A Practical Capital-Building Framework for $500-$5,000 Investors

Volatility has always been crypto’s defining feature. In a single quarter, markets can swing from euphoric expansion to sharp contraction, wiping out poorly timed entries and emotionally driven decisions. For most retail investors, the real challenge is not identifying promising assets it is managing when and how to enter a market that rarely moves in straight lines.

Dollar-cost averaging (DCA) has emerged as one of the few strategies that remains effective regardless of short-term market conditions. In 2025, as crypto adoption widens and price discovery accelerates across multiple chains, DCA is less a beginner’s tactic and more a capital discipline framework. It allows investors with modest capital between $500 and $5,000 to participate consistently without exposing themselves to timing risk or emotional overreach.

Rather than attempting to outsmart the market, DCA accepts volatility as a structural feature and uses it to the investor’s advantage.

Understanding Dollar-Cost Averaging Beyond the Textbook Definition

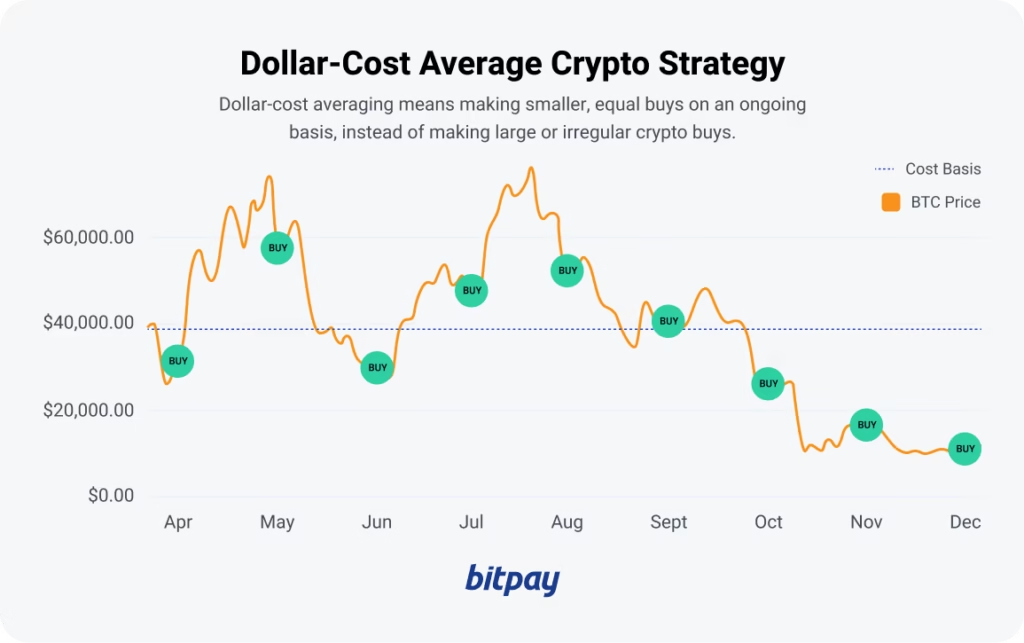

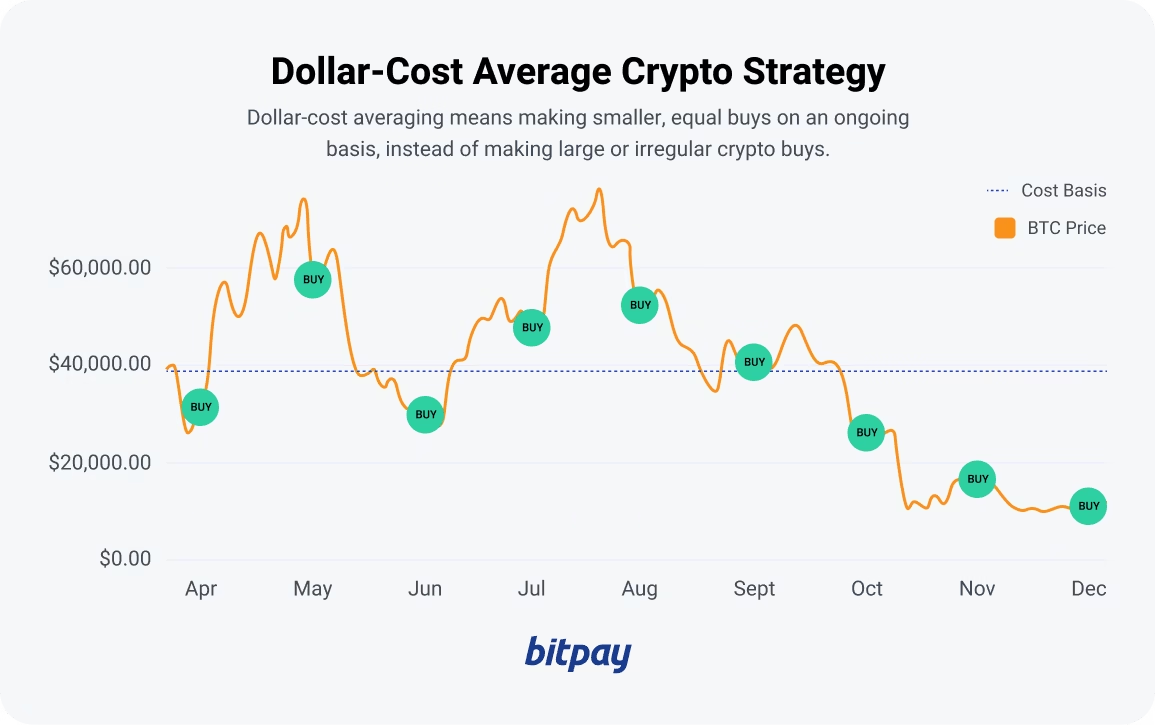

At its core, dollar-cost averaging means committing a fixed amount of capital at regular intervals, independent of price movements. What is often overlooked, however, is why this works so well in crypto specifically.

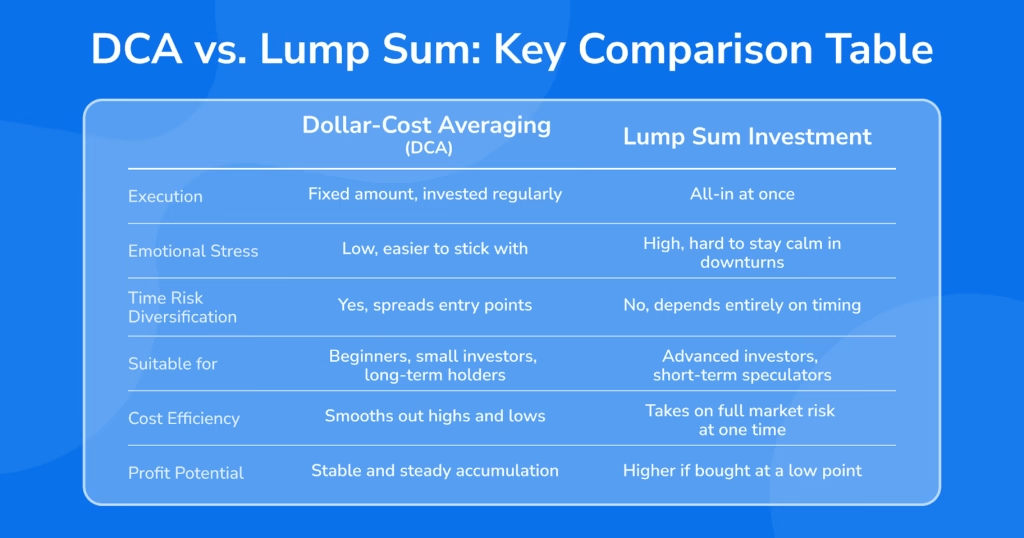

