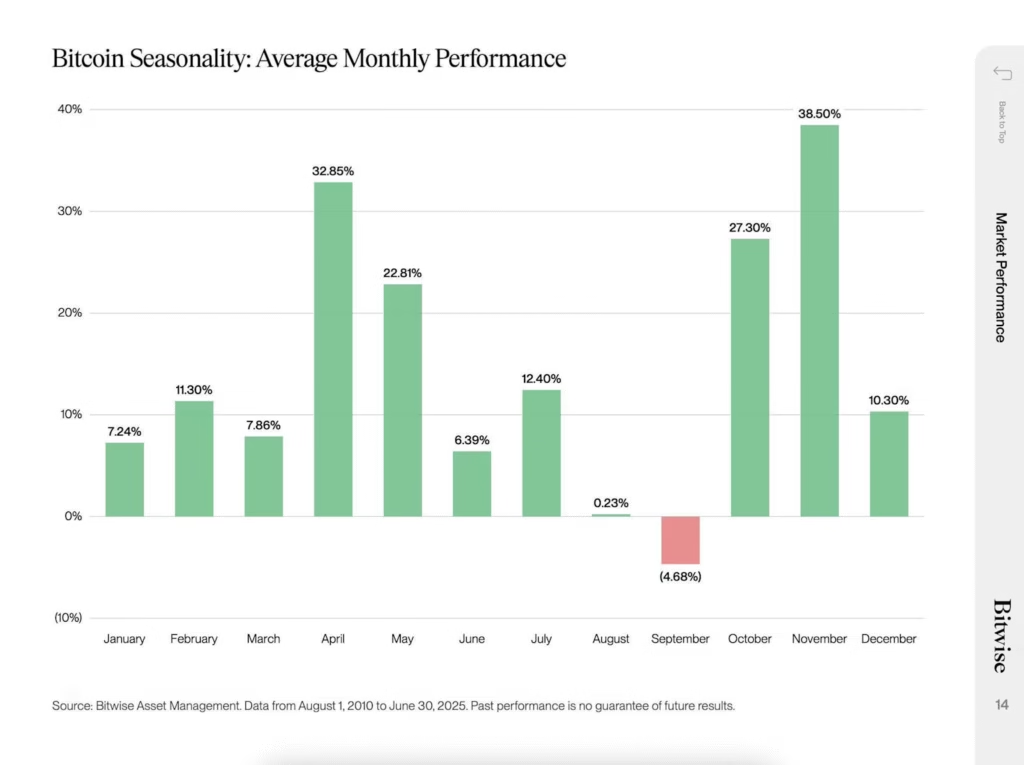

‘Uptober’ Myth Shattered

Bitcoin closed Sunday evening at $108,076, up 0.80% for the day but down 5% for October making this the worst “Uptober” in a decade. The month that historically delivers 19.8% average gains has instead become a cautionary tale about seasonal patterns failing amid macro shocks.

Bitcoin suffers worst October in 10 years with Elliott Wave analyst forecasting extended bear market as US seizes 127K BTC

The U.S.-China tariff standoff, weak liquidity, and $19B in liquidations have overwhelmed Bitcoin’s traditional October strength. CoinDesk data shows only 2014 and 2018 saw worse October closes in the past 12 years.

Bar chart showing Bitcoin’s average monthly performance with September as the only month showing a loss of 4.68%, illustrating seasonal trends and the historically worse month for Bitcoin reddit

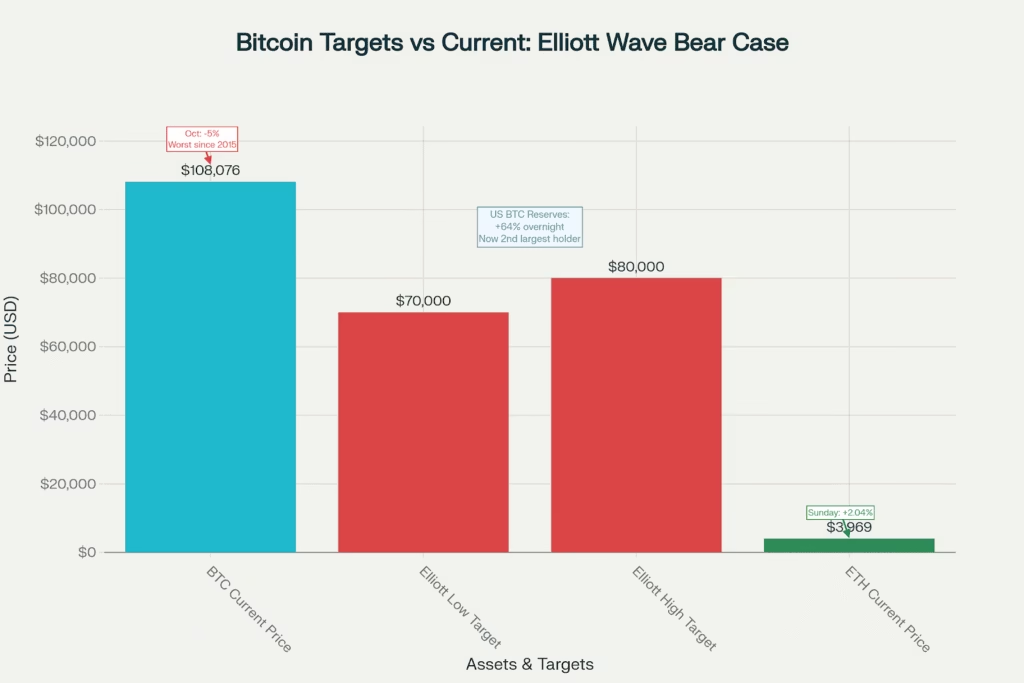

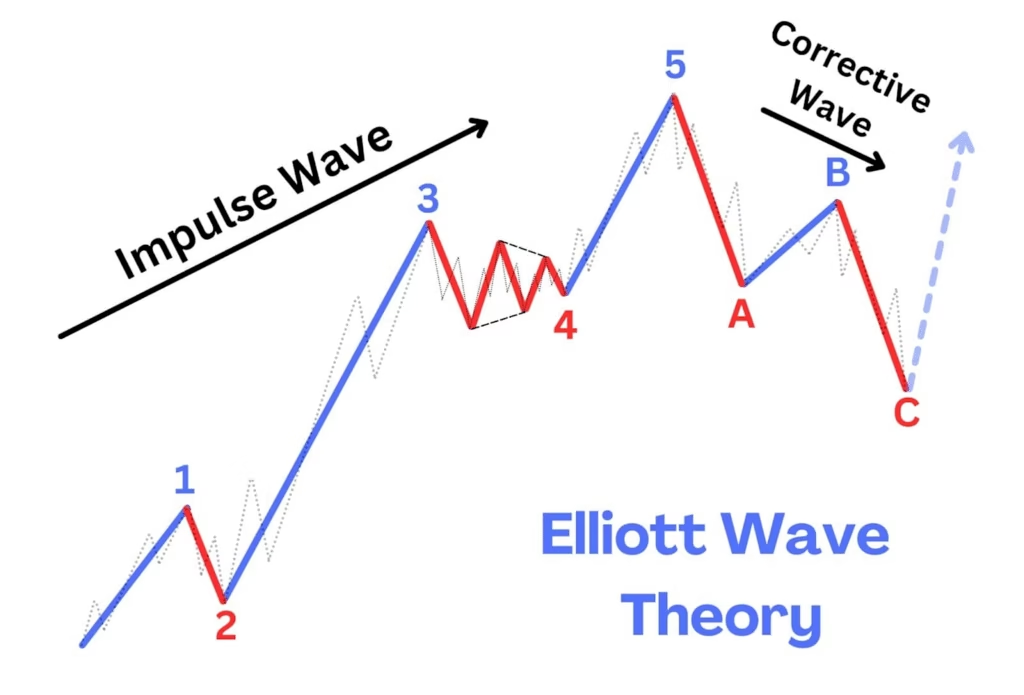

Elliott Wave: Bull Market Over

Jon Glover, Chief Investment Officer at Ledn and respected Elliott Wave analyst, delivered a stark warning Sunday: Bitcoin’s bull run that began in early 2023 is complete. After analyzing the five-wave upward structure and recent $126K to $104K collapse, Glover now forecasts a sustained bear market lasting until at least late 2026.

Elliott Wave theory illustrating impulse and corrective waves for market trend analysis alchemymarkets

Bear Market Thesis:

- Target Range: $70K-$80K (35%+ drop from current levels)

- Timeline: Extended weakness through late 2026

- Pattern: Five-wave Elliott structure complete

- Retesting Risk: While brief rallies to $124K possible, broader trend is bearish

“I firmly believe we have completed the five-wave upward move and are now entering a bear market that may last until at least late 2026,” Glover stated, going directly against bullish consensus.

US Government Bitcoin Seizure

In a dramatic development, the U.S. Department of Justice confiscated 127,271 BTC from the Prince Group,accused of scams and illegal mining operations. This single seizure increased Washington’s strategic Bitcoin reserves by 64% overnight, according to Galaxy Research.

Government Holdings:

- New Total: US now holds 3.5% of its gold reserves in Bitcoin

- Global Ranking: 2nd largest holder after MicroStrategy

- Timing: Seized during retail capitulation, not market peak

- Strategic Signal: Government accumulating while retail panics

The symbolism isn’t lost on traders: as retail investors sold into fear, the U.S. government dramatically strengthened its long-term crypto position.

XRP Accumulation Despite Price Weakness

While Bitcoin struggles, XRP holders are accumulating aggressively. Santiment data shows wallets holding over 10,000 XRP hit a record high of 317,500 addresses signaling institutional and whale confidence despite price trading at $2.40.

The 30-day MVRV ratio sits at -15.3%, an “extreme undervaluation zone” that historically precedes rebounds. XRP support holds at $2.20-$2.25, with $2.65 as first major resistance.

Stablecoin Instability Exposed

The recent $19B liquidation event revealed cracks in stablecoin stability. NYDIG’s Greg Cipolaro noted that stablecoins like USDC, USDT, and USDe aren’t truly pegged but float based on supply and demand. During Friday’s chaos, USDe dropped to $0.65 on Binance,a 35% depeg.

“The perceived stability of stablecoins is actually due to arbitrage and market dynamics,” Cipolaro explained, warning users often misunderstand real risks.

Recovery or Deeper Decline?

Markets remain divided. While some analysts point to 2020’s precedent when October flipped from early losses to 27% gains others note critical differences. Glover’s Elliott Wave analysis, combined with macro headwinds and ETF outflows, suggests this October’s weakness may signal a broader trend shift.

Outlook

Bitcoin’s worst October in a decade challenges the notion that seasonal patterns override macro realities. With Elliott Wave analysis suggesting extended weakness, US government accumulating seized coins, and stablecoins showing instability, the crypto market faces its most uncertain period since 2022.

Whether this represents capitulation before recovery or the beginning of Glover’s predicted 18-month bear market will likely be determined by Bitcoin’s ability to hold or break the critical $100K-$105K support zone in coming weeks.

Sunday Evening Summary:

- BTC: $108,076 (+0.80% daily, -5% October worst in 10 years)

- Elliott Wave: $70K-$80K bear market forecast to late 2026

- US Seizure: 127,271 BTC confiscated, reserves up 64%

- XRP: 317,500 wallets holding 10K+ (record accumulation)

- Stablecoins: USDe depegged to $0.65 exposing systemic risks

Related Coverage: