Bitcoin defends $95K-$96K support after worst week since March; Harvard’s $443M IBIT investment signals institutional conviction as Fear & Greed hits 10, lowest since February

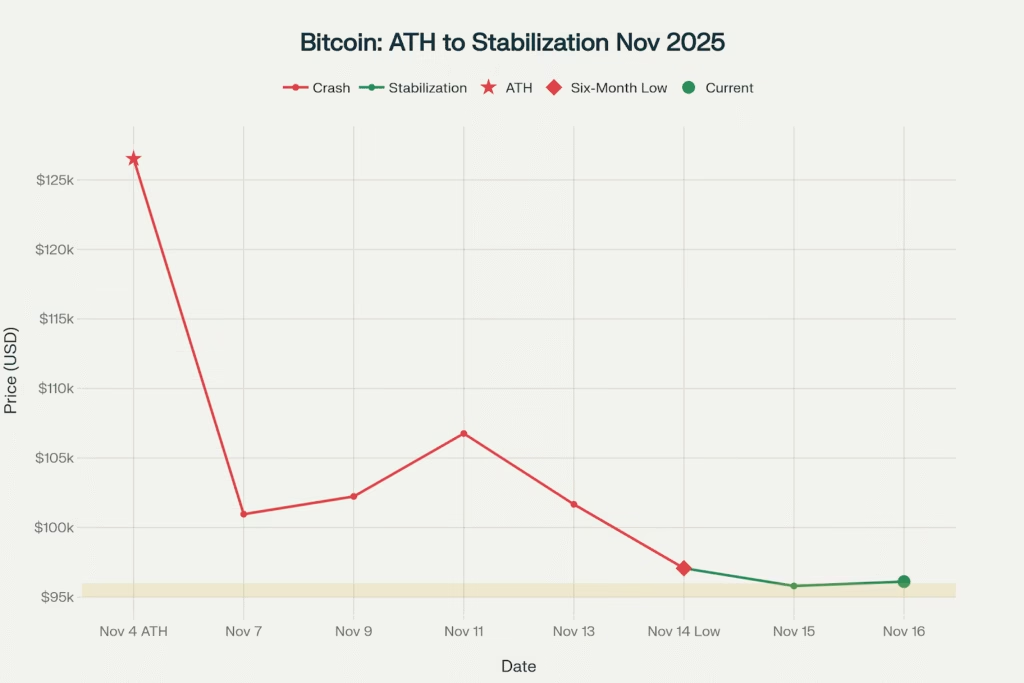

Bitcoin showed signs of stabilization Saturday, trading at $96,116 up 0.18% over 24 hours after the worst week since March that saw the cryptocurrency plunge 24% from its November 4 all-time high of $126,521. The weekend consolidation comes as market sentiment hits extreme lows with the Fear & Greed Index collapsing to 10, its lowest reading since late February.

Bitcoin stabilizes at $96K after 24% crash from $126.5K ATH, holding critical $95K-$96K support as extreme fear persists

