Bitcoin’s remarkable recovery caps September’s successful performance amid institutional confidence and blockchain infrastructure developments

September’s Stunning Reversal

As the final trading hours of September 2025 tick away, Bitcoin’s remarkable surge to $114,421 has officially shattered one of cryptocurrency’s most persistent patterns. The world’s largest digital asset has delivered a stunning +10.72% monthly performance, making this the second best September in Bitcoin’s 13-year history and definitively breaking the “September curse” that has plagued crypto markets for over a decade.

The dramatic turnaround from September 26th’s low of $108,611 to today’s peak of $114,800 represents more than just price recovery it signals a fundamental shift in institutional sentiment backed by over $1 billion in single day ETF inflows and groundbreaking blockchain infrastructure news from Swift. This convergence of factors has created conditions where professional adoption narratives are overtaking seasonal trading patterns.

Bitcoin’s stunning recovery to $114K completes September’s remarkable turnaround as $1B ETF inflows and Swift blockchain news signal institutional confidence

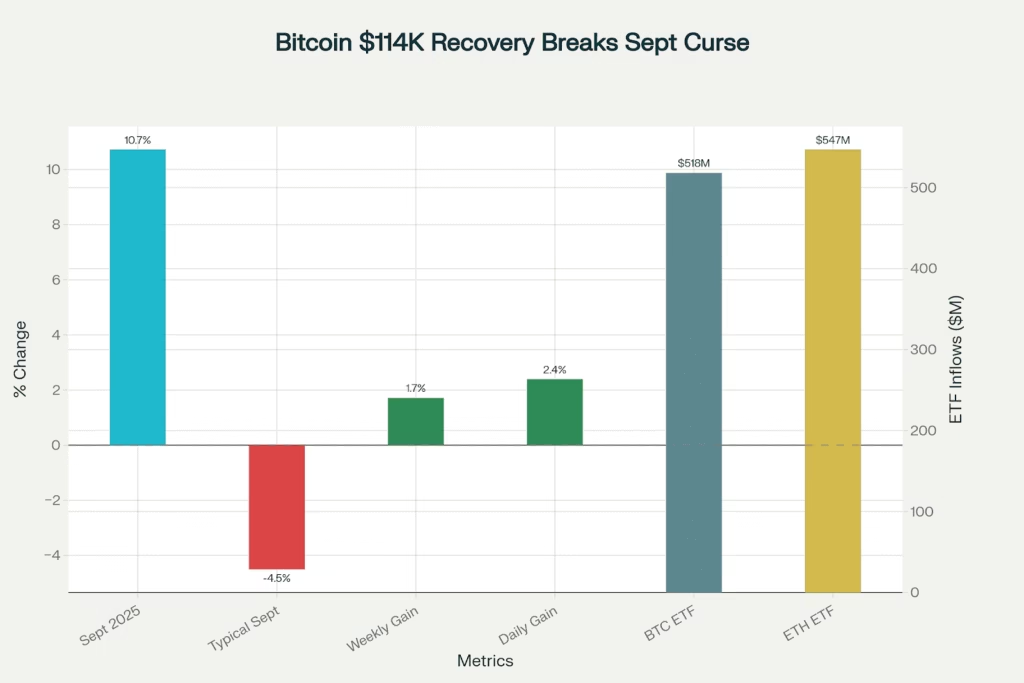

September Success Metrics:

- Bitcoin Recovery: $114,421 (+2.39% daily, +10.72% monthly)

- Historical Achievement: Second-best September in 13 years

- ETF Tsunami: $1.06B combined single-day inflows (Monday)

- Market Cap: $3.96T approaching record highs again

- Swift Catalyst: Blockchain ledger announcement with 30+ banks

economymiddleeast

$1 Billion ETF Explosion

Monday’s explosive $1.06 billion combined ETF inflows represent the most dramatic reversal in institutional sentiment since these products launched. Bitcoin ETFs absorbed $518 million led by BlackRock’s IBIT with $298.7 million, while Ethereum ETFs captured an even more impressive $546.9 million with ETHA leading at $154.2 million.

