Bitcoin miners embrace AI transformation as companies pivot from crypto mining to artificial intelligence infrastructure

The Great Mining Migration: From Bitcoin to AI

Saturday, October 18th marks a watershed moment in cryptocurrency history as Bitcoin mining companies complete a dramatic $4.6 billion capital raise to fund their strategic pivot from cryptocurrency mining to artificial intelligence infrastructure. Led by Bloomberg’s reporting, the transformation reveals an industry in rapid transition abandoning the volatile Bitcoin mining business for the more predictable and lucrative world of AI data centers.

Bitdeer Technologies (BTDR) exemplifies this shift, with shares surging 30% following announcements of AI expansion plans that could generate over $2 billion in annualized revenue far exceeding what Bitcoin mining could ever deliver. The company’s Ohio facility will provide 570 megawatts of capacity by Q3 2026, nearly a year ahead of schedule, demonstrating the urgency behind this industry-wide transformation.s3.amazonaws

Bitcoin miners pivot to AI with $4.6B capital raise as declining mining profits and AI opportunities drive historic transformation

AI Pivot Snapshot:

- Capital Raised: $4.6B+ across major mining companies

- Bitdeer Surge: +30% stock price on AI announcement

- Revenue Potential: $2B+ annualized from AI operations

- Infrastructure: 570MW Ohio facility by Q3 2026

- Industry Shift: From volatile mining to predictable AI hostingvecteezy

Why Miners Are Fleeing Bitcoin

The economics behind this mass exodus are stark. Bitcoin’s mining difficulty hit its seventh consecutive increase in early October, rising another 5% and pushing the network hashrate near 1.1 zettahashes per seconda staggering 1.1 sextillion hashes per second. Meanwhile, transaction fees have collapsed to near-zero, eliminating a critical revenue stream for miners.

Most damaging of all, the cost of mining a single Bitcoin now approaches the token’s $106,850 market price, obliterating profit margins. On-chain data from CryptoQuant reveals miners recently moved 51,000 BTC worth $5.6 billion to exchanges a desperate liquidity grab suggesting they’re selling holdings rather than accumulating them.

Rows of ASIC miners in a Bitcoin mining facility showcasing the hardware used for cryptocurrency mining ezblockchain

“The writing has been on the wall since the April halving,” noted one industry analyst. “Miners who don’t pivot to AI risk becoming obsolete as costs rise and revenues stagnate.”

The $4.6 Billion Infrastructure Bet

The scale of capital deployment into AI infrastructure is unprecedented in crypto mining history. TeraWulf raised $3.2 billion for its New York data center expansion, while IREN secured $1 billion for AI infrastructure buildouts. Cipher Mining upsized its debt offering to $1.1 billion for Texas facilities, and Bitfarms announced $300 million specifically for high-performance computing transitions.

CleanSpark took a different approach, securing $200 million in Bitcoin-backed credit facilities from Coinbase Prime and Two Prime Lending using their BTC holdings as collateral to fund the AI pivot without liquidating holdings.

Major Capital Raises:

- TeraWulf: $3.2B for NY data center expansion

- IREN: $1B for AI infrastructure general purposes

- Cipher Mining: $1.1B upsized for Texas facility

- Bitfarms: $300M for HPC transition

- CleanSpark: $200M Bitcoin-backed credit facilities

- Galaxy Digital: $460M private investment for Helios AI campus

The energy economics driving this transformation are compelling. Bitfarms’ Washington facilities will operate below $30 per megawatt hour nearly half previous costs making them among the most economical power sources for data centers nationwide. In Pennsylvania, where Google, Blackstone, and Meta have collectively invested $90 billion, miners are positioned to secure massive hyperscale client contracts.

Gold’s Peak Signals Bitcoin’s Moment

While miners pivot to AI, a parallel drama unfolds in traditional markets as gold appears to have peaked. After touching a record $4,392 per ounce, gold fell over 2% to $4,250 as institutional investors took profits. Meanwhile, Bitcoin held steady at $106,850, gaining 1.6% Saturday as trading volumes spiked to $78 billion—suggesting capital rotation from gold into crypto.

Crypto analyst Mario Nawfal argues this mirrors August 2020, when gold peaked and Bitcoin subsequently exploded from $10,000 to $60,000. With gold’s RSI above 85 (severely overbought) and Bitcoin’s RSI at 32 (deeply oversold), technical conditions suggest a major rotation could be imminent.

