From Automation to Adaptive Intelligence in a Decentralized World

For years, artificial intelligence and blockchain evolved like two powerful rivers flowing side by side occasionally intersecting, but rarely merging. AI focused on prediction, pattern recognition, and automation. Blockchain focused on trust, decentralization, and immutable record-keeping. Each solved a different problem.

In 2025, those rivers have merged.

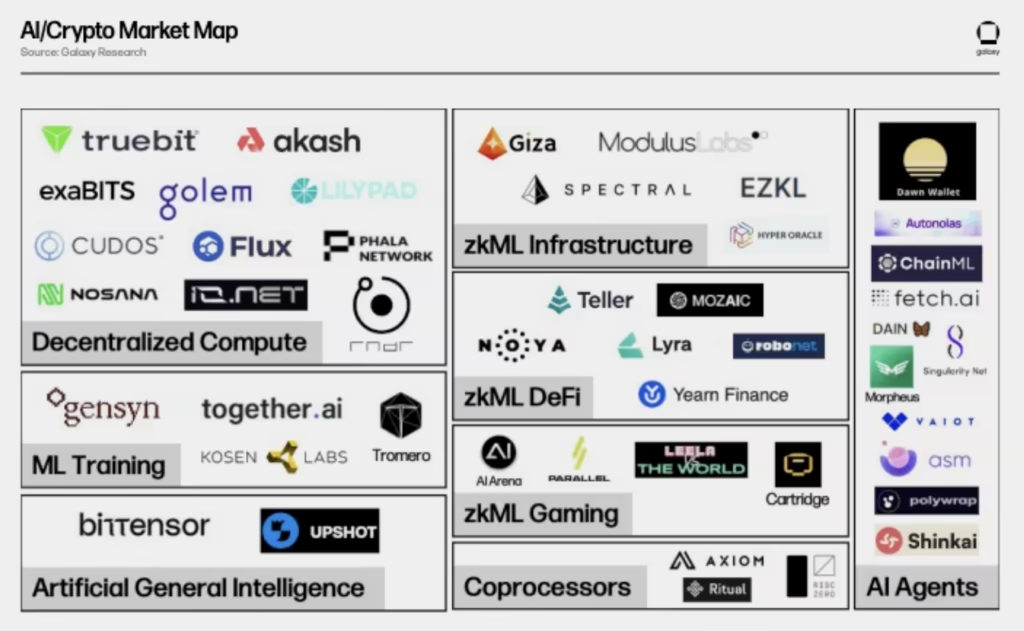

This convergence is not cosmetic, and it is not theoretical. AI is now embedded directly into blockchain infrastructure, DeFi protocols, governance systems, and security layers. At the same time, blockchain is becoming a critical counterweight to AI’s biggest weaknesses, opacity, centralized control, and unverifiable decision-making.

What’s emerging is not “AI coins” or marketing slogans, but an entirely new intelligence layer for Web3.

Smart Contracts Are Evolving Beyond Static Logic

Traditional smart contracts are deterministic. They do exactly what they’re programmed to do no more, no less. That reliability is their strength, but also their limitation. They cannot interpret nuance, assess changing conditions, or respond intelligently to uncertainty.

AI changes that constraint.

In 2025, a new class of adaptive smart contracts is emerging. These contracts still execute on-chain logic deterministically, but they rely on AI systems off-chain (or within specialized execution environments) to analyze complex inputs before triggering actions.

Consider decentralized lending. Instead of using rigid collateral ratios, AI-assisted protocols can now:

- Continuously assess market volatility

- Model liquidation cascades before they happen

- Adjust risk parameters dynamically

- Pause or throttle activity when abnormal behavior is detected

The smart contract remains the enforcement layer. AI becomes the decision-support layer. The result is a system that behaves less like a vending machine and more like a risk-aware financial organism.

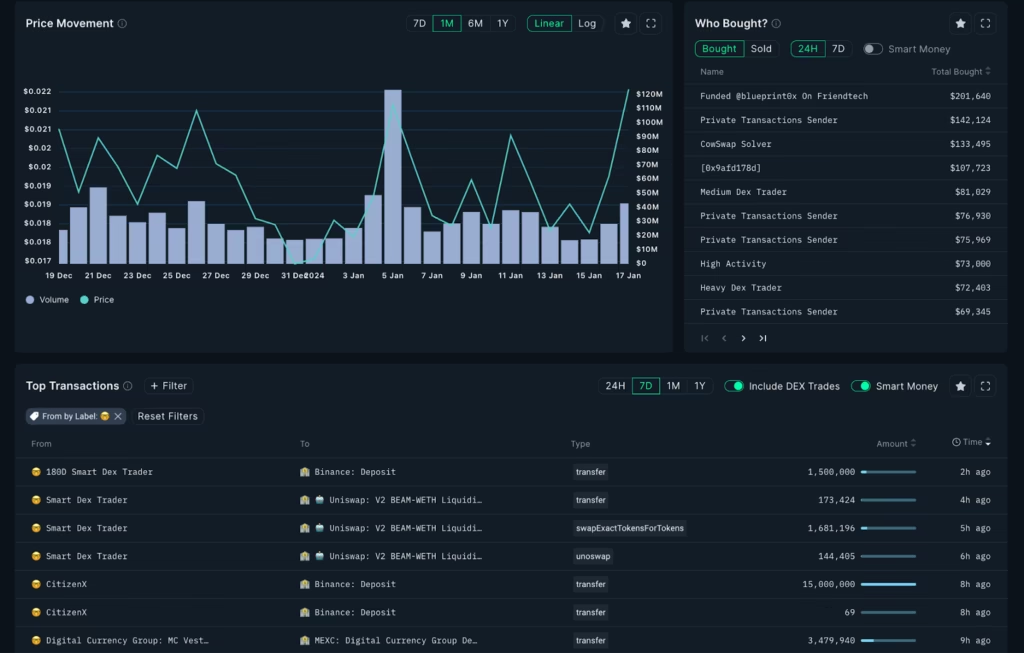

Trading and Market Intelligence Are No Longer Exclusive to Institutions

Crypto markets generate an absurd amount of data: wallet flows, liquidity shifts, governance votes, developer commits, social sentiment, macro correlations. Humans cannot process this volume meaningfully. AI can.

By 2025, AI-driven analytics have moved decisively on-chain.

Retail users now access tools that:

- Detect abnormal whale movements across chains

- Identify liquidity traps and fake breakouts

- Flag coordinated pump-and-dump behavior

- Model downside risk during high-leverage events

This is a quiet but profound shift. Information asymmetry, once the biggest advantage of hedge funds and market makers is narrowing. AI doesn’t make markets fair, but it makes them less blind for ordinary participants.

Importantly, this isn’t just about profit. Early detection of liquidity drains or contract anomalies can prevent catastrophic losses long before Twitter notices something is wrong.

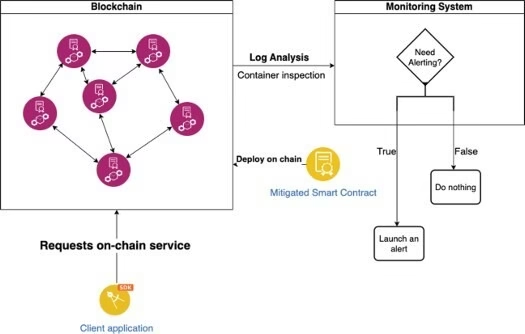

Security Is Becoming Predictive, Not Reactive

Security in crypto has historically been reactive. A hack happens. A post-mortem is written. Lessons are learned, too late.

AI is shifting this dynamic toward preemptive defense.

Modern blockchain security systems use machine learning models trained on years of exploit data. These models don’t just look for known attack signatures; they look for behavioral anomalies:

- Sudden changes in transaction cadence

- Abnormal gas usage patterns

- Repeated contract calls resembling exploit scaffolding

- Wallet behaviors consistent with draining scripts

In some protocols, AI systems can now trigger automatic safeguards rate limiting, contract pausing, or emergency governance actions, before funds are irreversibly lost.

This is especially critical in decentralized systems, where there is no central security team watching every transaction in real time. AI effectively becomes a distributed nervous system for Web3.

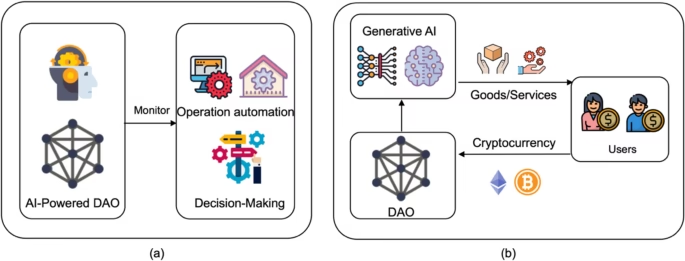

DAOs Are Moving From Crowd Chaos to Coordinated Intelligence

DAOs promised decentralized governance, but reality exposed their weaknesses: low participation, unreadable proposals, and decision paralysis.

AI is quietly fixing this.

In 2025, many DAOs use AI systems to:

- Summarize complex proposals into plain language

- Highlight trade-offs and potential risks

- Surface dissenting opinions early

- Predict voter turnout and proposal success

This doesn’t replace human judgment. It augments it.

The most effective DAOs now treat AI as a governance assistant, one that filters noise, reduces cognitive load, and allows members to focus on decisions, not documentation overload.

Decentralized AI and Data Markets Are Redefining Ownership

One of the most important, but least understood the impacts of AI-crypto convergence are happening at the data layer.

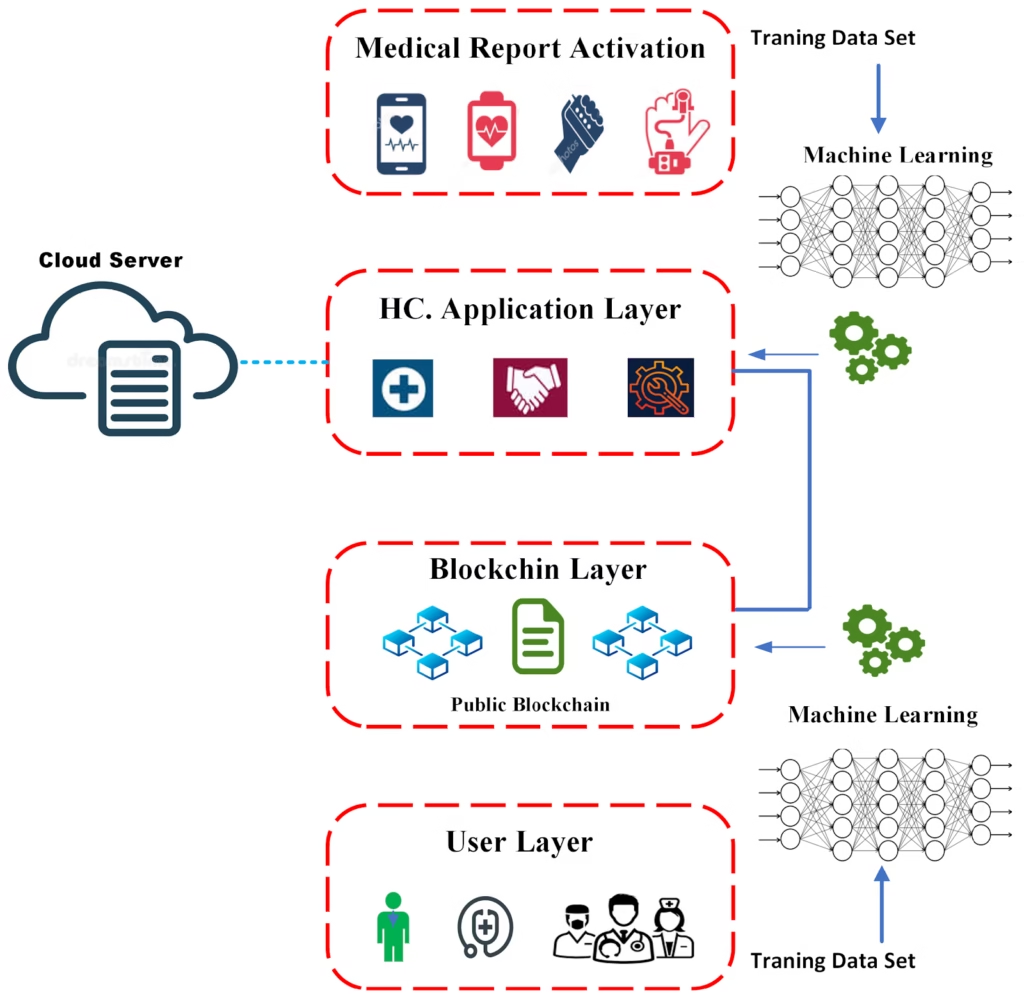

AI models need data. Historically, that data has been harvested, centralized, and monetized without meaningful consent. Blockchain introduces an alternative: verifiable, permissioned data markets.

In these systems:

- Data contributors retain ownership

- Usage is tracked on-chain

- Compensation is automatic and transparent

- Privacy is preserved through cryptographic techniques

This flips the AI economy on its head. Instead of users feeding models for free, they become participants in value creation. Blockchain doesn’t just support AI, it forces it to become accountable.

AI Is Quietly Fixing Crypto’s Usability Problem

For all its innovation, crypto has struggled with usability. Keys, gas fees, bridges, and approvals remain hostile to newcomers.

AI is smoothing these edges.

In 2025, AI systems act as:

- Natural-language interfaces for blockchain actions

- Risk explainers before transactions are signed

- Personalized learning guides for DeFi and staking

- Context-aware warning systems for dangerous actions

This matters more than price speculation ever will. Mass adoption doesn’t come from ideology. It comes from lowering cognitive friction.

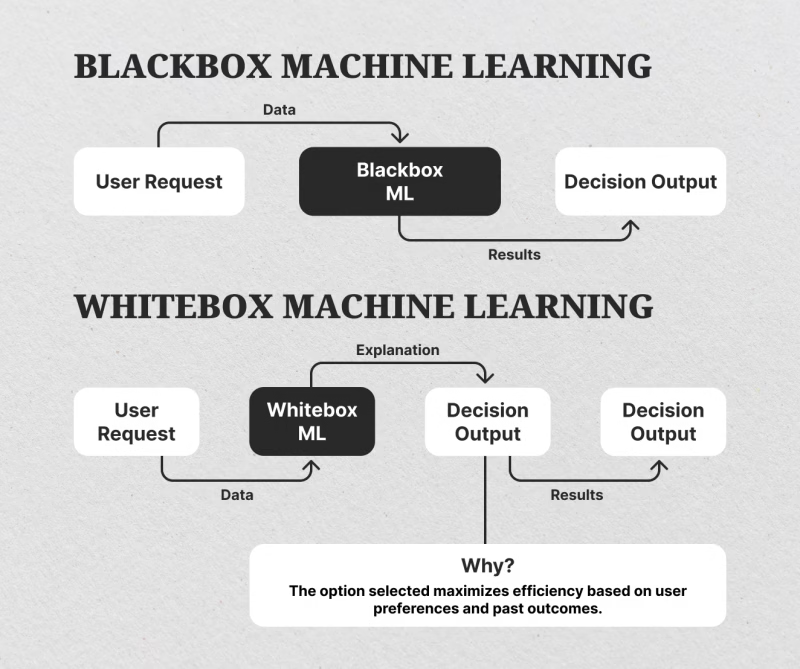

The Ethical Fault Line: Transparency vs Intelligence

There is a tension at the heart of this convergence.

Blockchain is transparent by design.

AI is often opaque by necessity.

As AI systems gain decision-making authority in financial and governance contexts, the risk of unexplainable outcomes grows. Who is accountable when an AI-assisted protocol denies access, triggers liquidation, or influences governance outcomes?

Blockchain may provide the answer by enforcing:

- On-chain audit trails of AI decisions

- Verifiable training data provenance

- Consensus-based approval of AI actions

The challenge of the next decade is not technical capability. It is alignment.

Conclusion

AI is not replacing blockchain. And blockchain is not restraining AI.

Together, they are creating systems that are:

- Trustless, but intelligent

- Autonomous, but accountable

- Decentralized, but adaptive

This is not the end of crypto’s volatility or risk. But it is the beginning of something more mature: decentralized systems that can learn, not just execute.

In 2025, the most important shift in Web3 is not faster chains or cheaper fees.

It’s the emergence of intelligence woven directly into decentralized infrastructure.

The next era of crypto won’t just run on code.

It will think.

Related Articles

- Crypto taxes made simple: how to report, calculate, and file your crypto gains without costly mistakes

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level

- CBDCs vs Crypto: can government digital currencies really kill decentralized money?

- 10 common crypto scams and exactly how to avoid losing your money to them

- Web3 decoded: what it is, why it matters, and how you can start participating today

- Ethereum vs Solana: which smart contract platform really wins on speed, cost, and ecosystem strength?