Bitcoin consolidates near $108,000 as markets extend weekly decline while WazirX prepares for operations restart and Revolut secures European crypto license

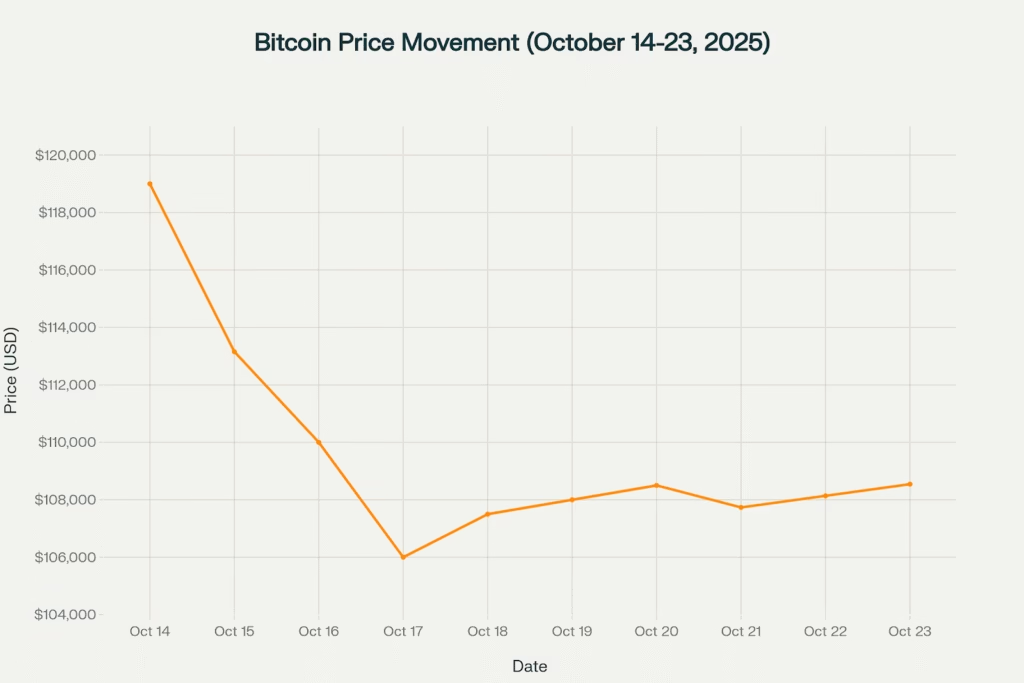

Bitcoin traded at $108,544 Thursday evening IST, extending the cryptocurrency market’s losing streak to seven consecutive days as traders await key macroeconomic catalysts amid persistent uncertainty surrounding U.S.-China trade relations and the ongoing government shutdown. The world’s largest digital asset edged down 0.2% over 24 hours and approximately 3% for the week, according to data from CoinMarketCap.

Ethereum traded near $3,829, down 1.14% intraday and 6% week over week, as altcoins continued to face sustained pressure following the historic $19-20 billion liquidation event on October 10. The global cryptocurrency market capitalization stands at approximately $3.74 trillion, declining 1.0% over the past day with 24-hour trading volumes reaching $238 billion.

Technical Breakdown

Bitcoin continues to trade within a narrow consolidation range between $106,500 and $110,000, with the 200-day exponential moving average at $109,500 serving as a key resistance level. The cryptocurrency recently closed its CME gap near $107,000, partially addressing a technical overhang that has kept traders cautious.

Bitcoin price trend showing consolidation around $108K after decline from October highs above $119K

According to the CoinSwitch Markets Desk, “BTC is steady around the $108K mark, awaiting a clear directional move. Uncertainty surrounding U.S.-China trade discussions and the U.S. government shutdown entering its fourth week, which has delayed key economic data releases, is keeping market activity measured”.

Sathvik Vishwanath, Co-Founder and CEO of Unocoin, provided technical context: “Bitcoin trades near $108,000 and market sentiment is neutral to mildly bearish as traders await confirmation of support between $104K–$110K. Resistance lies at $120K–$125K, where a breakout could renew bullish momentum”.

Market Sentiment Plunges to Extreme Fear

The Crypto Fear & Greed Index has collapsed to 28, firmly entrenched in “extreme fear” territory just one notch above extreme fear threshold of 25 underscoring pervasive anxiety following the largest liquidation event in cryptocurrency history.

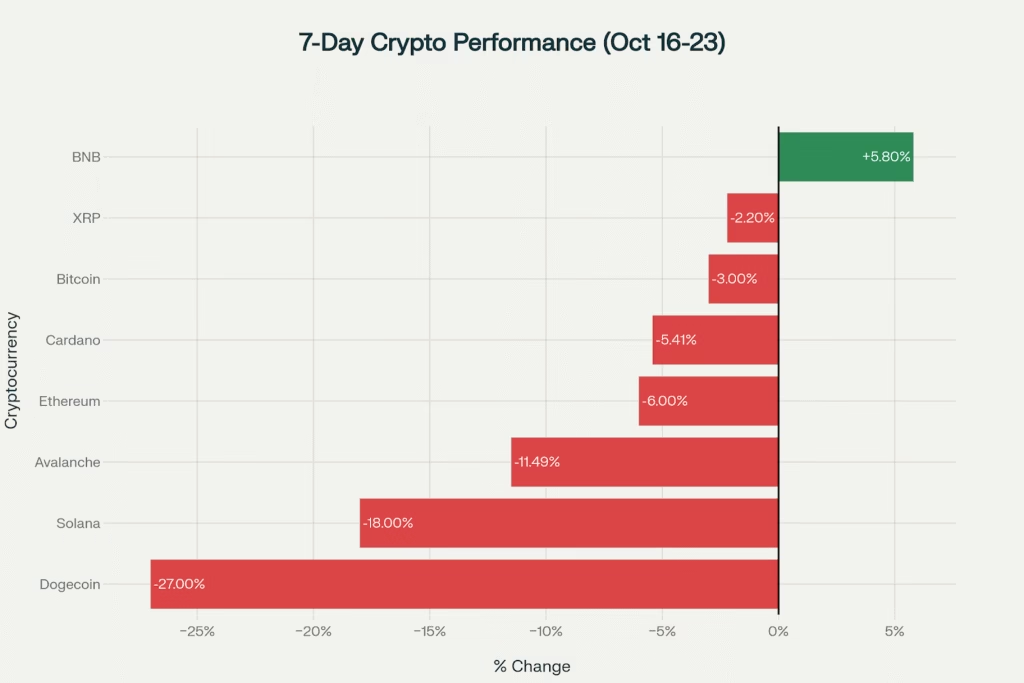

Weekly performance comparison showing BNB as the only gainer among major cryptocurrencies, while most assets face selling pressure

The October 10 deleveraging event wiped out over 1.6 million leveraged positions worth $19-20 billion as Bitcoin plunged from highs above $125,000 to briefly touch below $102,000 a drop of approximately 15%. Ethereum slumped over 20% to around $3,500 before partially recovering, while several altcoins experienced catastrophic losses ranging from 40-70% within minutes.

Market Sentiment Indicators:

- Fear & Greed Index: 28 (Extreme Fear)

- Market Cap: $3.74 trillion (-1.0% daily)

- 24h Volume: $238 billion

- Bitcoin Dominance: 57-62%

- Consecutive Days of Decline: 7 days

- CoinDesk 80 Index: Down 1.8% weekly

The Economic Times reported that “after a strong start to October, optimism in the cryptocurrency market has begun to fade. Traders trimmed risk ahead of Friday’s U.S. inflation data, while a major Bitcoin holder deposited $588 million to exchanges and increased short positions, signaling cautious sentiment in the crypto market”.

