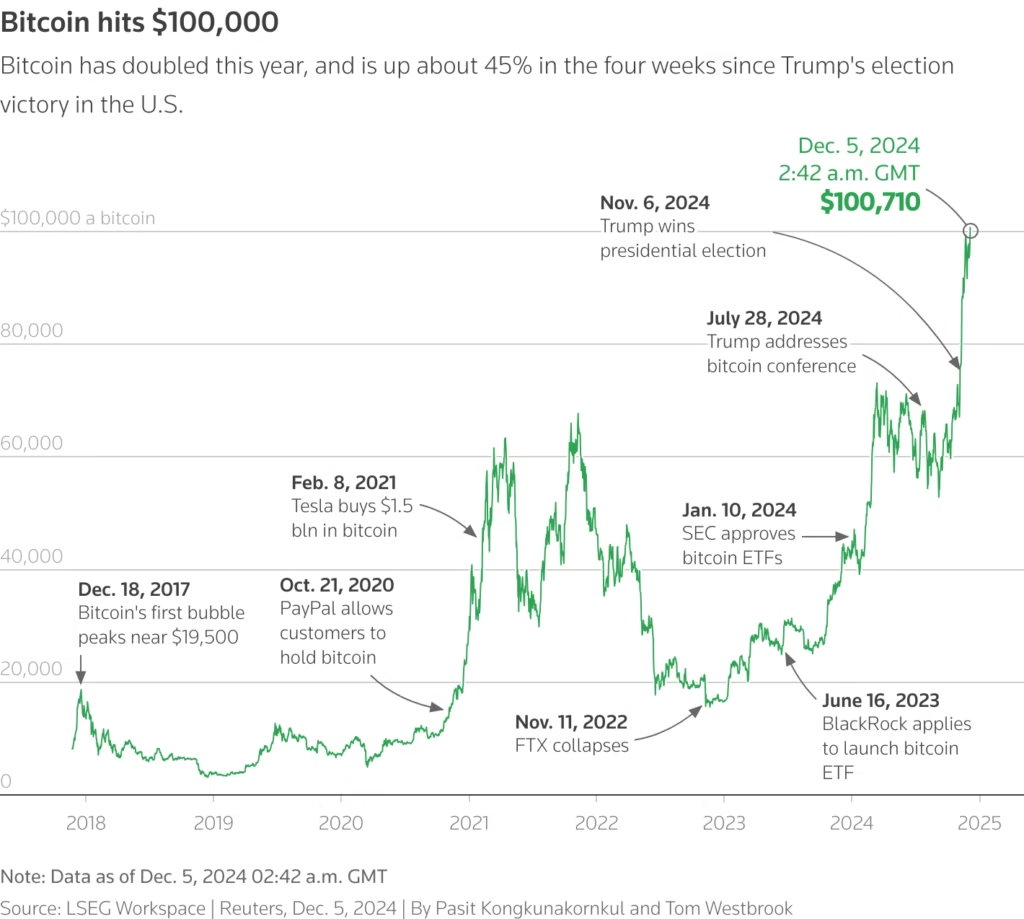

Bitcoin price timeline from 2017 to 2024 highlighting key events and its rise past $100,000 as of December 5, 2024

Bitcoin tests $100K support after 20% crash from ATH; Zcash explodes 700% while Tether buys $1B in Bitcoin and JPMorgan projects $170K fair value

Bitcoin tumbled to $100,965 on Thursday, November 7, 2025, shedding 20% from its all-time high of $126,521 just three days prior. The cryptocurrency’s sharp reversal has erased nearly all 2025 gains, with the global crypto market cap declining to $3.37 trillion amid persistent selling and liquidations.

Bitcoin drops 20% from all-time high of $126,521 to below $101K in just 3 days amid historic liquidations

Market Snapshot (November 7, 2025):

- Bitcoin (BTC): $100,965 (-1.95% daily, -9% weekly)

- Ethereum (ETH): $3,305 (-2.43% daily, -8.5% weekly)

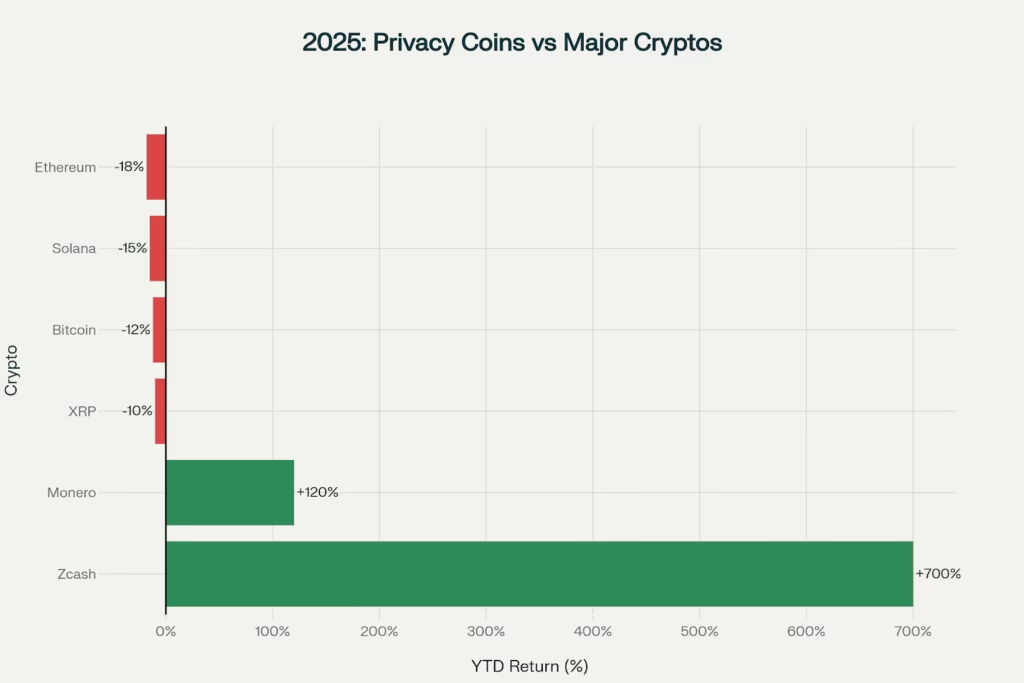

- Zcash (ZEC): $626.82 (+20.96% daily, +700% since September)

- Monero (XMR): $366.28 (+5.42% daily, +120% YTD)

- Global Market Cap: $3.37T (-1.72% daily)

- Major Support Level: Testing $100K psychological barrier

Privacy Coins Dominate Market with Historic Rally

Privacy focused cryptocurrencies have emerged as 2025’s biggest winners, with Zcash surging over 700% since late September to become the largest privacy coin by market capitalization. Zcash’s meteoric rise reflects enhanced shielded transaction adoption now accounting for over 30% of all transactions and renewed interest in financial privacy amid regulatory scrutiny.

Privacy coins dominate 2025 with Zcash up 700% while major cryptocurrencies erase year’s gains

Monero, the original privacy coin, posted a more modest 120% year-to-date gain despite strong fundamentals, as Zcash’s improved user experience (particularly its auto-shielded Zashi wallet) captured market attention.

Privacy Coin Surge Drivers:

- Institutional delisting fears driving privacy demand

- Retail rotation from transparent to anonymous transactions

- Enhanced protocol improvements making privacy seamless

- Venture capital rediscovery of “cypherpunk ideals”

- Regulatory uncertainty sparking anonymity demand

Overview of five privacy-focused cryptocurrencies highlighting their security features and privacy technologies swapzone

Zcash’s overtaking of Monero marks a significant power shift within the privacy segment, validating the strategy of making privacy default rather than optional. Industry analysts attribute the surge partly to fears of stricter government cryptocurrency oversight following regulatory proposals in multiple jurisdictions.

Bitcoin’s “Fair Value” at $170K

Despite Bitcoin’s weakness, JPMorgan issued a bullish thesis projecting $170,000 within 6-12 months based on volatility-adjusted gold comparison models. Managing director Nikolaos Panigirtzoglou argues Bitcoin trades approximately $68,000 below fair value when accounting for risk-capital dynamics versus gold’s $6.2 trillion institutional investment base.

JPMorgan’s $170K Bull Case:

- Target: $170,000 within 6-12 months (+68.4% upside)

- Methodology: Volatility-adjusted comparison to gold ETFs/private investment

- Bitcoin Risk Ratio: 1.8x vs gold (down from >2.0 historically)

- Market Cap Gap: Bitcoin needs 67% growth ($2.1T to $3.5T) to match gold exposure

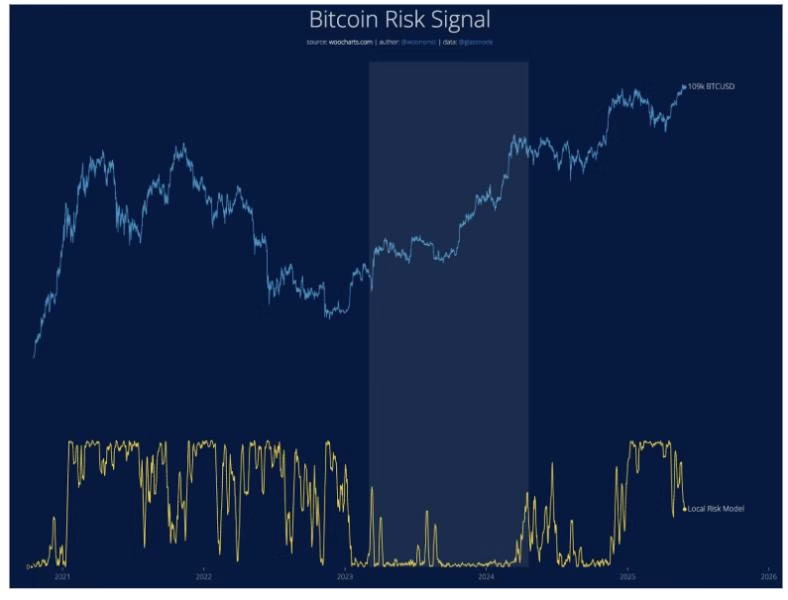

- Key Signal: Perpetual futures deleveraging likely complete; leverage ratio normalizing

The bank noted that “deleveraging in perpetual futures is likely behind us,” suggesting recent liquidations have cleared excessive leverage from derivatives markets. Bitcoin’s perpetual open interest has retreated to levels consistent with historical averages, signaling reduced forced selling risk.

However, Galaxy Digital recently lowered its 2025 Bitcoin forecast to $120,000, citing macro headwinds and a “maturity phase” with slower institutional absorption.

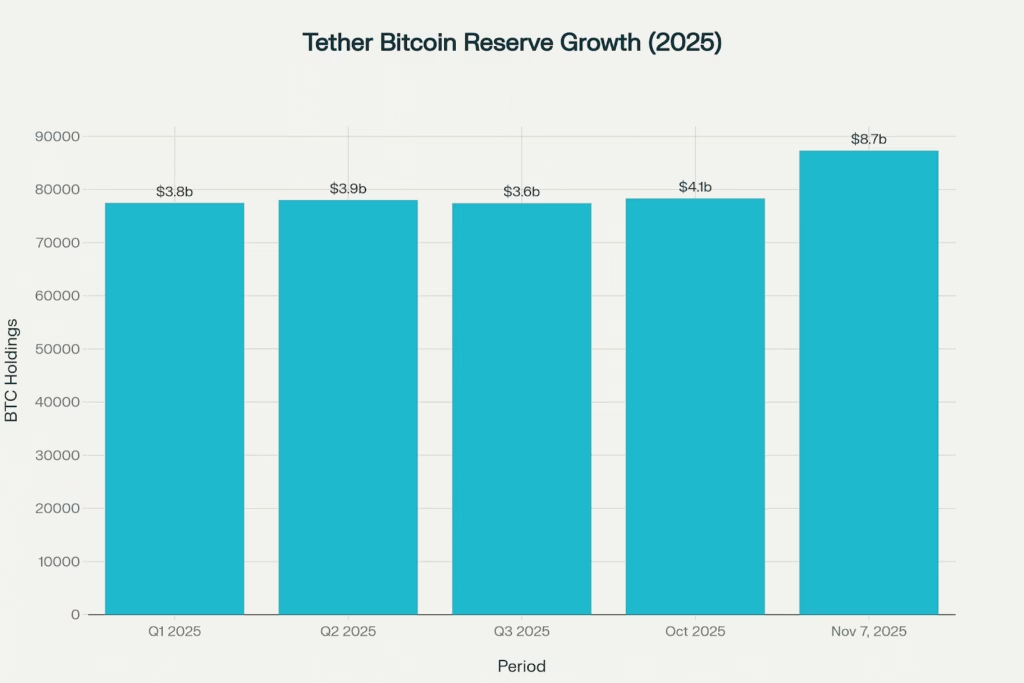

Tether Accelerates Bitcoin Purchases with $1B Spending

Stablecoin giant Tether has dramatically accelerated Bitcoin accumulation, purchasing 9,850 BTC worth approximately $1 billion over the past month as prices fell. The November 7 purchase alone involved 961 BTC valued at $97.3 million, bringing total holdings to 87,300 BTC worth $8.7 billion.

Tether accelerates Bitcoin accumulation with 9,850 BTC added in past month, holdings now at 87,300 BTC worth $8.7B

Tether Bitcoin Reserve Status:

- Total Holdings: ~87,300 BTC ($8.7 billion value)

- Cost Basis: $49,121 per BTC average

- Unrealized Profit: $4.55 billion (+93%)

- Strategy: Invests up to 15% of quarterly profits in Bitcoin

- Global Ranking: 6th largest Bitcoin holder (private)

- Recent Accumulation: 9,850 BTC in past month

Tether CEO Paolo Ardoino previously emphasized Bitcoin as “the ultimate reserve asset,” with the company’s Q3 2025 profits exceeding $10 billion. The dollar cost averaging approach demonstrates conviction despite near-term price volatility.

Technical Analysis: $100K Critical Support Under Siege

Bitcoin has broken below its 200 day exponential moving average near $110,000, a key support level that held since the 2022 bear market. The cryptocurrency’s technical structure has deteriorated significantly following the November 4 all time high breakout.

XTB analysts noted that previous correction patterns suggest “a potential decline toward $94,000, effectively erasing nearly all of this year’s gains”. RSI indicators show oversold conditions, potentially supporting short-term bounces, though sustained recovery requires reclaiming the 200 day EMA.

Perpetual futures open interest fell to $24.9 billion as traders reduced leverage, though options markets show 64%-35% call to put ratio favoring upside positioning. This divergence suggests sophisticated traders anticipate eventual recovery while avoiding leverage risks that triggered recent liquidations.

Market Breadth Collapse and Macro Headwinds

Only 5 of the top 100 cryptocurrencies posted gains on Thursday as the altcoin season index plummeted to 22/100 its lowest in 90+ days. Solana fell 2.78% to $154.92, XRP declined 4.84% to $2.197, with negative weekly returns ranging from -8% to -12%.

The ongoing U.S. government shutdown has delayed critical economic data and created uncertainty about Federal Reserve policy direction. Hawkish Fed commentary suggesting a potential slowdown in rate cuts has strengthened the U.S. dollar and pressured risk assets.

Macro Headwinds:

- Government shutdown delaying economic data releases

- Hawkish Federal Reserve tone strengthening dollar

- Tech stock weakness threatening crypto correlation

- Previous $20B+ liquidations still psychologically impacting markets

However, ETF inflows returned: Bitcoin and Ethereum ETFs recorded $253 million combined inflows Thursday, suggesting institutional accumulation at lower prices.

Binary Outcome at $100K

Bitcoin faces a critical inflection point at $100,000. A sustained break below triggers potential follow-through selling toward $94,000, while successful support defense combined with macro improvement (shutdown resolution, Fed clarity) could validate JPMorgan’s bullish thesis.

Market participants should monitor three key indicators:

(1) preservation of $100K support,

(2) reclamation of the 200-day EMA above $110,000, and

(3) macro developments including government resolution and Fed policy signals.

Thursday Summary (November 7, 2025):

- Bitcoin: $100,965 (-20% from ATH), testing critical $100K support

- Privacy Coins: Zcash +700% leads market; Monero +120% YTD

- Tether: Purchases 961 BTC; total holdings reach 87,300 BTC

- JPMorgan: $170K fair value forecast within 6-12 months

- Market Cap: $3.37T (-1.72% daily)

Risk Considerations: Cryptocurrency investments carry substantial risk including potential loss of principal. Recent volatility demonstrates rapid price movements. Privacy coins face regulatory delisting risks. Forecasts do not guarantee future performance. Market participants should conduct due diligence and maintain appropriate risk management.