This institutional tsunami occurred precisely as Bitcoin defended crucial $113,000 support, demonstrating sophisticated money’s ability to identify strategic entry points during technical consolidation. The magnitude of these flows suggests institutional portfolio managers view current levels as attractive accumulation zones rather than temporary bounces.

ETF Inflow Breakdown:

- Bitcoin ETFs: $518M led by BlackRock IBIT ($298.7M)

- Ethereum ETFs: $546.9M with ETHA ($154.2M) leading

- Combined Impact: $1.06B single-day professional allocation

- Trend Signal: Institutional confidence restoration after September selloff

Bitcoin ETF inflows visualized coingape

The reversal from massive outflows during September’s middle weeks to record inflows demonstrates how quickly institutional sentiment can shift when technical levels hold and macro conditions improve. Gold’s continued record highs above $2,670 have also supported the alternative asset thesis driving both precious metals and cryptocurrency demand.

Swift’s Blockchain Revolution

The financial world received seismic news as Swift announced plans to integrate a blockchain-based shared ledger into its infrastructure, enabling real-time 24/7 cross-border payments for its network of over 11,000 financial institutions across more than 200 countries. This development represents the largest traditional finance validation of blockchain technology in history.

Working with Consensys and over 30 major banks including JPMorgan Chase, Bank of America, HSBC, and Deutsche Bank, Swift will create secure, real time transaction logs using smart contracts for validation. The initiative builds on two years of digital asset trials and positions Swift as neutral infrastructure for the emerging tokenized economy.

Integration of SWIFT, traditional banks, and blockchain technology for instant cross-border payments cryptonomist

Swift Blockchain Impact:

- Network Scale: 11,000+ financial institutions globally

- Bank Partners: 30+ including JPMorgan, HSBC, Deutsche Bank

- Technology: Consensys prototype for 24/7 settlement

- Timeline: Rapid Phase 1 completion with subsequent phases

- Validation: Largest TradFi endorsement of blockchain infrastructure

“We provide powerful and effective rails today and are moving at a rapid pace with our community to create the infrastructure stack of the future,” said Swift CEO Javier Pérez-Tasso at the Sibos conference in Frankfurt. This institutional embrace of blockchain technology provides fundamental validation for cryptocurrency’s underlying infrastructure beyond speculative trading.

Technical Recovery Validates Double Bottom Pattern

From a technical perspective, Bitcoin’s recovery above $114,000 has confirmed a double bottom pattern formation that began with the September 6th low around $108,000. The subsequent test and successful defense of similar levels on September 26th, followed by this week’s explosive recovery, validates the pattern and suggests higher targets ahead.

The cryptocurrency now trades within a well established $108,000-$118,000 range with strong support building around $113,000-$114,000. Volume confirmation exceeding $60 billion daily demonstrates institutional participation rather than just retail speculation driving the recovery.

Technical Framework:

- Support Cluster: $113K-$114K now established foundation

- Resistance Targets: $117K-$118K next major test zone

- Pattern Confirmed: Double bottom from September lows validated

- Volume Evidence: $60B+ daily showing institutional engagement

- Range Trading: $108K-$118K established parameters

Close-up image of a physical Bitcoin coin representing the cryptocurrency economictimes

The successful test of support during high volume trading suggests that institutional algorithms and professional money identified these levels as strategic accumulation zones, providing confidence for continued upward momentum toward year-end.

Ethereum’s Institutional Validation

Ethereum’s performance alongside Bitcoin tells an equally compelling institutional adoption story. The second-largest cryptocurrency gained 1.96% to $4,203, holding firmly above the crucial $4,100 level while building toward $4,250 resistance that could confirm further upside momentum.

More significantly, Ethereum ETFs recorded $546.9 million in inflows actually exceeding Bitcoin’s $518 million suggesting institutional recognition of Ethereum’s blockchain infrastructure value extends beyond simple digital gold narratives. This professional validation of the Ethereum ecosystem supports broader altcoin strength.