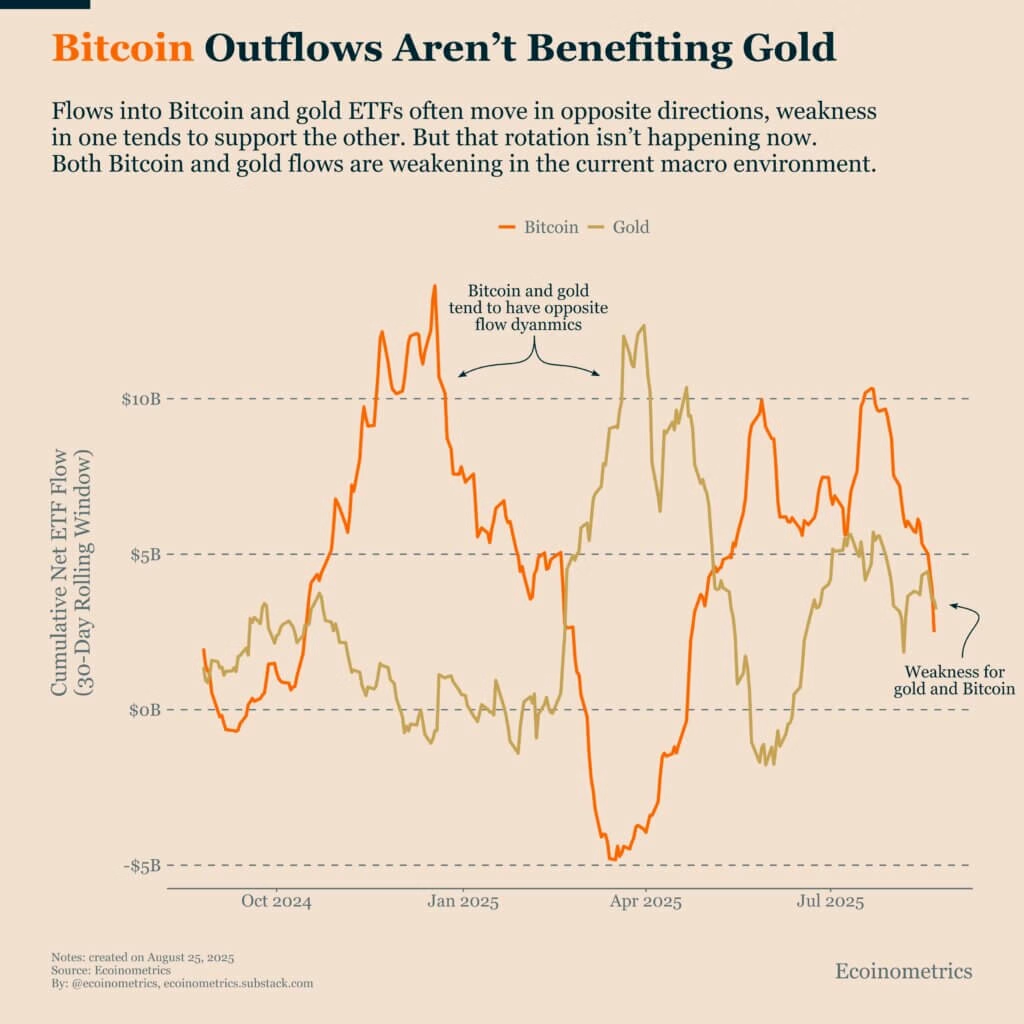

Graph showing weakening ETF flows in both Bitcoin and gold from late 2024 to mid-2025, breaking usual opposite flow pattern cryptoslate

“They pumped gold to sell it high, and now they’re using that liquidity to stack BTC,” Nawfal tweeted, suggesting institutional investors are executing a deliberate rotation strategy.”

XRP’s $2.40 Breakout Watch

Adding to Saturday’s market dynamics, XRP stabilized around $2.33-$2.36 after defending crucial $2.23-$2.25 support levels. Trading volume exploded to 246.7 million nearly triple the daily average as institutional buyers absorbed selling pressure during Friday’s market turbulence.

The setup is compelling: six spot XRP ETF applications remain under SEC review through October 25, while Ripple plans a $1 billion treasury raise to strengthen its balance sheet. Technical analysts identify $2.40 as the critical breakout level, with a sustained move above potentially triggering a rally toward $2.70-$3.00.

XRP Technical Setup:

- Current Price: $2.33-$2.36 consolidation

- Key Resistance: $2.40 breakout level

- Support: $2.23-$2.25 defended Friday

- Volume Spike: 246.7M (3x daily average)

- Catalyst: 6 SEC ETF filings under review (Oct 18-25)

- Upside Target: $2.70-$3.00 on $2.40 break

AI: The $2+ Billion Revenue Opportunity

The AI opportunity dwarfs Bitcoin mining economics. Bitdeer’s projected $2+ billion in annualized AI revenue from just one facility exceeds what most miners generate from their entire Bitcoin operations. The company cited a “sustained imbalance” between AI computing demand and supply, with hyperscale clients desperate for capacity.

Matt Kong, Bitdeer’s chief business officer, noted: “This push is driven by a marked increase in inbound interest in our power assets, which has become a strong catalyst for expanding our efforts.” The company will directly manage AI data center development rather than rely on partners, controlling the entire value chain from power to computing.

AI Economics vs Mining:

- Revenue Multiplier: 10x+ per megawatt vs Bitcoin mining

- Demand Imbalance: AI compute supply severely constrained

- Client Base: Hyperscale enterprise HPC/AI contracts

- Industry Investment: $40B from BlackRock, Nvidia, Microsoft

- Miner Advantage: Existing power infrastructure and grid connections

Institutional Backing Validates Transformation

The institutional support behind these pivots validates the strategic shift. Galaxy Digital secured a $460 million “private strategic investment” from “one of the world’s largest and most respected asset managers” to build out its Helios data center campus, a facility that once mined Bitcoin but now focuses exclusively on AI and high-performance computing.

Bitfarms received a $300 million debt facility from Macquarie Group, demonstrating that traditional financial institutions view the AI pivot favorably and are willing to provide financing at scale. The mix of Bitcoin-backed loans, traditional debt offerings, and private equity investments shows diverse capital sources supporting the transformation.

economictimes

Risks and Realities

Despite the enthusiasm, significant risks accompany this transformation. Bitcoin price volatility still affects miner balance sheets, particularly for those using BTC-backed financing. Execution risk looms large as companies race to build facilities on aggressive timelines, while the capital intensity of data center buildouts strains resources.

Competition from traditional data center operators like Equinix and Digital Realty who have decades of experience and established client relationships—poses threats. Regulatory uncertainty around the crypto-AI convergence adds another layer of complexity.

Risk Factors:

- BTC Volatility: Affects balance sheets and collateral values

- Execution Risk: Aggressive timelines for AI transitions

- Capital Intensity: Massive buildout costs strain resources

- Traditional Competition: Established players with client relationships

- Regulatory Uncertainty: Crypto-AI convergence uncharted territor

An Industry Reborn

October 18th, 2025 represents the crystallization of crypto mining’s most dramatic transformation. The $4.6 billion capital raise, Bitdeer’s 30% stock surge, and the broader industry pivot from Bitcoin to AI mark the end of one era and the beginning of another. Combined with the potential gold-to-Bitcoin wealth rotation and XRP’s technical setup, cryptocurrency markets face multiple catalysts converging simultaneously.

For miners, the choice was existential: adapt or die. Rising difficulty, collapsing fees, and costs approaching prices left no alternative. The AI boom offers not just survival but prosperity, with revenue potential exceeding anything Bitcoin mining could deliver.

Meanwhile, Bitcoin itself may benefit from reduced miner selling pressure as companies generate AI revenue rather than liquidating BTC holdings. If the gold-to-Bitcoin rotation materializes as analysts predict, BTC could reach $150,000-$180,000 while miners profit from AI infrastructure, a win-win scenario few predicted just months ago.

The crypto mining industry’s abandonment of Bitcoin for AI represents more than a strategic pivot, it’s an admission that cryptocurrency’s infrastructure layer has found more lucrative applications beyond creating digital tokens. Whether this proves prescient or premature, the transformation is now irreversible, backed by billions in institutional capital and the promise of AI’s unlimited computing appetite.

Industry Transformation Summary:

- Capital Deployed: $4.6B+ raised for AI infrastructure pivot

- Bitdeer Performance: +30% surge on AI expansion news

- Revenue Opportunity: $2B+ annualized vs declining mining profits

- Gold-to-BTC: Institutional rotation potentially triggering $150K-$180K rally

- XRP Setup: $2.40 breakout could spark $2.70-$3.00 move with SEC ETF catalysts

Related Coverage: