Bitcoin consolidates at $102,240 after 19% crash from ATH; $1.3B institutional ETF outflows and extreme fear grip markets as technical patterns signal deeper correction risks

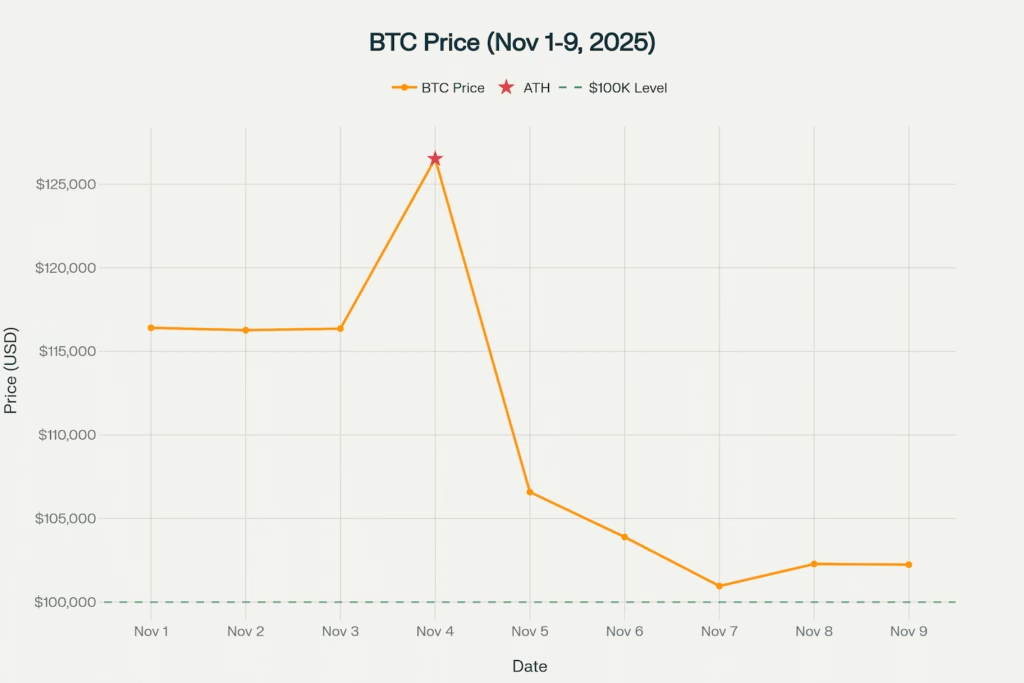

Bitcoin clings to $102,240 on Sunday, November 9, 2025, after a tumultuous week that saw the cryptocurrency plunge 19.2% from its all time high of $126,521 reached just five days earlier on November 4. The world’s largest digital asset is now locked in a critical battle to defend the psychologically crucial $100,000 support level, with bulls and bears fiercely contesting this threshold as billions in value evaporate from cryptocurrency markets.

Bitcoin plunges 19.2% from November 4 ATH of $126,521 to test $100K support amid institutional outflows and bearish technicals

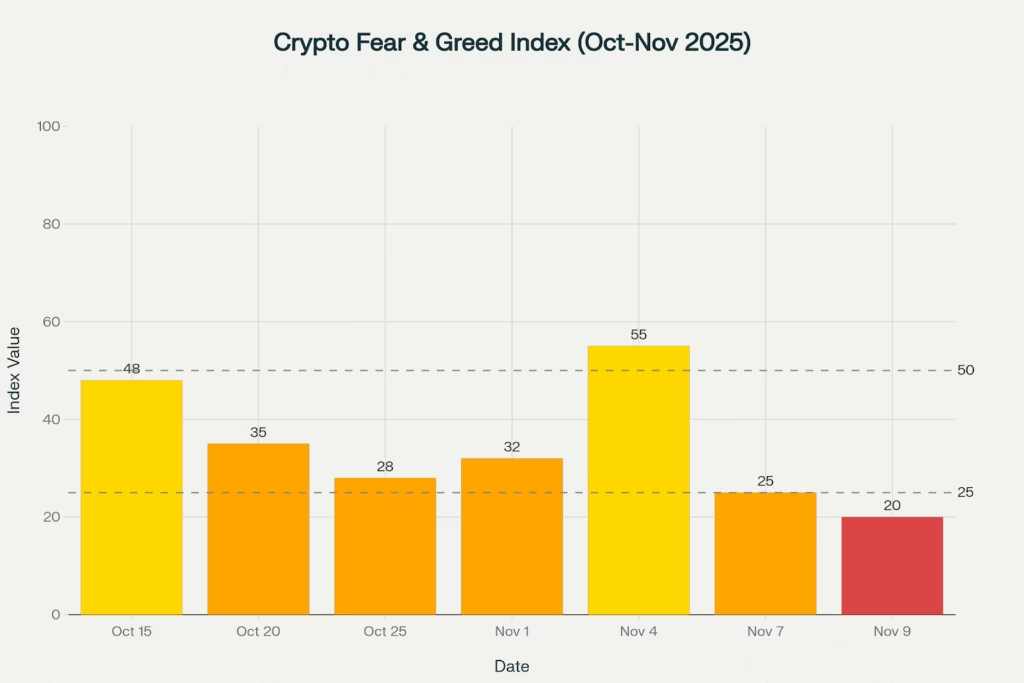

The dramatic reversal has pushed the Fear & Greed Index to 20 deep in “extreme fear” territory as traders grapple with deteriorating technical indicators, massive institutional outflows, and persistent macro headwinds. The global cryptocurrency market capitalization stands at $3.46 trillion, showing a modest 2.42% recovery over the past 24 hours after days of relentless selling.

Market Snapshot

Current Market Status (November 9, 2025, 4:30 PM IST):

- Bitcoin (BTC): $102,240 (-0.33% daily, -7.4% weekly), defending $100K

- Ethereum (ETH): $3,013 (-1.34% daily, -8.1% weekly), under pressure

- XRP: $2.01 (-2.15% daily, -9.2% weekly), weak momentum

- Solana (SOL): $154.92 (-0.12% daily, -10.5% weekly), declining

- BNB: $874.81 (-0.85% daily, -6.8% weekly), consolidating

- Market Cap: $3.46T (+2.42% daily), recovering from deeper lows

- Fear & Greed: 20 (Extreme Fear), lowest since March 2024

Fear & Greed Index plunges to 20 (Extreme Fear) as Bitcoin tests $100K, down from 55 (Greed) at November 4 ATH

Bitcoin briefly touched $103,000 on Saturday but failed to sustain momentum, sliding back below $102,500 as sell-side pressure resurfaces. The cryptocurrency has now tested the $100,000 level multiple times over the past 48 hours without breaking decisively lower ,suggesting this psychological barrier is attracting significant buyer interest despite overwhelming bearish sentiment.

Head and Shoulders Pattern Signals Risk

Bitcoin’s chart structure has deteriorated significantly, with a clear head-and-shoulders pattern forming that technical analysts view as a precursor to further declines. The pattern’s completion marked by BTC breaking below its 200-day exponential moving average near $110,000 on November 5 triggered additional selling and confirmed the bearish reversal.

Critical Technical Levels:

- Current Price: $102,240

- Immediate Support: $100,000 (psychological, being tested)

- Secondary Support: $94,000 (proportional correction target)

- Deep Support: $87,000 (major accumulation zone from prior cycles)

- Resistance: $103,000-$105,000 (near-term recovery ceiling)

- 200-Day EMA: $110,000 (now overhead resistance, previously support)

- Pattern: Head-and-shoulders bearish formation confirmed

“Each pullback has been very similar in scale, almost 1:1 corrective moves within the ongoing uptrend,” noted analyst Dark Whale. “However, if this proportional range repeats, the current correction could bottom around $94,000, essentially erasing nearly all of this year’s gains”.

On-chain data from Glassnode offers a more nuanced perspective. The analytics firm noted that Bitcoin’s network stress indicator registered just 3.1% during the recent dip below $100,000, significantly lower than the 5% threshold typical of major bear market drawdowns. This suggests the current selloff may represent a mid-cycle correction rather than the onset of a prolonged bear market.

