Cryptocurrency taxation has entered a decisive phase in 2025. What was once an ambiguous, loosely enforced area of finance is now a clearly regulated domain backed by sophisticated tracking systems, international data-sharing agreements, and explicit disclosure requirements. For serious participants in the digital asset economy, tax literacy is no longer optional. It is part of operational discipline.

How Governments View Crypto in 2025

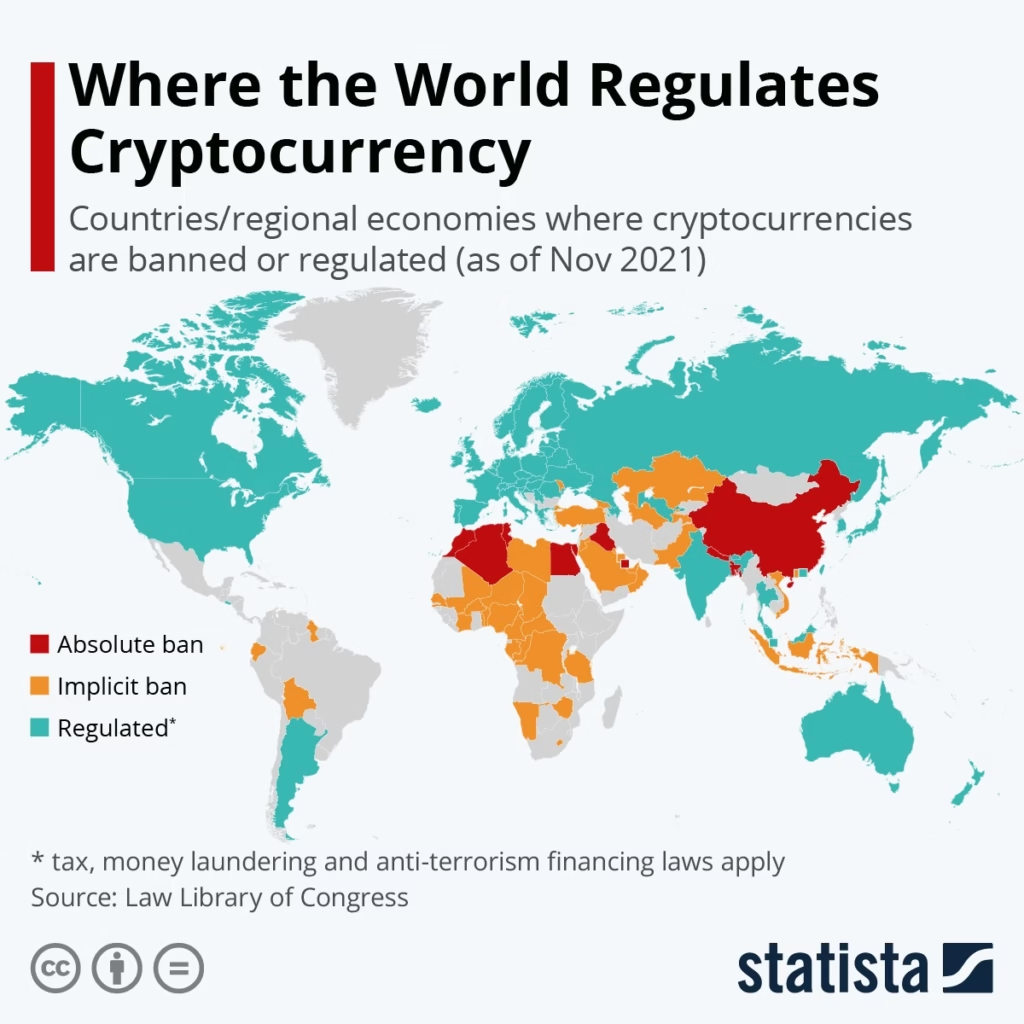

Across most jurisdictions, cryptocurrencies are no longer treated as experimental technology. They are legally recognized financial assets. In practice, this means crypto is taxed similarly to property or securities, not currency.

From a tax authority’s perspective, crypto represents measurable economic value that can be acquired, exchanged, and disposed of. The tax system does not care whether that value moved through a decentralized exchange, a self-custody wallet, or a smart contract. What matters is when value changed hands and whether that change created a gain or loss.

The misconception that decentralization implies invisibility is outdated. By 2025, regulators operate on the assumption that blockchain data is permanent, traceable, and eventually attributable.

What Actually Triggers a Crypto Tax Liability

Crypto taxes are event-driven, not balance-driven. Holding assets does nothing. Actions do. A taxable event occurs whenever crypto is disposed of, converted, or earned in a way that creates measurable value. This includes selling for fiat, trading one token for another, or using crypto to pay for goods or services. It also includes earning crypto through non-purchase means, such as staking rewards, liquidity incentives, mining, or compensation.

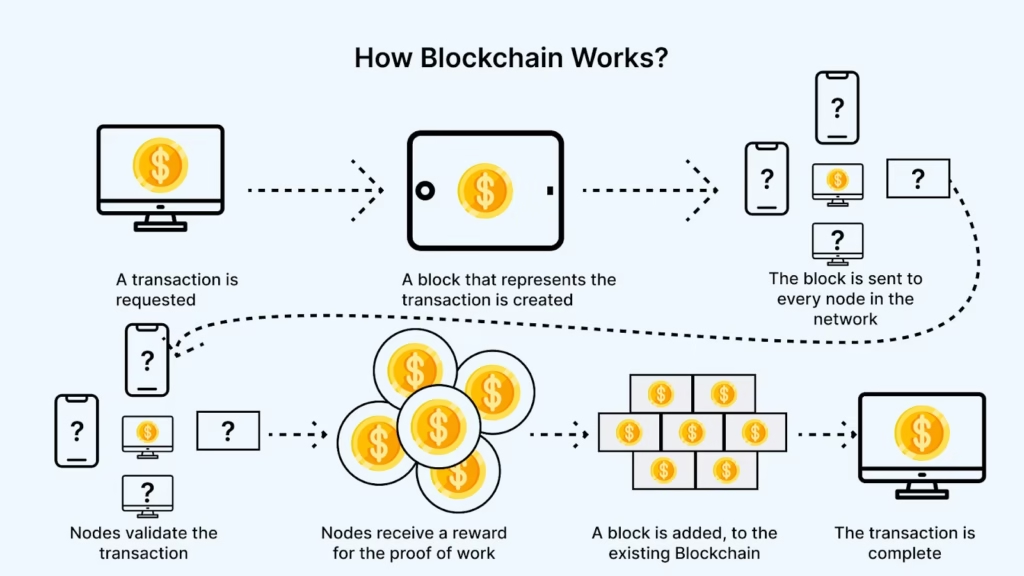

From a technical standpoint, most tax authorities treat crypto-to-crypto trades as two simultaneous actions:

- selling the asset you gave up, and

- acquiring a new asset at market value.

This duality is where many reporting errors originate.

Supporting reminders (not exhaustive):

- Swaps are taxable, even without fiat

- Income and capital gains are distinct categories

- Wallet-to-wallet transfers you control are usually non-taxable

Capital Gains: The Core Calculation Logic

At the heart of crypto taxation lies a simple economic equation:

gain or loss equals disposal value minus acquisition cost. However, complexity arises from time and inventory.

When you acquire the same asset multiple times at different prices, the system must determine which unit was sold. This is resolved using accounting conventions such as first-in-first-out or specific identification. The choice directly affects tax outcomes and must be applied consistently.

