Bitcoin (BTC) Flashes Bullish Breakout on Lower Timeframe

Bitcoin broke decisively above $91,500 on Thanksgiving Thursday, marking the cryptocurrency’s strongest week since early October as surging Federal Reserve rate cut expectations triggered a 7.3% recovery from Friday’s panic lows near $85,300. The rally contradicts historical Thanksgiving weakness patterns, Bitcoin has declined on the Wednesday before Thanksgiving in six of the past seven years, suggesting current institutional demand overcomes traditional seasonal pressures. Market capitalization expanded beyond $3.2 trillion as nearly $130 billion in value flooded back into digital assets within 24 hours.

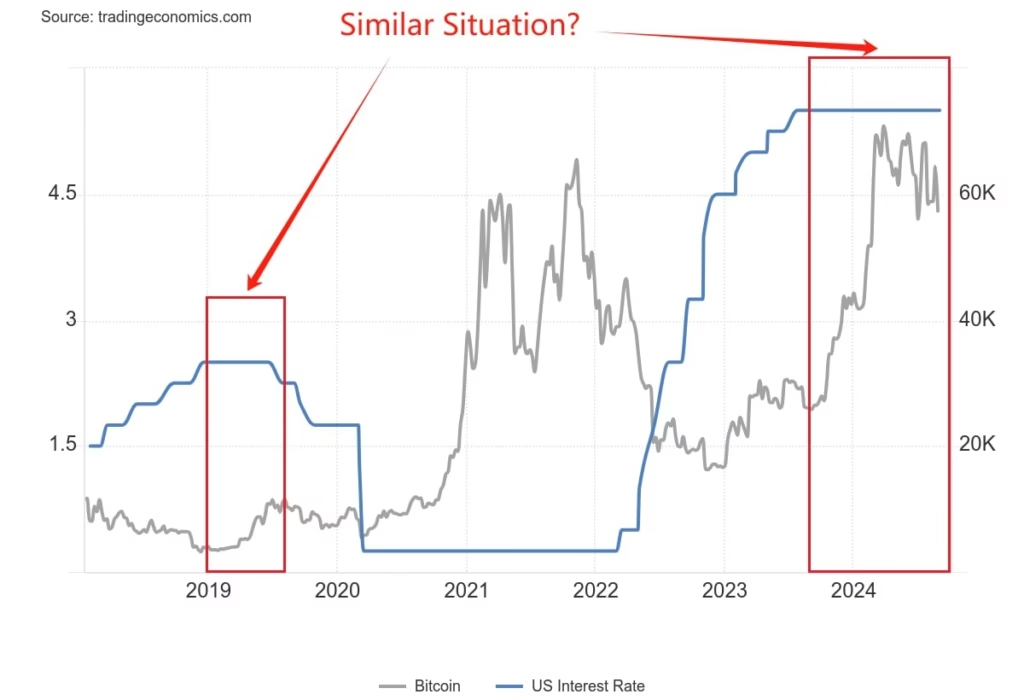

What drives this recovery matters more than the price move itself. Bitcoin ‘s surge directly correlates with Federal Reserve rate cut expectations rocketing from 41.8% just one week ago toward 85% as of Thursday, revealing how thoroughly cryptocurrency trading has become dependent on macroeconomic policy rather than on-chain fundamentals. When institutional allocators recalculate portfolio assumptions about future interest rates, they mechanically rotate capital into risk assets including Bitcoin regardless of crypto-specific developments.

The Federal Reserve Pivot Changes Everything

Rate cuts are here; Is Bitcoin set to surge?

Federal Reserve communications shifted dramatically during the past seven days. New York Fed President John Williams’ dovish commentary on November 21 triggered immediate repricing of December rate cut odds. JPMorgan now predicts a 25-basis-point cut as probable during the December 18 policy meeting, reversing their previous “rates on hold” guidance.

CME FedWatch data reflects this dramatic repricing. Monday’s 65% rate cut odds surged toward 82% Wednesday before reaching 85% Thursday, a 43-percentage-point swing in just three trading days. This represents one of the fastest policy expectation reversals in recent Federal Reserve history. Traders interpreted delayed economic data (held up by October’s government shutdown) as confirming inflation moderates faster than Fed officials anticipated. Better-than-expected unemployment claims and softening Producer Price Index readings provided ammunition for those betting on December cuts.

Bitcoin ‘s correlation with risk assets during this macro pivot proves instructive. The cryptocurrency’s 0.85 correlation with Nasdaq Composite technology stocks ensures that when Fed policy expectations improve, digital assets rally mechanically through portfolio rebalancing rather than fundamental conviction. This means Bitcoin ‘s future price depends far more on Fed Chair Jerome Powell’s December commentary than on developer activity or adoption metrics.

Institutional Capital Moves While Retail Exits

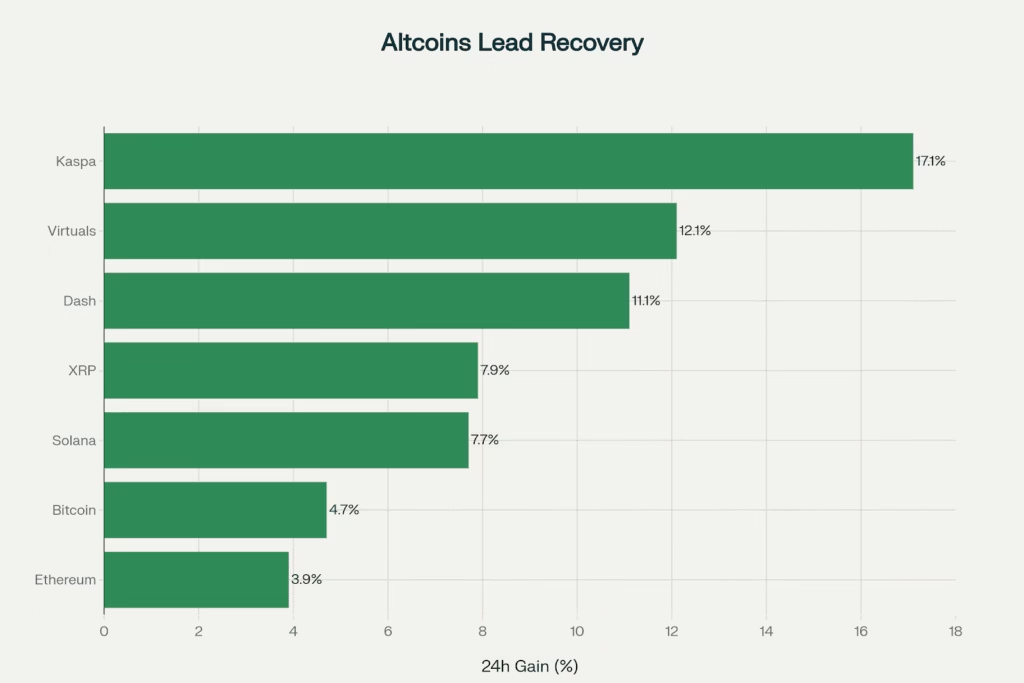

Altcoins surge ahead during Thanksgiving recovery with Kaspa +17.1% as risk appetite returns to markets

ETF products continued experiencing outflows despite price gains, $151 million net withdrawals occurred Monday despite Bitcoin climbing. This apparent contradiction reveals the timing divergence between retail and institutional cycles. Retail investors holding Bitcoin through ETF products saw daily unrealized losses evaporate during the week’s rally, triggering profit-taking even as prices recovered.

Meanwhile, direct institutional accumulation accelerated dramatically. Exchange inflows declined to 1.8 million Bitcoin net outflow during the week, the largest single withdrawal since October, signaling aggressive spot market accumulation by professional entities. Large custody flows (deposits exceeding 100 BTC per transaction) now represent 50% of institutional activity, up from 28% during October.

Ark Invest purchased $16.5 million in Coinbase stock Wednesday, its largest single day acquisition since August, demonstrating conviction that cryptocurrency infrastructure economics will strengthen substantially during the coming quarters despite current volatility. This pattern, retail redemptions coinciding with institutional accumulation typically precedes sustained market reversals as weak hands exit while strong hands establish positions.

Altcoins Signal Broad Market Recovery

The composition of Thanksgiving gains reveals critical market structure information. While Bitcoin posted 4.7% daily gains, altcoins surged dramatically: Kaspa jumped 17.1%, Virtuals Protocol rallied 12.1%, Dash advanced 11.1%, and Solana climbed 7.7%. This pattern emerges consistently during recovery phases when forced selling concludes and capital rotates from defensive positioning into higher-risk alternatives.

Bitcoin dominance the percentage of cryptocurrency market capitalization allocated to Bitcoin declined from 64% at November’s panic peak toward 58% currently. When smaller-cap assets outperform larger ones during uptrends, it signals traders moving beyond defensive accumulation into speculative positioning. This breadth expansion historically precedes 3-6 month periods where altcoins outperform by 100-300%.

Technical Setup Establishes Clear Parameters

Bitcoin formed a bullish hammer candle at November’s $82,500-$85,000 lows, a pattern where prices plunge sharply before recovering most losses on strong buying. This formation at support zones combined with increasing volume suggests genuine institutional demand rather than algorithmic short-covering bounces. Multiple support tests without lower breaks indicate buyers emerging at progressively higher levels.

Current structure creates defined scenarios. Breaking above $94,000 on sustained volume would establish a higher-low pattern confirming recovery legitimacy. Breakdown below $87,000 would invalidate the thesis and likely accelerate selling toward $80,000 where previous cycle support resides. These binary parameters enable disciplined positioning rather than ambiguous market conditions.

What Comes Next

December Fed policy communications will ultimately determine whether Thanksgiving gains extend into sustained year-end rallies. Rate cuts would likely trigger continued risk asset rallies as discount rates applied to growth assets decline across portfolios. Conversely, Fed hawkishness would invite sharp reversals testing recent support levels.

The fascinating element is that fundamental cryptocurrency adoption continues advancing regardless of price volatility. Institutional surveys show 55% of hedge funds now maintain digital asset exposure, up from 47% in 2024, with 71% planning allocation increases during 2026. Infrastructure development accelerated, tokenization initiatives expanded, and regulatory clarity improved markedly through November despite volatile price action.

For positioning purposes, Thanksgiving week validated the contrarian thesis: institutional accumulation during retail panic creates imbalances that eventually resolve through appreciation. Whether that occurs during December’s traditional Santa rally window or extends into Q1 2026 remains uncertain. But the direction of ultimate resolution clarifies daily as positioning data diverges from price movement.

Thanksgiving Summary (November 27, 2025):

- Bitcoin: $91,503 (+4.7% daily, +7.3% weekly)

- Ethereum: $3,027 (+3.9% daily), participating in recovery

- Altcoin Leadership: Kaspa +17.1%, confirming broad market strength

- Market Cap: $3.2T (+4.2% in 24 hours)

- Fed Rate Cut Odds: 85% for December (up from 41.8% last week)

- Exchange Outflows: 1.8M BTC withdrawn, largest weekly accumulation

- Technical: Bullish hammer formation at support, $94K resistance ahead