Regulatory clarity accelerated this institutional migration. The SEC approved Bitcoin and Ethereum spot ETFs after five years of deliberation, creating regulated pathways for institutional participation. Europe’s MiCA framework and Asia’s stablecoin regimes provided compliance certainty that professional participants required. This regulatory infrastructure once considered a barrier to adoption, became the catalyst enabling unprecedented professional capital inflows.

December: When Macro Dominates Micro

Federal Reserve policy will ultimately determine whether Thursday’s recovery extends into sustained December rallies or represents temporary relief within continued weakness. Markets currently assign 85% probability to a December 10th rate cut down from 87% earlier in the week but still indicating likely easing. If Fed Chair Jerome Powell delivers cuts alongside dovish guidance, risk asset rallies typically accelerate as discount rates applied to future cash flows decline across portfolios.

Bitcoin’s 0.85 correlation with Nasdaq Composite technology stocks ensures that Fed policy expectations drive cryptocurrency pricing mechanically through portfolio rebalancing rather than fundamental conviction about digital assets. This macro dependency explains why Bitcoin can experience 11% swings within 48 hours price action reflects changing Fed policy expectations rather than steady fundamental adoption advancement.

The technical setup establishes binary scenarios. Breaking decisively above $95,000-$98,000 on sustained volume would establish higher highs confirming recovery legitimacy and opening pathways toward retesting $100,000 psychological resistance. Failure to hold above $90,000 and subsequent breakdown below $87,000 would invalidate recovery signals and likely accelerate selling toward $80,000 where previous cycle support resides.

What This Moment Actually Represents

December’s opening volatility masked the real story: institutional accumulation during retail panic. The $732 billion in fresh capital deployed this cycle, combined with 10% Bitcoin concentration in corporate treasuries, demonstrates that professional allocators treat volatility as opportunity rather than warning signal.

The fascinating element is that fundamental adoption continues advancing independent of price noise. Tokenized asset markets expanded 380% from 2024 toward $33.91 billion. Institutional cryptocurrency holdings reached critical mass at 10% of total Bitcoin supply. Settlement volumes rivaled major payment networks. These metrics suggest Bitcoin has completed its transition from speculative frontier toward institutional portfolio component.

For positioning purposes, current conditions present defined scenarios. Those maintaining conviction can establish long positions with stops below $87,000 and targets at $98,000-$105,000. Those preferring confirmation can await a decisive $95,000 breakout before increasing exposure. Everyone benefits from acknowledging that market structure has shifted decisively toward institutional dominance and that this shift historically precedes sustained appreciation phases.

The next two weeks clarify whether December delivers traditional holiday rallies or extends November weakness into year-end weakness. But regardless of near-term direction, the structural transformation toward institutional dominance continues advancing independent of daily volatility.

Thursday Update (December 4, 2025):

- Bitcoin: $93,416 (+1.63% daily, +11.2% from Monday low)

- Ethereum: $3,136 (+4.68% daily), stronger than Bitcoin

- Market Cap: $3.24T (+7.4% from Monday lows)

- Institutional Capital: $732B this cycle, exceeding all prior cycles

- Corporate Holdings: 6.2M BTC (10% of total supply)

- Settlement Volume: $6.9T annually, rivaling payment networks

- ETF Inflows: $1.38B record daily, $6.96B annually

- Fed Rate Cut Odds: 85% for December meeting

Related Articles

- How Bitcoin’s rebound to $88K marks the moment pro investors took control from panic sellers

- Inside Bitcoin’s flash crash paradox: how historic regulatory wins collided with a brutal $2.2B liquidation-driven plunge

- Bitcoin roars past $91.5K on Thanksgiving as Fed rate-cut fever ignites a sharp reversal from weeks of losses