A practical, developer- and investor-focused comparison (2025 edition)

Quick summary

Ethereum and Solana solve the same basic problem, running smart contracts, but they take different engineering routes. Ethereum prioritizes decentralization, security, and a massive developer ecosystem; Solana prioritizes throughput, low-cost transactions, and fast finality. For high-value DeFi and institutional builds, Ethereum remains the safer, more composable choice. For consumer apps, games, and microtransaction-heavy UIs, Solana offers compelling performance advantages. Many teams choose both: Ethereum for asset logic, Solana for UX.

What are smart contracts

Smart contracts are self-executing programs that run on blockchains and automatically enforce rules coded into them. They replace manual processes and intermediaries, think automated escrow, programmable tokens, or autonomous market makers and they form the backbone of DeFi, NFTs, and on-chain governance.

Platform snapshots: Ethereum and Solana

Ethereum (L1 + L2s)

- Launched: 2015

- Consensus (2025): Proof of Stake

- Primary language: Solidity (EVM-compatible toolchains)

- Typical L1 TPS: ~15 (massively scaled on L2s)

- Strengths: security, decentralization, largest dev ecosystem, rich tooling and composability.

- Trade-offs: L1 costs and UX complexity; reliance on Layer 2s for mainstream scaling.

Solana

- Launched: 2020

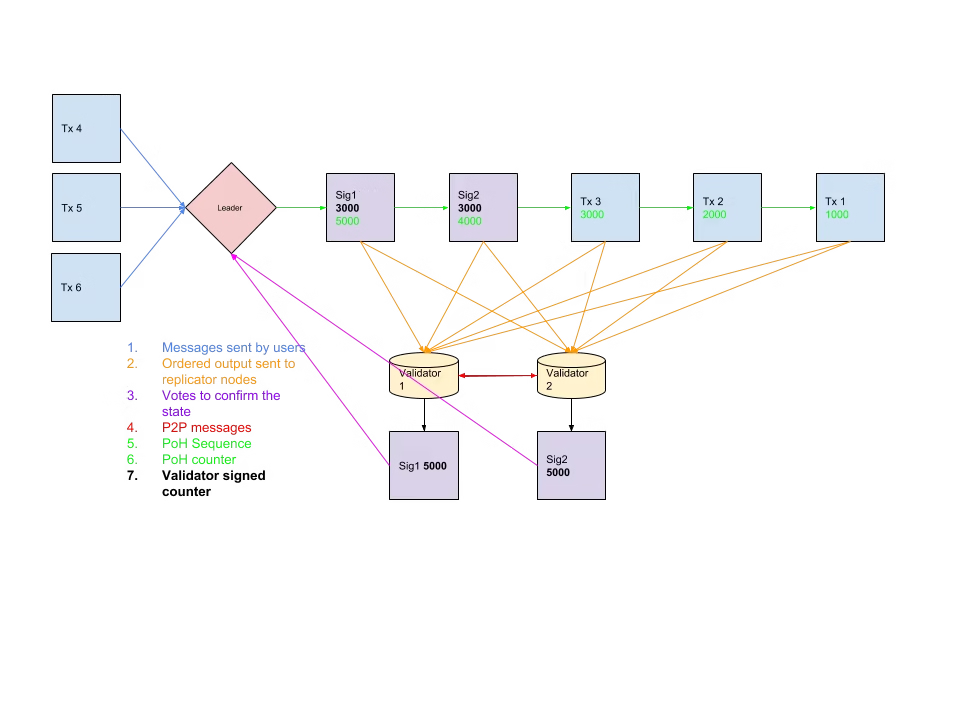

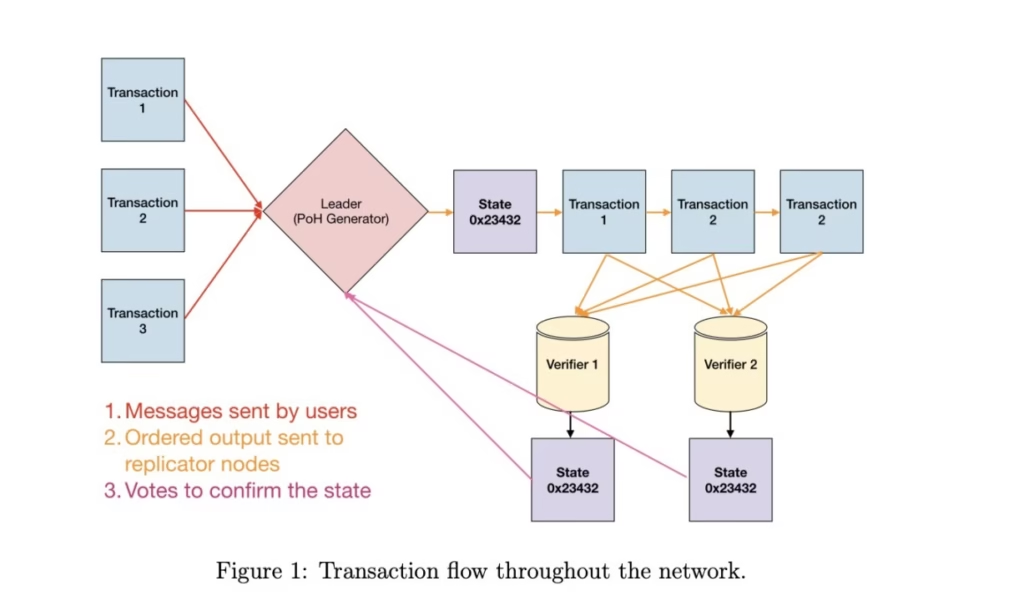

- Consensus (2025): Proof of History + Proof of Stake

- Primary language: Rust (also supports C, Move)

- Typical TPS: 2,000+ (real-world)

- Strengths: speed, low fees, instant finality, great for games, social, and microtransactions.

- Trade-offs: smaller ecosystem, historical outages (stability improving), Rust learning curve.

Developer experience

The developer journey differs meaningfully between the two chains.

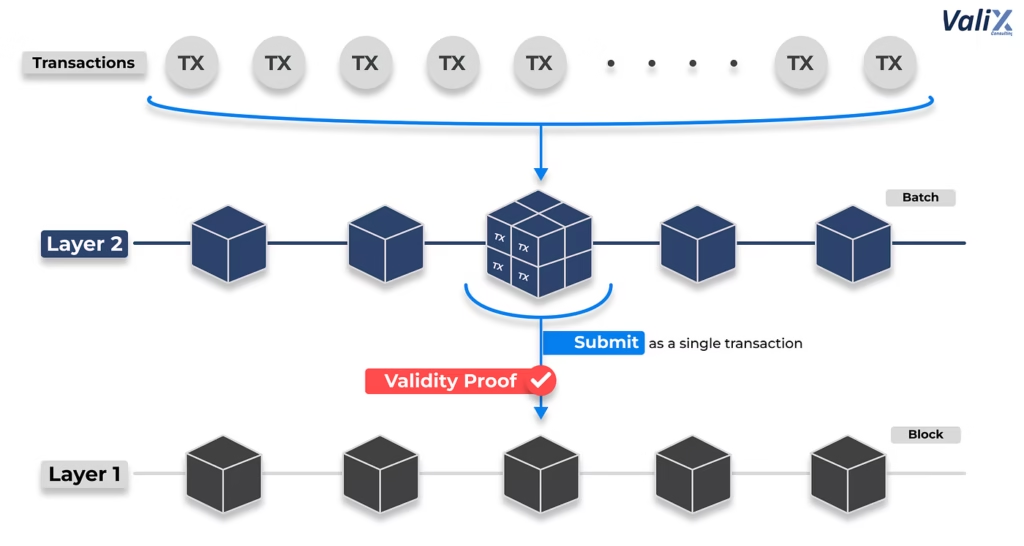

Ethereum offers an accessible onboarding path with mature tools: Hardhat, Foundry, Remix, Ethers.js, OpenZeppelin libraries, and a vast collection of tutorials. Solidity is domain-specific and beginner-friendly for many JavaScript-focused developers. Most new projects also consider Layer 2 networks (Arbitrum, Optimism, zkSync) to avoid L1 fees.

Solana leans into system-level performance. Its primary language Rust is powerful and safe but carries a steeper learning curve for teams used to JavaScript/TypeScript. Tooling like Anchor simplifies development, but the ecosystem is younger. Solana shines when an app needs high-frequency transactions or micro-payments.

Developer snapshot table (for embedding)

| Developer Feature | Ethereum | Solana |

| Tooling & Frameworks | Hardhat, Foundry, Remix, Truffle | Anchor, Solana CLI, Solana SDKs |

| Primary Language | Solidity (EVM) | Rust (also C, Move) |

| Common Wallets | MetaMask, WalletConnect, Coinbase Wallet | Phantom, Solflare, Sollet |

| Scaling Options | Layer-2 rollups (zkRollups, Optimistic) | Native high TPS, cross-chain bridges |

| Audit ecosystem | OpenZeppelin, ConsenSys Diligence, MythX | CertiK, Halborn, manual audits |

Fees, speed, and user UX: trade-offs that matter

Users care about speed and cost. Developers care about predictability.

- Ethereum L1: Lower TPS (~15) and potentially higher fees on mainnet. Layer 2s bring fees down to cents and finality faster, but introduce UX complexity (bridging, different networks).

- Solana: Ultra-low fees (microcents) and near-instant finality (~400ms) make it easy to build mobile-first, frictionless apps.

Verdict: For microtransactions, gaming, or high-frequency consumer apps, Solana is a natural fit. For high-value financial systems, composable protocols, and projects that prioritize decentralization, Ethereum’s ecosystem and security are superior.

Security and decentralization

Security isn’t only code: it’s the network, validators, and time-tested resilience.

- Ethereum: Very large validator set and long operational history; outages are rare. The L2 ecosystem inherits much of Ethereum’s security model via rollups.

- Solana: Fewer validators historically and incidents of downtime under stress. The team and ecosystem have delivered resilience improvements in 2024–2025, but some critics still flag centralization risks.

If your app handles significant financial value, prefer security-first architectures. Many teams deploy core asset logic on Ethereum and user-facing components on Solana or L2s.

Best use cases

| Use case | Best platform |

| High-value DeFi (lending, derivatives) | Ethereum |

| Institutional-grade tokenization | Ethereum |

| Blockchain games & NFTs with cheap minting | Solana |

| Microtransactions & social apps | Solana |

| Cross-chain UX (bridges, rollups) | Multi-chain (both) |

Many modern dApps adopt hybrid approaches: Ethereum for core assets and Solana for fast front-ends.

Interoperability:multi-chain futures

Cross-chain bridges and interoperability layers let projects leverage both ecosystems. Developers can mint or custody assets on Ethereum and mirror operations on Solana for UX-heavy interactions. But bridges have security trade-offs, any cross-chain movement introduces attack surfaces, so design carefully and minimize trust assumptions.

How to choose?

Ask these four questions:

- What’s the value at risk? High-value assets → favor Ethereum.

- Does the app need microtransactions? Yes → favor Solana.

- What’s your team’s language comfort? JS/Solidity → Ethereum; Systems/Rust → Solana.

- Do you need rapid UX scaling? Yes → Solana or Ethereum L2.

Often the pragmatic answer is “use both”: smart-contracts and assets on Ethereum; high-throughput interactions on Solana or L2s.

The near-term future (2025-beyond)

Ethereum’s roadmap focuses on rollup-centric scaling and improving developer UX, while Solana focuses on stability, mobile integrations, and consumer adoption. Expect more tooling to make multi-chain deployment easier, plus continued specialization: Ethereum for trust-minimized finance, Solana for consumer-scale experiences.

Final verdict: no single winner

Ethereum and Solana are complementary. Ethereum’s depth, composability, and security make it the default for complex financial products. Solana’s raw throughput and low fees make it ideal for user-facing, transaction-heavy applications. The wisest builders choose the platform that matches their product’s risk profile, user expectations, and team strengths, and increasingly, they build hybrid architectures that stitch both together.

Related Articles

- Cryptocurrency 101: a beginner’s guide to how digital money really works

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level safety tips

- Top 5 crypto wallets every new investor should consider in 2025

- DeFi explained: how decentralized finance is reshaping the future of money and traditional banking