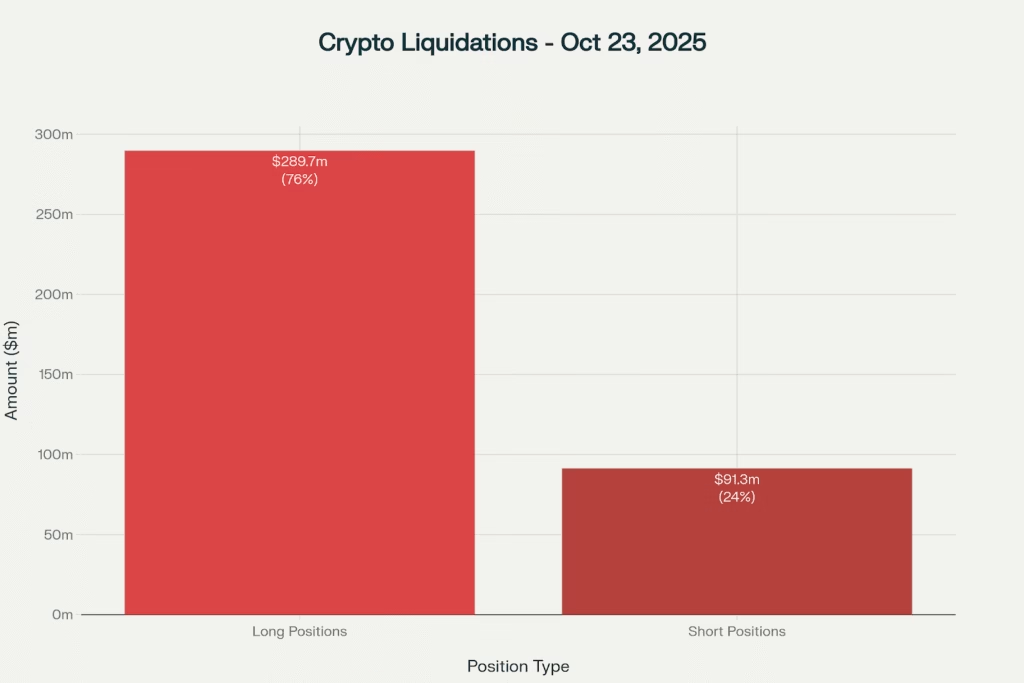

$381M Liquidation Wave Hits Leveraged Positions

Thursday’s market volatility triggered $381 million in liquidations across the cryptocurrency ecosystem over 24 hours, with long positions bearing the brunt at 76% of losses totaling $289.7 million. Short positions accounted for $91.3 million in liquidations, representing 24% of the total.

Liquidation Breakdown:

- Total: $381M (76% long, 24% short)

- BTC: $102M liquidated

- ETH: $94M wiped out

- Other Altcoins: $185M across various tokens

- Driver: Excess leverage flush as confidence fades and volatility rises

Market liquidations total $381M with long positions bearing the brunt at 76% as deleveraging continues

Bitcoin liquidations totaled approximately $102 million, while Ethereum saw $94 million eliminated, with the remaining $185 million distributed across altcoins including Solana, Cardano, XRP, and other major tokens.Despite the liquidations, futures open interest has risen to $26.06 billion as some traders re-engage with the market, though funding rates have turned neutral to positive indicating short conviction has largely cleared from the system. OKX currently leads with a 7.51% positive funding rate, suggesting traders are positioning for potential upside.

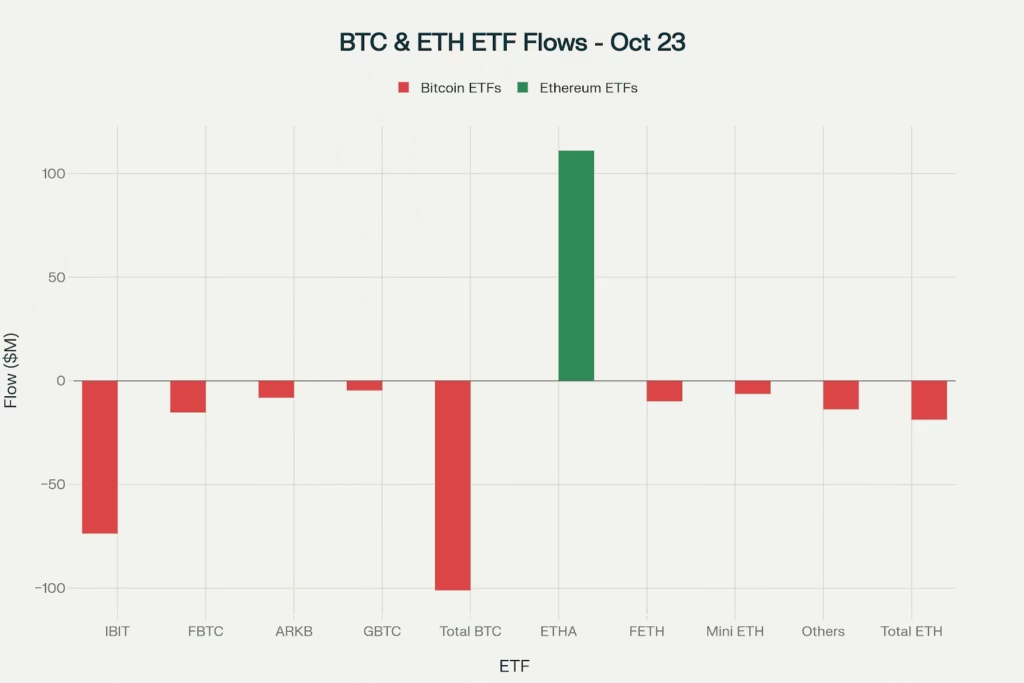

ETF Flows Show Mixed Institutional Signals

U.S. spot Bitcoin exchange-traded funds recorded net outflows of $101 million Wednesday, October 22, extending a pattern of institutional redemptions that has raised concerns about weakening demand during the market correction.

ETF Flow Analysis:

- BTC ETFs: -$101M net outflows Wednesday

- BlackRock IBIT: -$73.6M (despite largest cumulative inflows since inception)

- Fidelity FBTC: -$15.2M

- ARK 21Shares ARKB: -$8.1M

- Grayscale GBTC: -$4.6M

- ETH ETFs: -$18.7M net outflows

- BlackRock ETHA: +$111M (largest single-day inflow on record)

- Fidelity FETH: -$9.8M

- Grayscale Mini ETH: -$6.2M

- Others: -$13.7M combined

Mixed ETF flows show $101M Bitcoin outflows while Ethereum sees $18.7M net outflows despite BlackRock’s $111M inflow

Ethereum ETFs displayed divergent flows with $18.7 million in net outflows overall, though BlackRock’s ETHA dramatically bucked the trend with $111 million in inflows representing the largest single-day inflow for any Ethereum ETF product since their July 2024 launch.

Jordan Knecht, who leads institutional strategies at GlobalStake, characterized the current environment: “Major investors perceive the current downturn as a deleveraging reset rather than a systemic failure,” suggesting measured rather than panicked institutional sentiment.

However, analysts from Bitfinex warned that the slowdown in ETF accumulation is creating fragile support: “The lack of institutional accumulation has made the $107,000 to $108,000 zone increasingly difficult to defend as support. The absence of meaningful dip-buying by institutions contrasts sharply with earlier cycles when strong ETF accumulation played a key role in pushing Bitcoin higher”.

WazirX Set to Resume Operations After 15-Month Shutdown

Indian cryptocurrency exchange WazirX announced Thursday it will restart trading operations on October 24, 2025, following a 15-month shutdown caused by a $230-235 million cyberattack in July 2024. The resumption follows completion of a restructuring process sanctioned by the High Court of Singapore under the Insolvency, Restructuring and Dissolution Act and backed by over 95% of creditors.