Ethereum Institutional Metrics:

- Current Price: $4,203 (+1.96% daily, holding above $4,100)

- ETF Success: $546.9M inflows exceeding Bitcoin’s $518M

- Support Validation: $4,050 level holding firmly

- Next Targets: $4,250 resistance, then $4,400-$4,500 zone

Market Psychology, From Fear to Optimism

The transformation in market psychology over September’s final week represents one of cryptocurrency’s most dramatic sentiment reversals. The Fear & Greed Index has recovered from extreme fear readings of 28 to approaching neutral territory, while social media sentiment shows “buy the dip” mentions returning and whale accumulation accelerating.

Notably, over 3,900 BTC was transferred in a single day by large holders, suggesting institutional and whale-level accumulation during the recent consolidation phase. This type of professional positioning often precedes sustained upward momentum as smart money positions ahead of broader market recognition.

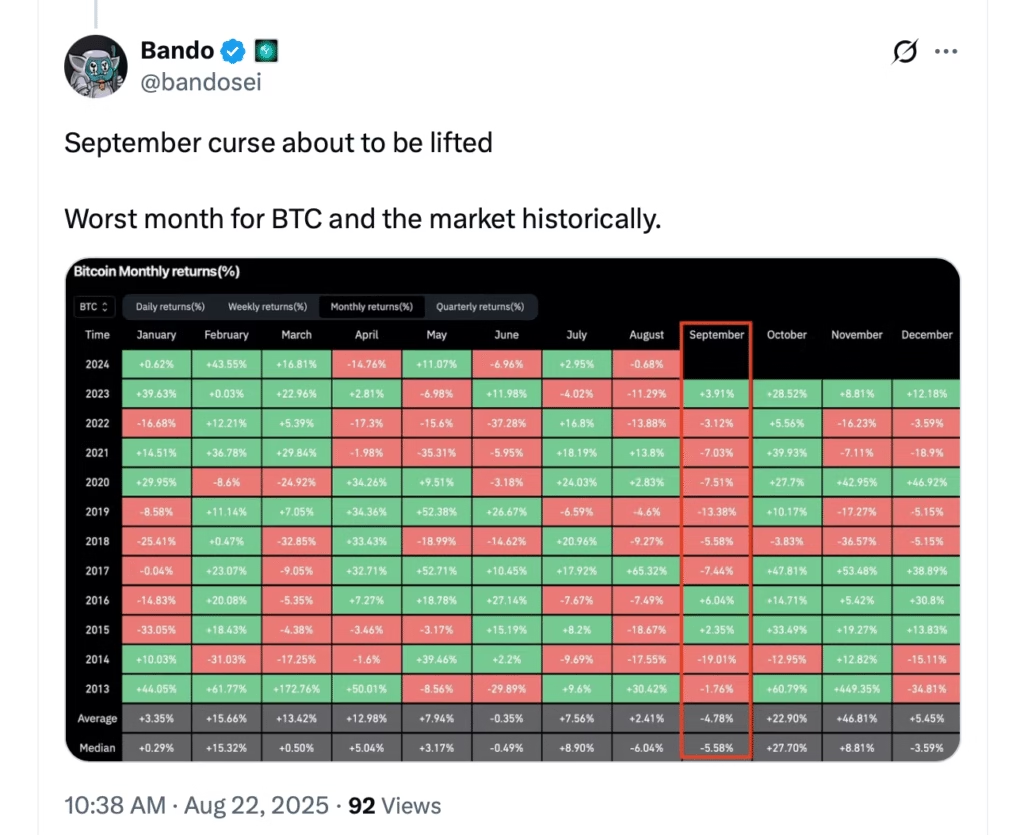

Bitcoin monthly returns from 2013 to 2024 highlighting historically poor performance in September mexc

Sentiment Recovery Indicators:

- Fear & Greed: Recovering from 28 extreme fear toward neutral

- Social Metrics: “Buy the dip” sentiment returning strongly

- Whale Activity: 3,900+ BTC single-day accumulation

- Professional Flows: ETF inflows demonstrating confidence

Breaking Historical Patterns: September Success

Bitcoin’s +10.72% September performance represents a decisive break from historical seasonal patterns that typically see the month average -4.5% returns. This makes 2025 the second-best September in Bitcoin’s history, suggesting that institutional ETF infrastructure has fundamentally altered seasonal dynamics.

