Bitcoin retreated to $89,619 during Saturday trading after experiencing a volatile first week in December that oscillated between desperate capitulation at $84,000 and institutional relief bounces toward $93,416. The swings reveal the friction between short term liquidation cascades and longer-term positioning strategies that characterize market transitions. While price action remains turbulent, the week’s most significant developments occurred not in spot markets but in regulatory corridors where unprecedented cryptocurrency integration within mainstream finance gained momentum.

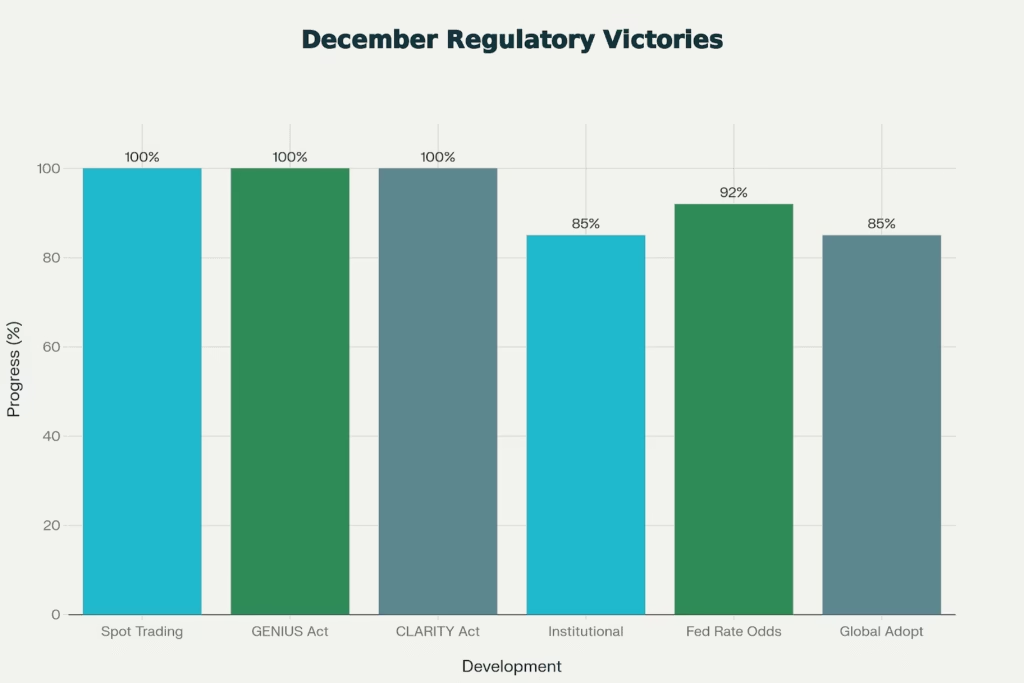

The CFTC announced Thursday that federally-regulated exchanges would commence offering listed spot cryptocurrency trading products, the first legal framework for such activity in U.S. regulated markets. This announcement, combined with passage of comprehensive stablecoin and market structure legislation, transformed December into a regulatory inflection point that overshadows current price volatility. Understanding this disconnect, where prices decline amid regulatory progress separates those who recognize inflection points from those fixating on daily noise.

Governance, Risk and Compliance (GRC) Frameworks – Consultia

The Weekend Pullback Obscures Institutional Accumulation Patterns

Coinbase published detailed analysis suggesting that December typically delivers cryptocurrency recovery despite volatile early-week positioning. The exchange’s proprietary global liquidity index detected meaningful increases as December commenced, data suggesting that funding conditions have improved from November’s constrained environment. Their analysis emphasized that Fed policy expectations have shifted decisively toward December rate cuts, with probability readings surging to 92% as of Thursday.

This creates a peculiar market dynamic where Bitcoin falls despite improving macro conditions. Current weakness stems from year end book squaring where funds lock in annual gains and liquidate overleveraged positions heading into final reporting deadlines. This forced selling overwhelms natural demand temporarily, creating what market professionals view as capitulation-driven dislocations. Historical patterns show that such forced selling events often precede sustained recoveries once position-liquidating traders complete their activity.

Approximately $414 million in long positions were liquidated during Friday’s session alone as prices gyrated around $89,000. This persistent liquidation volume suggests that leveraged traders still hold oversized positions vulnerable to unexpected price moves. Once this overleveraged positioning exhausts, the forced-selling pressure that has characterized early December should substantially diminish.

Regulatory Clarity Accelerates Institutional Migration

December’s regulatory breakthroughs including first-ever spot crypto exchange trading and comprehensive stablecoin legislation transform market access

The CFTC’s announcement that spot cryptocurrency trading will commence on federally regulated futures exchanges eliminates a structural gap that has frustrated institutional participants for years. Previously, Bitcoin and Ethereum spot trading occurred exclusively on unregulated cryptocurrency exchanges, creating operational and compliance friction for large financial institutions. With the CFTC framework establishing regulated pathways, major fund managers can now access crypto markets through familiar institutional infrastructure.

