One of the biggest misconceptions about cryptocurrency investing is that you need large amounts of capital to begin. In reality, process beats capital. A well-structured $100 portfolio built with discipline will outperform a reckless $10,000 portfolio over time.

Crypto rewards patience, risk awareness, and education far more than raw money. This guide breaks down how beginners can responsibly build a crypto portfolio at three realistic starting points- $100, $500, and $1,000, while developing habits that scale as capital grows.

Foundational Principles Before Investing (Non-Negotiable)

Before allocating even a single dollar, three rules apply at every portfolio size:

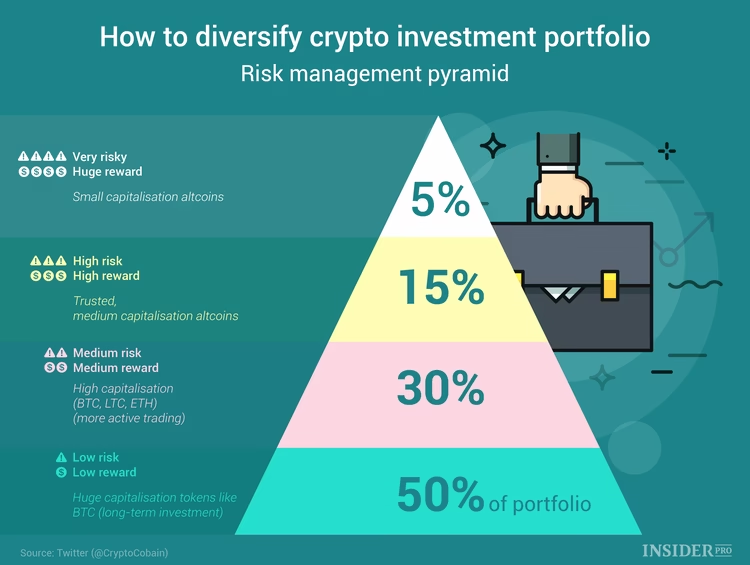

1. Diversification Reduces Emotional Risk

Crypto volatility isn’t just financial, it’s psychological. Concentrating all funds into one asset increases emotional decision-making. Diversification smooths volatility and keeps beginners from panic selling.

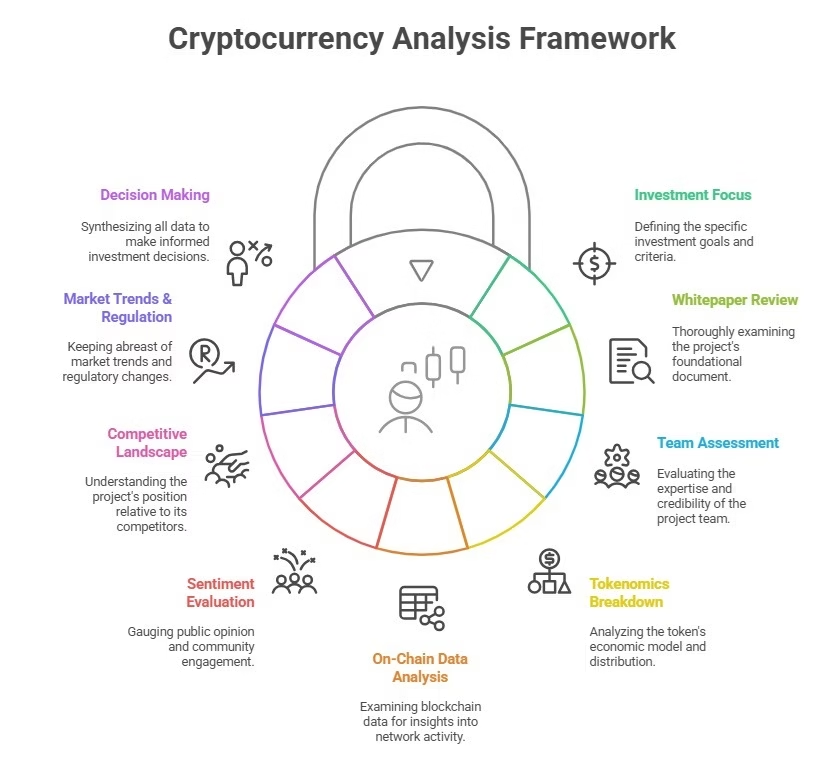

2. Utility Over Noise

Coins with real use cases, settlement, security, scaling, data, infrastructure, survive market cycles. Hype tokens rarely do.

