Custody, Exchange Insolvency, and the Reality of Legal Protection in Digital Asset Markets

By 2025, cryptocurrency markets have reached institutional scale, yet investor protection remains uneven, jurisdiction-dependent, and often misunderstood. The failures of centralized platforms over the last few years did more than wipe out capital, they exposed a fundamental gap between technical ownership and legal ownership of digital assets.

For many investors, the realization came too late: holding crypto on an exchange does not necessarily mean owning it in the eyes of the law. As courts, regulators, and legislators attempt to catch up, a cleare, but still incomplete framework for investor rights is beginning to take shape. Understanding this framework is now essential for anyone participating in crypto markets beyond casual speculation.

Why Investor Rights in Crypto Are Structurally Different

Traditional finance is built on layers of investor protection. Custodial segregation, deposit insurance, trustee obligations, and well-defined bankruptcy hierarchies ensure that ownership rights are clearly preserved even when institutions fail. Crypto, by contrast, evolved in an environment where speed of innovation outpaced legal definition.

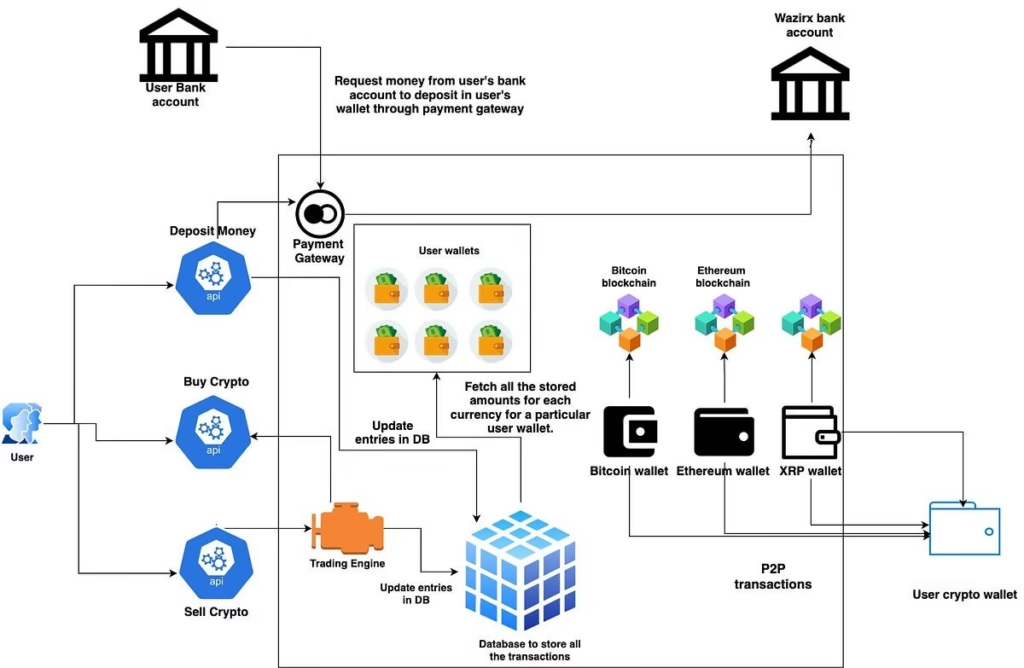

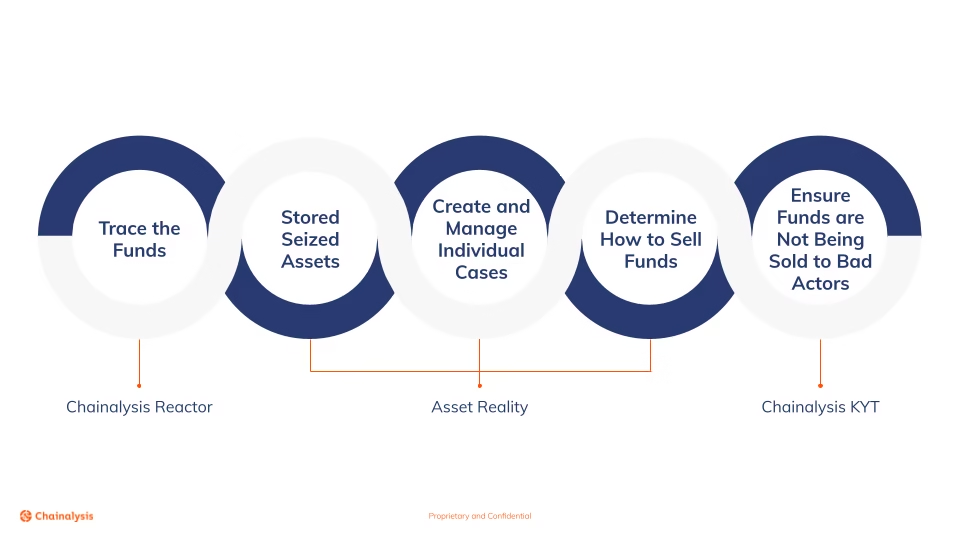

In early crypto markets, exchanges often blurred the line between custodian, broker, lender, and market maker. User assets were pooled, rehypothecated, or deployed for yield without clear disclosure. When those platforms collapsed, courts were forced to answer a question that had rarely been tested: are customer crypto assets property held in trust, or liabilities owed by a failed company?

The answer, as many investors learned painfully, depended on contracts, jurisdiction, and regulatory status, not on blockchain transparency.

Custody in Crypto: Control, Ownership, and Legal Reality

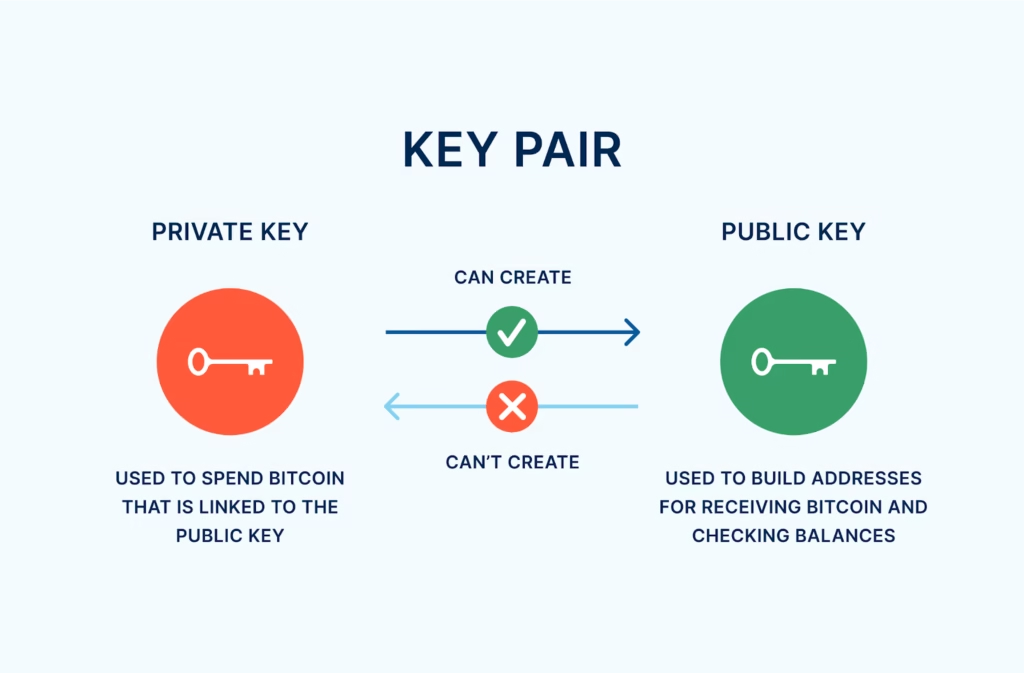

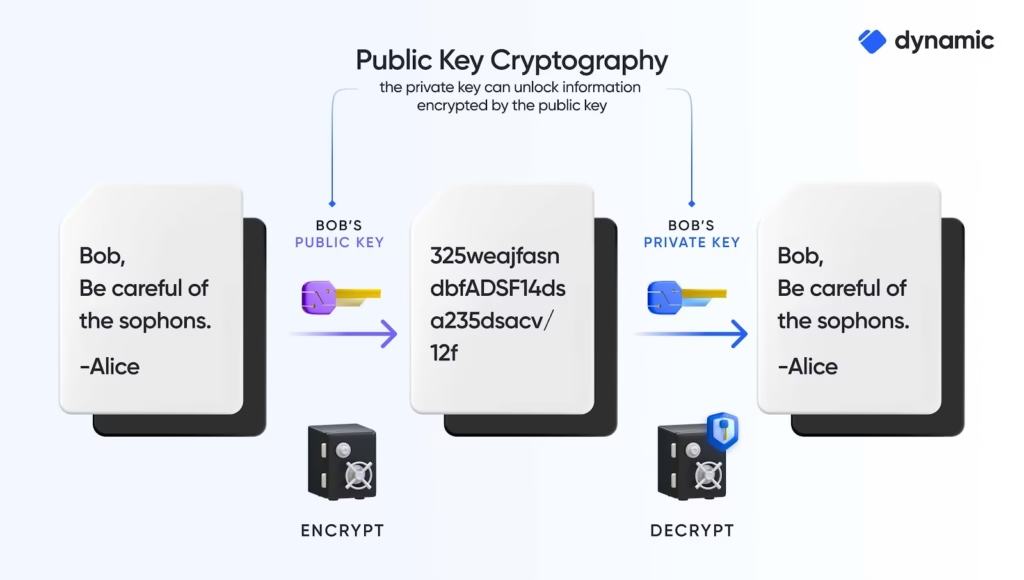

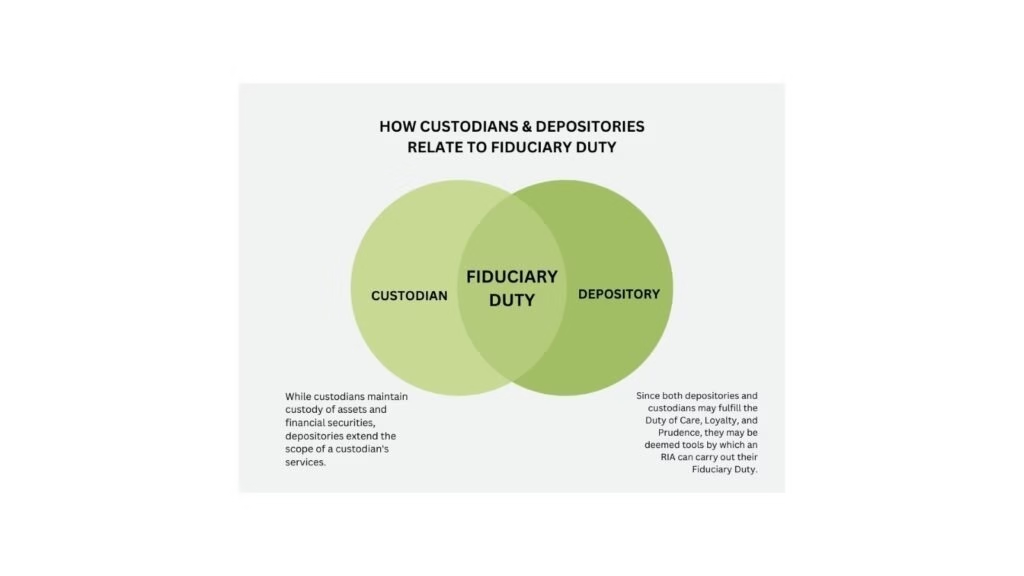

Crypto custody is often discussed in technical terms private keys, wallets, and signing authority, but the legal dimension is just as important. From a rights perspective, custody determines whether you are an asset owner or merely a creditor.

When assets are held in self-custody, ownership is clear. The private key confers control, and there is no intermediary whose failure can legally impair your claim. Once assets move to a third-party platform, however, ownership becomes conditional on contractual language and regulatory oversight.

In many pre-2023 exchange models, customer crypto was not held in trust. Instead, it was commingled with corporate funds, allowing platforms to deploy it for lending or trading. In insolvency proceedings, this structure placed users at the bottom of the recovery hierarchy.

The lesson emerging from court rulings is unambiguous: technical possession does not equal legal ownership. Only explicitly segregated custody arrangements backed by enforceable legal frameworks offer meaningful protection in failure scenarios.

Exchange Insolvency: What Actually Happens When Platforms Collapse

Exchange insolvency is no longer a hypothetical risk; it is a recurring feature of crypto market cycles. When a platform fails, access to funds is typically frozen immediately, followed by a long legal process that prioritizes claims according to national bankruptcy law.

In most cases, retail users discover that their status is closer to unsecured creditors than asset owners. Recovery timelines can stretch into years, and distributions if they occur at all are often partial, delayed, and denominated in fiat rather than crypto.

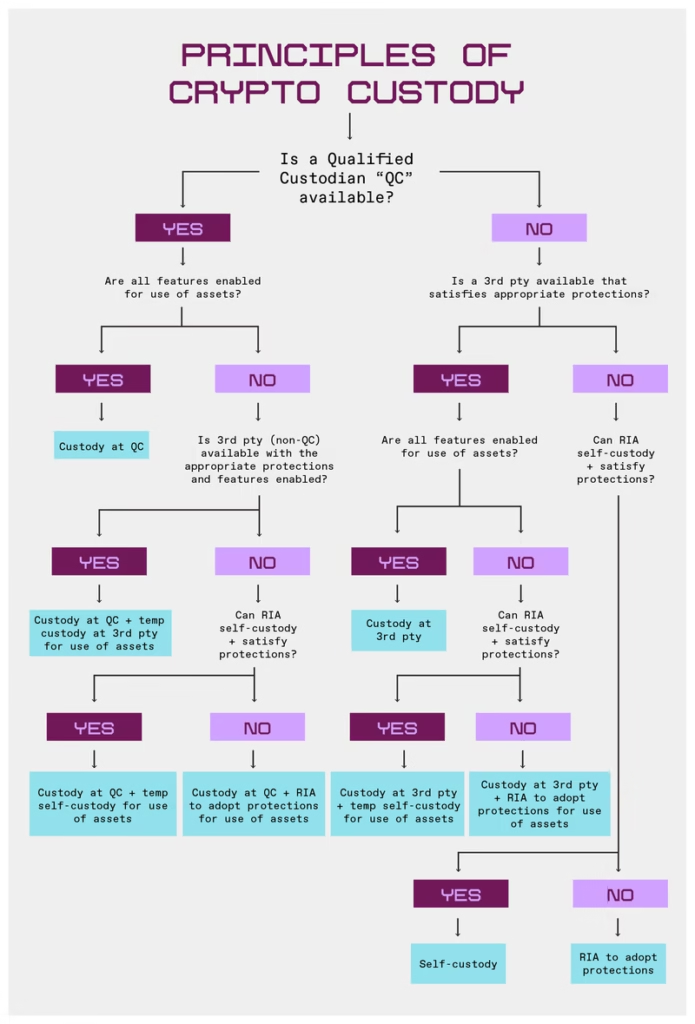

Jurisdiction plays a decisive role. Some legal systems increasingly recognize crypto held in custody as trust property, while others still treat it as contractual debt. The distinction determines whether customer assets are excluded from bankruptcy estates or absorbed into them.

For investors, this reality means that platform selection is no longer just about fees or liquidity, it is a legal risk decision with long-term consequences.