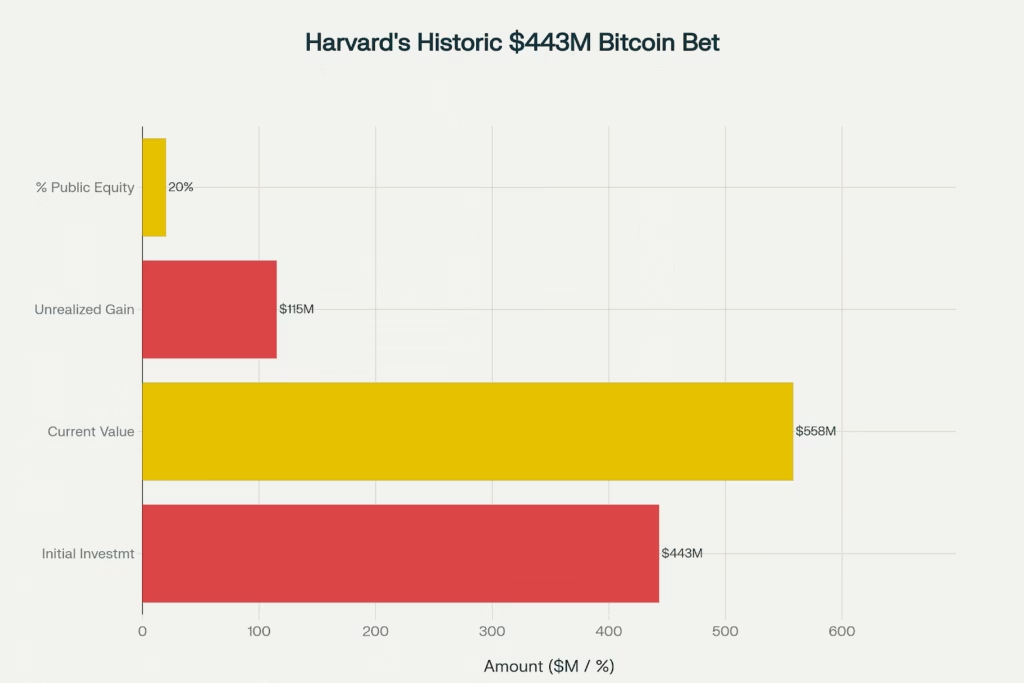

Despite the brutal selloff, Harvard University’s endowment disclosed a $443 million investment in BlackRock’s iShares Bitcoin Trust (IBIT), representing 20% of the prestigious institution’s U.S. listed public equity holdings a rare and substantial bet on digital assets by an Ivy League institution. The revelation suggests some of the world’s most sophisticated investors view Bitcoin’s weakness as a strategic buying opportunity rather than the beginning of a prolonged bear market.

Weekend Stabilization After Historic Crash

Current Market Snapshot (November 16, 09:30 UTC):

- Bitcoin: $96,116 (+0.18% daily, -5.7% weekly)

- Ethereum: $3,217 (+1.81% daily, -7.2% weekly)

- XRP: $2.26 (-0.04% daily, -4.8% weekly)

- Solana: $142.09 (+0.45% daily, -10.3% weekly)

- Market Cap: $3.25T (-0.78% daily)

- Fear & Greed: 10 (Extreme Fear, lowest since Feb)

- Weekly Performance: Worst since March 2025

Bitcoin traded in a narrow $94,842-$96,471 range Saturday, defending the psychologically critical $95,000-$96,000 support zone that has emerged as the new battleground between bulls and bears. The cryptocurrency briefly dipped to $94,842 Friday before buyers stepped in, suggesting this level represents significant demand from long-term accumulation.

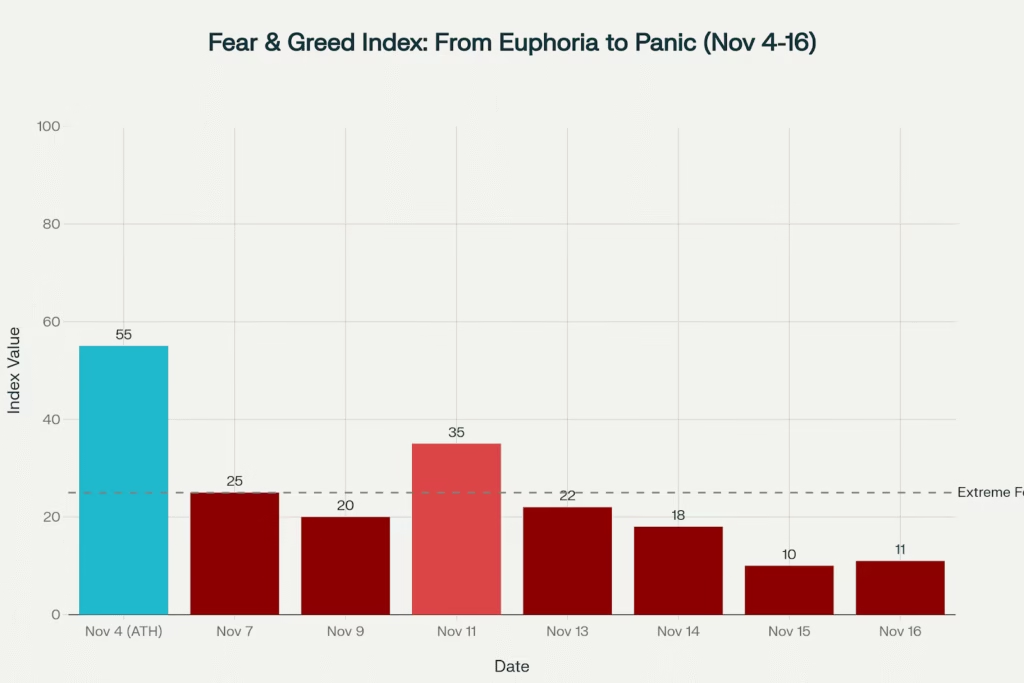

Fear & Greed Index crashes from 55 (Greed) at ATH to 10 (Extreme Fear), lowest since February, as Bitcoin loses $30K in value

Polymarket prediction markets show 61% odds that Bitcoin closes November 16 between $96,000-$98,000, with 29% odds for $94,000-$96,000 indicating traders expect consolidation rather than further dramatic moves in either direction over the immediate weekend. Combined, these brackets represent 90% of all bets, suggesting high confidence in range bound trading.

Harvard Makes Historic $443M Bitcoin Bet

Harvard University’s endowment, one of the world’s largest at $52.9 billion revealed a $443 million position in BlackRock’s IBIT, acquired during Q3 2025 when Bitcoin traded between $70,000-$90,000. The investment represents approximately 5,800 BTC and accounts for 20% of Harvard’s reported U.S.-listed public equity holdings, making it one of the most concentrated institutional Bitcoin exposures among traditional endowments.

Harvard Bitcoin Investment Breakdown:

- Investment Vehicle: BlackRock iShares Bitcoin Trust (IBIT)

- Amount: $443 million (~5,800 BTC)

- Purchase Period: Q3 2025 (prices $70K-$90K)

- Current Value: ~$558M (at $96K BTC)

- Unrealized Gain: ~$115M (+26%)

- Portfolio Weight: 20% of U.S. listed public equity holdings

- Endowment Size: $52.9 billion total

- Significance: First major Ivy League direct Bitcoin exposure

Harvard endowment’s $443M BlackRock IBIT investment now worth ~$558M, representing 20% of public equity holdings and +26% gain

The disclosure marks a watershed moment for institutional Bitcoin adoption, with Harvard joining MicroStrategy, Tether, and other forward-thinking institutions in allocating substantial capital to the digital asset. CoinDesk noted the investment is “notable” given Harvard’s traditionally conservative approach and the timing during Q3 when many institutions remained skeptical of cryptocurrency.

Harvard’s decision to allocate through BlackRock’s IBIT rather than direct custody or other ETF vehicles reflects confidence in BlackRock’s market leading product, which has attracted over $50 billion in assets since launching in January 2024. The endowment’s 20% equity portfolio weighting in a single Bitcoin ETF suggests conviction that digital assets will play a significant role in future institutional portfolios.

Extreme Fear Grips Market as ETF Outflows Accelerate

The Fear & Greed Index, a popular sentiment gauge combining volatility, market momentum, social media, surveys, Bitcoin dominance, and Google trends crashed to 10 on Saturday, marking the lowest reading since late February and signaling “extreme fear” among market participants. The index stood at 55 (Greed) on November 4 when Bitcoin hit its all-time high, illustrating the dramatic psychological reversal over just 12 days.

“Crypto market sentiment has deteriorated sharply, with the Fear & Greed Index dropping to 10, a level indicating ‘extreme fear,’ marking a near nine-month low,” CoinDesk reported. The extreme reading reflects the confluence of Bitcoin’s 24% crash, $866 million in Friday ETF outflows (the second-worst day ever), collapsing Fed rate cut odds, and broader risk-off sentiment across financial markets.

Friday’s $866 million combined Bitcoin and Ethereum ETF outflow represented the second-largest single-day redemption since the products launched, trailing only the October 10 flash crash that saw $1+ billion exit. The sustained institutional selling now totaling over $2.5 billion since late October has removed a key pillar of support that had propelled Bitcoin to all-time highs.

“The selloff is a confluence of profit-taking by long term holders, institutional outflows, macro uncertainty, and leveraged longs getting wiped out,” Jake Kennis, Senior Research Analyst at Nansen, stated. “What is clear is that the market has temporarily chosen a downward direction after a long period of consolidation/ranging”.

Technical Analysis, Critical Support Holds…For Now

Bitcoin’s price action Saturday suggests the $95,000-$96,000 zone is attracting significant buying interest, with multiple touches of the lower bound followed by recoveries back toward $96,000. This level coincides with the 61.8% Fibonacci retracement from Bitcoin’s 2024 low to the November ATH, a commonly watched technical indicator.

