Securities and Futures Commission greenlights ChinaAMC Solana spot ETF for October 27 listing; Bitcoin consolidates above $112K as crypto whales pocket $17M in volatility profits

The Securities and Futures Commission (SFC) of Hong Kong officially approved the first Solana (SOL) spot exchange traded fund on Friday, October 25, 2025, marking a significant milestone for cryptocurrency investment products in Asia. Issued by ChinaAMC (Hong Kong), the ETF (ticker symbol: 03460) is scheduled to begin trading on the Hong Kong Stock Exchange (HKEX) on Monday, October 27, with a management fee of 0.99%.

The approval makes Solana the third cryptocurrency to receive spot ETF authorization in Hong Kong following Bitcoin and Ethereum, and represents the first such product globally for the high performance blockchain platform. The development underscores Hong Kong’s increasingly progressive approach to crypto asset regulation and positions the city as a leading hub for digital asset innovation in Asia.

Bitcoin Consolidates Above $112K on Weekend Trading

Bitcoin maintained its position above $112,000 on Saturday, October 26, trading at $112,723 up 0.94% over 24 hours and 1.6% for the week. The world’s largest cryptocurrency continues to show resilience following October’s historic $20 billion liquidation event, with traders cautiously rebuilding positions as volatility subsides.

Bitcoin recovers to $112,723 on weekend trading, up 1.6% for the week after mid week consolidation

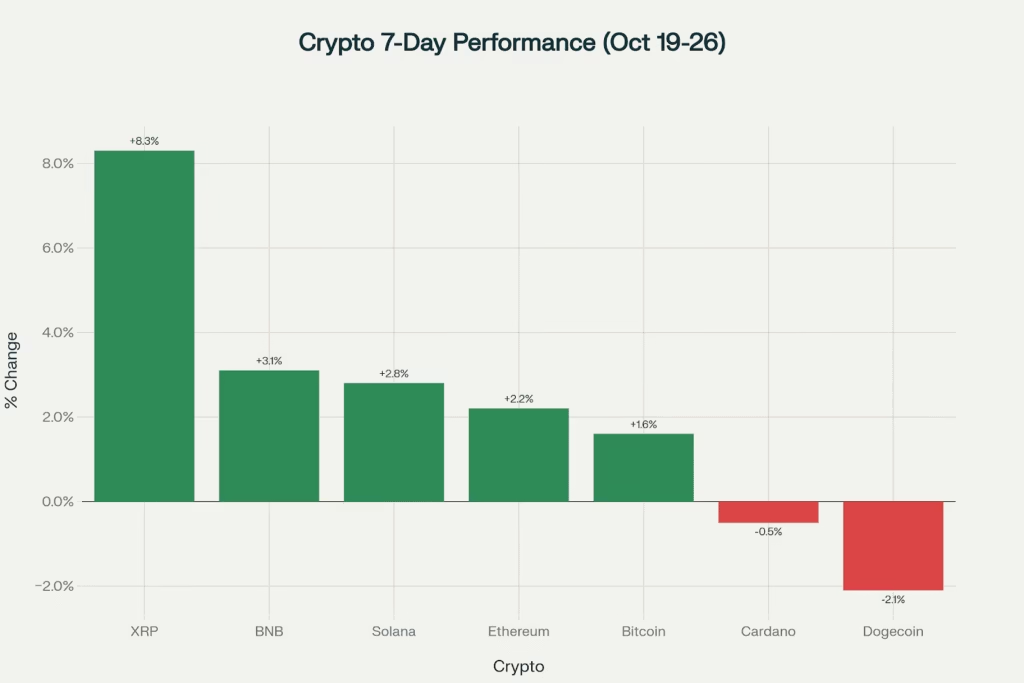

Ethereum posted stronger gains, climbing 1.45% to $4,007 and extending its weekly advance to 2.2%. Major altcoins displayed selective strength, with XRP leading the pack with a 4.60% daily gain to $2.66 and an impressive 8.3% weekly surge. Solana rose 1.25% to $196.18, BNB gained 1.48% to $1,131, while Cardano and Dogecoin lagged with modest declines.

Market Snapshot (October 26, 2025, 09:30 UTC):

- Bitcoin (BTC): $112,723, +0.94% (24h), +1.6% (weekly)

- Ethereum (ETH): $4,007, +1.45% (24h), +2.2% (weekly)

- Solana (SOL): $196.18, +1.25% (24h), +2.8% (weekly)

- XRP: $2.66, +4.60% (24h), +8.3% (weekly, leading major assets)

- BNB: $1,131, +1.48% (24h), +3.1% (weekly)

- Global Market Cap: $3.76 trillion, +0.15% (24h)

XRP leads major cryptocurrencies with 8.3% weekly gain as market shows selective strength across altcoins

The CoinDesk 20 Index, tracking the largest cryptocurrencies by market capitalization, edged higher on Saturday as traders showed renewed willingness to selectively add risk exposure. However, market sentiment remains cautious following the turbulent mid-October period that saw Bitcoin briefly dip below $105,000.

Hong Kong Solana ETF: Asia’s Crypto Innovation Leadership

The approval of Hong Kong’s first Solana ETF represents a strategic expansion of Asia’s cryptocurrency investment infrastructure and highlights the region’s willingness to embrace next-generation blockchain platforms beyond Bitcoin and Ethereum.

forbes

ChinaAMC Solana ETF Details:

- Issuer: ChinaAMC (Hong Kong), a subsidiary of China Asset Management Co.

- Ticker Symbol: 03460

- Listing Date: October 27, 2025 (Monday)

- Exchange: Hong Kong Stock Exchange (HKEX)

- Management Fee: 0.99% annually

- Asset Type: Solana (SOL) spot ETF (physically-backed)

- Regulatory Approval: Securities and Futures Commission (SFC) of Hong Kong

- Global Significance: World’s first Solana spot ETF, third crypto ETF in Hong Kong after BTC and ETH

The product launch follows Hong Kong’s January 2024 approval of spot Bitcoin and Ethereum ETFs, which established the regulatory framework for direct crypto asset exposure through traditional investment vehicles. The expansion to include Solana reflects growing institutional recognition of alternative Layer-1 blockchain platforms that offer different technological capabilities and use cases beyond Bitcoin’s store-of-value proposition and Ethereum’s smart contract dominance.

Solana has gained significant traction among institutional investors as a “liquidity proxy for risk-on sentiment,” according to market observers, with the blockchain’s high transaction throughput and low fees attracting developers and users in decentralized finance (DeFi), non-fungible tokens (NFTs), and Web3 applications.

“Solana continues to attract institutional flow and is increasingly treated as a liquidity proxy for risk-on sentiment,” noted analysis from CoinDesk. The cryptocurrency’s 5% weekly gain outperforming most major assets despite broader market caution suggests continued appetite for the platform among sophisticated investors.

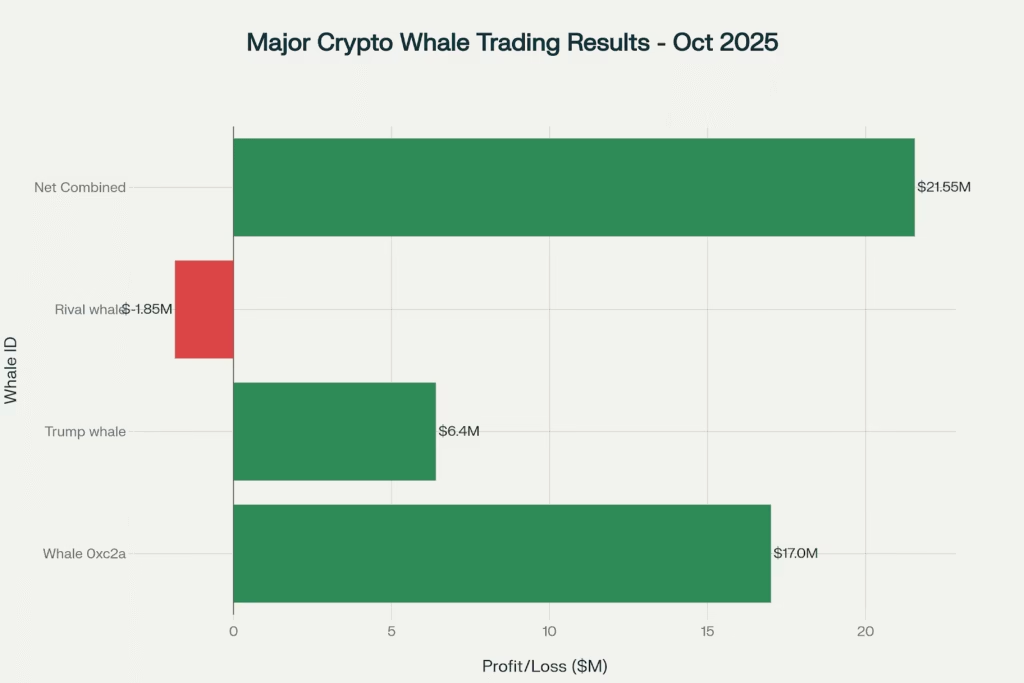

Crypto Whale Profits $17M Navigating October Volatility

A cryptocurrency trader identified as “0xc2a” secured approximately $17 million in profits from long positions on Bitcoin and Ethereum during October’s turbulent market conditions, according to blockchain intelligence firm Arkham Intelligence. The trader, classified as a “crypto whale” due to holding nearly $300 million in open long positions, strategically initiated positions just before last week’s market recovery.

Whale Trading Activity Summary:

- Trader Identification: 0xc2a (on chain address)

- Total Profit: ~$17 million (October 2025)

- Strategy: Long positions on Bitcoin and Ethereum

- Current Holdings: Nearly $300 million in long positions

- Timing: Positions opened before market recovery following Oct 10 liquidation event

- Win Rate: 100% (no documented losses since account inception)

- Market Impact: Demonstrates successful navigation of $20B liquidation volatility

The whale’s strategic positioning came after October 10’s massive market disruption, when over $20 billion in leveraged positions were liquidated following President Donald Trump’s announcement of a 100% tariff on Chinese imports. Bitcoin briefly fell below $105,000 during that event before recovering, creating opportunities for sophisticated traders anticipating a rebound.

Crypto whales collectively profit $21.55M navigating October volatility, with one trader earning $17M from strategic long positions

“This trader, often referred to as a ‘crypto whale,’ currently holds nearly $300 million in long positions. His strategic timing followed one of the most erratic periods in the crypto market,” Yahoo Finance reported. Blockchain analysis from Lookonchain revealed active portfolio adjustments synchronized with evolving market sentiment, contributing to the trader’s perfect win rate.

In contrast, another prominent whale faces a $1.85 million floating loss as Bitcoin prices approach liquidation thresholds, highlighting the substantial risks inherent in leveraged crypto trading during periods of heightened volatility. A Trump-linked whale also closed a $200 million Bitcoin short position for $6.4 million in profit before the recent price rebound, sparking discussions about potential market manipulation.

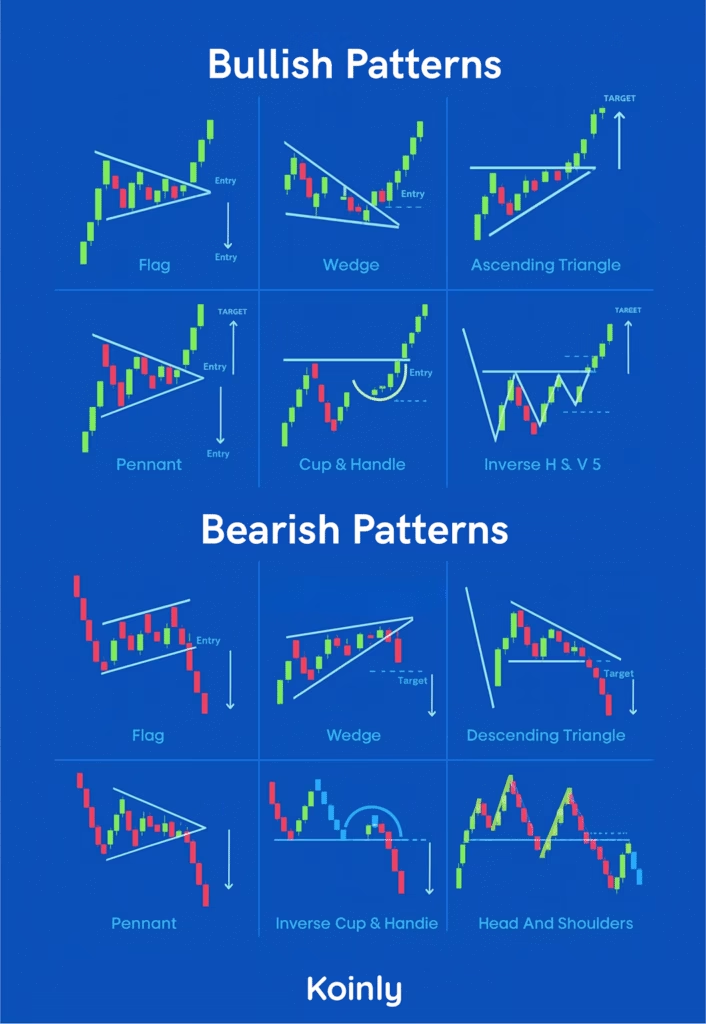

Technical Analysis: Path to New ATH Requires $115K Break

Bitcoin remains confined within a well-defined consolidation range bounded by its 100-day and 200-day moving averages, with the 200-day MA near $109,000 providing solid support and the 100-day MA around $115,000 acting as immediate resistance. The recent rebound from the $108,000 demand zone has pushed prices back toward the upper boundary of this structure.

Bitcoin Key Technical Levels:

- Current Price: $112,723

- Immediate Resistance: $115,000-$116,000 (100-day MA + institutional supply zone)

- Major Resistance: $120,000-$122,000 (liquidity pocket)

- All-Time High: $126,272 (October 6, 2025)

- Support Levels: $108,000 (accumulation zone), $104,000 (demand base)

- Critical Breakout Level: $115,000 decisive close required for bullish continuation

According to technical analysis from CryptoPotato, “a decisive close above [the $115K-$116K] level could open the path for a retest of the $120K-$122K liquidity pocket, followed by a potential revisit of the $126K all-time high”. Conversely, rejection from the 100 day moving average would likely prompt a pullback toward the $108,000 accumulation zone, which continues to serve as a high-liquidity demand base.

On the 4-hour timeframe, Bitcoin is trading within a symmetrical triangle pattern following its sharp recovery from the $102,000-$104,000 institutional demand zone. This compression pattern typically precedes a strong breakout, with current price action attempting to breach the upper trendline. However, failure to sustain above resistance could invite renewed downside pressure.

October’s “Uptober Dud” Heading for Final Week

Despite the recent stabilization, October 2025 is on track to deliver disappointing returns for cryptocurrency investors, breaking with the asset class’s historical tendency to post strong gains during the month. The period has been characterized by extreme volatility, massive liquidations, and uncertain macroeconomic signals that have dampened enthusiasm.

Market observers note that Bitcoin’s current consolidation represents a “dud” compared to the typically bullish “Uptober” seasonal pattern, with the asset still trading well below its early-October all-time high near $126,000. The final week of October will be critical in determining whether bulls can reclaim momentum heading into November, traditionally another strong month for crypto assets.

Traders appear selective in their risk-taking, focusing on assets with clear catalysts rather than broad-based accumulation. BNB’s 5% weekly rally followed renewed optimism around Binance after founder Changpeng Zhao received a pardon from U.S. President Donald Trump, removing a regulatory overhang that had weighed on the token since late 2023.

“This is a massive moment for the industry,” said David Namdar, CEO of CEA Industries, which holds one of the largest BNB treasuries. “We believe CZ’s pardon is more than an inflection point for him personally, but also for BNB and potentially for Binance, paving the way for greater access to the U.S. market”.

Selective Optimism Amid Macro Uncertainty

As October draws to a close, cryptocurrency markets display cautious optimism tempered by awareness of persistent macro headwinds. The Hong Kong Solana ETF approval provides a positive regulatory signal and expands institutional access to alternative blockchain platforms, potentially attracting fresh capital to the sector.

However, Bitcoin’s struggle to decisively break above $115,000 resistance suggests underlying hesitation among traders awaiting clearer directional signals. The successful navigation of October’s volatility by sophisticated whales demonstrates opportunities for skilled traders, but also highlights substantial risks for overleveraged participants.

For the week ahead, market participants will monitor Bitcoin’s ability to maintain support above $108,000 while testing resistance at $115,000. A confirmed breakout above this level could trigger momentum-driven buying toward $120,000, while failure to hold support may prompt another retest of the $104,000 demand zone established during October’s liquidation event.

Weekend Market Summary (October 26, 2025):

- Bitcoin: $112,723 (+0.94% daily, +1.6% weekly), consolidating between $108K-$115K

- Ethereum: $4,007 (+1.45% daily, +2.2% weekly), testing $4,000 psychological level

- Market Cap: $3.76 trillion (+0.15% daily), selective strength in major assets

- Top Gainer: XRP (+8.3% weekly), leading major cryptocurrencies

- Hong Kong ETF: First Solana spot ETF approved, listing October 27 (ticker: 03460)

- Whale Activity: $17M profit from strategic BTC/ETH longs amid October volatility

- Technical Setup: Bitcoin needs $115K break for path to new all-time high

Risk Considerations: Cryptocurrency investments involve substantial risk including potential loss of principal. Leveraged trading amplifies both gains and losses, with liquidation risk during volatile periods. Market participants should conduct thorough due diligence, understand technical support and resistance levels, monitor whale activity and institutional flows, and maintain appropriate risk management strategies. Past performance does not guarantee future results.