Regulatory Protections Taking Shape in 2025

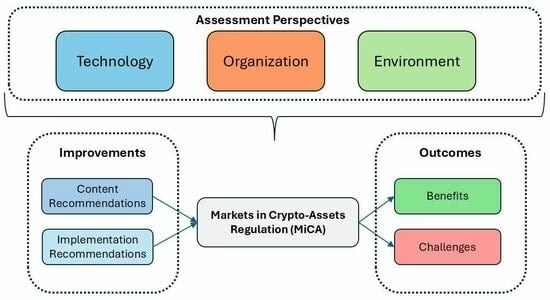

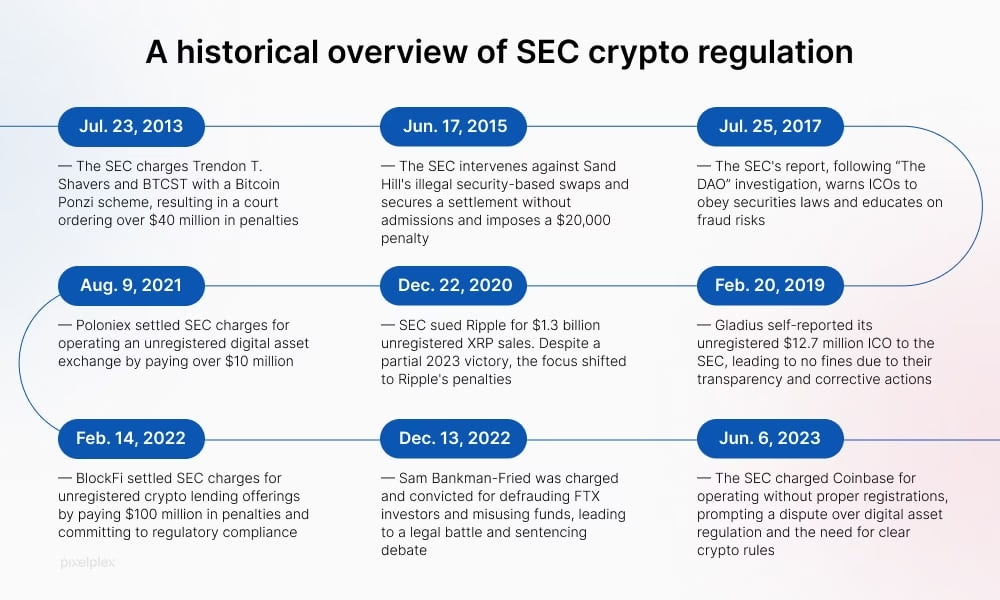

After years of reactive enforcement, regulators are finally embedding investor protection into formal crypto frameworks. The changes unfolding in 2024-2025 represent the first serious attempt to align crypto custody with traditional fiduciary standards.

In Europe, comprehensive regulation now requires licensed providers to segregate client assets, maintain transparent records, and clearly disclose custody risks. This reduces ambiguity in insolvency scenarios and strengthens user claims.

In the United States, custody rules originally designed for securities are being extended to digital assets, particularly for institutional funds. While retail protections remain uneven, the legal precedent is shifting toward treating custodial crypto as client property rather than exchange assets.

Elsewhere, common-law jurisdictions are increasingly classifying crypto as property rather than contractual rights, strengthening investor claims during liquidation. These developments do not eliminate risk, but they materially improve legal standing for compliant platforms and their users.

Insurance, Guarantees, and Their Limits

Unlike bank deposits, crypto balances are not protected by government insurance schemes. Some platforms maintain internal insurance funds, and institutional custodians often carry private coverage against theft or operational failure. However, these protections are limited in scope and rarely cover insolvency losses.

Decentralized insurance protocols have emerged to address smart contract risk, but they do not protect against centralized platform failure. For retail investors, meaningful insurance coverage remains the exception rather than the norm. This gap reinforces a core principle of crypto investing in 2026: risk management begins with custody choices, not after losses occur.

Practical Risk Reduction for Crypto Investors

Investor protection in crypto is not binary it exists on a spectrum shaped by custody decisions, platform transparency, and jurisdictional safeguards. While regulation is improving, responsibility still rests heavily with the individual.

Long-term holdings are best kept in self-custody, where legal risk is eliminated entirely. Assets that must remain on exchanges for liquidity or trading should be placed only with platforms that demonstrate segregation, regulatory licensing, and verifiable reserves. Diversification across custodians and jurisdictions further reduces exposure to single-point failure. Most importantly, investors must treat terms of service as legal documents—not marketing material, because those clauses define ownership when disputes arise.

The Direction of Investor Rights in Crypto

Investor protection in crypto is no longer stagnant, but it is still uneven. The trajectory is clear: clearer custody definitions, stronger segregation mandates, and growing recognition of crypto as property under law.

Yet until protections approach the robustness of traditional finance, the burden of safety remains asymmetric. Freedom and self-sovereignty are powerful features of crypto, but they demand legal awareness and disciplined risk management. In 2026, informed investors are not just choosing assets wisely. They are choosing where, how, and under whose control those assets exist.

Related Articles

- Blockchain interoperability 101: how cross‑chain bridges actually work and why they’re critical for crypto’s future

- How to build a balanced crypto portfolio that works in both brutal bear phases and euphoric bull runs (2025 blueprint)

- Gas fees explained: how rollups slash Ethereum transaction costs without sacrificing security

- Best Layer‑2 networks in 2025: Arbitrum, Optimism, zkSync and how they really compare