The GENIUS Act’s passage established comprehensive federal stablecoin regulations establishing reserve requirements, audit standards, and issuer oversight frameworks. This legislation transforms stablecoins from regulatory gray areas into clearly compliant money market instruments. Similarly, the House passage of the CLARITY Act, which divides SEC and CFTC jurisdiction while establishing security to commodity transition pathways, provides the regulatory certainty that institutional participants require before substantial capital deployment.

These regulatory victories compound dramatically. When analyzed collectively, they establish the most comprehensive cryptocurrency regulatory framework in U.S. history. Financial institutions no longer face the “regulate by enforcement” environment that characterized 2023-2024. Instead, they operate within clearly defined compliance pathways that reduce legal and operational risk substantially.

Treasury Department officials announced active work on GENIUS Act implementing regulations, targeting January 2027 full effectiveness. This timeline creates urgency for financial institutions to develop cryptocurrency infrastructure during 2026, precisely when Bitcoin historically experiences strong performance in post correction cycles. The regulatory tailwind will likely provide sustained support for asset prices once year end liquidations exhaust.

Why December Weakness Coexists With Structural Strength

The apparent paradox, declining Bitcoin prices amid regulatory progress—resolves when examining market mechanics. Year-end positioning creates temporary supply-demand imbalances where forced selling overwhelms fundamental buying interest. Hedge funds close positions to lock annual results and simplify balance sheet complexity for new investors entering January. This forced selling creates technical dislocations divorced from fundamental conditions.

Current conditions differ materially from November’s panic selling. Bitcoin’s three-standard deviation underperformance relative to its 90-day trend suggests extreme technical oversold conditions likely to revert toward longer-term trends. Coinbase analysis indicates that digital asset products traded below their net asset value for the first time during 2025 this week, another capitulation indicator historically associated with market bottoms.

Long-term Bitcoin holders exhibited unusual distribution behavior this week, selling accumulated positions despite year-to-date profitability. This coin distribution from experienced holders typically coincides with resignation rather than rational pricing. When long-term holders capitulate to selling pressure rather than maintaining accumulation, it signals that psychological exhaustion has reached levels that support eventual reversals.

The Santa Rally Setup: Historical Context

December historically delivers strong returns for risk assets as year-end flows, tax-motivated positioning, and New Year optimism create tailwinds for equities and cryptocurrencies. Bitcoin’s December average returns exceed 15% over 20 year lookbacks, though 2025’s early weakness makes that target challenging. The critical observation is that nearly every December that begins with weakness has recovered to post positive monthly returns, a pattern suggesting that early-month selling creates attractive valuations that attract holiday-period capital.

Institutional allocators planning 2026 capital deployment often finalize positioning during December’s final weeks. With regulatory clarity improving and liquidity conditions stabilizing post-year-end, the next 3-4 weeks likely determine whether Bitcoin recovers toward $95,000-$100,000 or continues declining toward $85,000.

What Saturday’s Pullback Actually Signals

Bitcoin trading at $89,619 on Saturday represents profit-taking from Thursday’s $93,416 high rather than reversal of the recovery thesis. The $3,797 pullback across 48 hours falls well within normal consolidation ranges following volatile up moves. Support levels at $87,000-$88,000 remain intact, suggesting that institutional buyers have successfully established accumulation zones.

For positioning purposes, current weakness creates defined scenarios. Those maintaining conviction can view $88,000-$87,000 as strategic entry zones with defined stops below $85,000. Those preferring confirmation can await decisive breaks above $92,000 on sustained volume. The binary nature of current structure enables disciplined positioning rather than ambiguous market conditions.

The next two weeks will clarify whether December delivers sustained recovery or extended weakness. But regardless of near-term direction, the regulatory environment has transformed decisively in favor of institutional adoption, something that creates durable structural tailwinds independent of daily price noise.

Saturday Update (December 6, 2025):

- Bitcoin: $89,619 (-1.85% daily, -3.8% weekly from $93K)

- Ethereum: $3,022 (-4.26% daily), underperforming in pullback

- Market Cap: $3.04T (-2.08% daily), consolidating after volatility

- Liquidations: $414M Friday session, $637M+ total December

- CFTC Approval: Listed spot crypto trading authorized (historic)

- GENIUS Act: Federal stablecoin regulations passed

- Fed Rate Cut Odds: 92% for December (per Coinbase analysis)

- Support Zone: $87K-$88K, critical for recovery thesis

Related Articles

- Inside Bitcoin’s flash crash paradox: how historic regulatory wins collided with a brutal $2.2B liquidation-driven plunge

- Bitcoin roars past $91.5K on Thanksgiving as Fed rate-cut fever ignites a sharp reversal from weeks of losses

- Bitcoin’s rebound to $93K: December volatility is hiding a much bigger shift toward deep institutional adoption