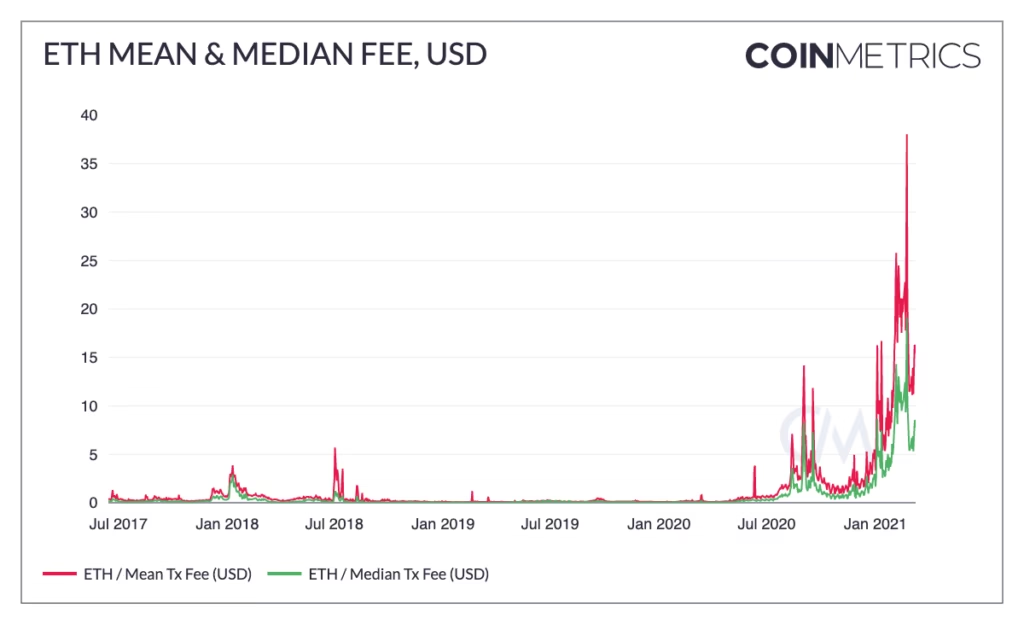

Gas fees have long been Ethereum’s most visible weakness. Anyone who has swapped tokens, minted NFTs, or interacted with DeFi during periods of congestion knows the pain: a simple transaction that should cost cents suddenly demands $20, $50, or even $200. These costs are not arbitrary, they emerge from Ethereum’s core design, where every computation competes for scarce blockspace.

For smaller traders and everyday users, this friction isn’t just annoying. It fundamentally changes behavior. High gas discourages experimentation, kills small trades, and forces users to wait on the sidelines until fees cool down. Over time, this bottleneck threatened Ethereum’s promise of open, global finance. That pressure is exactly what gave rise to rollups.