3. Custody Equals Ownership

Leaving funds on exchanges is convenience, not ownership. Learning self-custody early protects both capital and confidence.

Starting With $100: Learn the Market, Not the Moon

At $100, your goal is not profit maximization, it’s market literacy. This stage is about understanding behavior, volatility, and mechanics.

Suggested Allocation (Low Stress, High Learning)

| Asset | Allocation | Purpose |

| Bitcoin (BTC) | 70% | Store of value, market anchor |

| Ethereum (ETH) | 30% | Smart contracts, ecosystem exposure |

Why this works:

- BTC teaches macro cycles and sentiment

- ETH introduces ecosystem thinking (DeFi, NFTs, L2s)

What You Should Actively Learn at This Stage

- How market prices move during news events

- How gas fees work

- How to transfer assets to a wallet safely

- How emotions affect decision-making

Avoid: meme coins, leverage, “next 100x” narratives. This is training capital.

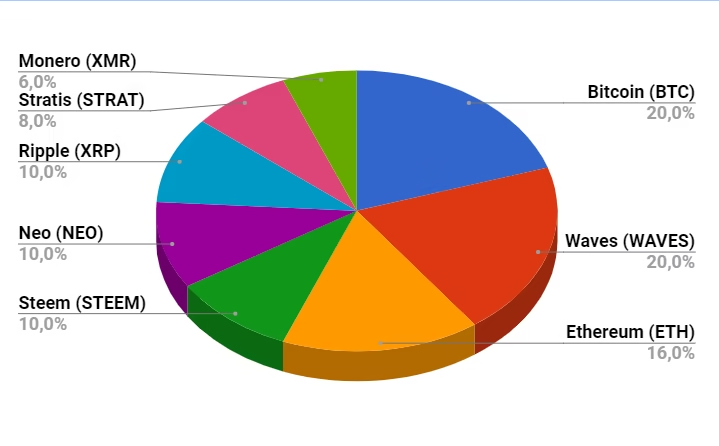

Starting With $500: Add Strategy and Controlled Risk

With $500, you now have room to layer exposure without overcomplicating things.

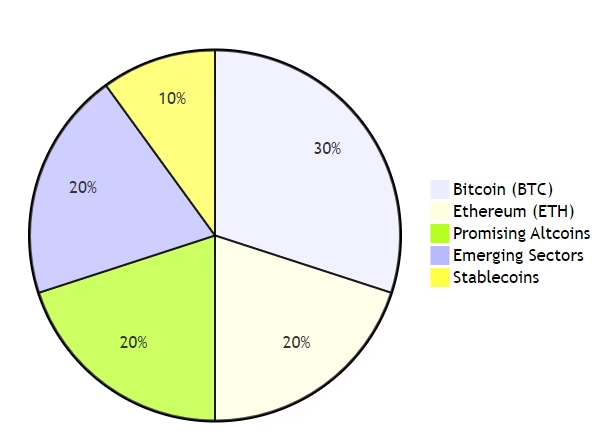

Suggested Allocation (Balanced Growth)

| Category | Allocation | Role |

| Bitcoin | 40% | Stability & macro hedge |

| Ethereum | 30% | Ecosystem growth |

| Utility Altcoins | 20% | Growth & innovation |

| Stablecoins | 10% | Flexibility & discipline |

Example Utility Altcoins (Research Required):

- Chainlink – decentralized data

- Polygon – scaling infrastructure

- Arbitrum / Optimism – Ethereum Layer 2s

Introduce Dollar-Cost Averaging (DCA)

Instead of investing all $500 at once:

- Split entries over 4-6 weeks

- Reduce timing risk

- Remove emotional pressure

Build Observation Habits

Use portfolio trackers (CoinGecko, CoinStats) to:

- Monitor drawdowns

- Track correlation between assets

- Observe dominance shifts (BTC vs alts)

This is where investors either mature or become gamblers.