WazirX Restart Details:

- Launch Date: October 24, 2025 at 10:00 AM IST (order placement), 5:00 PM IST (order matching)

- Trading Fees: 0% across all pairs for first 30 days

- Gradual Rollout: 25% of tokens activated per day over 4 days

- Full Operations: October 27, 2025

- Security Partner: BitGo (institutional-grade custody with insurance)

- Creditor Support: 95%+ approval for restructuring plan

- Withdrawals: Crypto withdrawals available from Day 1; INR withdrawals already enabled

The platform has partnered with BitGo, a global leader in digital asset custody managing over $64 billion in assets, to provide institutional-grade, insured custody solutions designed to prevent recurrence of the 2024 security breach.

“At the heart of everything we do is our mission to make crypto accessible to every Indian. I want to thank the WazirX community for their patience through these difficult times,” stated Nischal Shetty, Founder of WazirX. “Asset security is currently a crucial aspect in the global crypto ecosystem. Our partnership with BitGo adds an additional layer of trust and protection with world-class custody standards, as we restart. This isn’t just a return to operations, it’s a reinforcement of our integrity which we’ve always strived for”.

The exchange has completed necessary token swaps, mergers, delistings, and migrations that occurred during the platform’s inactive period, with detailed documentation published on the WazirX website. The phased rollout will begin with USDT trading pairs before expanding to additional assets over the four-day activation period.

Revolut Secures MiCA License for EU-Wide Crypto Expansion

British fintech giant Revolut obtained a Markets in Crypto Assets (MiCA) license from the Cyprus Securities and Exchange Commission (CySEC) on Thursday, October 23, enabling the company to offer regulated cryptocurrency services across all 30 countries in the European Economic Area.

Revolut Crypto 2.0 Expansion:

- Geographic Coverage: All 30 EEA countries (450 million potential customers)

- Current User Base: 65 million globally, 40 million in Europe

- Token Selection: 280+ cryptocurrencies

- Staking Services: Zero fees with yields up to 22% APY

- Stablecoin Conversion: Direct 1:1 USD conversion with no spread

- Regulatory Framework: Full MiCA compliance under Cyprus hub

- Launch Timeline: Phased rollout beginning Q4 2025

“Securing the licence reflects CySEC’s trust in our regulatory standards,” said Costas Michael, CEO of Revolut Digital Assets Europe, in an emailed statement Thursday. “MiCA gives us the clarity to deliver trusted, next-generation crypto products for Europe’s growing digital finance community”.

The authorization positions Revolut to significantly expand its digital asset services with full regulatory compliance under Europe’s comprehensive MiCA framework, which came into effect across the European Union in 2024. The company plans to leverage its Cyprus operation as the central hub for EEA-wide crypto services, building on the success of its Revolut X trading platform.

The crypto license follows Revolut’s Mexican banking approval granted just three days earlier, making it the first independent digital bank to complete the full licensing process from scratch in Mexico. The dual regulatory victories across Europe and Latin America underscore Revolut’s strategic focus on expanding regulated crypto services in major markets.

Ethereum Faces Pressure as Long-Term Holders Sell

Ethereum has struggled to maintain levels above $4,000 throughout October, with the second-largest cryptocurrency currently trading in a broad consolidation range between $3,750 and $4,250. Exchange flow data reveals significant shifts in trader behavior over the past 10 days, raising concerns about near-term price pressure.

Ethereum On Chain Indicators:

- Current Price: $3,829 (down 6% weekly)

- Trading Range: $3,750 – $4,250

- Exchange Outflows: Sharply decreased (reduced accumulation)

- Exchange Inflows: Increased (potential selling pressure)

- Age Consumed Spike: Third largest in 3+ months (long-term holder distribution)

- Volume Trend: Declining (lower market participation)

According to analysis from Pintu Academy, exchange outflows which typically signal accumulation have sharply decreased while inflows have increased, indicating more ETH is being sent to exchanges for possible sale. The Age Consumed indicator, which tracks movement of previously inactive coins, recorded a large spike in the last 24 hours, suggesting long-term holders are beginning to distribute holdings.

“Ethereum holders are beginning to sell their assets as they grow impatient with stagnant prices, creating downward pressure that could push ETH toward the lower end of its consolidation range if buying support doesn’t materialize,” Pintu Academy analysts noted.

Altcoin Performance Shows Market Divergence

Market performance across major cryptocurrencies displayed significant divergence Thursday, with BNB leading gains while most altcoins continued to face selling pressure.

Top Performers (24h):

- BNB: +4.04% to $1,113 (weekly: +5.8%, only major crypto with positive 7-day return)

- Solana (SOL): +4.53% to $188.44 (weekly: -18%)

- Cardano (ADA): +2.49% to $0.64 (weekly: -5.41%)

- Dogecoin (DOGE): +2.51% to $0.19 (weekly: -27%)

- XRP: +1.91% to $2.41 (weekly: -2.2%)

Underperformers (7-day):

- Dogecoin (DOGE): -27%

- Solana (SOL): -18%

- Avalanche (AVAX): -11.49%

- Ethereum (ETH): -6.0%

- Polkadot (DOT): -6.50%

- Cardano (ADA): -5.41%

BNB’s outperformance reflects ongoing strength in the Binance ecosystem, while Solana’s recovery attempt from deeper weekly losses suggests some speculative interest returning to high-beta altcoins. However, the broader altcoin market remains under pressure as traders consolidate positions in Bitcoin and stablecoins pending clearer macro signals.

Market Outlook

Market participants remain cautious ahead of Friday’s U.S. Consumer Price Index (CPI) report, the only major economic indicator unaffected by the ongoing government shutdown entering its fourth week. The inflation data could provide the catalyst needed to break Bitcoin from its current consolidation range.

Analysts suggest that lower-than-expected inflation could restore risk appetite and potentially push Bitcoin toward $120,000, while unexpectedly high readings could trigger another selloff toward $100,000 psychological support. Beyond immediate data releases, developments in U.S.-China trade relations remain a key overhang, with any concrete progress or setbacks likely to influence risk asset performance including cryptocurrencies.

Potential Scenarios:

- Bull Case: Break above $110K opens path to $112.8K-$115K; lower CPI could spark rally to $120K

- Base Case: Continued consolidation $106.5K-$110K until macro clarity emerges

- Bear Case: Break below $107K risks $104K-$100K retest; high CPI could accelerate selling

The CoinSwitch Markets Desk advised: “Traders can focus on blue-chip assets like BTC and ETH as core holdings while keeping altcoin exposure moderate until broader macro clarity returns”.

Unocoin’s Sathvik Vishwanath noted: “Institutional demand and ETF inflows remain strong, though macro uncertainty and profit taking create short-term pressure. Technical indicators show consolidation, hinting at potential volatility ahead. Despite temporary cooling, the broader trend stays upward, supported by limited supply and increasing adoption”.

With sentiment deep in extreme fear and substantial leverage flushed from the system following the October 10 liquidation event, some market observers suggest this consolidation phase could represent a bottoming process, though confirmation will require positive catalysts, renewed institutional accumulation, and sustained breaks above key resistance levels.

Thursday Summary (October 23, 2025):

- BTC: $108,544 (-0.2% daily, -3% weekly), seventh consecutive day of decline

- ETH: $3,829 (-1.14% daily, -6% weekly), long-term holder distribution evident

- Market Cap: $3.74 trillion (-1.0% daily)

- 24h Volume: $238 billion

- Fear & Greed: 28 (Extreme Fear)

- Liquidations: $381M total (76% longs, 24% shorts)

- ETF Flows: BTC -$101M, ETH -$18.7M (BlackRock ETHA +$111M)

- WazirX: Resumes October 24 with 0% fees, BitGo custody partnership

- Revolut: Secures MiCA license for 30 EEA countries, launching Crypto 2.0