A Rebalancing Framework for Volatility, Capital Preservation, and Compounding (2026)

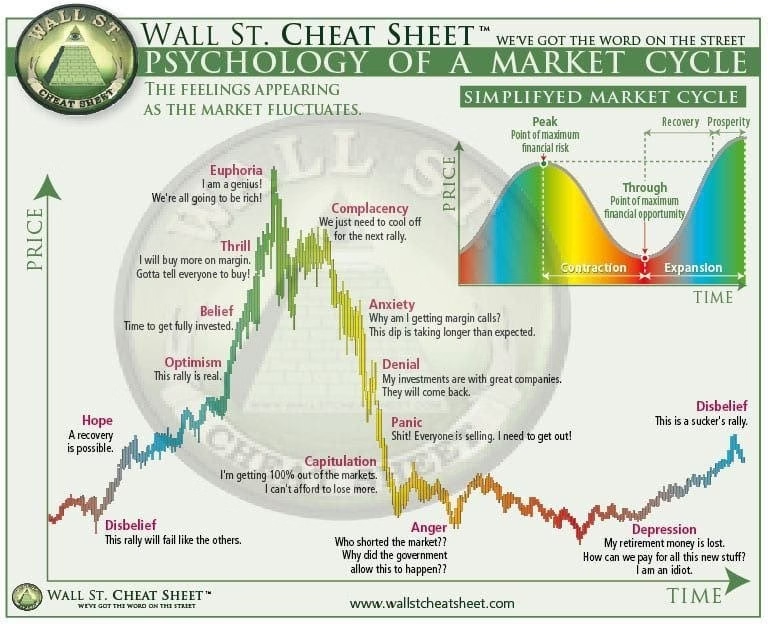

Cryptocurrency investing is often mistaken for a game of timing catching bottoms, selling tops, and riding narratives before they fade. In reality, long-term success in crypto rarely comes from prediction. It comes from structure. In a market defined by violent volatility, fragmented liquidity, and rapid innovation, portfolio balance and disciplined rebalancing are the only reliable defenses against both permanent capital loss and emotional decision-making.

By 2025, crypto has matured into a multi-sector financial ecosystem: base-layer networks behave differently from Layer 2s, yield-bearing RWAs respond to macro rates, and speculative governance tokens move on sentiment alone. Treating these assets as interchangeable “coins” is a structural error. A balanced portfolio must instead be built as a system, one that assumes instability and profits from it through controlled exposure and periodic recalibration.

Why Balance Is Structural, Not Conservative, in Crypto

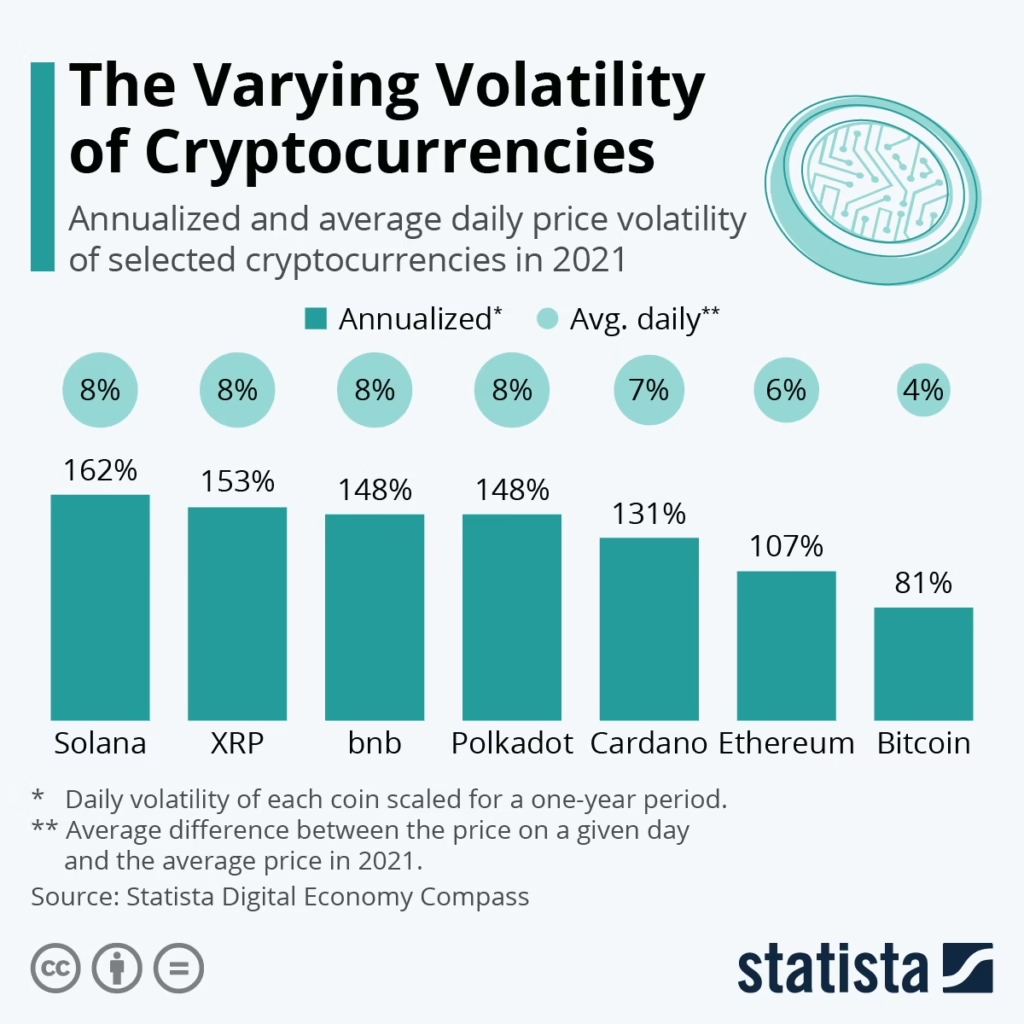

Balance in crypto is often misunderstood as risk aversion. In truth, it is risk engineering. Crypto markets are reflexive: rising prices attract leverage, leverage amplifies volatility, and volatility eventually forces liquidation. Portfolios that are not diversified across volatility profiles inevitably become fragile precisely when confidence is highest.

A balanced crypto portfolio reduces fragility by ensuring that no single asset class, narrative, or protocol failure can dominate outcomes. Bitcoin and Ethereum offer deep liquidity and long-term survivability, but they do not capture all innovation. DeFi and RWA tokens generate yield and exposure to financial primitives, but they carry smart contract and regulatory risk. Stablecoins provide optionality, not returns, yet they often determine whether an investor survives a drawdown with capital intact. Balance does not limit upside; it keeps upside investable over time.

Portfolio Construction as Risk Layering, Not Asset Picking

Professional crypto investors do not begin with a list of tokens. They begin with risk layers, each designed to behave differently under stress. At the foundation lies core capital, typically composed of assets with the highest liquidity, strongest network effects, and longest survival probability. These assets anchor the portfolio during systemic drawdowns and act as collateral-like reserves.

Above this sits growth capital, allocated to sectors where adoption curves are steep but uncertainty remains high Layer 2 infrastructure, modular blockchains, or emerging financial primitives. These positions are expected to outperform in expansion phases and underperform sharply during contractions.

Stability capital plays a deceptively important role. Stablecoins and low-volatility yield assets are not idle cash; they are strategic reserves that enable opportunistic redeployment, reduce drawdowns, and provide psychological resilience.

Finally, optional risk capital exists solely for asymmetric opportunities. This layer must be strictly capped, frequently reviewed, and emotionally expendable. Its purpose is optionality, not identity. A portfolio constructed this way remains functional even when individual layers fail.