Key Technical Levels:

- Current Price: $96,116

- Critical Support: $95,000-$96,000 (holding, multiple tests)

- Secondary Support: $92,000 (next major level)

- Deep Support: $87,000-$88,000 (demand zone from May)

- Resistance: $98,000 (former support turned resistance)

- Major Resistance: $100,000 (psychological barrier)

- JPMorgan Bear Target: $94,000 (essentially reached)

- JPMorgan Bull Target: $170,000 (6-12 months)

Bitcoin analyst Bitcoin.com noted the cryptocurrency is “stuck in the basement” with the key question being whether “a bounce or breakdown” comes next. The analysis emphasized that “support at $95K is critical if it holds with volume, we could see a relief rally back toward $98K-$100K. Break below, and $92K or even $87K could come fast”.

Glassnode reported “unusual divergence between Bitcoin and altcoins,” with BTC showing relative strength versus smaller cryptocurrencies that have experienced even steeper declines. This divergence often precedes either a Bitcoin bounce that lifts the entire market, or a final capitulation selloff where BTC catches down to altcoin weakness.

Institutional Activity

While Friday’s massive ETF outflows and collapsing sentiment paint a bearish picture, several weekend developments suggest institutional players remain constructively engaged with cryptocurrency markets:

Weekend Institutional Developments:

- Harvard Endowment: $443M IBIT position revealed (Q3 purchase)

- BlackRock BUIDL: Listed as collateral on Binance, expands to BNB Chain ($2.5B tokenized fund)

- Tether: Eyes $1B investment in German robotics firm Neura

- WisdomTree: Predicts crypto index ETFs will drive next adoption wave

- 10x Research: Notes Ethereum bearish but whales continuing purchases

- Analyst Consensus: Most see $95K-$98K consolidation before next move

Binance announced Friday that BlackRock’s $2.5 billion BUIDL tokenized Treasury fund will be accepted as collateral for institutional crypto trading and expanded to BNB Chain, deepening the integration between traditional finance and decentralized markets. The move suggests infrastructure development continues despite price weakness.

Tether, the largest stablecoin issuer, disclosed it’s considering a $1 billion investment in German robotics startup Neura, which aims to produce 5 million robots by 2030 and has already booked €1 billion in orders. The potential investment highlights how crypto native firms are deploying capital into real-world businesses, bridging digital and physical economies.

Market Outlook: Bull vs Bear Scenarios

As Bitcoin tests six-month lows, analysts remain divided on whether current levels represent a generational buying opportunity or merely a waypoint in a deeper correction. Bulls point to extreme fear sentiment (historically a contrarian buy signal), Harvard’s institutional validation, holding key support at $95K, and JPMorgan’s maintained $170K target.

Bears counter that deteriorating Fed rate cut odds (now 50% for December versus 70% last week), sustained ETF outflows, weakening altcoin breadth, and technical breakdown below $100K suggest further downside before sustainable recovery. Some analysts set downside targets as low as $84,000 if the $95,000 support fails decisively.

JPMorgan’s $170,000 price target within 6-12 months assumes liquidity conditions improve after the Fed ends quantitative tightening on December 1, institutional accumulation resumes, and Bitcoin’s role as “digital gold” gains further acceptance. The bank notes Bitcoin’s recent weakness stems primarily from liquidity drainage rather than fundamental deterioration.

For traders and investors, the weekend stabilization offers a brief respite but doesn’t resolve the underlying tension between bullish long term narratives (institutional adoption, limited supply, digital gold thesis) and bearish near-term realities (hawkish Fed, ETF outflows, extreme technical damage). The coming week will determine whether $95K holds or breaks, setting the trajectory for Bitcoin’s year-end performance.

Weekend Summary (November 16, 2025):

- Bitcoin: $96,116 (+0.18% daily), stabilizing after -24% crash from ATH

- Fear & Greed: 10 (Extreme Fear), lowest since February

- Harvard: $443M IBIT position (20% of public equity) revealed

- ETF Flows: -$866M Friday (second-worst day ever)

- Support: $95K-$96K holding with multiple tests

- Outlook: Consolidation $95K-$98K expected short-term

Risk Considerations: Cryptocurrency investments carry substantial risk including potential loss of principal. Extreme volatility persists with rapid price swings possible. Leveraged positions face liquidation risk. Even prestigious institutions can suffer losses. Market participants should conduct thorough due diligence, avoid excessive leverage, understand key support/resistance levels, monitor Fed policy and liquidity conditions, and maintain strict risk management including appropriate position sizing and stop-losses.