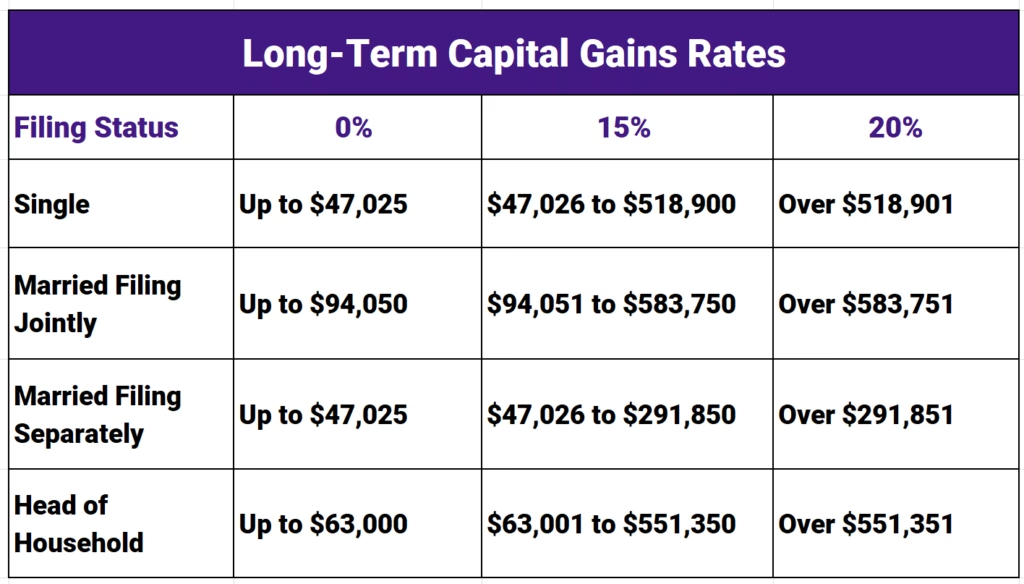

Holding period also matters. Many jurisdictions reward long-term holding with reduced rates, reflecting the difference between speculative trading and capital formation. In contrast, short-term activity is often taxed at ordinary income rates. The critical professional habit here is consistency. Switching methods opportunistically invites scrutiny.

Income vs Capital Gains: The Line That Cannot Be Blurred

One of the most misunderstood aspects of crypto taxation is the distinction between how crypto is obtained and how it is later disposed of.

If crypto is earned through staking, mining, airdrops, salaries, or protocol incentives, it is typically taxed as income at the moment it becomes accessible. That value becomes the cost basis for future capital gains calculations. When that same crypto is later sold or swapped, a second tax event may occur. Professionally speaking, this is not double taxation. It is two separate economic events:

- income recognition, then

- asset appreciation or depreciation.

Failing to separate these categories is one of the fastest ways to misreport.

DeFi, NFTs, and Complex On-Chain Activity

Decentralized finance introduced composability, but it also introduced tax ambiguity. Protocol interactions often bundle multiple actions, deposits, withdrawals, token minting, burns into a single user experience. From a tax lens, each of those steps may carry distinct consequences.

Providing liquidity may be interpreted as exchanging assets for LP tokens. Claiming rewards may generate taxable income. Exiting a position may crystallize gains or losses across several assets at once.

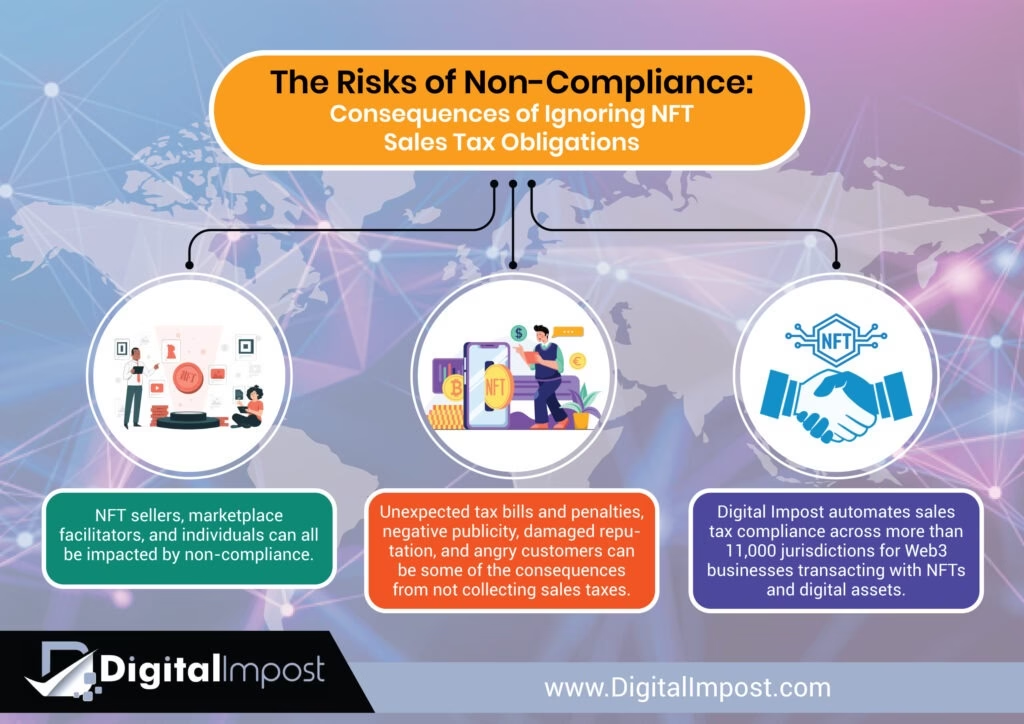

NFTs introduce further nuance. Minting can be non-taxable, but selling is usually a disposal. Royalties received by creators are typically income. Wash-sale rules, valuation challenges, and illiquid markets add layers of judgment. In 2025, the safest professional approach is conservative classification supported by documentation.

Reporting in Practice: How Professionals Actually Do This

Experienced participants do not attempt to reconstruct a year of activity at filing time. They maintain continuous records. The professional workflow is cyclical:

- transactions are logged regularly,

- classified by economic purpose,

- reconciled against on-chain data, and

- reviewed before submission.

Specialized crypto tax software is now standard, not optional, but it is treated as an assistant not an authority. Manual review remains essential for edge cases, especially across chains and protocols. What matters most in an audit scenario is not perfection, but reasonable methodology applied consistently.

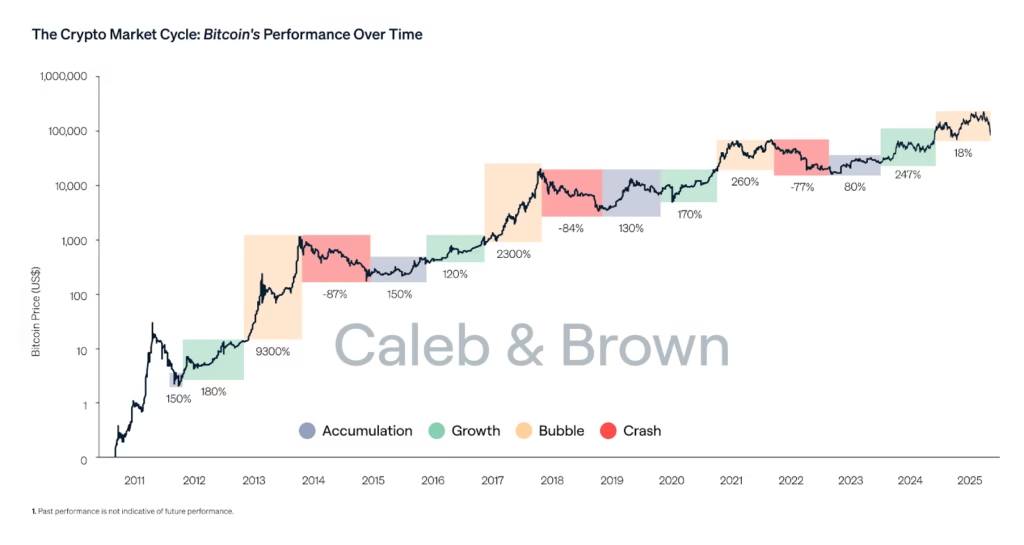

Managing Losses Without Emotional Bias

Losses are an inevitable part of crypto markets. Tax systems recognize this reality. When assets are sold below cost, losses may offset gains or be carried forward, depending on jurisdiction. Strategically realizing losses during downturns can materially reduce long-term tax exposure, but this should be driven by portfolio logic, not panic. Professionals plan exits with both market structure and tax impact in mind. The goal is not to avoid tax, but to avoid unnecessary tax.

Enforcement Reality in 2025

Tax authorities now assume access to:

- exchange-reported transaction data,

- wallet attribution via analytics, and

- cross-border reporting pipelines.

The enforcement model is increasingly automated. Discrepancies are flagged by systems long before a human reviews them. This shifts the risk profile. Under-reporting is no longer a gray area; it is a detectable anomaly. Voluntary correction remains far less costly than reactive defense.

Closing Perspective

Crypto taxation in 2025 is not about fear or punishment. It is about maturity. Digital assets have crossed the threshold into mainstream finance, and with that comes responsibility. Investors who integrate tax awareness into their trading, DeFi participation, and portfolio construction operate with a structural advantage. Those who ignore it are not rebellious, they are exposed. In a transparent financial system built on immutable ledgers, discipline is the only sustainable edge.

Related Articles

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level

- Blockchain interoperability 101: how cross‑chain bridges actually work and why they’re critical for crypto’s future

- How to build a balanced crypto portfolio that works in both brutal bear phases and euphoric bull runs (2025 blueprint)

- Gas fees explained: how rollups slash Ethereum transaction costs without sacrificing security

- Best Layer‑2 networks in 2025: Arbitrum, Optimism, zkSync and how they really compare