The Altcoin Awakening: Ethereum’s $4,700 Breakthrough

Tuesday’s crypto markets witness Ethereum surging past $4,700 with impressive 3.54% daily gains, leading a spectacular altcoin rally that has analysts declaring October the “last chance” for discounted digital assets. The world’s second largest cryptocurrency has delivered remarkable 80.78% gains over 90 days, approaching the crucial $5,000 milestone while institutional money floods Ethereum ETFs at record rates.

This altcoin revolution extends beyond Ethereum, with 90% of major cryptocurrencies posting gains and altcoin dominance climbing to 43% the highest since 2021. Analyst Virtual Bacon identifies six compelling reasons why October represents the final accumulation opportunity before the explosive altcoin season begins.

Ethereum breaks past $4,700 with 80% quarterly gains leading altcoin surge as analysts identify October as final window for discounted digital assets

Altcoin Revolution Metrics:

- Ethereum: $4,701 (+3.54% daily, +80.78% quarterly)

- Market Breadth: 90% of major altcoins gaining

- Altcoin Dominance: 43% (highest since 2021)

- ETF Momentum: $1.3B Ethereum ETF inflows past week

- Technical Signal: MACD bullish cross on altcoin market cap

Ethereum price chart showing surge and potential bounce areas around $4,100 and $4,300 cryptodnes

Ethereum’s Technical Breakout

Ethereum’s surge represents a decisive breakthrough above the descending channel pattern constraining price since August’s $4,956 highs. The breakout, with strong volume confirmation, suggests a new uptrend targeting a $5,000 psychological milestone.

Major resistance sits at $4,800 while support holds at $4,400 and $4,000. The ETH/BTC ratio strengthening to 0.0377 indicates Ethereum outperforming Bitcoin classic altcoin season development.

Record ETF Inflows: $1.3 Billion Institutional Surge

Ethereum’s surge coincides with an extraordinary $1.3 billion flowing into Ethereum ETFs over the past week. Grayscale’s Ethereum Staking ETF staked 32,000 ETH on Day One, while former BlackRock executives joined Ethereum treasury firms.

This institutional adoption represents recognition of Ethereum’s blockchain infrastructure value extending beyond currency into DeFi, smart contracts, and network upgrades.

BNB Hits All Time High Above $1,222

BNB achieves new ATH above $1,222, gaining 5% daily and 20% weekly, demonstrating Binance ecosystem strength. The exchange token’s record performance reflects developer activity growth and potential ETF speculation.

Close-up of a physical Binance Coin (BNB) depicting the cryptocurrency’s logo and design economictimes

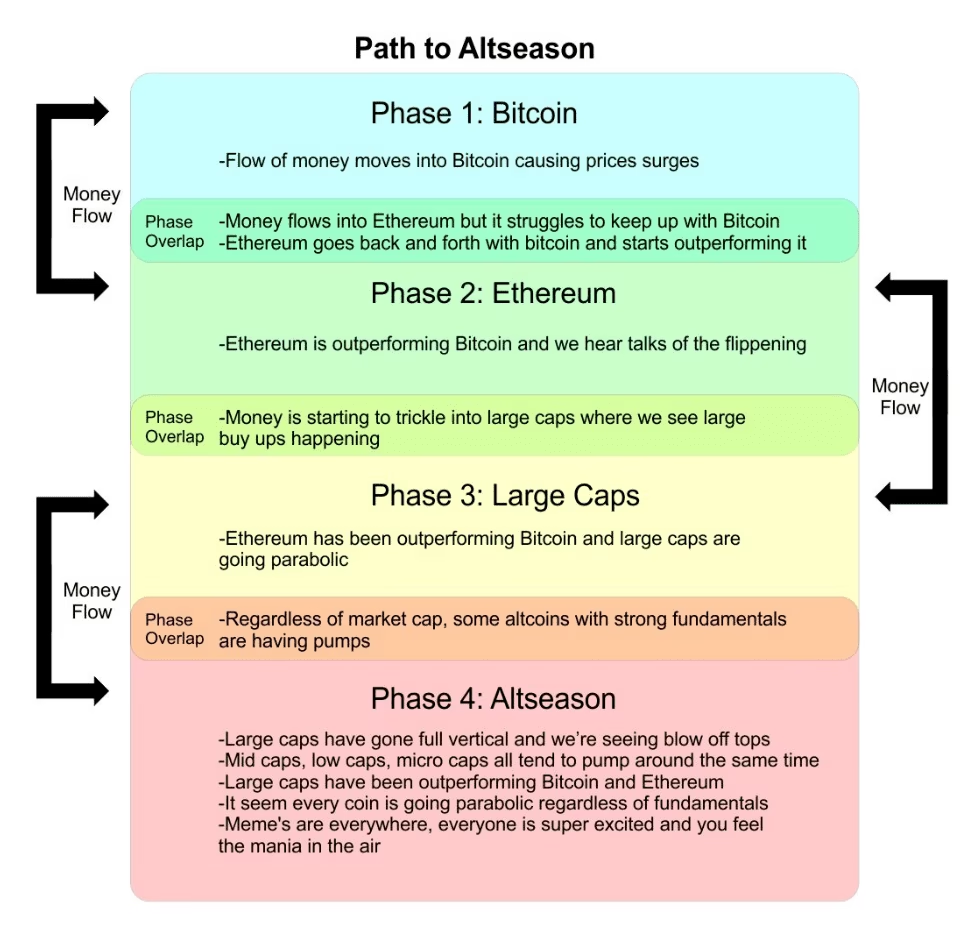

Six Pillars of Altseason 2025

Virtual Bacon’s analysis identifies why October represents the final accumulation window:

- October Pattern: Bitcoin’s 21.59% average October gains trigger altcoin rotation

- Momentum Transfer: 20%+ Bitcoin monthly gains lead to aggressive altcoin surges

- Technical Signal: MACD bullish cross on altcoin market cap charts

- Bitcoin ATH: New highs triggering institutional rotation

- Q4 Seasonality: Traditional altcoin outperformance period

- Smart Money: Accumulation phase before retail euphoria

Path to altseason chart showing phases from Bitcoin dominance to widespread altcoin market surge cryptomaniaks

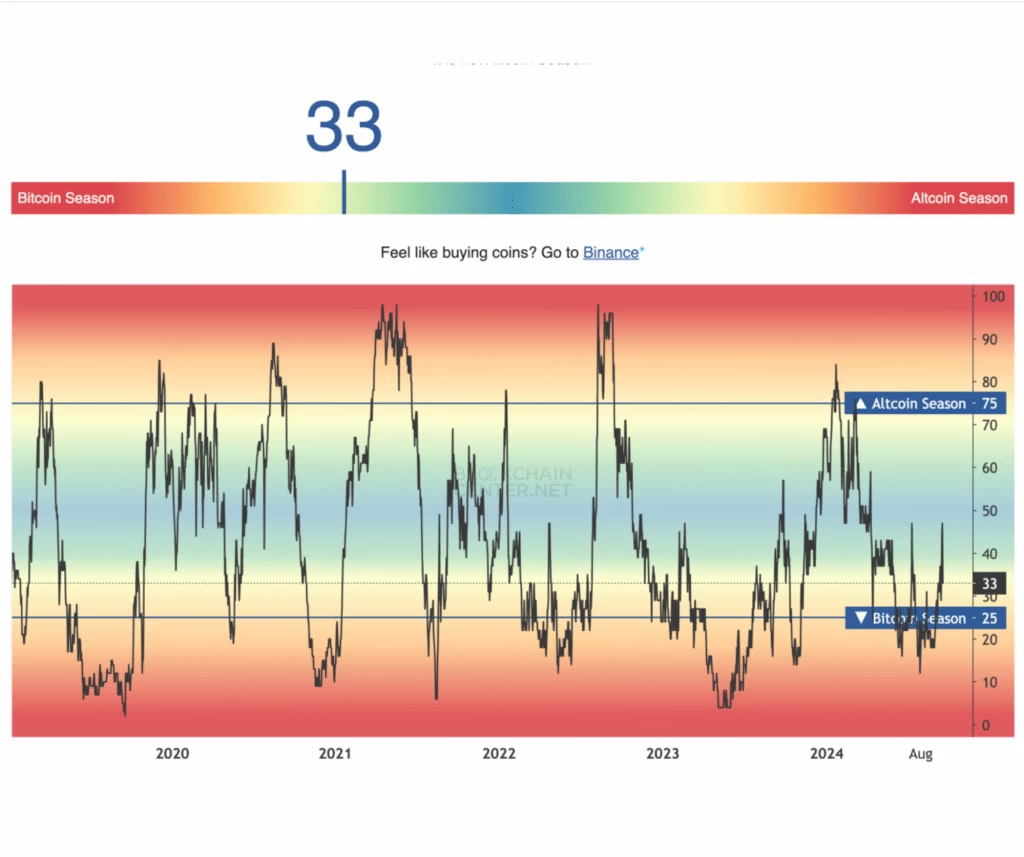

Altcoin Season Index Rising

Altcoin dominance climbs toward 43% highest since 2021 while total altcoin market cap exceeds $720 billion. Stablecoin market cap at $175 billion provides substantial rotation liquidity.

Market Indicators:

- TOTAL3 Market Cap: $720 billion altcoin valuation

- Stablecoin Liquidity: $175 billion available

- Trading Volume: $90+ billion weekly

Altcoin Season Index chart showing market cycles between Bitcoin and altcoin dominance from 2020 to 2024 b2binpay

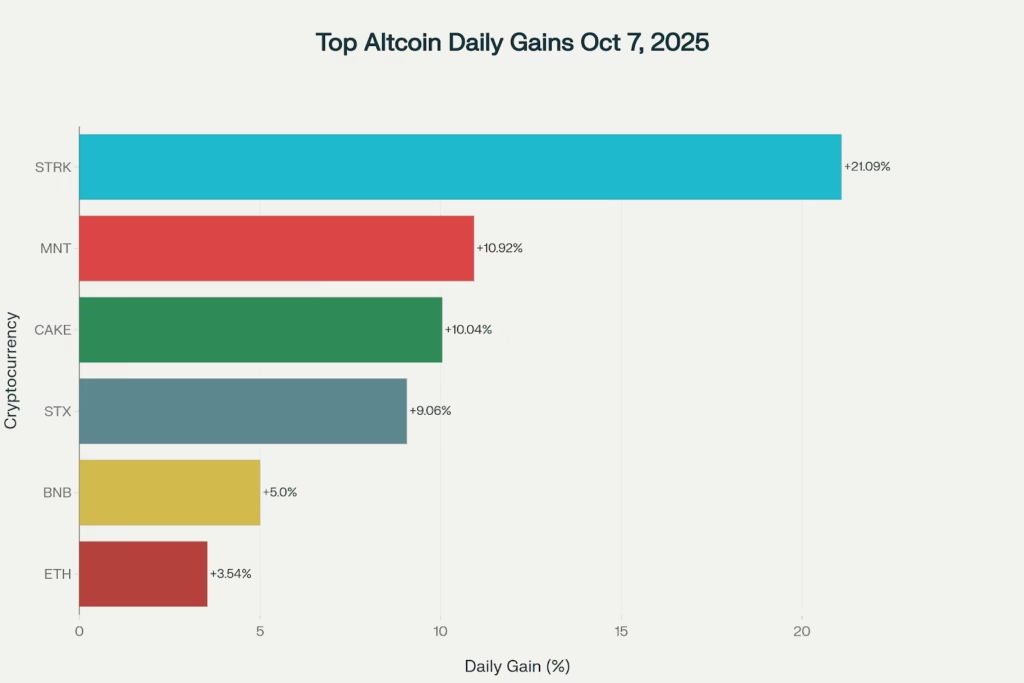

Sector Performance Leaders

Layer 1 protocols lead gains with Starknet (STRK) posting 21.09% daily gains and Mantle (MNT) up 10.92%. DeFi protocols show revival with PancakeSwap (CAKE) gaining 10.04%, while meme coins like Dogecoin add 5%.

Top Performers:

- STRK: +21.09% (layer-2 scaling)

- MNT: +10.92% (infrastructure)

- CAKE: +10.04% (DeFi revival)

- BNB: New ATH (exchange ecosystem)

Risk Factors

Despite bullish indicators, risks include Bitcoin dominance reassertion, profit taking at resistance levels, and government shutdown uncertainty. Some altcoins show overbought conditions requiring consolidation.

Key Risks:

- Bitcoin dominance could limit rotation

- Natural profit-taking pressure

- Macro uncertainty from shutdown

- Overbought technical conditions

Q4 Outlook: November Strength Ahead

November historically represents Bitcoin’s strongest month, creating a framework for continued altcoin strength. The convergence of seasonal patterns, institutional adoption, and technical breakouts suggests potential for the most significant altcoin season since 2021.

Final Call for Discounted Assets

Ethereum’s $4,700 surge leading broad altcoin rally signals potential altseason 2025 beginning. With 80% quarterly gains, record ETF inflows, and technical breakouts across cryptocurrencies, October may indeed represent the final opportunity for discounted digital asset accumulation.

The institutional infrastructure maturation, regulatory clarity, and adoption acceleration distinguish 2025’s cycle from previous speculative phases. As Ethereum approaches $5,000 and altcoin dominance reaches 2021 levels, the altcoin revolution appears ready to deliver its most explosive chapter yet.

Altcoin Revolution Summary:

- Ethereum: $4,701 (+80.78% quarterly) approaching $5,000

- Market Breadth: 90% altcoin participation, 43% dominance

- ETF Validation: $1.3B institutional inflows

- Final Window: October identified as last accumulation opportunity

- Q4 Setup: Traditional altcoin outperformance period ahead

Related Coverage: