Bitcoin’s explosive surge launches the highly anticipated Uptober rally with strong upward momentum

Bitcoin’s Explosive Breakout

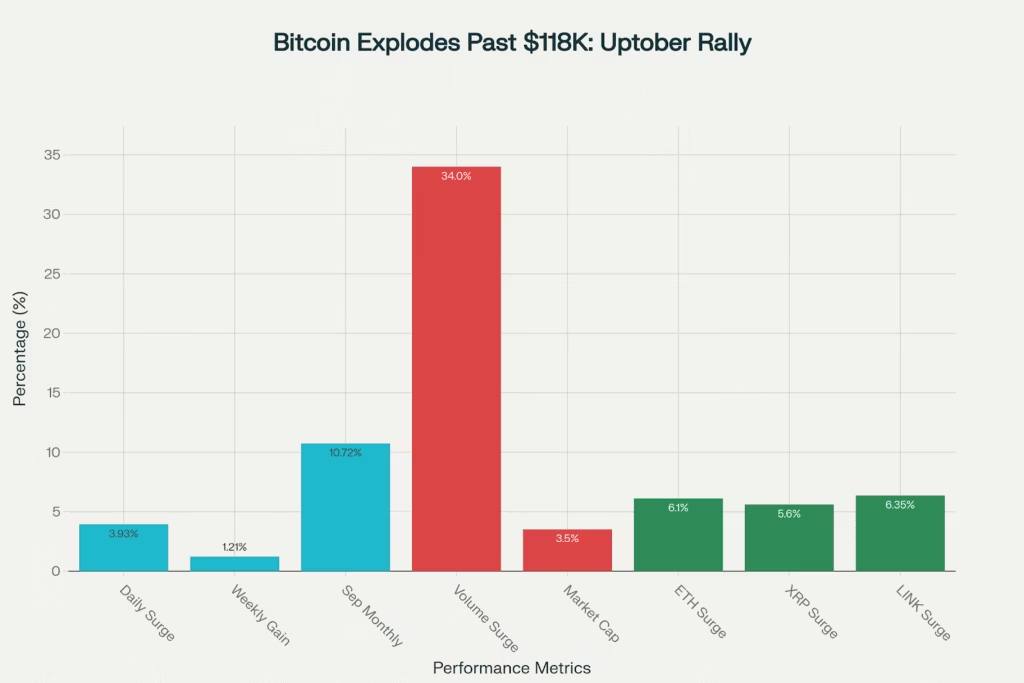

October 2nd, 2025 has delivered exactly what crypto enthusiasts have been anticipating the explosive launch of the legendary “Uptober” rally. Bitcoin rocketed past $118,500 in early Thursday trading, reaching a seven week high of $119,455 and pulling the entire cryptocurrency market along for a spectacular ride that has pushed total market capitalization to $4.17 trillion.

The world’s largest digital asset gained 3.93% in 24 hours, adding over $4,400 to its value as the convergence of seasonal patterns, government uncertainty, and Federal Reserve policy expectations created perfect storm conditions for cryptocurrency markets. This surge represents Bitcoin’s highest level since August 14th, when it began correcting from its previous peak.

Bitcoin’s explosive surge past $118K kicks off the legendary ‘Uptober’ rally as crypto market cap soars to $4.16 trillion amid government shutdown chaos

Golden Bitcoin coin with an overlaid upward trending price graph indicating a strong rally in its value indiatoday

Government Shutdown Creates Unexpected Bitcoin Catalyst

The October rally received an unexpected boost from the U.S. government shutdown that began at midnight Wednesday after Congress failed to reach a funding agreement. With over 800,000 federal employees furloughed and critical economic data releases potentially delayed, Bitcoin has emerged as a beneficiary of the resulting uncertainty and liquidity conditions.

According to Matt Mena, Crypto Research Strategist at 21Shares, the shutdown could delay Friday’s crucial nonfarm payrolls report, creating conditions for a “positive liquidity impulse” that historically supports Bitcoin. The delayed economic data gives the Federal Reserve more justification for continued rate cuts, with CME futures now showing a 99% probability of a 0.25% rate reduction at the October 29th meeting.

