Scalability, Adoption, and the Real Battle for Ethereum’s Future

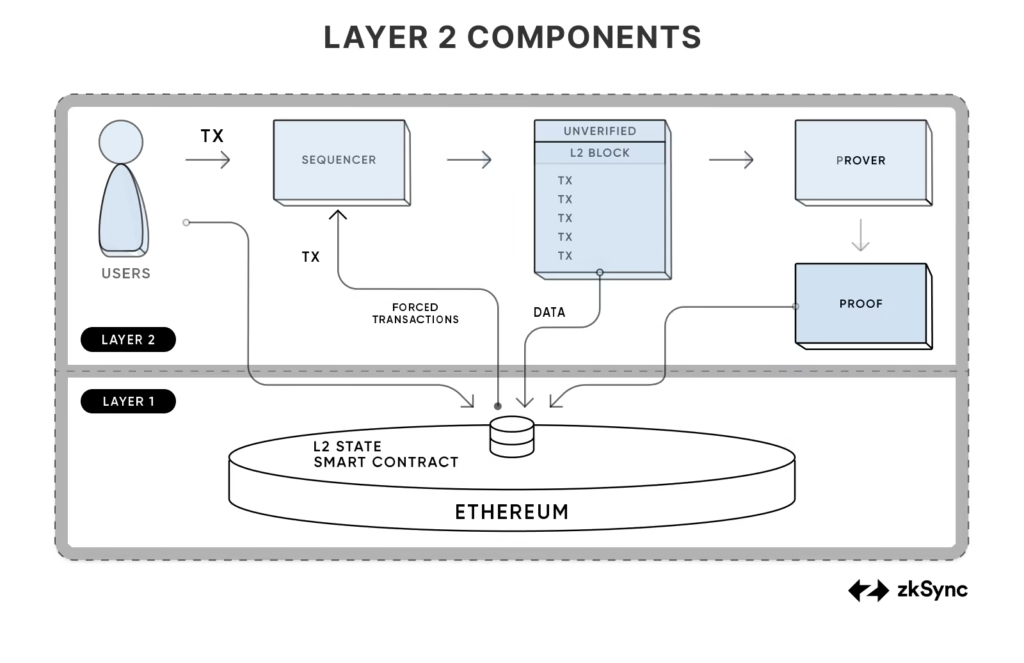

Ethereum in 2025 looks nothing like Ethereum in 2020. The base layer is no longer where users live, it’s where truth is finalized. High-value settlements, security guarantees, and dispute resolution remain on Layer 1, while almost everything else has migrated upward into Layer 2s.

This shift isn’t theoretical. It’s structural. Ethereum’s limited throughput and variable gas fees made it clear that global-scale adoption could never happen on Layer 1 alone. Layer 2 networks didn’t emerge as optional optimizations, they emerged as Ethereum’s execution layer.

Among dozens of rollups and scaling experiments, three networks have clearly separated themselves from the rest: Arbitrum, Optimism, and zkSync. Each represents a different philosophy of scaling Ethereum, and understanding their differences is now essential for users, builders, and investors alike.

Why Layer 2s Matter More Than Ever in 2025

Ethereum’s security model is intentionally conservative. That’s its strength, but also its bottleneck. Processing roughly 15 transactions per second, Ethereum L1 simply cannot support mass-market applications without pricing out users.

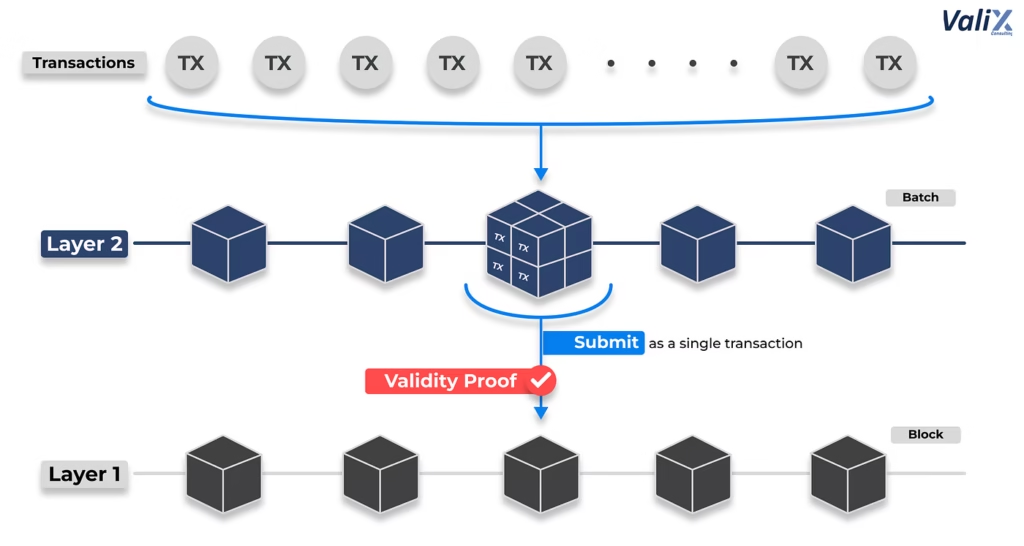

Layer 2s solve this by moving computation off-chain while anchoring final state back to Ethereum. The result is a dramatic improvement in throughput, cost efficiency, and user experience, without abandoning Ethereum’s decentralization.

By 2025, this architecture has matured. Layer 2s routinely process more daily transactions than Ethereum itself, host most user-facing dApps, and serve as the primary environment for DeFi, gaming, NFTs, and consumer crypto apps. Ethereum has effectively become a settlement court, while Layer 2s are the cities where economic life happens.

Arbitrum: Liquidity, Gravity, and Ecosystem Dominance

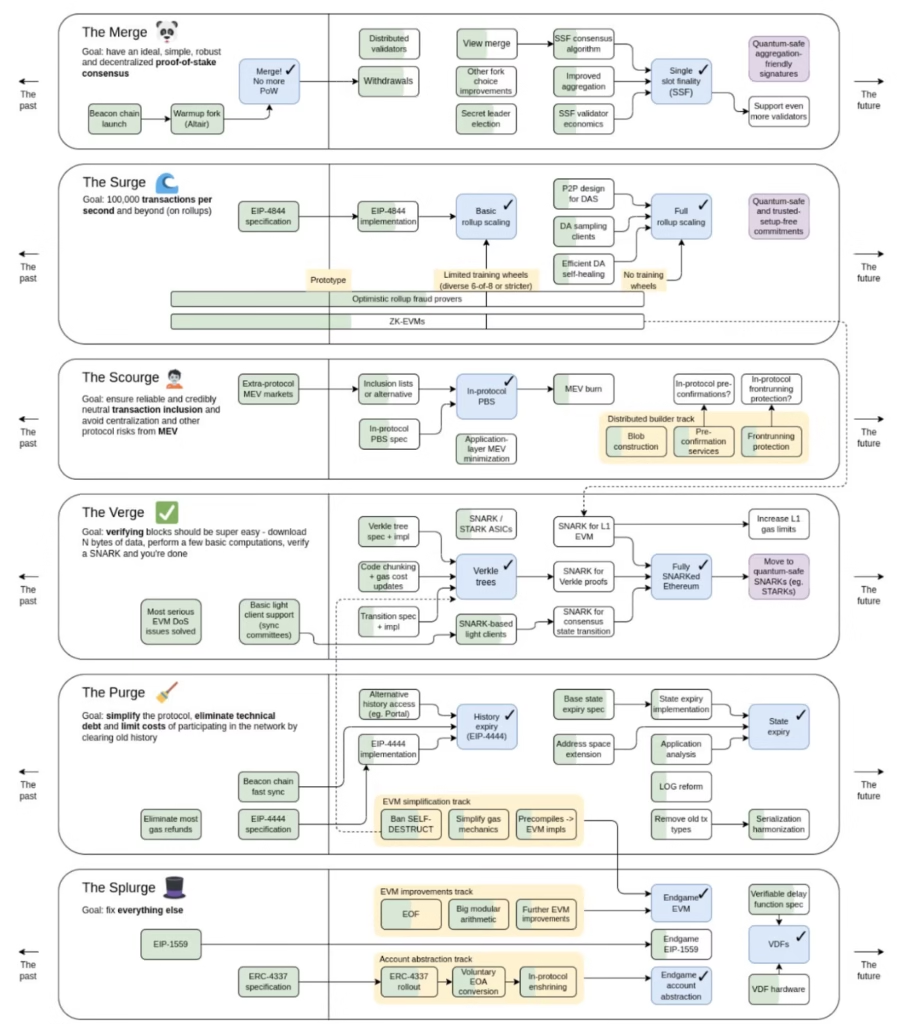

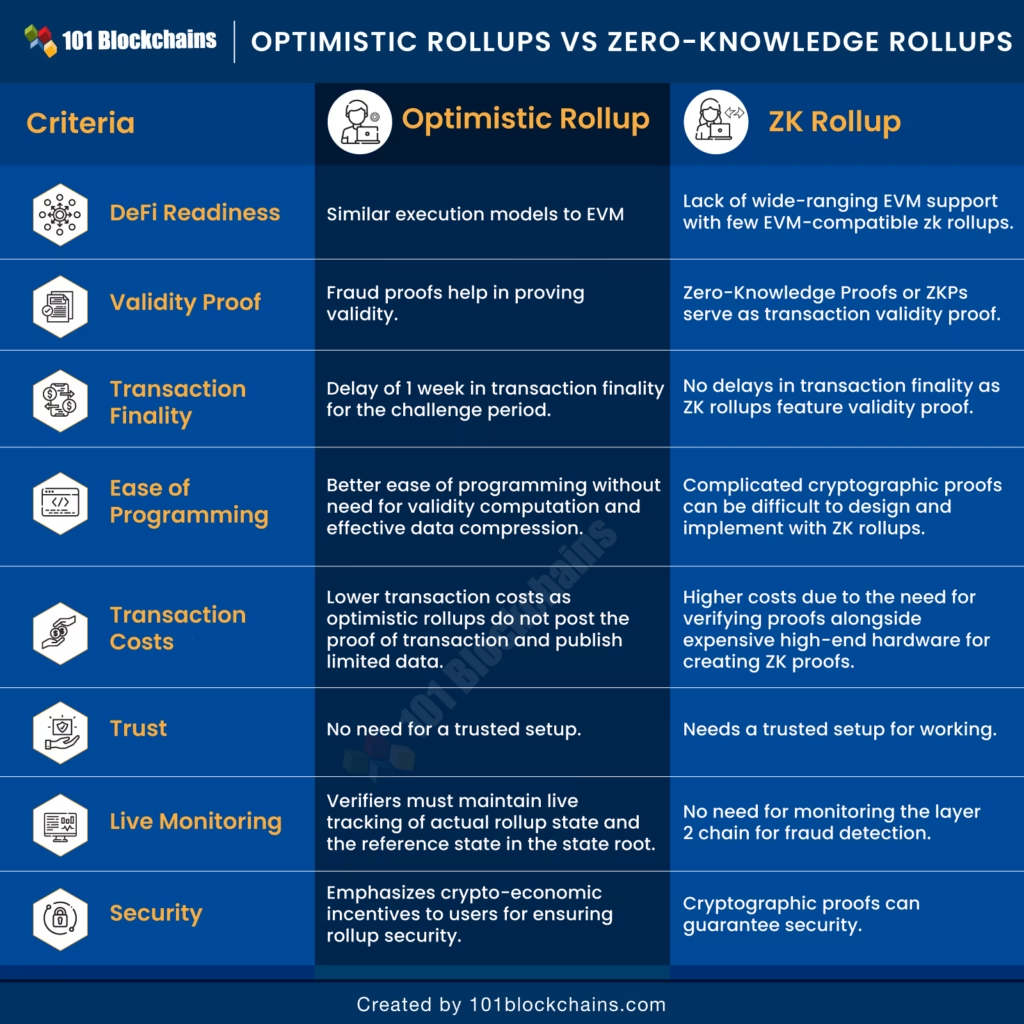

Arbitrum’s strength in 2025 is not just technical, it’s gravitational. Built as an Optimistic Rollup, Arbitrum assumes transactions are valid unless challenged, relying on fraud proofs to enforce correctness. This design favors simplicity, compatibility, and rapid ecosystem growth.

What truly differentiates Arbitrum is momentum. Liquidity attracts builders, builders attract users, and users attract more liquidity. This feedback loop has made Arbitrum the default home for serious DeFi activity.

Protocols like GMX, Radiant, and major Ethereum-native dApps didn’t just deploy on Arbitrum, they optimized for it. This matters. Deep liquidity and familiar tooling reduce friction for both power users and institutional participants.

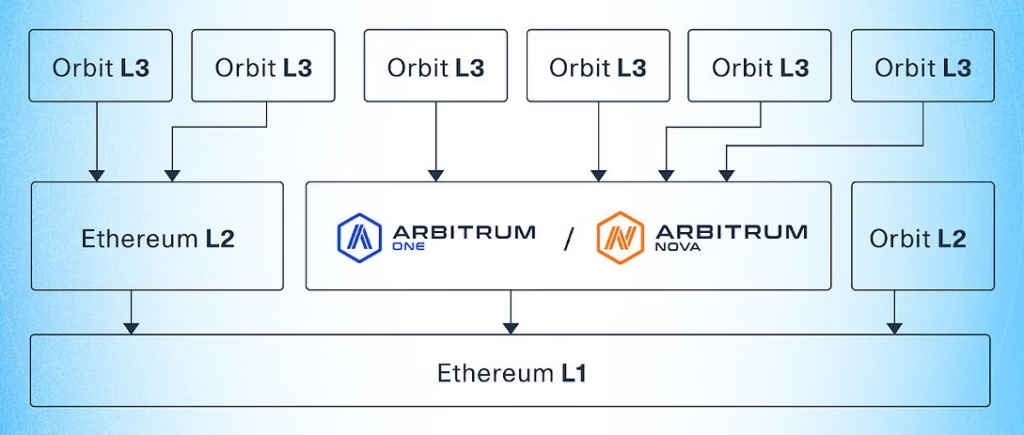

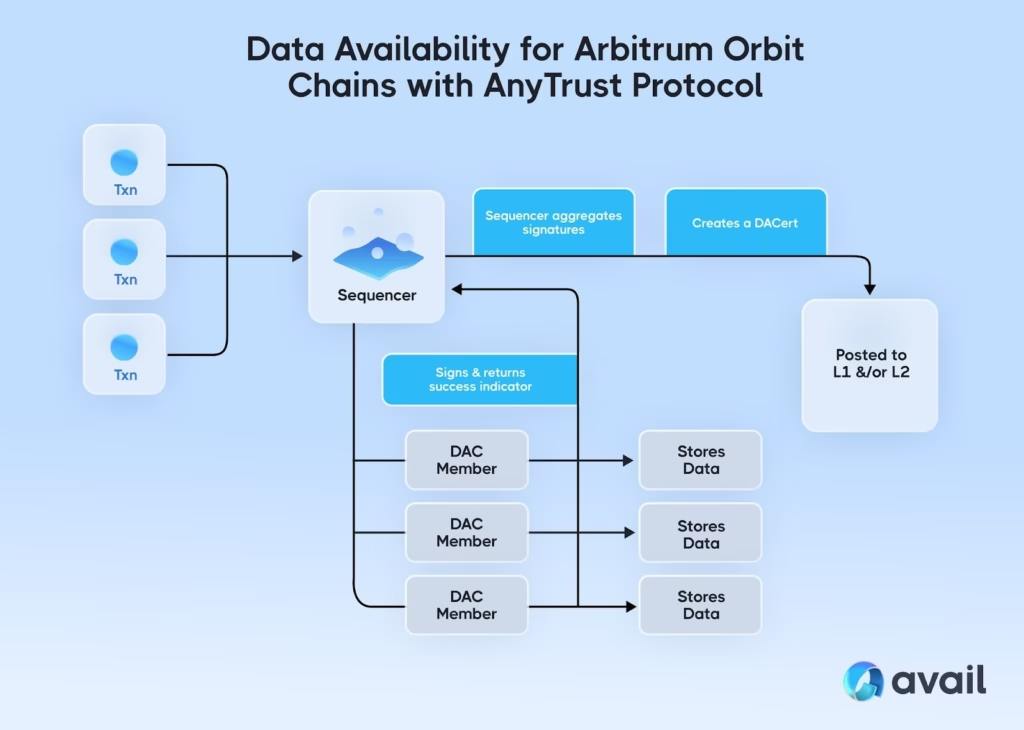

In 2025, Arbitrum Orbit extends this dominance further by allowing teams to launch their own app-specific chains secured by Arbitrum itself. This positions Arbitrum not merely as an L2, but as a scaling platform for other L2s, creating a layered ecosystem above Ethereum.

Arbitrum’s tradeoff remains withdrawal latency, assets typically require a challenge window to exit back to L1. But for most users, this is an acceptable cost for ecosystem depth and reliability.

Optimism: Scaling Through Coordination, Not Just Code

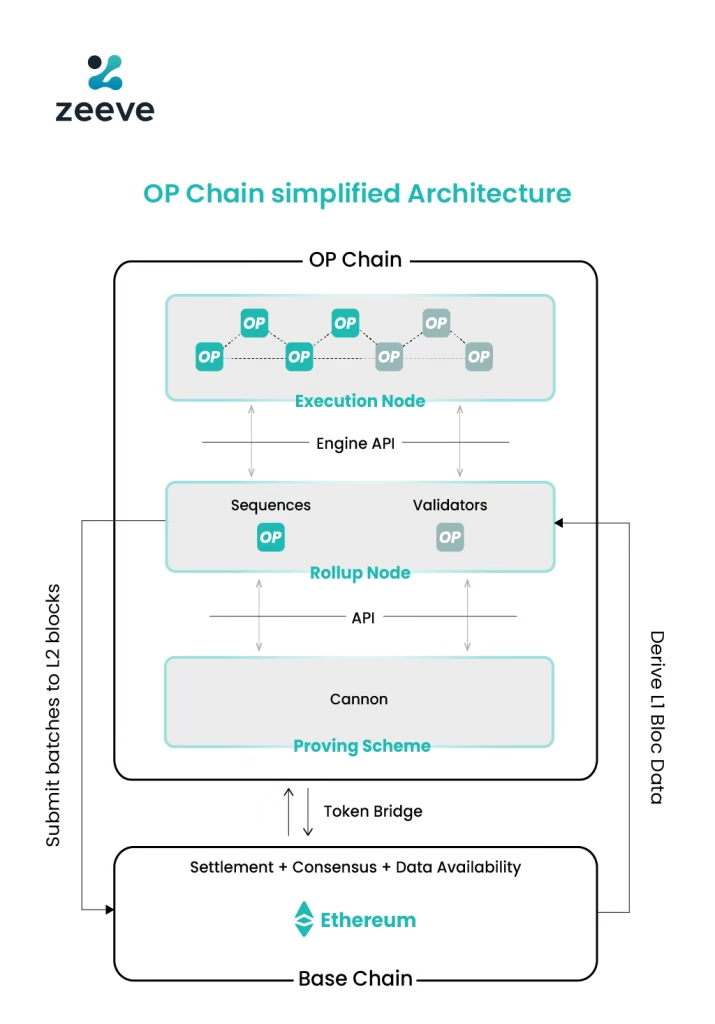

Optimism is also an Optimistic Rollup, but its ambitions go beyond transaction throughput. Where Arbitrum emphasizes market leadership, Optimism emphasizes coordination.

At the center of this vision is the OP Stack a modular, open-source framework that allows anyone to deploy a rollup compatible with Ethereum and Optimism’s ecosystem. In practice, this has led to the emergence of the “Superchain”: a network of interoperable rollups sharing infrastructure, standards, and economic alignment.

Base, built by Coinbase, is the clearest validation of this strategy. Rather than competing with Optimism, Base strengthens it by bringing millions of retail users into the OP ecosystem through consumer-facing apps, social protocols, and stablecoin infrastructure.

Optimism’s governance model is equally distinctive. Through the Optimism Collective, a portion of network value is explicitly directed toward public goods, developer tooling, and Ethereum-aligned infrastructure. This makes Optimism less extractive and more ecosystem-oriented than most rollups.

The tradeoff is that Optimism often moves slower in raw metrics than Arbitrum. But strategically, it is building something larger: a standardized rollup economy, not just a single dominant chain.

zkSync Era: Technical Precision and the Future of UX

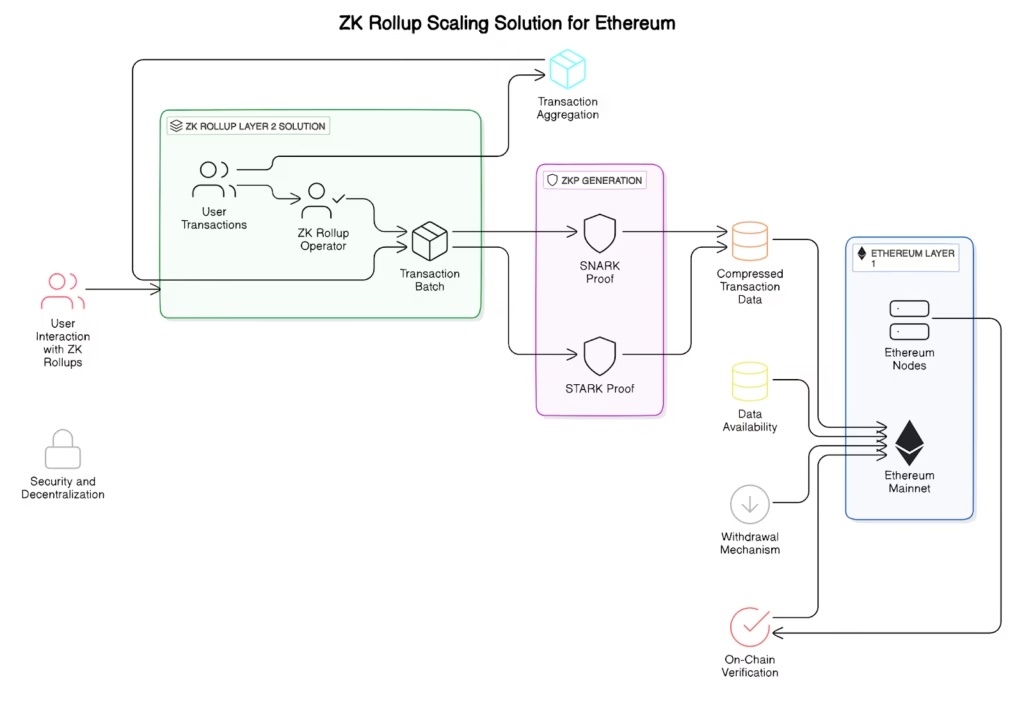

zkSync represents a different scaling philosophy altogether. Instead of assuming transactions are valid and checking later, zkSync proves correctness cryptographically before Ethereum accepts the result. This eliminates challenge periods and enables near-instant finality.

The technical complexity here is enormous, but so are the benefits. Withdrawals to Ethereum are fast. Transaction confirmations feel immediate. Security assumptions are tighter.

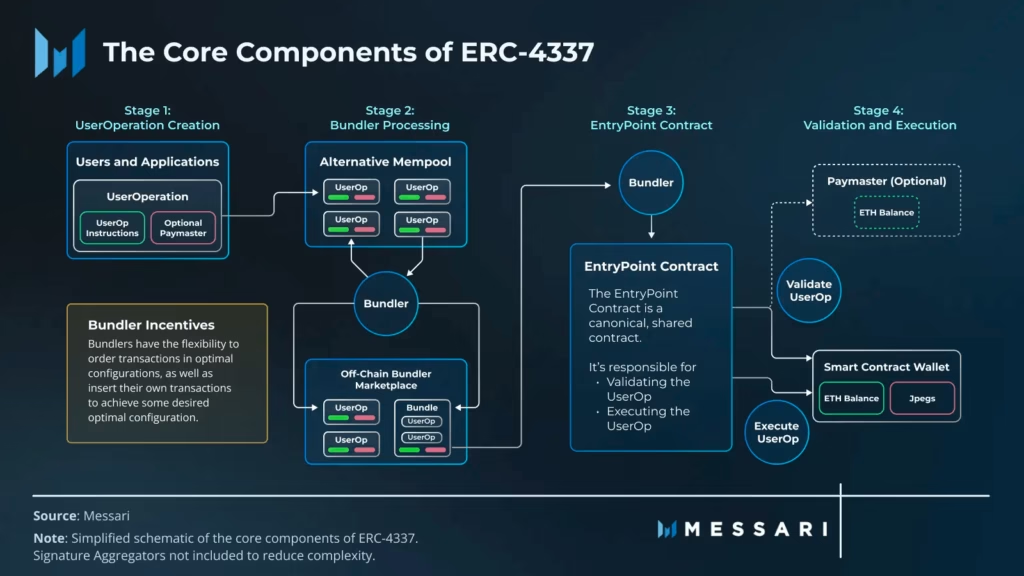

In 2025, zkSync’s biggest advantage isn’t speed alone, it’s user experience. Native account abstraction allows gasless transactions, social recovery wallets, session keys, and smart wallet logic to exist at the protocol level rather than as hacks layered on top.

This makes zkSync uniquely well-suited for consumer-facing applications: payments, gaming, NFTs, and mobile-first dApps. Users don’t need to understand gas, nonce management, or even Ethereum itself, the system abstracts that away.

zkSync’s ecosystem is smaller than Arbitrum’s, but it is more curated. Builders who choose zkSync tend to do so intentionally, prioritizing UX, security, and long-term architecture over immediate liquidity.

Side-by-Side Reality Check (2025)

| Feature | Arbitrum | Optimism | zkSync Era |

| Rollup Type | Optimistic | Optimistic | zk-Rollup |

| Finality | Delayed withdrawals | Delayed withdrawals | Near-instant |

| Ecosystem Depth | Very high | High via Superchain | Focused, high-quality |

| Developer Experience | Mature Solidity | Modular OP Stack | zkEVM + AA |

| UX Innovation | Standard Ethereum UX | Improving | Best-in-class |

| Strategic Edge | Liquidity gravity | Ecosystem coordination | Cryptographic finality |

Which Layer 2 Fits Which Use Case?

There is no universal winner, only context.

If you are a DeFi-native user, managing liquidity, leverage, or DAO treasuries, Arbitrum’s depth and composability make it the safest environment.

If you are a builder launching infrastructure, consumer apps, or a new rollup, Optimism’s OP Stack offers a path to scale without fragmentation.

If you are designing applications for mainstream users payments, social platforms, gaming zkSync’s UX advantages and instant finality make it the most future-proof choice.

The Hard Problems Layer 2s Still Face

Layer 2s have solved scaling, but not everything. Liquidity fragmentation remains real. Users still struggle to understand bridges, chains, and network selection. Interoperability standards are improving, but not yet seamless.

Security, too, remains layered. While Ethereum secures final settlement, bugs at the rollup level can still cause damage. The difference in 2025 is that these risks are better understood, better priced, and increasingly mitigated by audits and shared infrastructure.

The Bigger Picture: Layer 2s Are Ethereum Now

Ethereum’s future is rollup-centric. Layer 1 is becoming a global settlement engine. Layer 2s are where applications live, users interact, and value flows. Arbitrum, Optimism, and zkSync are not competing to replace Ethereum. They are competing to define how Ethereum is experienced. And in 2026, that battle matters more than ever.

Related Articles

- Ethereum vs Solana: which smart contract platform really wins on speed, cost, and ecosystem strength?

- Beginner’s guide: how to earn real passive income from DeFi lending without blowing up your capital

- How to build a balanced crypto portfolio that works in both brutal bear phases and euphoric bull runs (2025 blueprint)

- Ultimate 2025 guide: how to protect your seed phrase from theft, fire, and family members

- Crypto taxes made simple: how to report, calculate, and file your crypto gains without costly mistakes