The success occurs despite traditional September headwinds including quarter-end rebalancing, tax loss harvesting preparation, and general risk off sentiment that historically pressures cryptocurrency markets. The ability to not just survive but thrive during this period validates the maturation thesis surrounding crypto market structure.

Historical Context:

- Typical September: -4.5% average returns over past decade

- 2025 Performance: +10.72% (second-best September ever)

- Pattern Break: ETF infrastructure dampening seasonal volatility

- Institutional Effect: Professional flows overcoming retail patterns

Q4 Outlook: Catalysts Align for Continued Strength

Looking ahead to October and Q4, multiple catalysts appear aligned for continued cryptocurrency strength. Historical data shows October as typically the strongest month for Bitcoin, while 16 pending crypto ETF applications with the SEC could provide additional institutional access throughout the quarter.

The Federal Reserve’s continued dovish stance supports risk asset valuations, while Swift’s blockchain integration provides fundamental infrastructure validation that extends beyond speculative trading. Even potential government shutdown risks (86% probability according to prediction markets) are viewed as temporary headwinds rather than structural threats.

Q4 Catalysts:

- October Seasonality: Historically strongest month for Bitcoin

- Fed Policy: Additional rate cuts expected supporting risk assets

- ETF Pipeline: 16 pending applications could expand institutional access

- Swift Integration: Blockchain legitimacy boost from traditional finance

- Infrastructure: Continued professional adoption acceleration

Altcoin Sector Strength

The broader cryptocurrency ecosystem has participated in September’s recovery, with KAITO leading gains at +12.80% driven by staking rewards and airdrop programs. Layer 1 protocols including Mantle and Aster have shown weekly strength, while Solana maintains its critical $200-$210 range that could lead to $250 targets if momentum continues.

XRP’s consolidation around $2.87 below the $3 psychological level is viewed by many analysts as accumulation before potential moves toward $4, though conviction remains measured pending regulatory clarity and broader market confirmation.

Altcoin Performance:

- KAITO: +12.80% (staking rewards driving interest)

- Solana: $208.86 holding critical $200-$210 range

- XRP: $2.87 consolidating, viewed as potential accumulation

- Sector Strength: CeFi, Layer 1, Layer 2, PayFi advancing

Institutional Adoption Overcomes Seasonality

September 30th, 2025 will be remembered as the day cryptocurrency markets definitively proved that institutional infrastructure can overcome historical seasonal patterns. Bitcoin’s surge to $114,421 and +10.72% monthly performance, supported by over $1 billion in ETF inflows and Swift’s blockchain endorsement, represents the convergence of institutional adoption with technical recovery.

The month’s success validates the thesis that professional portfolio allocation, regulatory clarity, and infrastructure development create more sustainable market dynamics than pure speculation. As Q4 begins with multiple supportive catalysts aligned, September’s triumph may represent not just seasonal pattern breaking, but cryptocurrency’s evolution toward permanent integration in institutional portfolios.

Swift’s blockchain announcement provides particular significance, demonstrating that traditional financial infrastructure recognizes blockchain technology’s superiority for settlement and payments. This institutional validation, combined with record ETF flows and technical pattern completion, suggests cryptocurrency markets are entering a new phase where adoption narratives drive performance more than seasonal trading patterns.

The September curse has been officially broken, replaced by evidence that institutional money views current levels as strategic allocation opportunities rather than speculative risks.

September Success Summary:

- Bitcoin Achievement: $114,421 (+10.72% monthly, second-best September ever)

- Institutional Validation: $1.06B combined ETF inflows signal confidence return

- Infrastructure News: Swift blockchain ledger with 30+ banks revolutionary

- Pattern Break: September curse officially broken by institutional flows

- Q4 Setup: Multiple catalysts aligned for continued strength into year-end

Related Coverage: