Bitcoin’s remarkable journey toward all-time highs continues with strong momentum and institutional support

The Final Approach- Bitcoin’s $122K Weekend Consolidation

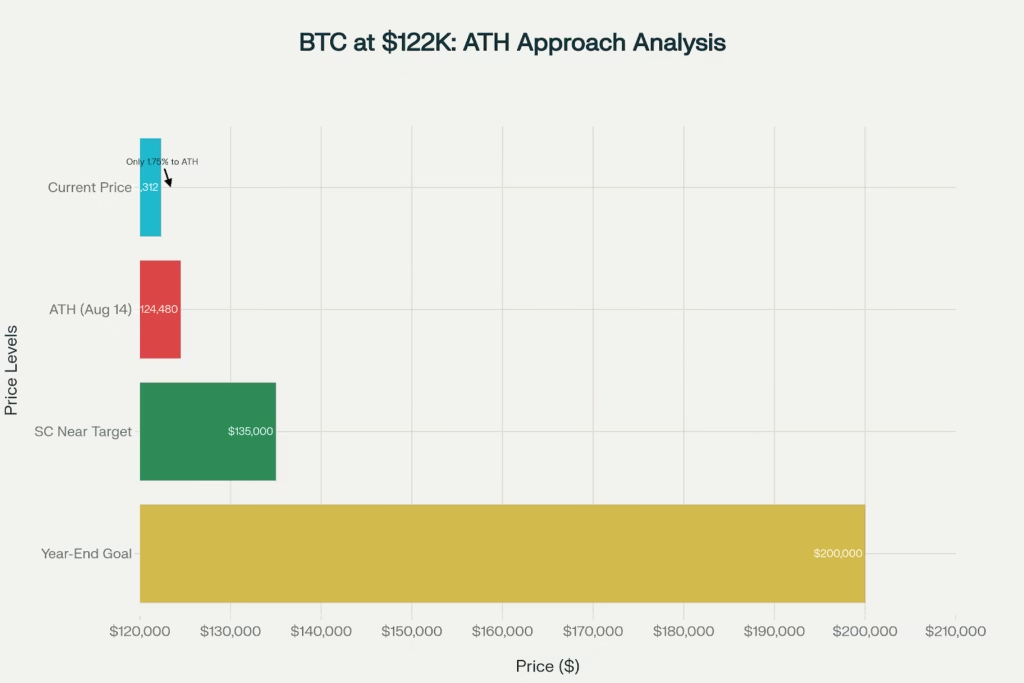

Saturday’s crypto markets present a tantalizing scenario as Bitcoin trades at $122,312 a mere 1.75% or $2,168 away from its August all time high of $124,480. This weekend consolidation at elevated levels comes amid an explosive week that saw the cryptocurrency surge over 10.71%, pushing the total crypto market capitalization to a record breaking $4.21 trillion while institutional money continues flooding into digital assets.

The proximity to new highs has created palpable tension across crypto markets, with traders and institutions positioning for what could be Bitcoin’s definitive breakout into uncharted territory. Standard Chartered’s lead analyst Geoffrey Kendrick adds fuel to the anticipation, projecting Bitcoin could “quickly” reach $135,000 before potentially hitting $200,000 by year-end.

Bitcoin trades at $122K just 1.75% below all-time high as crypto market cap hits $4.21 trillion with Standard Chartered projecting rapid move to $135K

ATH Approach Metrics:

- Bitcoin Position: $122,312 (just 1.75% below $124,480 ATH)

- Weekly Explosion: +10.71% Uptober rally confirming seasonal strength

- Market Milestone: $4.21T total crypto market cap (new 2025 record)

- Institutional Signal: $2.25B Bitcoin ETF inflows this week alone

- Cycle Context: Day 533 from halving, approaching theoretical peak zone

Bitcoin price chart showing a sharp rise to an all-time high of $124K in August 2024 coincentral

Standard Chartered’s Bold $135K-$200K Roadmap

The banking giant’s cryptocurrency research team has issued one of the most aggressive Bitcoin predictions of 2025, with Geoffrey Kendrick arguing that current conditions support a “quick move to $135,000” followed by potential year-end targets reaching $200,000. The analysis centers on an unprecedented convergence of government shutdown uncertainty, ETF adoption acceleration, and rotation from gold ETFs into Bitcoin vehicles.

Kendrick’s research highlights Bitcoin’s emerging correlation with U.S. Treasury term premiums a relationship suggesting the cryptocurrency now trades as a hedge against government risk rather than simply speculative digital asset. With Polymarket traders assigning over 60% probability to the government shutdown lasting 10-29 days, this dynamic could sustain upward pressure through October.

Standard Chartered Analysis:

- Immediate Target: $135,000 “quickly incoming” per Kendrick

- Year-End Projection: $200,000 potential based on ETF flow modeling

- Government Catalyst: Shutdown uncertainty driving institutional hedge demand

- ETF Projection: Additional $20 billion inflows by December

- Gold Rotation: Professional money shifting from gold ETFs to Bitcoin

Bitcoin ETF approval announced with a physical Bitcoin coin showcased on coin stacks reuters

The bank’s $200,000 year-end target relies heavily on projected ETF momentum, with Kendrick noting that Bitcoin ETFs have attracted $23 billion in 2025 alone from a total $58 billion since launch. His models suggest another $20 billion in institutional capital could flow into these vehicles by year end enough liquidity to support dramatic price appreciation.

Market Cap Milestone: $4.21 Trillion Territory

The crypto ecosystem’s expansion to $4.21 trillion represents more than numerical achievement it signals digital assets approaching the scale of entire national economies. Bitcoin’s market capitalization now commands $2.44 trillion, exceeding the valuations of most S&P 500 companies and approaching the GDP of major developed nations.

This weekend’s 0.93% market cap growth demonstrates sustained momentum even during typically quieter trading sessions. The breadth of participation extends well beyond Bitcoin, with major altcoins contributing meaningfully to overall ecosystem expansion.

Digital representation of Bitcoin with an upward trending financial chart indicating market growth economictimes

Market Structure Evolution:

- Bitcoin Leadership: 59.7% dominance maintaining market guidance

- Ecosystem Expansion: Altcoins participating in broad-based growth

- Institutional Scale: Market cap approaching national economy levels

- Volume Confirmation: Heavy professional participation sustaining moves

- Global Recognition: Digital assets achieving mainstream financial scale

Bakkt’s 150% Surge-Infrastructure Play Validates Adoption

Among the week’s most spectacular performers, Bakkt Holdings stock exploded 150% higher as investors recognized the company’s transformation into a debt-free Bitcoin infrastructure platform. The digital asset services provider eliminated all long-term debt while raising $75 million in fresh capital moves that position it as a pure-play beneficiary of institutional crypto adoption.

Bakkt’s surge reflects broader recognition that Bitcoin’s institutional integration requires specialized infrastructure services. As corporations and funds increase their digital asset allocations, companies providing custody, trading, and compliance services are experiencing dramatic revaluations.

Illustration showing Bakkt’s involvement in Bitcoin investment with money bags and Bitcoin coins against a stock market chart background bitcoinworld.co

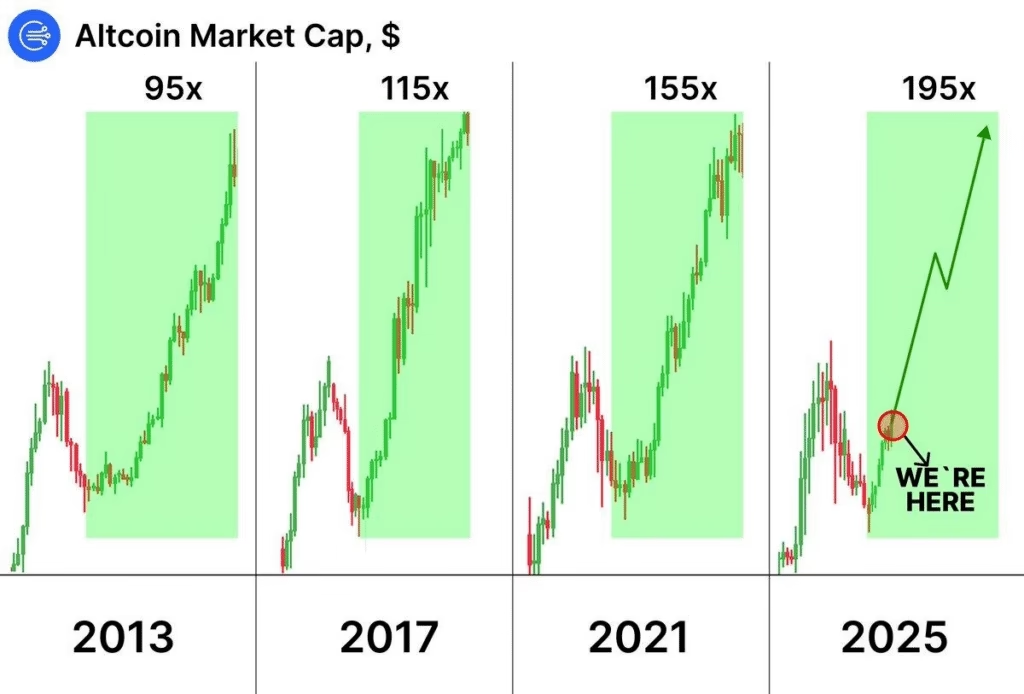

Altcoin Dynamics: Season Index Rising Amid BTC Dominance

Weekend altcoin markets present intriguing dynamics as the Altcoin Season Index climbs toward 65-70 territory while Bitcoin maintains 59.7% market dominance. This creates tension between technical signals suggesting altcoin rotation potential and Bitcoin’s continued leadership preventing widespread alternative cryptocurrency breakouts.

Ethereum approaches the psychologically significant $5,000 level at $4,497, while XRP trades above $3.00 following decisive resistance breaks. However, the most dramatic altcoin action comes from meme tokens like FLOKI, which surged 25% Saturday, suggesting retail speculation is accelerating alongside institutional Bitcoin accumulation.

Altcoin Performance Spectrum:

- Ethereum: $4,497 approaching $5,000 psychological milestone

- XRP: $3.00+ sustaining key resistance breakthrough

- BNB: $1,161 (+4.26%) ecosystem strength continuing

- Solana: $229 DeFi activity supporting momentum

- FLOKI: +25% daily gain leading meme token revival

Altcoin market rallies show increasing multipliers in 2013, 2017, 2021, and a projected rally for 2025 indicating strong future growth potential cryptodnes

The mixed signals rising Altcoin Season Index alongside persistent Bitcoin dominance suggest markets are in transition between Bitcoin led rallies and broader cryptocurrency participation. Resolution of this tension likely depends on Bitcoin’s ability to break definitively above $124,480.

Government Shutdown: Unexpected Crypto Catalyst

The ongoing U.S. government shutdown has evolved into an unexpected tailwind for Bitcoin’s all time high approach. Unlike previous shutdowns that occurred during crypto’s speculative phases, the current episode finds Bitcoin trading as a mature asset class with established correlations to government risk metrics.

Prediction markets assign over 60% probability to the shutdown lasting 10-29 days, creating extended uncertainty that historically supports alternative asset demand. The delay in economic data releases including critical employment reports provides Federal Reserve policymakers with additional justification for continued monetary accommodation.

Shutdown Market Impact:

- Duration Expectations: 60%+ probability of 10-29 day timeline

- Economic Data: Delayed reports creating policy uncertainty

- Fed Implications: Additional easing justification from limited data

- Safe Haven Demand: Bitcoin benefiting alongside traditional hedges

- Liquidity Conditions: Positive impulse for risk asset performance

Technical Setup

Chart analysis reveals Bitcoin exhibiting textbook pre breakout behavior as it consolidates in the $121,700-$122,800 range just below all time highs. Volume patterns show heavy institutional participation rather than retail speculation, suggesting professional money is positioning for potential upside rather than distribution.

The cryptocurrency’s ability to hold above $122,000 during weekend trading traditionally a period of reduced liquidity demonstrates underlying strength that often precedes explosive moves. Options markets show skew favoring upside, with institutional traders positioning for potential breakouts rather than hedging downside risk.

Technical Framework:

- Consolidation Range: $121,700-$122,800 tight weekend trading

- Volume Profile: Heavy institutional participation evident

- Support Quality: $122,000 level holding during reduced liquidity

- Options Positioning: Skew favoring upside breakout scenarios

- Momentum Indicators: RSI neutral with room for continued advancement

qz

Institutional Flows- $2.25 Billion Weekly Tsunami

This week’s $2.25 billion Bitcoin ETF inflows represent one of the largest institutional allocation periods in cryptocurrency history, bringing 2025’s total to $23 billion from $58 billion accumulated since product launches. The magnitude suggests professional portfolio managers view current levels as strategic entry points rather than late cycle positioning.

The flow patterns indicate sophisticated timing, with institutional capital entering precisely as Bitcoin approaches technical breakout levels. This coordination between professional positioning and technical setups often precedes major price movements in institutional asset classes.

ETF Flow Analysis:

- Weekly Surge: $2.25 billion institutional allocation

- 2025 Momentum: $23 billion YTD from $58 billion total

- Timing Coordination: Professional entry at technical breakout levels

- Future Projections: Standard Chartered models $20 billion additional inflows

- Rotation Evidence: Early signs of gold ETF to Bitcoin ETF shifts

Weekend Psychology-Cautious Excitement Builds

Market psychology Saturday reflects cautious optimism rather than euphoric speculation a sentiment structure that historically supports sustained rallies rather than bubble formations. Social media discussions focus on technical levels and institutional adoption rather than get rich quick narratives, suggesting healthier market development.

The approach to all time highs without extreme Fear & Greed readings indicates markets have matured beyond purely emotional trading patterns. Professional participation appears to be moderating retail speculation while providing liquidity foundation for potential breakouts.

Sentiment Assessment:

- Market Psychology: Cautious optimism avoiding euphoria extremes

- Social Media: Technical and fundamental focus over speculation

- Fear & Greed: Optimistic but measured readings

- Institutional Behavior: Professional positioning over emotional trading

- Retail Participation: FOMO building but not yet extreme

Q4 Outlook: Historical Patterns and Modern Catalysts

October’s performance continues validating the “Uptober” phenomenon with Bitcoin delivering over 10% weekly gains that align with historical seasonal strength. With the month’s 83% success rate over the past dozen years, current momentum suggests potential continuation through traditional fourth-quarter strength periods.

November historically represents Bitcoin’s strongest month, creating conditions where current all time high approaches could expand into sustained new territory. The convergence of seasonal patterns, institutional adoption, and macroeconomic support creates a setup potentially rivaling Bitcoin’s most explosive historical periods.

The $124,480 Moment Approaches

Bitcoin’s weekend consolidation at $122,312 creates one of cryptocurrency’s most anticipated scenarios a major digital asset trading within touching distance of all-time highs while institutional money floods in at record rates and market capitalization reaches historic peaks above $4.2 trillion.

The convergence of Standard Chartered’s aggressive $135,000-$200,000 predictions, record ETF inflows, government shutdown uncertainty, and classic technical breakout setups suggests the coming days could define Bitcoin’s trajectory for the remainder of 2025. Whether the cryptocurrency can decisively breach $124,480 and maintain momentum toward $135,000 represents the critical question facing digital asset markets.

The institutional adoption story evidenced by Bakkt’s 150% surge and sustained professional inflows provides fundamental support independent of technical patterns. As traditional economic systems face shutdown induced uncertainty, Bitcoin continues demonstrating its evolution from speculative asset to institutional hedge and portfolio diversifier.

Saturday’s patient consolidation just 1.75% below all-time highs may prove to be the calm before Bitcoin’s next explosive chapter, with $135,000 and beyond potentially within reach before October concludes.

ATH Approach Summary:

- Bitcoin Position: $122,312 (just 1.75% or $2,168 below $124,480 ATH)

- Market Milestone: $4.21T crypto market cap reaching new 2025 record

- Standard Chartered: $135K “quickly incoming” with $200K year-end potential

- Institutional Surge: $2.25B Bitcoin ETF inflows this week alone

- Weekend Setup: Classic pre-breakout consolidation near record highs

Related Coverage: