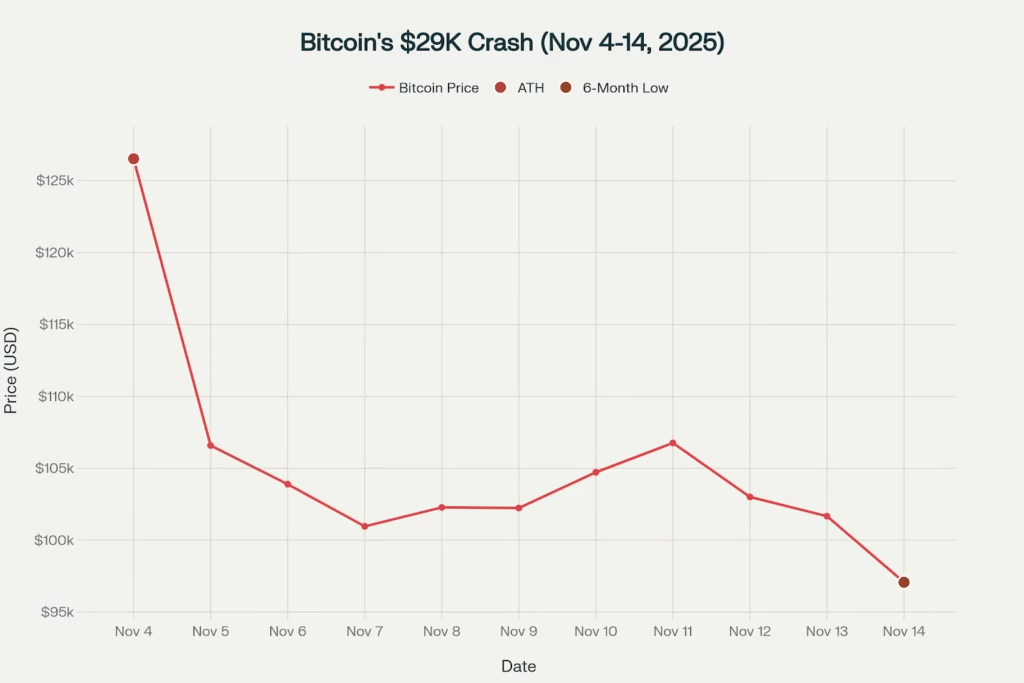

Bitcoin plunges 23% from ATH to $97K amid Fed hawkishness, $1.4B Ethereum ETF exodus, and collapsing liquidity; Citi maintains $181K forecast despite six-month lows

The cryptocurrency market suffered its worst day in months on Friday, November 14, 2025, with Bitcoin crashing to $97,078 a six-month low as $1.1 billion in leveraged positions were liquidated and institutional investors continued fleeing digital assets. The world’s largest cryptocurrency plunged 5.62% over 24 hours and now sits 23.3% below its November 4 all-time high of $126,521, entering bear market territory by traditional metrics.

Bitcoin crashes $29,443 (-23.3%) from $126.5K all-time high to six-month low of $97K in just 10 days amid Fed hawkishness and liquidity crisis

Ethereum suffered even steeper losses, tumbling 8.98% to $3,189 as spot ETFs hemorrhaged over $1.4 billion in outflows since late October. The broader cryptocurrency market capitalization collapsed 6.14% to $3.27 trillion, with nearly every major asset posting significant losses as panic selling accelerated into Friday’s close.

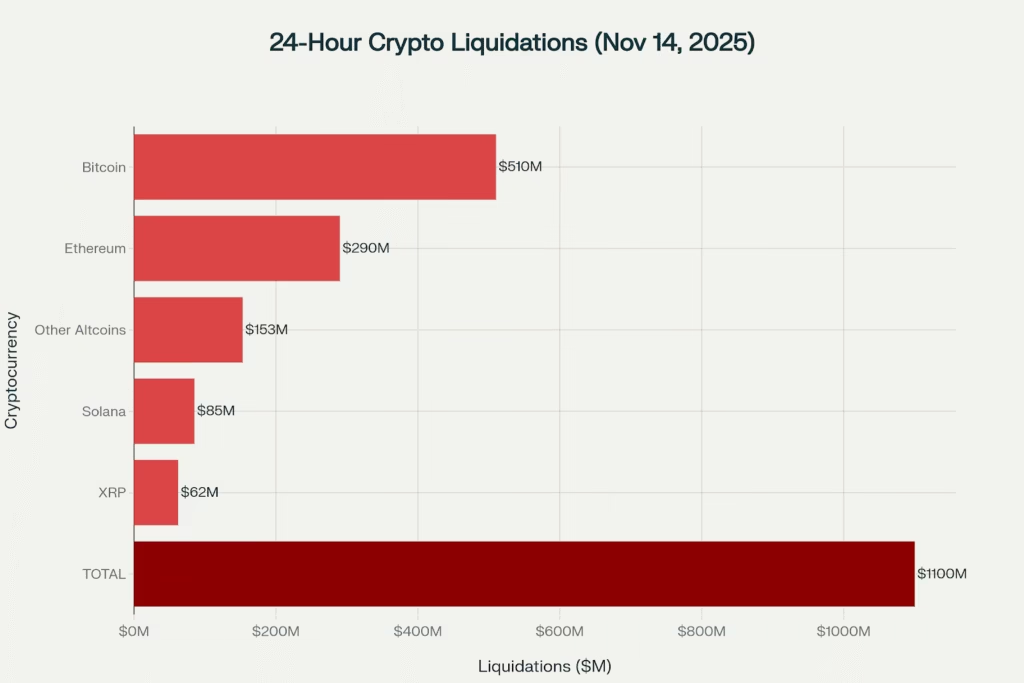

$1.1 Billion Liquidation Cascade

The selloff triggered $1.1 billion in forced liquidations across cryptocurrency derivatives markets, with approximately $510 million coming from Bitcoin positions alone. The liquidation cascade began during Asian trading hours and intensified as U.S. markets opened, overwhelming order books and forcing prices through key support levels.

Liquidation Breakdown (24 Hours):

- Total Liquidated: $1.1 billion

- Bitcoin Positions: $510 million (46% of total)

- Ethereum Positions: $290 million (26% of total)

- Altcoin Positions: $300 million combined (SOL, XRP, others)

- Long vs Short: Predominantly long liquidations as support levels faileds3.amazonaws

$1.1 billion in leveraged positions liquidated in 24 hours with Bitcoin accounting for $510M as crash accelerates

According to CoinGlass data, the liquidations represent one of the largest forced-selling events since October 10’s historic $19 billion wipeout that marked the beginning of crypto’s current bear phase. Friday’s cascade, while smaller in absolute terms, hit a market already weakened by sustained institutional outflows and deteriorating technical structure.

Altcoins suffered disproportionately, with Aave falling to its lowest level since May, while tokens including Jupiter (JUP) and Sui (SUI) posted double-digit percentage losses. Several altcoins have now erased 50-70% of their value from recent highs, prompting concerns about a broader altcoin capitulation event.

Ethereum ETFs Hemorrhage $1.4 Billion

Ethereum’s weakness accelerated as U.S. spot Ether ETFs recorded their worst outflow period since launch, shedding $1.4 billion in net redemptions since late October. Thursday’s $260 million single-day outflow represented the largest institutional exit in over a month, signaling deteriorating confidence in the second largest cryptocurrency.

Ethereum ETF Crisis:

- Total Outflows (Oct 29-Nov 14): $1.4 billion

- Thursday Single-Day: $260 million (month’s largest)

- Assets Under Management: Down significantly from October highs

- Long-Term Holder Selling: 45,000 ETH daily ($140M at current prices)

- Monthly Active Addresses: 8.2M (down from 9M in September)

- Transaction Fees: $27M monthly (down 42% month-over-month)

Glassnode’s blockchain data revealed that long-term Ethereum holders spanning 3-10 year cohorts are distributing at approximately 45,000 ETH daily on a 90-day moving average the fastest pace since February 2021’s bull market peak. This suggests even the most convicted HODLers are losing faith amid the sustained price weakness and lack of positive catalysts.

Token Terminal data shows Ethereum network fundamentals deteriorating across multiple metrics. Monthly active addresses dropped to 8.2 million from over 9 million in September, while transaction fees generated by network activity plunged 42% to just $27 million over the past month both indicating sharply reduced on-chain activity and demand for block space.

Federal Reserve Hawkishness Crushes Rate Cut Hopes

Bitcoin’s collapse accelerated following signals that the Federal Reserve remains committed to fighting inflation despite recent labor market weakness. Market-implied odds of a December rate cut collapsed to 52%—down from 98% just two weeks ago after Fed officials emphasized that “sticky” inflation remains above target and requires sustained tight monetary policy.

Macro Headwinds:

- December Rate Cut Odds: 52% (down from 98% on Nov 1)

- Fed Stance: Hawkish on inflation, cautious on easing

- U.S. Job Data: Largest decline since 2020

- Inflation: Sticky, above 2% target

- Treasury Yields: Rising sharply, strengthening USD

- Nasdaq Futures: -2.95% (24h), tech carnage

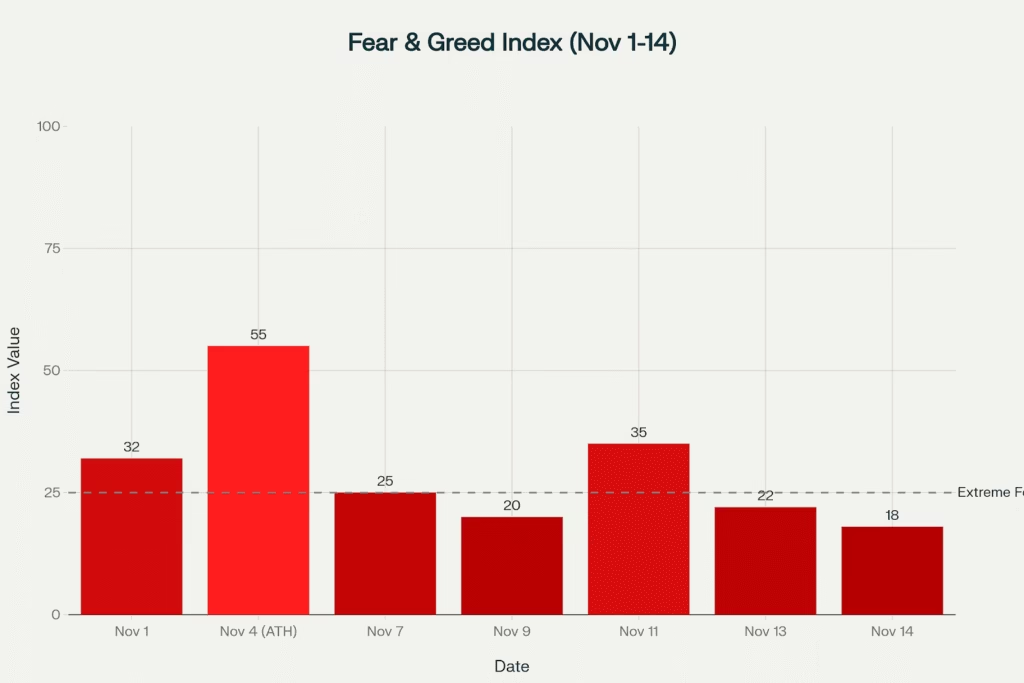

Fear & Greed Index crashes to 18 (2025 low) as Bitcoin selloff intensifies, down from 55 (Greed) at November 4 ATH

One Fed official stated publicly that “the dollar’s decline is not a concern, but inflation still requires tight policy,” effectively ruling out near-term accommodation that crypto bulls had been counting on. The hawkish pivot triggered broad risk-asset selling, with the Nasdaq losing nearly 3% as AI and technology stocks that had been highly correlated with Bitcoin suffered sharp declines.

Citigroup analysts argue the real culprit behind Bitcoin’s weakness isn’t interest rate expectations but rather collapsing liquidity in U.S. financial markets. According to Citi strategist Dirk Willer, “the recent decline appears linked to falling liquidity in the US financial system rather than interest rate expectations,” suggesting the Fed’s quantitative tightening program has drained too much cash from markets.

However, Willer noted that “liquidity conditions should improve going forward” as the Fed plans to end quantitative tightening on December 1, which “should support bitcoin, and could also get the Nasdaq Santa rally back on track”. Despite Bitcoin’s 23% plunge, Citi maintains its 12 month price target of $181,000, citing the cryptocurrency’s emerging status as digital gold.

Technical Breakdown: Critical Support Levels Shattered

Bitcoin’s price action shattered multiple critical support levels Friday, confirming a bearish trend with consecutive lower highs that began after the November 4 all time high. The cryptocurrency broke decisively below its 200 day exponential moving average near $110,000 last week and has now violated the psychologically crucial $100,000 level multiple times.

Key Technical Levels:

- Current Price: $97,078

- Primary Support: $95,000-$96,000 (being tested)

- Secondary Support: $92,000 (next major floor)

- Deep Support: $87,000-$88,000 (demand zone from May)

- Resistance: $98,000 (former support turned resistance)

- Major Resistance: $100,000-$101,000 (critical psychological level)

- 200-Day EMA: $110,000 (now overhead resistance)

CoinDesk Research’s technical analysis model identified $98,000 as a critical pivot level breaking and holding below this threshold would confirm a downtrend and potential bear market reversal from October’s high. Bitcoin briefly touched $95,934 during Friday’s session before recovering marginally to current levels.

Privacy Coins Defy Gravity

In a striking divergence from the broader market meltdown, privacy-focused cryptocurrencies Zcash and Monero posted gains Friday as investors rotated toward assets emphasizing financial anonymity. Zcash is now up more than 1,000% since August as the sector experiences a dramatic renaissance amid concerns about surveillance and government overreach.

“ZEC is now up by more than 1,000% since August as investors go full circle, back to a narrative that is centered on libertarian politics over speculative gains,” CoinDesk noted, highlighting how the privacy coin rally reflects ideological rather than purely profit-driven investment.

Strategy Rumor Denied; MSTR Stock Plunges

Amid Friday’s chaos, online rumors suggested MicroStrategy Bitcoin’s largest corporate holder with over 641,000 BTC was selling its position, sparking additional panic. Executive Chairman Michael Saylor quickly denied the speculation in a CNBC appearance, stating emphatically: “We are buying bitcoin. There is no truth to the rumor”.

Despite Saylor’s denial, MicroStrategy stock (MSTR) plunged an additional 4% Friday, trading below $200 and now down almost 35% year-to-date as its leveraged Bitcoin exposure weighs on the equity. The stock’s weakness reflects investor concerns about the company’s concentrated exposure to Bitcoin’s price movements and questions about its aggressive debt-funded accumulation strategy.

Binance-BlackRock Partnership Amid Turmoil

In positive news largely overshadowed by the selloff, Binance announced Friday it will accept BlackRock’s BUIDL token as collateral for institutional trading. BUIDL, which trades at $1 and is backed by Treasury bills and safe short-term assets, has grown to $2.5 billion in market capitalization and is now available to large institutional investors including hedge funds and private equity firms.

“Integrating BUIDL with our banking triparty partners and our crypto-native custody partner, Ceffu, meets their needs and enables our clients to confidently scale allocation while meeting compliance requirements,” stated Binance Head of VIP & Institutional Catherine Chen.

The partnership represents ongoing institutional infrastructure development even as prices collapse, suggesting long-term participants remain committed to building crypto capital markets despite near-term volatility.

Searching for a Bottom

As Bitcoin tests six-month lows, traders and analysts are divided on whether current levels represent capitulation or merely a waypoint in a deeper correction. Bulls point to oversold technical indicators, extreme fear sentiment (Fear & Greed Index at 18), and institutional holders like MicroStrategy and Tether maintaining positions despite volatility.

Bears counter that deteriorating on chain metrics, accelerating long-term holder selling, collapsed rate cut odds, and weakening liquidity conditions suggest further downside before any sustainable recovery. Historical volume analysis suggests the $92,000-$88,000 zone represents major support from prior cycles where significant accumulation occurred.

The immediate question is whether Bitcoin can stabilize above $95,000 or if continued weakness breaks this level and triggers capitulation selling toward $87,000 a decline that would erase virtually all 2025 gains and test the resolve of even the most convicted long-term holders.

Friday Summary (November 14, 2025):

- Bitcoin: $97,078 (-5.62% daily, -23.3% from ATH), six-month low

- Ethereum: $3,189 (-8.98% daily, -41.7% from ATH), severe weakness

- Market Cap: $3.27T (-6.14% daily), worst day since October crash

- Liquidations: $1.1B total ($510M Bitcoin alone)

- ETF Outflows: $1.4B from Ethereum ETFs since Oct 29

- Fear & Greed: 18 (Extreme Fear), lowest reading of 2025

- Fed Rate Cut Odds: 52% December (down from 98%)

- Privacy Coins: Zcash +1,000% since August, defying selloff

Risk Considerations: Cryptocurrency investments carry substantial risk including potential loss of principal. Current market conditions show extreme volatility with rapid price movements. Leveraged positions face liquidation risk. Market participants should conduct thorough due diligence, avoid excessive leverage, monitor Fed policy and liquidity conditions, understand technical support levels, and maintain strict risk management including stop-losses and position sizing appropriate to risk tolerance.

[…] See why Bitcoin plunged below $97K in a six-month low, $1.1B liquidations and Fed pressure triggered… […]