Crypto markets are reflexive and sentiment-driven. Price rallies attract leverage, leverage amplifies volatility, and volatility eventually forces liquidation. Lump-sum investing concentrates risk at a single psychological moment, often near local peaks. DCA disperses that risk across time, allowing entry prices to normalize as markets fluctuate.

More importantly, DCA shifts decision-making away from prediction and toward process. You are no longer asking whether today is the right time to buy. You are executing a predefined plan that assumes uncertainty as a constant.

Why DCA Is Structurally Suited to Crypto Markets

Traditional equity markets reward patience; crypto markets reward discipline. DCA provides that discipline in three distinct ways.

First, it reduces behavioral risk. Fear and greed account for the majority of poor crypto outcomes. By automating decisions, DCA removes the impulse to chase green candles or freeze during drawdowns.

Second, it improves cost efficiency during high volatility. When prices fall sharply, fixed-amount purchases naturally acquire more units. When prices rise, exposure increases at a slower rate. This asymmetric behavior is particularly valuable in an asset class prone to deep but temporary drawdowns.

Third, it encourages consistency. Crypto wealth is rarely built in a single trade; it is accumulated through repeated, unemotional participation over multiple cycles.

Who DCA Is Actually Designed For

Dollar-cost averaging is often marketed to beginners, but its real value extends well beyond that label. It is most effective for investors who believe in the long-term relevance of digital assets but acknowledge that short-term price movements are largely uncontrollable.