Why Ethereum Gas Fees Exist in the First Place

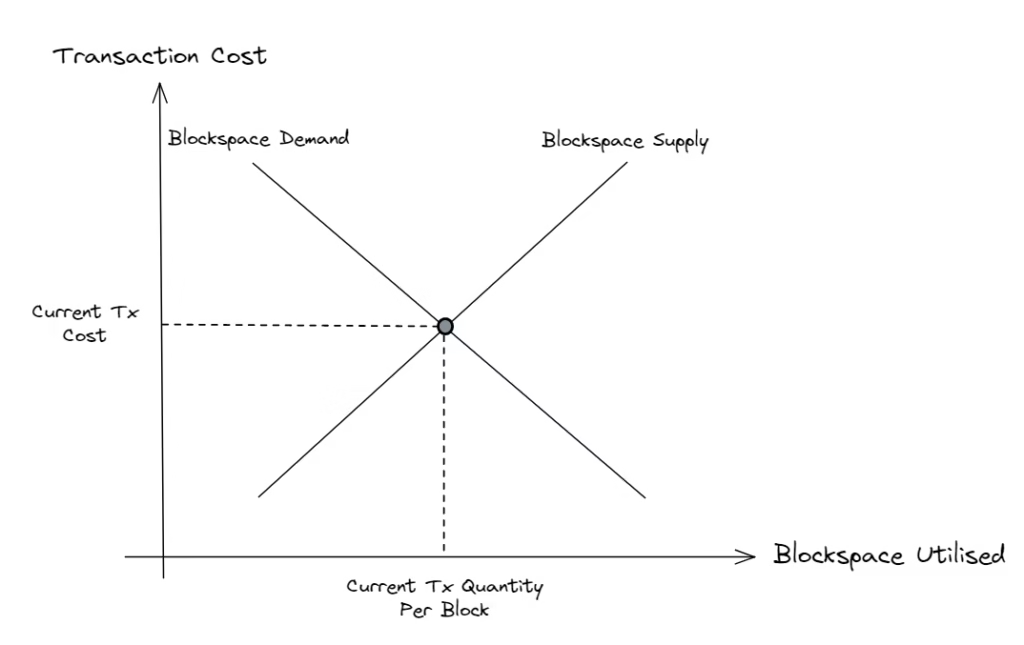

Ethereum gas fees are denominated in gwei, a tiny fraction of ETH. Every action on Ethereum sending ETH, interacting with a smart contract, swapping tokens, consumes computational resources. Gas is simply the pricing mechanism for that computation. When network demand is low, fees remain reasonable. But during moments of intense activity NFT launches, market volatility, DeFi incentives, users compete to get their transactions processed first. Validators prioritize higher-paying transactions, and gas prices skyrocket.

A Uniswap swap that might cost $3 during quiet periods can balloon to $75 when the mempool is full. For traders, that cost eats directly into profitability. For new users, it creates a psychological barrier: “Why should I pay more in fees than the amount I’m trading?”

Ethereum didn’t fail, it succeeded too well. And success exposed its limits.

Rollups: Ethereum’s Scaling Strategy in Practice

Rollups emerged as Ethereum’s most credible scaling solution because they don’t try to replace Ethereum. Instead, they work with it.

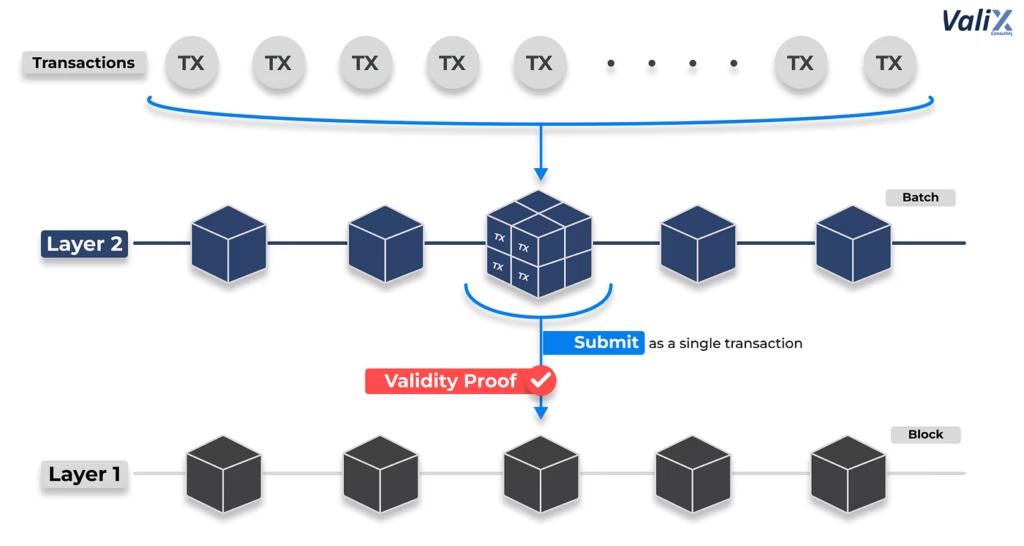

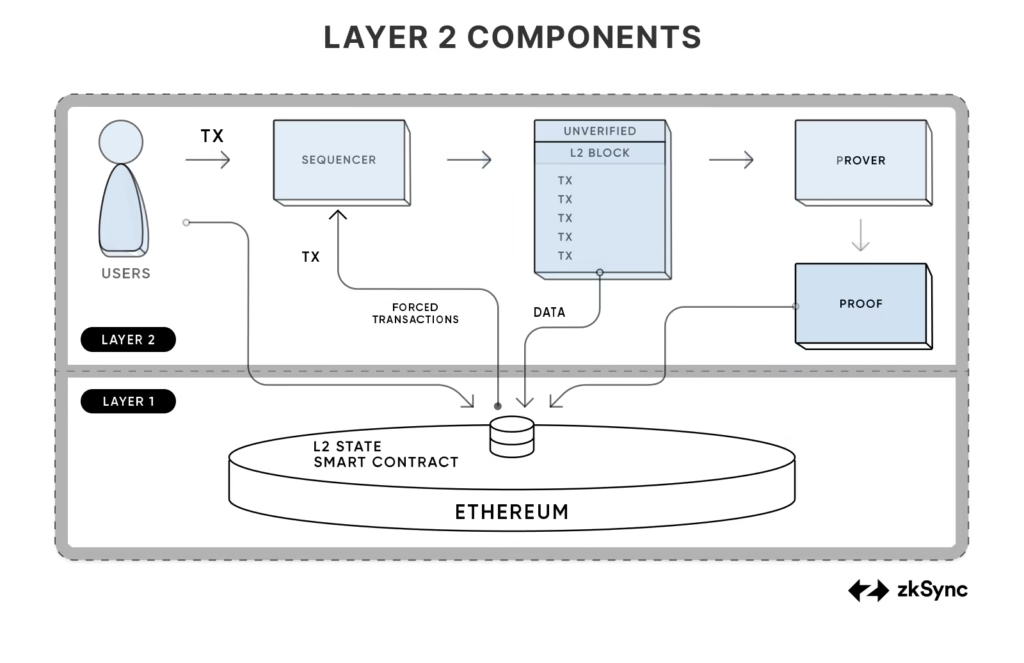

Rather than executing every transaction on Ethereum’s base layer, rollups process transactions off-chain and then submit a compressed summary back to Ethereum for settlement. Thousands of transactions are bundled together, sharing the cost of posting data on-chain.

This architectural shift changes everything.

In 2025, two rollup models dominate:

Optimistic Rollups

These assume transactions are valid unless proven otherwise. Fraud proofs can be submitted during a challenge window. Examples include Arbitrum, Optimism, and Base.

ZK-Rollups

These use cryptographic validity proofs to mathematically guarantee correctness before Ethereum accepts the batch. Examples include zkSync Era, Starknet, Polygon zkEVM, and Linea.

Both models slash costs often by 90% or more, while keeping Ethereum as the final source of truth.

Why Rollups Change Trading Economics

For traders, gas fees are not cosmetic, they shape strategy. When fees are high, only large trades make sense. Arbitrage becomes inefficient. Yield farming stops being worth the effort unless capital is massive. Rollups flip this dynamic. Lower transaction costs allow traders to rebalance frequently, compound yields, and deploy capital with precision. Smaller accounts regain relevance. Strategies that were impossible on mainnet suddenly become routine.

DeFi protocols followed quickly. Uniswap, Aave, Curve, Balancer, Synthetix, and many others now run natively on Layer 2s. Trading on Arbitrum or zkSync feels identical to Ethereum, but costs cents instead of dollars. In effect, rollups didn’t just reduce fees. They expanded who gets to participate.

The State of Rollup Adoption in 2025

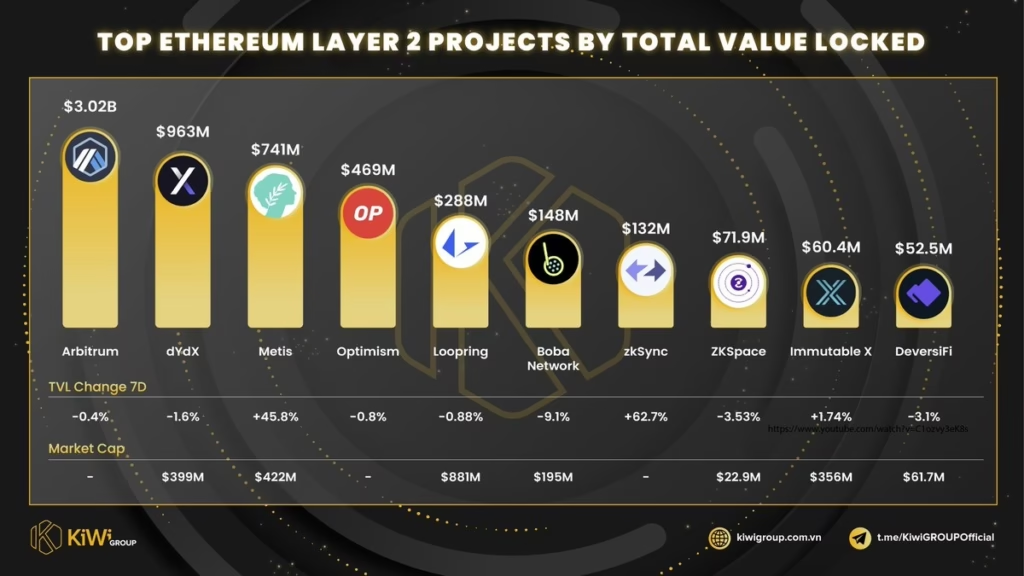

By mid-2025, rollups are no longer experimental, they are the default execution layer for Ethereum users.

Arbitrum leads in total value locked and liquidity depth, hosting some of the most active DeFi markets in crypto. Optimism’s OP Stack has evolved into an ecosystem of interoperable chains, most notably Coinbase’s Base, which onboarded millions of retail users.

ZK-rollups like zkSync Era and Polygon zkEVM have matured rapidly, offering near-instant finality and better UX through native account abstraction. Starknet, while technically demanding, attracts advanced applications requiring custom performance. Derivatives platforms like dYdX, Aevo, and Perpetual Protocol now operate entirely on L2s. A trader opening a $1,000 leveraged position may pay a few cents in fees instead of tens of dollars.

How Rollups Actually Reduce Costs

The cost reduction comes from shared execution. On Ethereum mainnet, every transaction is executed and verified independently by all nodes. On rollups, thousands of transactions are executed off-chain, then posted as a single compressed update to Ethereum. Ethereum verifies the batch, not each transaction. Think of it as shipping: instead of mailing 10,000 individual packages, rollups send one container. Everyone splits the cost. This dramatically reduces gas consumption per user and relieves pressure on Ethereum blockspace.

Security Trade-Offs

Rollups inherit Ethereum’s security, but they are not identical to mainnet.

Optimistic rollups introduce withdrawal delays due to fraud-proof windows, though fast-bridging services mitigate this. ZK-rollups eliminate delays but rely on complex cryptography that is still evolving.

Crucially, rollups are non-custodial. Users retain control of assets through their wallets. The primary risks lie in bridges, sequencers, and smart contract bugs, not in custody itself.

Security audits, decentralized sequencers, and Ethereum upgrades continue to reduce these risks over time.

Gas Fee Reality Check (2025)

| Action | Ethereum Mainnet | Arbitrum | zkSync Era | Optimism |

| ETH Transfer | $2–$8 | ~$0.01 | ~$0.005 | ~$0.02 |

| Token Swap | $12–$40 | ~$0.25 | ~$0.10 | ~$0.30 |

| NFT Mint | $30–$120 | ~$0.50 | ~$0.20 | ~$0.60 |

(Representative averages, Q2 2025)

Using Rollups Today Without Friction

Modern wallets support rollups by default. Bridging ETH or stablecoins takes minutes. DEXs, lending markets, and dashboards feel familiar. Gas tracking tools make cost optimization trivial. Once users experience DeFi without gas anxiety, going back to mainnet feels unnecessary.

Ethereum’s roadmap now assumes rollups handle execution. With EIP-4844 and blob data, rollup costs will fall even further pushing fees toward sub-cent territory. Ethereum becomes the settlement and security layer. Rollups become where life ensures. This separation is not a compromise, it’s an evolution.

Conclusion

Gas fees no longer need to gatekeep Ethereum. Rollups have transformed Ethereum from an expensive settlement network into a scalable, inclusive financial platform. For traders, this isn’t optional infrastructure, it’s a competitive advantage. Faster execution, lower costs, and better capital efficiency define the new baseline.

Related Articles

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level

- How real‑world assets (RWAs) on-chain are becoming crypto’s next trillion‑dollar narrative

- How to build a balanced crypto portfolio that works in both brutal bear phases and euphoric bull runs (2025 blueprint)

- Top 5 emerging Layer‑1 blockchains to watch closely in 2025

- Ultimate 2025 guide: how to protect your seed phrase from theft, fire, and family members

- Best Layer‑2 networks in 2025: Arbitrum, Optimism, zkSync and how they really compare