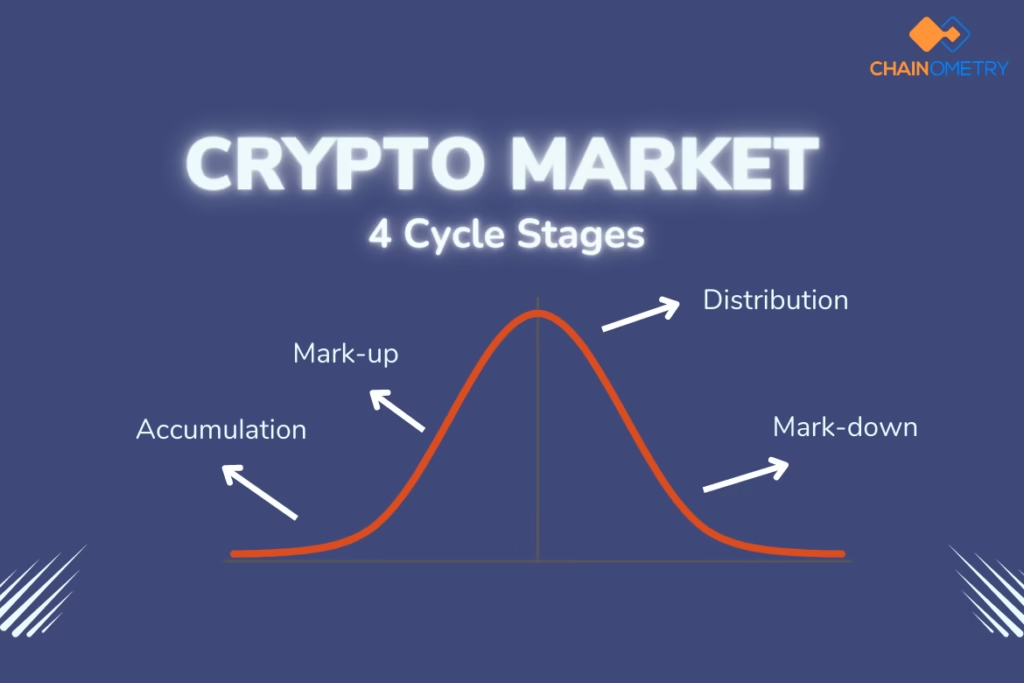

Market Cycles as Allocation Stress Tests

Crypto market cycles compress years of traditional market behavior into months. Expansion phases are characterized by abundant liquidity, narrative proliferation, and rising correlations. In these periods, even weak assets appreciate, masking underlying risk concentration.

Contraction phases reverse this dynamic brutally. Liquidity evaporates, correlations spike toward one, and only assets with real usage or institutional support retain relative value. Sideways or accumulation phases follow often misread as irrelevance, but in reality, they are periods of silent repositioning by informed capital.

Balanced portfolios are not static across these cycles. Their behavior changes even when their structure remains intact. Rebalancing is the mechanism that enforces this adaptive behavior without requiring constant judgment calls.

Rebalancing as a Mechanical Advantage

Rebalancing is frequently discussed as a maintenance task. In crypto, it is a return-generating process. Because crypto assets exhibit extreme mean reversion, portfolios naturally drift toward overexposure to recent winners. This drift increases risk precisely when expected returns decline. Rebalancing counteracts this by systematically selling relative strength and reallocating toward relative weakness, without attempting to time absolute tops or bottoms.

The effectiveness of rebalancing lies in its indifference to narratives. It operates on deviation, not conviction. When an asset exceeds its intended role, exposure is reduced. When it underperforms but remains fundamentally viable, exposure is restored. This process converts volatility into a structural ally rather than an existential threat.

Cycle-Specific Rebalancing Dynamics

In bull markets, rebalancing is an act of restraint. As speculative assets outperform, portfolios must shed excess exposure not because assets are “bad,” but because risk has become asymmetrically concentrated. Profits are redirected into core assets or stability capital, preserving the ability to remain invested when sentiment eventually turns.

In bear markets, rebalancing becomes an act of patience. Capital migrates toward assets with the highest survival probability, while stablecoin reserves expand. Deployment into risk assets is gradual, rules-based, and indifferent to short-term price action.

During sideways markets, rebalancing maintains equilibrium. It prevents decay through neglect and ensures readiness for directional resolution.

The key insight is this: rebalancing logic changes with the cycle, but discipline does not.

Automation and the Elimination of Behavioral Risk

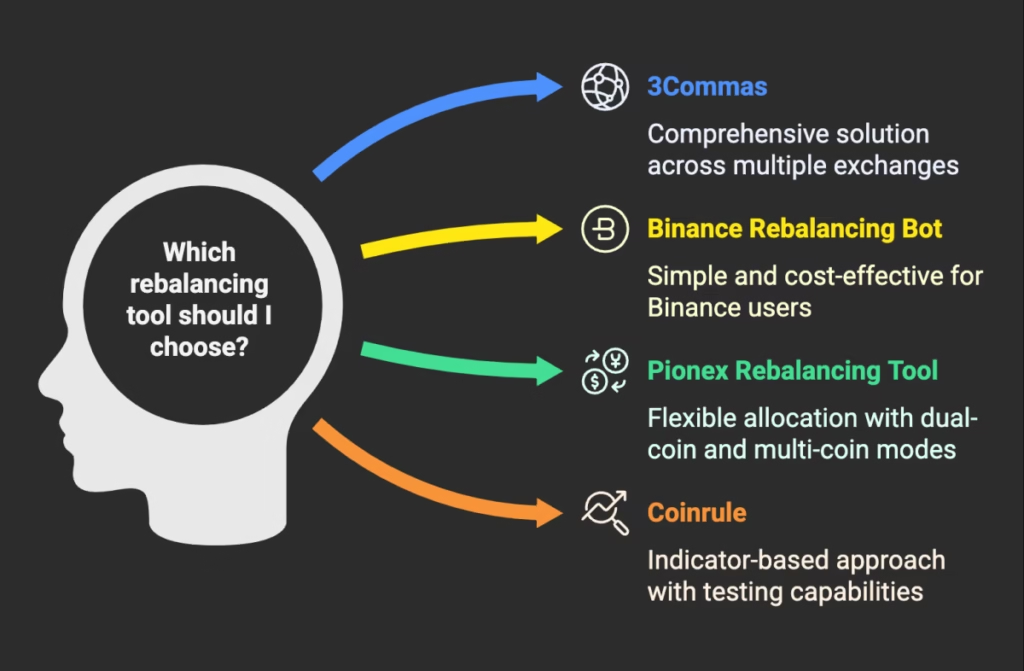

By 2025, the primary advantage of portfolio tools is not convenience, it is behavioral insulation. Automation enforces rules when emotions are least reliable.

Modern portfolio platforms integrate wallets, exchanges, and DeFi positions into a unified risk view. They allow investors to define allocation bands, receive deviation alerts, and execute rebalances with minimal friction. Tax tracking, once a deterrent to discipline, is now integrated directly into workflow.

Automation does not remove responsibility. It removes hesitation.

Structural Errors That Undermine Balanced Portfolios

Even well-designed portfolios fail when execution is compromised. The most common failure is emotional override abandoning predefined rules in response to news, fear, or euphoria. Others include rebalancing too frequently, ignoring deteriorating fundamentals, or allowing speculative positions to graduate into core holdings without justification. Balanced portfolios succeed not because they are complex, but because they are consistently respected.

Discipline as a Competitive Edge in Crypto

Crypto remains one of the few markets where structural discipline is still rare. Most participants oscillate between overconfidence and paralysis. A balanced, rebalanced portfolio sidesteps this cycle entirely. It does not react; it responds.

In 2025, as crypto integrates further with traditional finance and volatility remains intrinsic, portfolio management is no longer an advanced skill. It is a baseline requirement for survival. Those who endure will not be those who predicted correctly.

They will be those whose structure allowed them to stay invested long enough to matter.

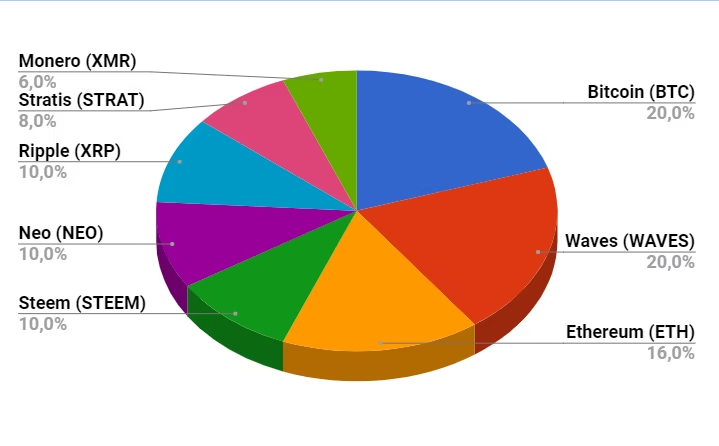

Illustrative Allocation Framework (Conceptual)

| Risk Layer | Typical Range | Primary Function |

| Core assets | 30–45% | Liquidity, durability |

| Stable capital | 15–30% | Volatility buffer |

| Growth assets | 20–35% | Upside participation |

| DeFi / RWA | 10–20% | Yield and innovation |

| Speculative | 5–10% | Optional asymmetry |

Related Articles

- Your investor rights in crypto: custody disputes, exchange failures, and the legal protections you need to know

- Blockchain interoperability 101: how cross‑chain bridges actually work and why they’re critical for crypto’s future

- Global crypto regulations in 2025: what’s changing in the EU, US, India, and other key markets

- Gas fees explained: how rollups slash Ethereum transaction costs without sacrificing security

- Best Layer‑2 networks in 2025: Arbitrum, Optimism, zkSync and how they really compare