A Complete Beginner’s Guide Backed by Practical Expertise

Quick overview

Buying Bitcoin in 2025 is easier than ever, but doing it safely still requires care. With scams becoming more sophisticated and self-custody placing full responsibility on users, beginners need more than just a “buy button.” This guide walks you through what Bitcoin is, why people buy it, how to purchase it securely, how to store it properly, and how to avoid common (and costly) mistakes, whether you’re investing ₹1,000 or $10,000.

First things first: what exactly is Bitcoin?

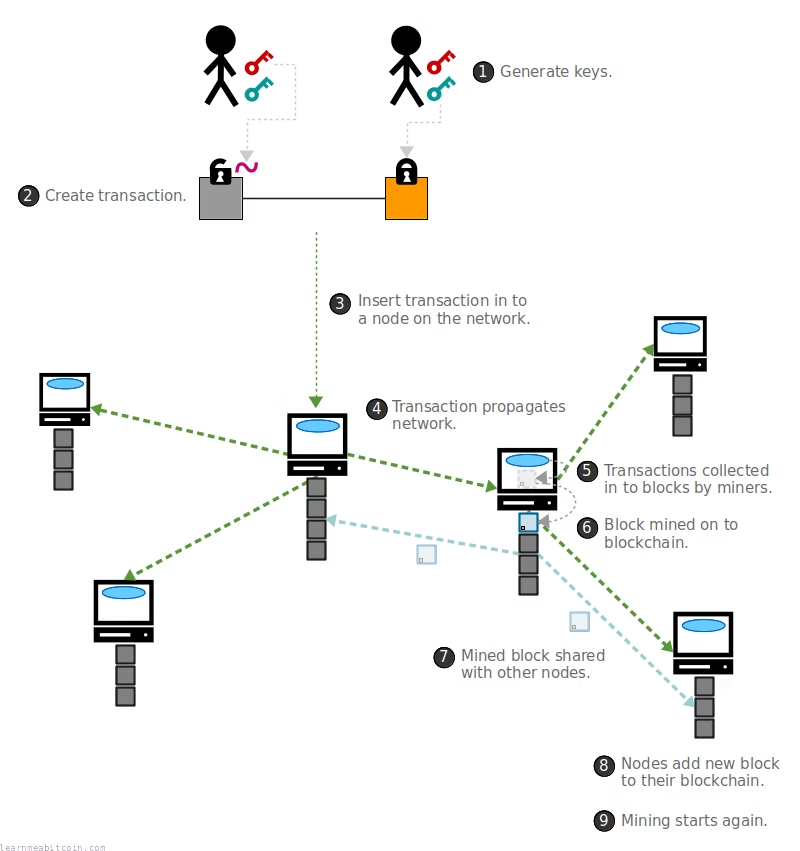

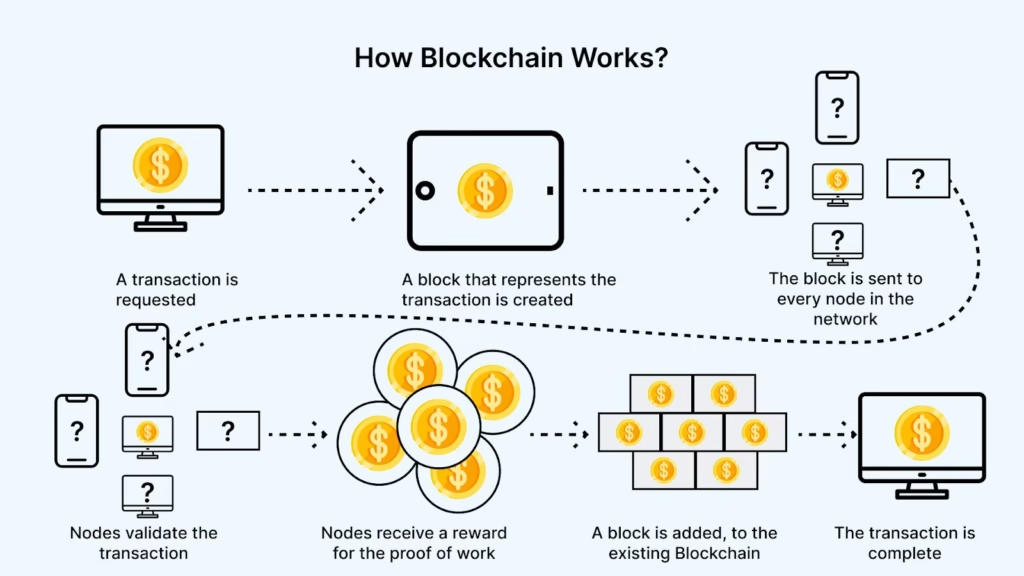

Bitcoin is a decentralised digital currency that operates without banks or governments. Instead of being printed, Bitcoin is issued according to code and verified by a global network of computers. Every transaction is recorded on a blockchain, a public, tamper-resistant ledger that anyone can inspect.

One feature sets Bitcoin apart: scarcity. Only 21 million bitcoins will ever exist. By 2025, more than 90% of that supply has already been mined. This limited supply is why many people compare Bitcoin to digital gold, scarce, difficult to produce, and increasingly valuable to those who trust the network.

Owning Bitcoin means controlling your money directly. There is no customer support line to reverse a mistake, which makes learning safe buying and storage practices essential.

Image source: Educational blockchain diagrams commonly published by Wikimedia Commons and open-license crypto learning resources.

Why people are buying Bitcoin in 2025

Bitcoin’s appeal is no longer niche. People buy it today for different, often overlapping, reasons:

- As a long-term investment with asymmetric upside

- As a hedge against currency debasement and inflation

- To send or receive borderless payments

- As income from Web3, freelancing, or remote work

- As an asset held by institutions, ETFs, and even governments

Despite broader adoption, one rule still applies universally: Bitcoin security is personal responsibility.

What you need before buying Bitcoin

Preparation is half of safety. Before buying even a small amount, make sure you have the following in place.

1. A secure personal device

Use your own phone or laptop only. Avoid shared or public computers. Keep your operating system updated and use basic antivirus protection. Advanced users may add a VPN for extra network privacy.

2. Understanding wallets (this is critical)

A Bitcoin wallet does not “store” coins, it stores private keys that give you access to your Bitcoin on the blockchain.

| Wallet type | Who controls keys | Best for | Risk level |

| Exchange (custodial) | Exchange | Beginners, trading | Medium–High |

| Mobile wallet | You | Daily use, small amounts | Medium |

| Hardware wallet | You | Long-term storage | Low |

Eventually, you should move Bitcoin to a non-custodial wallet where you control the keys.

3. Identity documents for KYC

Most regulated platforms require identity verification:

- Government ID

- Selfie or video verification

- Occasionally proof of address

This is legally required in many countries and reduces fraud risk.

Choosing the right platform to buy Bitcoin

Where you buy matters more than when you buy.

What to look for

- Security: 2FA, cold storage, transparency

- Compliance: Licensed or registered in your jurisdiction

- Usability: Clean interface, responsive support

- Fees: Clear trading fees and reasonable spreads

Beginner-friendly platforms focus on simplicity, while advanced exchanges offer lower fees and more control.

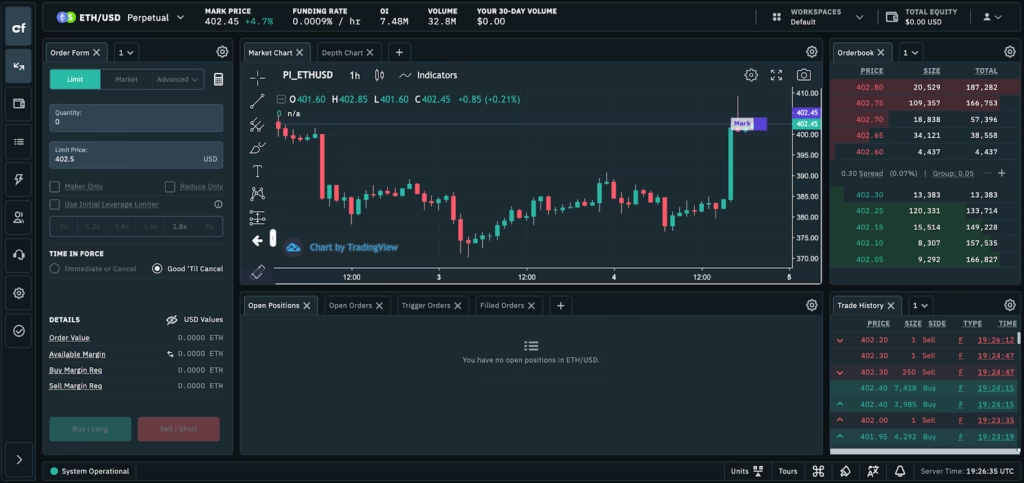

Image source: Screenshots and UI illustrations inspired by major exchanges’ educational blogs (Coinbase, Kraken, Binance Academy).

Funding your account in 2025

Most platforms support multiple deposit options:

| Method | Speed | Fees | Best use |

| Bank transfer (NEFT/SEPA/ACH) | Slow–Medium | Low | Large amounts |

| UPI / instant payments | Instant | Low | Small–medium buys |

| Debit/Credit card | Instant | High | Quick first buy |

| P2P escrow | Medium | Variable | Limited banking access |

Always test with a small deposit first.

Buying your first Bitcoin

Once funded, you’ll usually see two buying options:

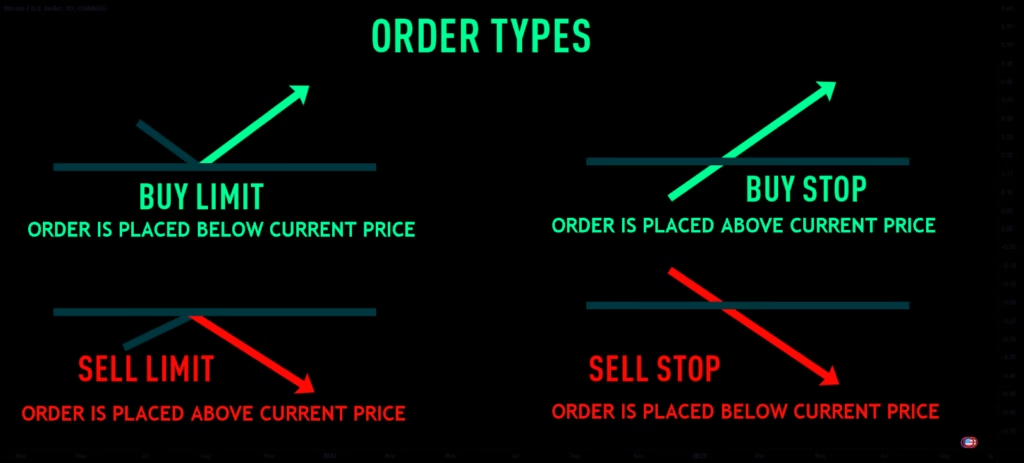

- Market order: Buys instantly at current price (simple)

- Limit order: Buys only if price hits your target (controlled)

You can buy fractions, owning 0.001 BTC is perfectly normal. Starting small builds confidence and reduces costly mistakes.

Image source: Screenshots and UI illustrations inspired by major exchanges’ educational blogs (Coinbase, Kraken, Binance Academy).

Storing Bitcoin safely (where most people fail)

Buying Bitcoin is easy. Keeping it safe is the real work.

Storage options

- Hot wallets: convenient, always online

- Cold wallets: offline hardware devices, highest security

- Paper/metal backups: physical recovery storage

Your recovery phrase (12–24 words) is the master key. Never store it digitally. Never share it. Ever.

Avoiding scams in 2025

Crypto scams evolve quickly. Watch for these red flags:

- Guaranteed or “risk-free” returns

- Links asking for your wallet recovery phrase

- Fake apps or cloned websites

- Romance or social-engineering scams

Bookmark official sites, enable 2FA, and slow down before every transfer.

Do you need to pay tax on Bitcoin?

In most countries, yes.

| Region | Typical treatment |

| United States | Capital gains tax |

| India | 30% flat tax + 1% TDS |

| Europe | Country-specific, MiCA aligned |

Keep records of every transaction. Use crypto tax tools if needed and consult a professional for compliance.

Expert advice for first-time buyers

- Use dollar-cost averaging (DCA)

- Avoid active trading early on

- Separate crypto funds from essential savings

- Test withdrawals and wallets with small amounts

- Keep learning, calmly and critically

Final thoughts

Buying Bitcoin in 2025 isn’t about speed, it’s about discipline. The tools are better, the ecosystem is larger, but responsibility still sits with the user. Start small, stay secure, and treat Bitcoin not as a shortcut to wealth, but as a long-term financial skill.