This includes:

- New entrants building confidence and familiarity

- Working professionals who cannot monitor markets daily

- Investors operating during uncertain or transitional market phases

- Long-term holders seeking exposure without leverage or stress

If your available capital falls between $500 and $5,000, DCA allows meaningful participation without requiring aggressive risk assumptions.

Designing a DCA Plan That Matches Your Capital Size

The effectiveness of DCA depends less on sophistication and more on alignment. Your budget, asset selection, and schedule must reinforce each other.

Defining the Investment Envelope

Before allocating a single dollar, the total amount must be clearly defined and emotionally expendable. Crypto remains a high-risk asset class, and DCA is a risk-management tool, not a guarantee of profit. The capital you commit should not be needed for short-term obligations.

Once defined, this total is treated as committed capital regardless of market noise.

Asset Selection: Fewer, Stronger Convictions

A common mistake among small investors is excessive diversification. Spreading $1,000 across ten tokens does not reduce risk; it dilutes focus and increases management complexity.

In 2025, a DCA portfolio is best built around two to four assets with clear, differentiated roles:

- A primary store-of-value asset (e.g., Bitcoin)

- A programmable settlement or smart-contract platform (e.g., Ethereum)

- One infrastructure or growth exposure (Layer 2, RWA, or scaling solution)

- Optional stablecoin allocation for liquidity or yield

Each asset should justify its place through adoption, liquidity, and long-term relevance—not short-term hype.

Timing Without Timing: Choosing the Right Interval

The interval is where DCA transforms from theory into habit. Weekly, bi-weekly, and monthly schedules each have merit, but the correct choice is the one you can execute without interruption.

Shorter intervals smooth volatility more effectively but may incur higher transaction fees. Longer intervals reduce friction but increase sensitivity to price swings. What matters most is consistency. Skipped entries undermine the strategy more than imperfect timing ever could.

Once chosen, the interval should be treated as non-negotiable.

Automation as a Behavioral Safeguard

In crypto, automation is not a convenience, it is a psychological shield. Headlines, social media narratives, and sudden price spikes can derail even the best-intentioned plan.

Most centralized exchanges now offer recurring purchase features, while decentralized tools and smart wallets allow scheduled execution on-chain. Automation ensures that your strategy executes even when emotions would otherwise interfere.

The less discretion involved, the more reliable the outcome.

A Practical Example: Structuring a $2,000 DCA

Consider an investor allocating $2,000 over eight weeks. Instead of deploying the capital at once, it is divided into equal weekly commitments.The allocation might favor long-term durability over speculation, with periodic purchases reinforcing exposure regardless of short-term price action. Over time, the resulting average entry price reflects market reality rather than emotional timing.

This approach does not maximize returns in hindsight, but it minimizes regret in real time.

Market Cycles and DCA: What Changes, What Doesn’t

DCA is deliberately indifferent to short-term market phases. However, its psychological value increases during downturns. Bear markets, often perceived as failure periods, are structurally ideal for accumulation provided the assets are fundamentally sound.

In bull markets, DCA prevents over-exposure by enforcing fixed investment sizes. In sideways markets, it maintains engagement while others lose interest. The plan remains the same; only sentiment changes.

That stability is its greatest strength.

Security and Post-Purchase Discipline

DCA does not end at execution. Assets accumulated over time should not remain indefinitely on exchanges. Periodic transfers to self-custody wallets reduce counterparty risk and reinforce long-term ownership discipline.

Security lapses negate even the best investment strategy.

Closing Perspective

Dollar-cost averaging survives because it aligns with human limitations. It accepts uncertainty, removes ego, and replaces reaction with routine. In a market as unforgiving as crypto, that alone is a competitive edge.

For investors deploying $500 to $5,000 in 2025, DCA offers something rare: participation without pressure. It turns volatility into a background condition rather than a source of constant anxiety.

In crypto, longevity matters more than brilliance. DCA is how most investors stay long enough to matter.

Illustrative Crypto DCA Framework

| Element | Practical Guidance |

| Capital range | $500–$5,000 |

| Asset count | 2–4 high-quality assets |

| Interval | Weekly or monthly |

| Execution | Automated where possible |

| Review cadence | Quarterly |

| Custody | Periodic self-custody |

| Risk rule | Only invest surplus capital |

Related Articles

- Your investor rights in crypto: custody disputes, exchange failures, and the legal protections you need to know

- Global crypto regulations in 2025: what’s changing in the EU, US, India, and other key markets

- Gas fees explained: how rollups slash Ethereum transaction costs without sacrificing security

- Best Layer‑2 networks in 2025: Arbitrum, Optimism, zkSync and how they really compare