Starting With $1,000: Think Like a Risk Manager

At $1,000, you are no longer experimenting, you are allocating capital. This is where process matters most.

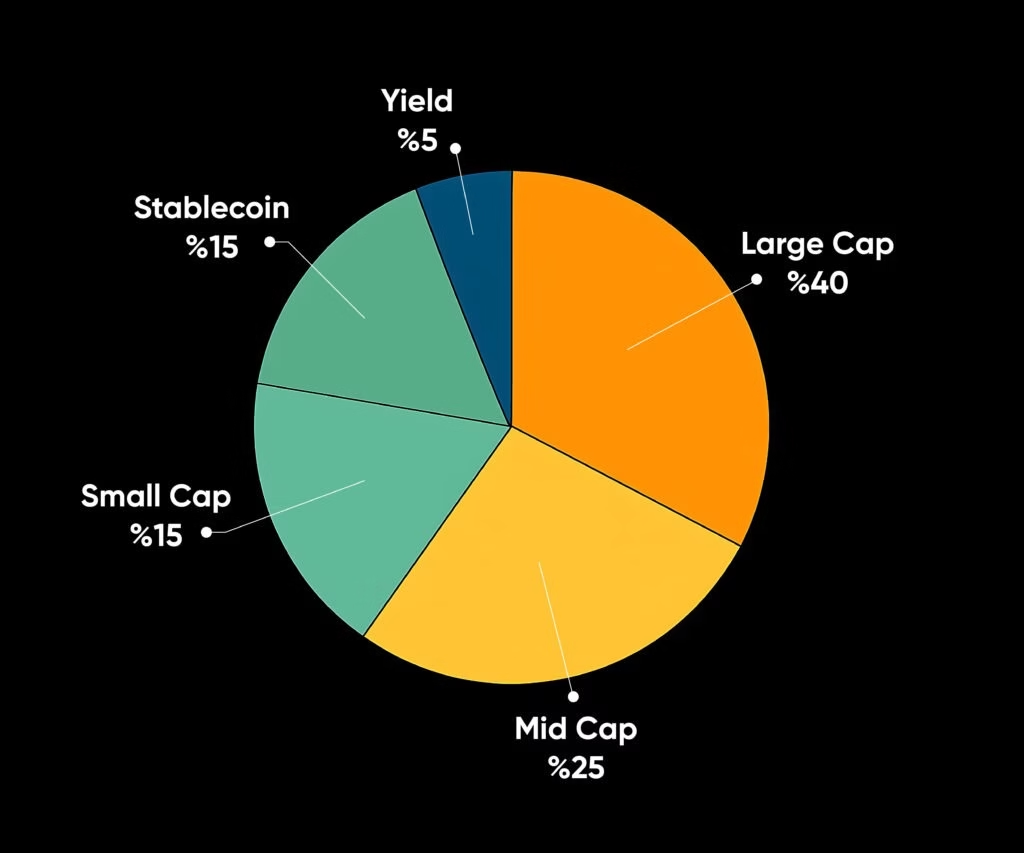

Professional-Style Allocation Example

| Category | Allocation | Strategy |

| Bitcoin | 35% | Cold storage, long-term |

| Ethereum | 25% | Staking or ecosystem exposure |

| High-Conviction Altcoins | 20% | Deep research only |

| Stablecoins | 10% | Dry powder & yield |

| High-Risk Bets | 10% | Optional, capped downside |

Security Is No Longer Optional

At this level:

- Use a hardware wallet (Ledger, Trezor)

- Separate wallets for holding vs experimenting

- Revoke DeFi permissions monthly

Security mistakes cost more than bad investments.

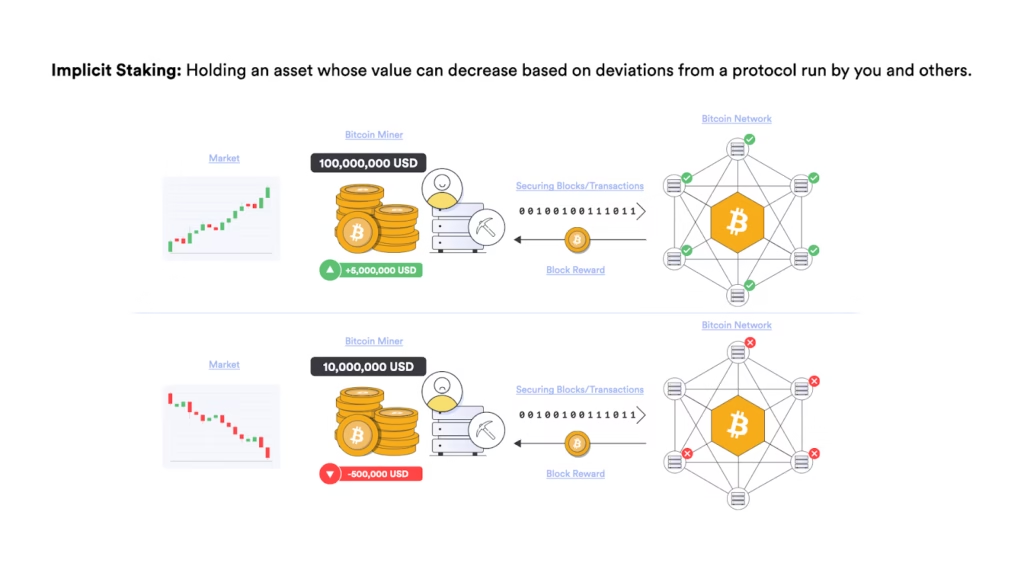

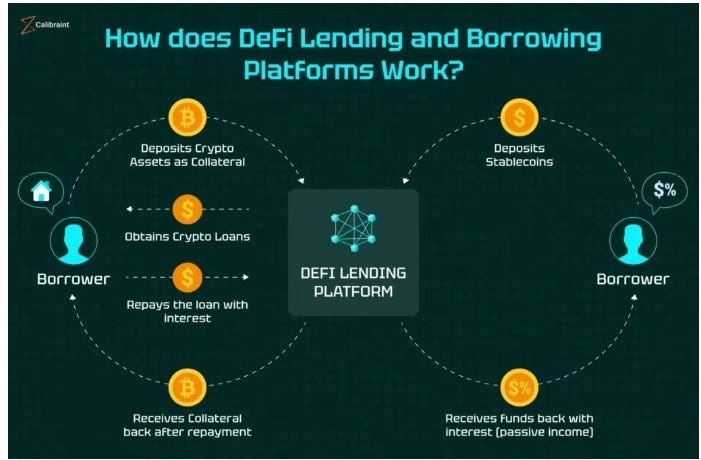

Earning While Holding (Optional, Not Mandatory)

Passive income is attractive, but only when understood.

Safer Options for Beginners

- ETH staking (liquid or native)

- Blue-chip DeFi lending (Aave, Compound)

What to Avoid Early

- Obscure protocols with extreme APYs

- Locked funds without exit clarity

- Yield without understanding liquidation risk

Yield is a bonus, not the core goal.

Mental Models From a Trading Desk Perspective

- Capital preservation beats profit chasing

- Fees quietly destroy beginners

- Narratives change faster than fundamentals

- Strong communities outlast strong marketing

- Boring portfolios survive bear markets

Most losses come from impatience, not poor assets.

Your Portfolio Is a Skill, Not a Snapshot

Crypto portfolios are living systems, not static lists of coins. They evolve with knowledge, conviction, and experience.

Starting with $100 teaches humility.

$500 builds structure.

$1,000 introduces responsibility.

If you respect the process, your capital will follow

Your first portfolio isn’t about wealth.

It’s about becoming fluent in a new financial language.

And fluency compounds faster than money ever could.

Related Articles

- Cryptocurrency 101: a beginner’s guide to how digital money really works

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level

- Beginner’s guide: how to earn real passive income from DeFi lending without blowing up your capital

- 10 common crypto scams and exactly how to avoid losing your money to them

- Why you should never leave your crypto on an exchange and the safer storage options professionals actually use

- Ethereum vs Solana: which smart contract platform really wins on speed, cost, and ecosystem strength?