Bitcoin drops below $108K as market flushes excess leverage amid rising volatility and ETF outflows

Technical Breakdown:-200-Day EMA Lost

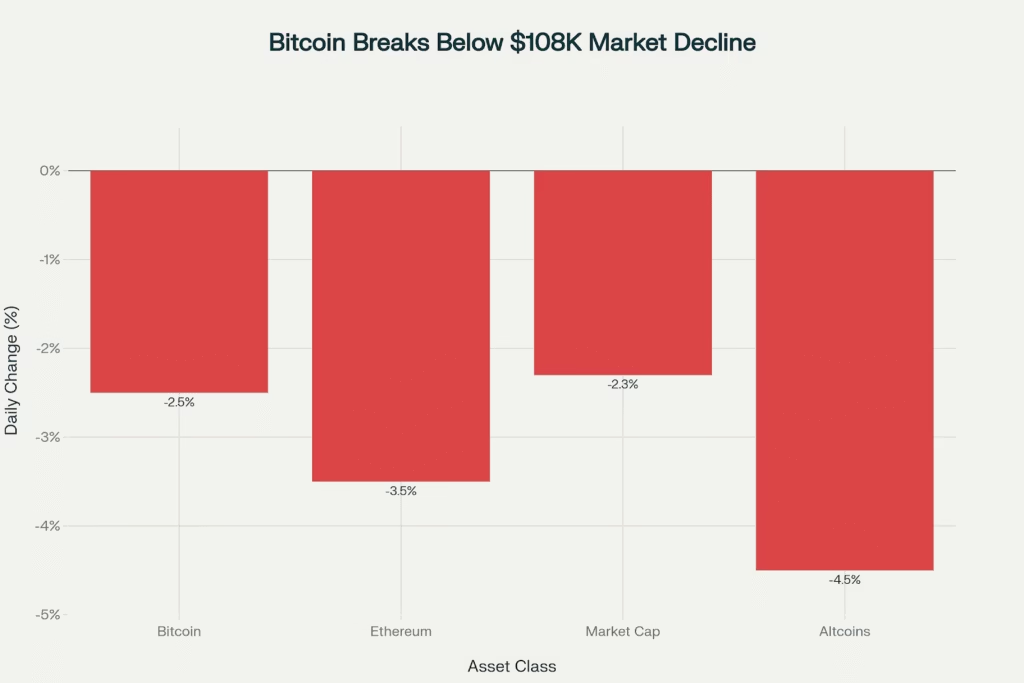

Bitcoin fell to $107,800 Tuesday evening IST, dropping 2.5% intraday after touching $107,460 the lowest since last week’s crash. The critical development: BTC broke below its 200-day EMA at $109,500, a key technical level signaling potential medium-term weakness.

Bitcoin falls below 200-day EMA as market undergoes deep deleveraging with $320M liquidations and sustained ETF outflows

Ethereum fared worse, sliding 3.5% to $3,867 as altcoins extended losses. The CoinDesk 80 Index dropped 4.5% with CAKE and ETHFI both losing 10%. Total crypto market cap fell 2.3% to $3.70 trillion while Fear & Greed Index held at 33 (Fear).

$320M Liquidation Wave Hits Longs

The selloff triggered $320 million in 24-hour liquidations with longs taking 76% of losses. Bitcoin accounted for $88M, Ethereum $85M, reflecting the market’s “deep phase of deleveraging” per analyst Alex Hasn.

Liquidation Breakdown:

- Total: $320M (76% long, 24% short)

- BTC: $88M liquidated

- ETH: $85M wiped out

- Driver: Excess leverage flush as confidence fades

Futures open interest rose to $26.06 billion as traders re-engage, but funding rates turned neutral-to-positive indicating short conviction has cleared. OKX leads with 7.51% positive rate.

ETF Exodus Continues

U.S. spot Bitcoin ETFs saw $40.47M outflows Tuesday, extending the redemption streak. BlackRock’s IBIT led with $100.65M exit despite holding largest net inflows since inception. Ethereum ETFs suffered worse: $145.68M outflows led by BlackRock’s ETHA (-$117.86M) and Fidelity’s FETH (-$27M).

ETF Flow Crisis:

- BTC ETFs: -$40.47M Tuesday

- ETH ETFs: -$145.68M (one of largest single-day redemptions)

- BlackRock IBIT: -$100.65M

- Total AUM: Still strong but momentum fading

Short-Term Holders Underwater

BGeometrics data shows short-term holders facing average losses with purchase prices above $113,000. Current levels represent 4-5% underwater positions, creating selling pressure as these traders capitulate.

A SpaceX-linked wallet moved $268M in BTC after a 3-month pause, adding to uncertainty about large holder intentions.

CME Gap and $100K Risk

Traders eye the CME futures gap at $107,390 partially filled Tuesday but full closure would require further downside. Popular trader Daan Crypto Trades warns bulls must hold $107K to avoid signaling deeper weakness.

Key Levels:

- Support: $107K critical, then $104.5K, $100K psychological

- Resistance: $110K, $113.2K, $115K

- CME Gap: $107,390 target

- Bear Case: Break below $107K risks $100K-$98K retest

Options Market Shows Bullish Conviction

Despite price weakness, BTC options traders pay steep premiums for upside exposure. The 25-delta skew exceeds 11.86% across all timeframes, with implied volatility term structure upward sloping signaling expectations of increased future price swings and sustained rally potential.

Deleveraging Before Recovery?

Analyst Alex Hasn notes: “The broader crypto market continues to experience a deep phase of deleveraging, with traders stepping back as volatility rises and confidence fades. Should this pattern persist, it may later serve as a foundation for a more resilient bull recovery once macro and liquidity conditions improve.”

The market tests whether weekend’s bounce formed a “lower high” bearish pattern suggesting further downside. Break below $107K would confirm fears, while reclaim of $110K+ could spark short squeeze given high options skew.

Tuesday Summary:

- BTC: $107,800 (-2.5%), broke 200-day EMA at $109,500

- ETH: $3,867 (-3.5%), altcoins down 4.5%

- Liquidations: $320M (76% longs)

- ETF Outflows: BTC -$40.47M, ETH -$145.68M

- Market: Deep deleveraging phase, $107K critical support