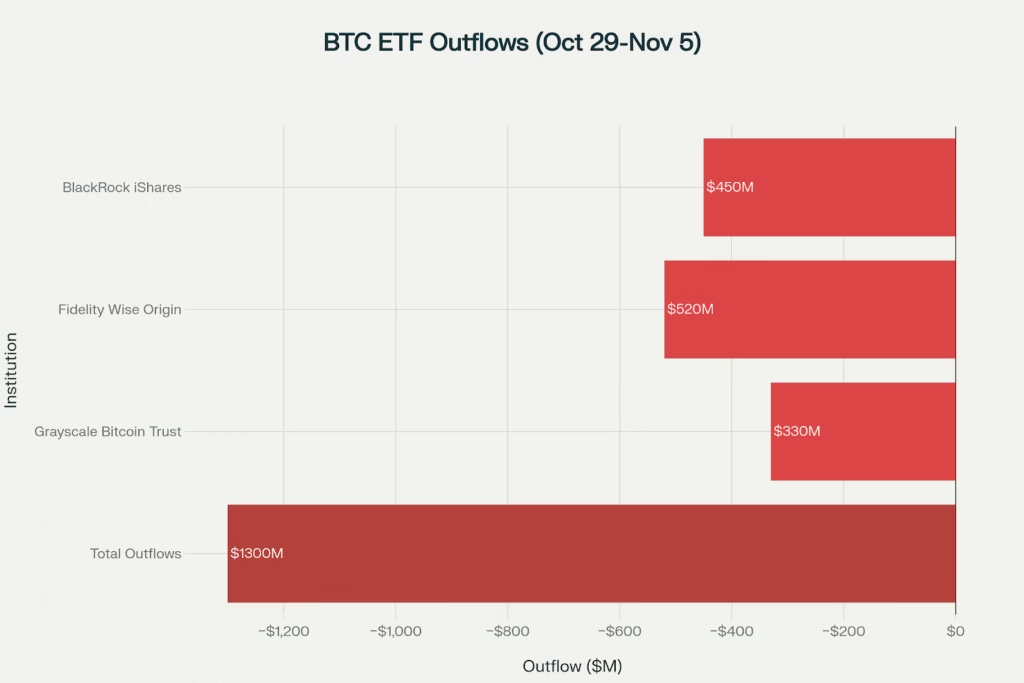

Institutional Outflows: $1.3 Billion Exit Weighs on Sentiment

The most concerning development for Bitcoin bulls has been the sustained exodus from U.S. spot Bitcoin ETFs. Since October 29, major institutional products have hemorrhaged approximately $1.3 billion in combined outflows, signaling waning institutional appetite during the correction.

$1.3 billion in Bitcoin ETF outflows from major institutions since October 29 weighs on market sentiment and price action

ETF Outflow Breakdown (Oct 29 – Nov 5):

- BlackRock iShares Bitcoin Trust: ~$450M in outflows

- Fidelity Wise Origin Bitcoin Fund: ~$520M in redemptions

- Grayscale Bitcoin Trust: ~$330M in exits

- Total Outflows: $1.3 billion

- Impact: Reduced institutional buying pressure, increased selling

The sustained institutional selling contrasts sharply with the aggressive accumulation seen during Bitcoin’s October rally to $126,000. ETF inflows had reached record levels in early November before reversing dramatically once BTC broke above $120,000 suggesting many institutions were profit-taking rather than establishing long-term positions.

However, not all institutional players are retreating. Tether continues its Bitcoin reserve accumulation strategy, maintaining approximately 87,300 BTC worth $8.7 billion despite the volatility. MicroStrategy, the largest corporate Bitcoin holder with over 641,000 BTC, has shown no signs of wavering from its Bitcoin-first treasury strategy.

Macro Headwinds and Government Shutdown

Bitcoin’s correction coincides with mounting macroeconomic pressures. The ongoing U.S. government shutdown now entering its sixth week has delayed critical economic data releases and created uncertainty about Federal Reserve policy direction. Recent hawkish commentary from Fed officials suggesting a potential slowdown in rate cuts has strengthened the U.S. dollar and pressured risk assets including cryptocurrencies.

“The markets were expecting the end of the government shutdown this weekend, but it didn’t happen,” Dark Whale tweeted. “I still think Bitcoin could go a bit lower, given that institutional demand has gone and OG whales are selling”.

Adding to the bearish narrative, concerns about AI and technology stock valuations have triggered broader risk off sentiment across financial markets. Bitcoin’s correlation with tech stocks particularly the Nasdaq 100 remains elevated, meaning weakness in traditional risk assets tends to spill over into crypto markets.

Altcoin Weakness Confirms Market Stress

The broader cryptocurrency market is experiencing even more pronounced weakness than Bitcoin, with major altcoins posting double digit weekly losses. Ethereum fell 1.34% to $3,013 (down 8.1% weekly), Solana declined 0.12% to $154.92 (down 10.5% weekly), and meme coins like Dogecoin plummeted 3.69% to $0.154 (down 12.3% weekly).

The altcoin season index has collapsed below 25/100, indicating that virtually no altcoins are outperforming Bitcoin a classic sign of risk-off sentiment where traders flee to the relative safety of BTC or exit crypto markets entirely.

Competing Price Forecasts: Bulls vs Bears

Despite the bearish technical setup, some algorithmic models and analysts maintain optimistic near-term price targets. Changelly’s Bitcoin price forecast suggests BTC could surge 18.2% to $120,438 by November 11, with potential to reach $128,689 by November 12 implying a rapid V-shaped recovery if bulls can reclaim momentum.

Price Forecast Range (November 2025):

- Bullish Case: $120,438 by Nov 11 (+18.2% from current)

- Base Case: $102,729-$115,784 average (consolidation continues)

- Bearish Case: $94,000 (if $100K breaks decisively)

- Extreme Bearish: $87,000 (major support from prior cycles)

However, more bearish analysts point to the confirmed head and shoulders pattern and weakening on-chain metrics as evidence that further downside is likely before any sustainable recovery can begin. The key determinant will be Bitcoin’s ability to hold above $100,000 on high volume; a decisive break below could trigger cascading liquidations and forced selling.

Critical Week for Bitcoin

The coming week represents a pivotal moment for Bitcoin’s 2025 trajectory. Bulls must reclaim $105,000-$110,000 to invalidate the bearish head-and-shoulders pattern and restore upward momentum. Failure to do so particularly if BTC closes multiple daily candles below $100,000 would likely accelerate selling toward the $94,000 target zone.

Key catalysts to monitor include:

- Government Shutdown Resolution: Could remove uncertainty and restore risk appetite

- Federal Reserve Clarity: December rate cut odds currently at ~35% vs 65% previously

- Institutional Flows: Any reversal of ETF outflows would signal renewed demand

- Technical Confirmation: Daily close above $105K needed to shift momentum

For traders and investors, the current environment demands extreme caution. The combination of extreme fear, negative institutional flows, bearish technical patterns, and macro uncertainty creates a challenging backdrop. However, historical precedent suggests Bitcoin corrections of 20-30% during bull markets often represent accumulation opportunities for patient long-term holders.

Weekend Summary (November 9, 2025):

- Bitcoin: $102,240 (-19.2% from ATH), defending critical $100K support

- Fear & Greed: 20 (Extreme Fear), lowest since March 2024 correction

- ETF Flows: -$1.3B institutional outflows since Oct 29

- Technical: Bearish head-and-shoulders confirmed; $94K downside target

- Forecast Range: $94K (bear) to $120K (bull) within next 1-2 weeks

Risk Considerations: Cryptocurrency investments carry substantial risk including potential loss of principal. Recent volatility demonstrates rapid price movements. Leveraged positions face liquidation risk. Market participants should conduct thorough due diligence, understand technical support levels, monitor institutional flows and macro developments, and maintain appropriate risk management including stoplosses.

[…] Bitcoin fights for $100K support […]