Government Shutdown Impact:

- Federal Workers: 800,000+ furloughed creating economic uncertainty

- Data Delays: Nonfarm payrolls and other critical reports potentially postponed

- Fed Policy: Rate cut probability jumps to 99% for October meeting

- Market Effect: Positive liquidity impulse favoring risk assets like Bitcoin

Political leader speaking at a government podium during a formal event fortune

“The message is clear: with traditional data releases in flux and macro uncertainty running high, Bitcoin remains one of the few assets that thrives when the old playbook breaks down,” Mena noted, suggesting this could mark “the next explosive leg higher in crypto markets.”

October’s Historical Magic: Why ‘Uptober’ Works

The timing of Bitcoin’s breakout aligns perfectly with historical seasonal patterns that have made October the cryptocurrency’s most bullish month. Data from CoinGlass shows Bitcoin has posted gains in 10 of the past 12 Octobers, creating the “Uptober” phenomenon that often becomes a self-fulfilling prophecy as traders position for seasonal strength.

This October launch comes after September’s remarkable +10.72% performance that broke the traditional “September curse,” suggesting that institutional ETF infrastructure may be fundamentally altering cryptocurrency’s seasonal dynamics. The combination of historical strength and improved market structure creates conditions where October could deliver even more explosive gains than usual.

Bitcoin and Ethereum prices show strong upward momentum in early October 2025 during the ‘Uptober’ rally pattern, with ETF flows increasing sharply tradesteady

Uptober Historical Performance:

- Success Rate: 83% (10 positive out of 12 recent Octobers)

- Seasonal Pattern: October historically Bitcoin’s strongest month

- Setup Conditions: Following September’s curse-breaking +10.72% gains

- Market Structure: ETF infrastructure potentially amplifying seasonal effects

Adding intrigue to the rally is the “4 year cycle” theory suggesting Bitcoin could reach its cycle peak around October 19th, 2025. According to analysis by Alphractal CEO João Wedson, previous cycles have shown consistent patterns, with the current cycle at day 528 since the April 2024 halving, approaching the theoretical 548-day peak.

Altcoin Army Joins the Party

Bitcoin’s surge has lifted the entire cryptocurrency ecosystem, with major altcoins posting even more impressive gains. Ethereum jumped 6.1% to $4,385, reaching its highest level since September 22nd and demonstrating the network’s strength ahead of its upcoming Fusaka upgrade scheduled for early December.

XRP gained 5.6% to $2.97, benefiting from expanding institutional adoption in cross border payments and favorable regulatory clarity following the conclusion of its SEC case. Other major altcoins including Solana, Chainlink, and Cardano all posted gains exceeding 6%, creating broad-based strength across the sector.

Altcoin Momentum:

- Ethereum: $4,385 (+6.1%, highest since September 22nd)

- XRP: $2.97 (+5.6%, institutional adoption expanding)

- Chainlink: +6.35% (infrastructure narrative strengthening)

- Market Breadth: Over 90% of top 100 cryptocurrencies positive

Man viewing cryptocurrency market performance with significant gains and candlestick chart on large screens bloomberg

The participation of altcoins in the rally suggests institutional capital is rotating broadly across the cryptocurrency ecosystem rather than concentrating solely in Bitcoin, indicating genuine risk-on sentiment rather than simple safe haven flows.

Technical Breakout Confirms Momentum Shift

From a technical perspective, Bitcoin’s surge past $117,500 resistance represents a decisive breakout from September’s consolidation pattern. The cryptocurrency now faces the psychologically crucial $120,000 level, where a clean break could open pathways to new all-time highs.

Volume patterns show heavy institutional participation in the breakout, with professional money appearing to drive the momentum rather than retail speculation. The establishment of support around $118,000-$118,500 creates a foundation for further advances, while the speed of the breakout suggests accumulated buying pressure finally found expression.

Technical Analysis:

- Resistance Cleared: $117,500 level broken decisively

- Next Target: $120,000 psychological barrier

- Support Base: $118,000-$118,500 established

- Volume Profile: Heavy institutional participation confirmed

- Pattern: Clean breakout from September consolidation

Physical Bitcoin coin with background charts and upward arrow representing a surge in Bitcoin price and market momentum economymiddleeast

Options market data suggests near-term BTC contracts are looking “cheap” according to Deribit analysts, potentially setting up conditions for additional volatility as institutional participants position for continued upside.

Federal Reserve Policy

The confluence of weak economic data and government shutdown chaos has strengthened expectations for continued Federal Reserve easing, creating increasingly supportive conditions for risk assets like cryptocurrencies. Wednesday’s ADP private payrolls report showed declining hiring despite marginal increases in job openings, reinforcing labor market concerns.

Analysts expect unemployment to rise from 4.3% to 4.4% in September data, “guaranteeing more Fed rate cuts” according to IG market analyst Tony Sycamore. This dovish trajectory provides structural support for Bitcoin’s growing role as both a monetary hedge and institutional portfolio diversifier.

Fed Policy Tailwinds:

- Rate Cut Probability: 99% chance of 0.25% reduction October 29th

- Labor Market: Continued deterioration supporting easing bias

- Policy Trajectory: Multiple cuts expected through year-end

- Bitcoin Sensitivity: Increasing correlation with monetary policy outlook

“As traditional economic indicators weaken, Bitcoin’s rally past $118,000 demonstrates its increasing sensitivity to monetary policy outlooks and its appeal as a hedge against economic uncertainty,” noted Nick Ruck, director at LVRG Research.

Institutional Adoption Accelerates

The Uptober rally coincides with accelerating institutional adoption across multiple fronts. Bitcoin’s market capitalization of $2.37 trillion now exceeds that of Amazon, while sustained ETF inflows continue demonstrating professional investors’ commitment to cryptocurrency allocation despite short-term volatility.

Recent developments including Swift’s blockchain infrastructure announcement and expanding corporate treasury adoption create fundamental support for higher valuations independent of seasonal patterns. This institutional foundation distinguishes the current rally from purely speculative cycles.

Risk Factors and Road Ahead

Despite the explosive start to October, several risk factors warrant monitoring. The duration and economic impact of the government shutdown remains uncertain, while traditional markets’ response to delayed economic data could create volatility spillovers into cryptocurrency markets.

Additionally, Bitcoin approaches the theoretical cycle peak timeframe suggested by 4 year cycle analysis, raising questions about whether current momentum can sustain through potential profit-taking pressures at higher levels.

Uptober’s Explosive Launch

October 2nd’s explosive Bitcoin rally past $118,500 has delivered the spectacular launch that “Uptober” enthusiasts have been anticipating. The convergence of historical seasonal strength, government shutdown uncertainty, dovish Federal Reserve policy, and strong technical breakouts has created conditions where cryptocurrency markets are thriving despite or perhaps because of traditional market disruption.

With Bitcoin reaching seven-week highs and the crypto market capitalization surging to $4.17 trillion, the legendary Uptober rally appears to be delivering on its reputation. Whether this momentum can sustain toward the theoretical cycle peaks predicted for mid-to-late October remains the critical question for the remainder of 2025.

The combination of institutional adoption, seasonal patterns, and macroeconomic support suggests that October 2025 could indeed become a historic month for cryptocurrency markets. As traditional economic indicators fail and government dysfunction creates uncertainty, Bitcoin continues demonstrating its unique ability to thrive when conventional systems break down.

The Uptober rally has begun with explosive force now the question becomes whether it can maintain this momentum through what cycle theorists suggest could be the climactic final weeks of the current market cycle.

Uptober Rally Summary:

- Bitcoin Breakout: $118,838 (+3.93% daily) reaching 7-week high of $119,455

- Market Explosion: Total crypto market cap surges to $4.17T (+3.5%)

- Government Catalyst: US shutdown creating uncertainty favoring Bitcoin

- Fed Support: 99% probability of October rate cut boosting risk assets

- Historical Pattern: October delivering on reputation as Bitcoin’s strongest month

Related Coverage: