The Quiet Skill That Decides Whether Crypto Makes You Free or Broke

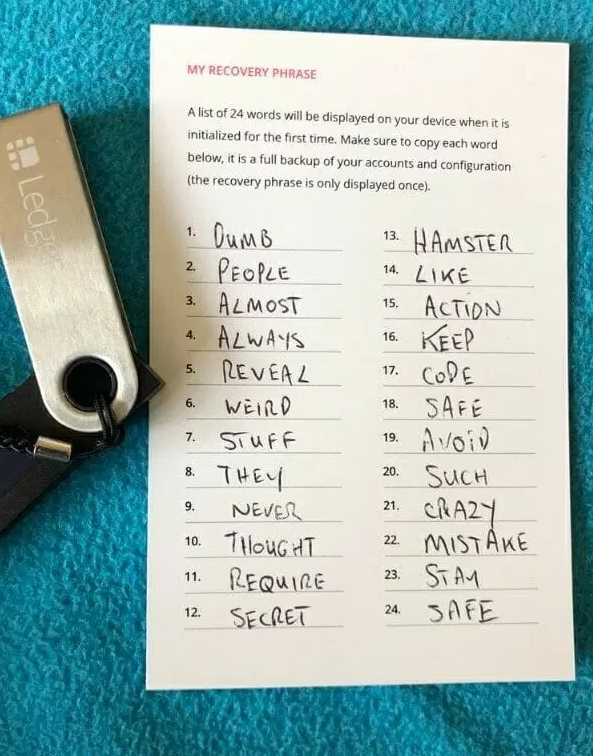

In crypto, everything looks modern. Wallet apps feel smooth. Blockchains feel futuristic. Even the language sounds advanced. Yet the single most important element of this entire system is painfully low-tech: a list of words written down somewhere.

That contrast is exactly why people get this wrong.

By 2025, more people than ever are holding crypto long-term. Some see it as savings, some as insurance, some as belief in a different financial future. But regardless of why you hold crypto, your relationship with it is defined by one thing alone: how well you protect your seed phrase.

This isn’t about fear. It’s about realism.

The Seed Phrase Is Not a Backup, It Is the Asset

Most beginners think of the seed phrase as a spare key. Something you might need one day if your phone breaks. That misunderstanding is the root of almost every self-custody disaster.

The wallet app is replaceable.

The device is replaceable.

The seed phrase is not.

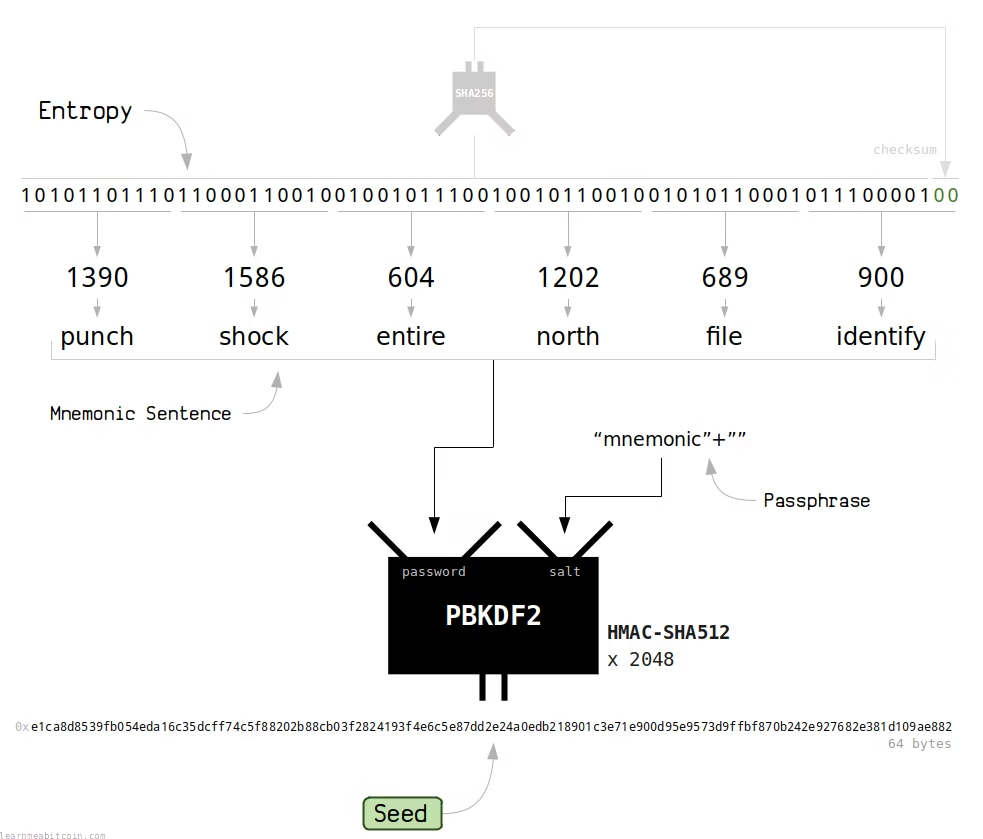

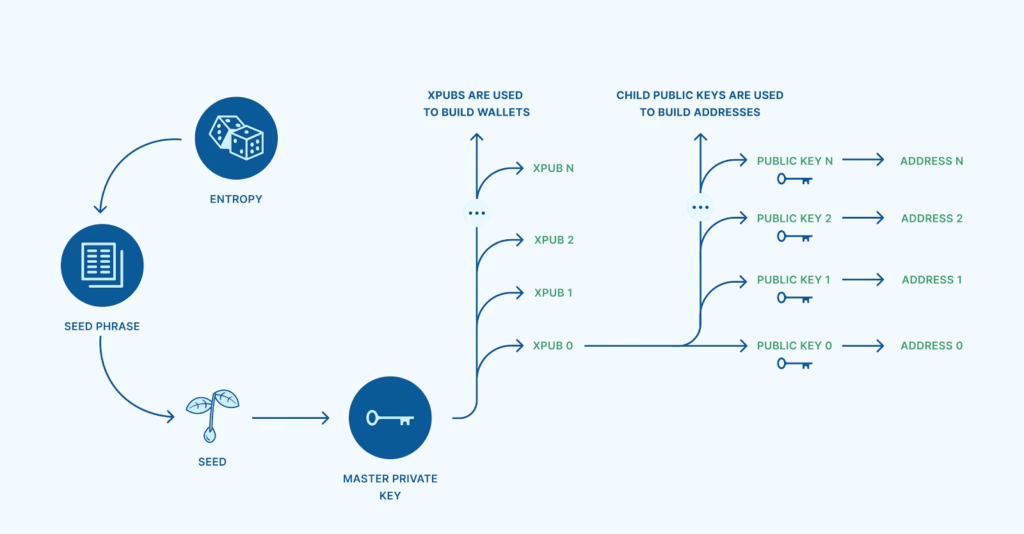

Those 12 or 24 words mathematically generate every private key your wallet will ever use. Whoever has them doesn’t need your permission, your phone, or your fingerprint. They simply recreate your wallet elsewhere and take everything.

There’s no alert. No reversal. No regret window.

Once you understand this, the rest of the security conversation changes tone. This stops being about convenience and starts being about responsibility.

Why “Just Saving It Digitally” Fails So Often

People don’t store seed phrases digitally because they’re careless. They do it because it feels sensible. Notes apps sync. Cloud drives back up automatically. Password managers promise encryption.

The problem is not whether these tools are “secure enough.”

The problem is exposure.

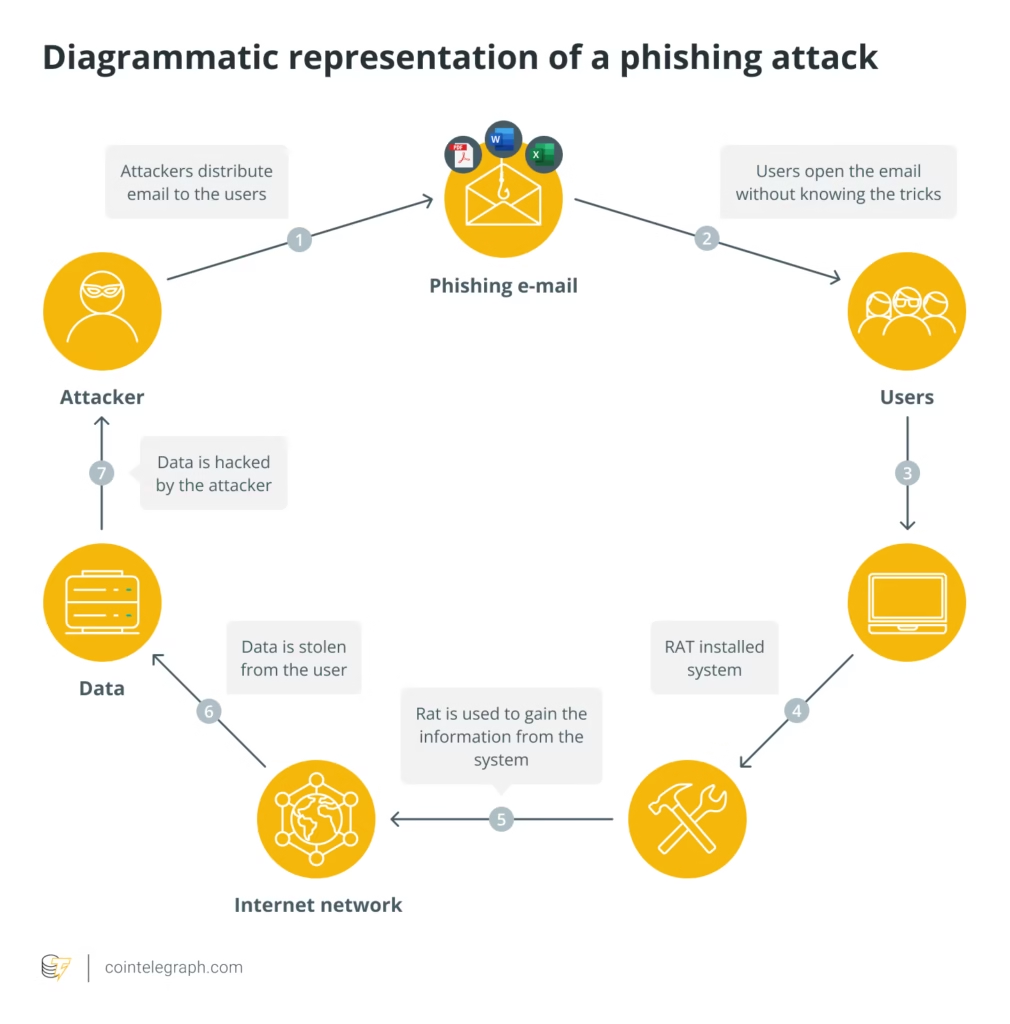

Any device that touches the internet lives in an environment where:

- Malware evolves constantly

- Phishing is indistinguishable from real interfaces

- Browser extensions overreach

- Clipboard data leaks silently

Most wallet drains don’t happen dramatically. There’s no explosion. Funds just move while the owner is asleep, at work, or busy living life.

Digital storage turns a permanent key into a temporary secret. That mismatch is fatal.

Paper: A Step Forward, But Not a Destination

Writing your seed phrase on paper is often recommended, and for good reason: it disconnects your keys from the internet. That alone blocks entire categories of attack.

But paper has a quiet enemy: time.

Ink fades. Paper tears. Fires don’t care how careful you were. Floods don’t respect intentions. People move houses. Parents clean drawers. Old notebooks get thrown away.

Paper works for experimentation. It does not work well for assets meant to outlive hardware cycles and market cycles.

Crypto is designed for decades. Paper rarely survives them.

Why Metal Backups Changed the Conversation

The move toward metal backups wasn’t driven by paranoia. It was driven by experience.

People lost wallets not because hackers were brilliant, but because life happened. Fires. Floods. Accidents. Moves. Forgetfulness.

Metal backups solve a boring but crucial problem: durability.

Stainless steel doesn’t rot.

It doesn’t burn at household fire temperatures.

It doesn’t fade or crumble.

The point isn’t luxury. It’s alignment. If your assets are permanent and digital, your backup should be permanent and physical.

Where You Store It Matters More Than You Think

Many people obsess over how to store their seed phrase and give almost no thought to where it ends up.

That’s a mistake.

Threats are rarely cinematic. They’re mundane. A guest opens a drawer. A repair worker notices a safe. A relative stumbles across a labeled envelope.

Good storage locations share three traits:

- They don’t look important

- They don’t centralize risk

- They don’t rely on secrecy alone

Some people split phrases. Others distribute copies geographically. What matters is resilience. One accident shouldn’t erase everything.

Security that collapses from a single mistake isn’t security.

Obfuscation Can Help, Until It Hurts

Hiding a seed phrase inside a system only you understand can be effective. It can also be dangerous.

Over time, memory degrades. Stress changes how you think. Illness, emergencies, or even simple aging can turn clever systems into locked doors.

The best obfuscation methods are boring:

- Easy to explain

- Easy to reconstruct

- Hard for outsiders to notice

If your future self needs a diagram and perfect recall to recover funds, the system is already failing.

The Question No One Wants to Ask: What Happens If You’re Gone?

Self-custody has a dark side few talk about. Perfect security can become a permanent loss.

If no one can access your crypto after you’re gone, it doesn’t pass on. It disappears.

Inheritance planning isn’t about handing over keys today. It’s about designing a recovery path that activates under specific conditions. Legal instructions, multisignature wallets, trusted intermediaries, there are many approaches.

What matters is intent. Crypto should not die with its owner simply because no one planned for continuity.

A Practical Mental Model for 2025

Instead of rules, think in principles:

- Offline

- Durable

- Redundant

- Distributed

- Understandable

- Reviewable

Security is not something you “set and forget.” It evolves as your holdings grow and your life changes.

This Is the Cost of Owning Your Money

Crypto removes banks, support desks, and intermediaries. What it gives you instead is direct responsibility.

Your seed phrase is not just technical data. It is authority, ownership, and accountability condensed into a few words.

Handle it casually, and the system will punish you without warning.

Handle it deliberately, and you gain a level of financial control that few humans in history have ever had.

In 2025, seed phrase security isn’t advanced knowledge.

It’s literacy.

And like all literacy, it quietly separates those who survive from those who don’t.

Related Articles

- Crypto taxes made simple: how to report, calculate, and file your crypto gains without costly mistakes

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level

- Beginner’s guide: how to earn real passive income from DeFi lending without blowing up your capital

- 10 common crypto scams and exactly how to avoid losing your money to them

- Web3 decoded: what it is, why it matters, and how you can start participating today

- Ethereum vs Solana: which smart contract platform really wins on speed, cost, and ecosystem strength?