British fintech giant obtains Cyprus regulatory approval to offer compliant crypto trading, staking, and stablecoin services across entire European Economic Area under groundbreaking MiCA framework

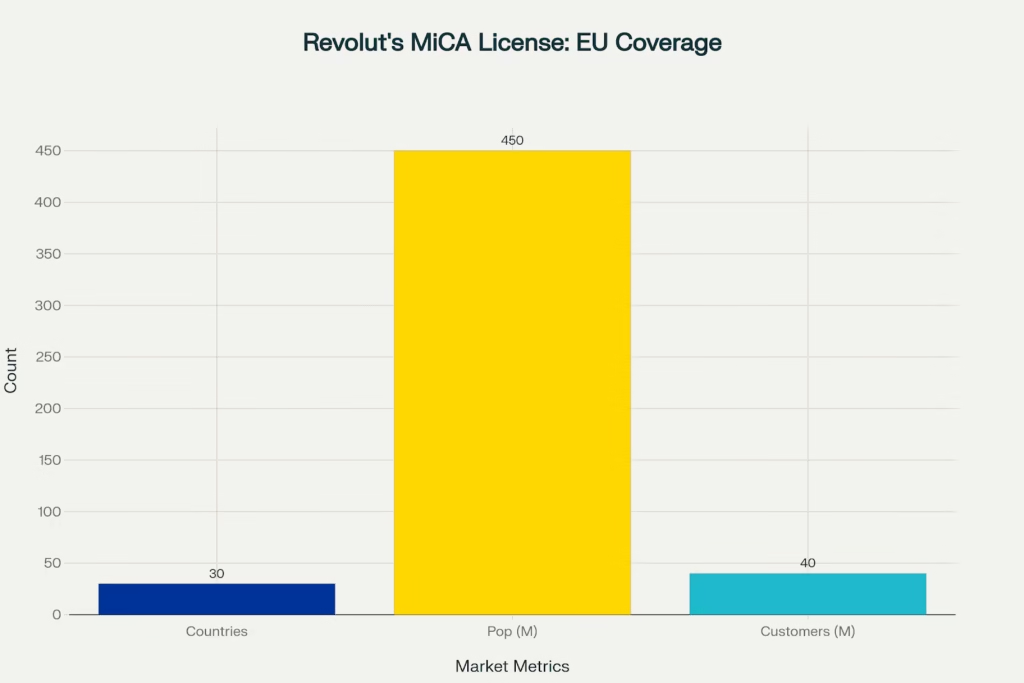

British Fintech major Revolut has secured a Markets in Crypto Assets (MiCA) license from the Cyprus Securities and Exchange Commission (CySEC), marking a pivotal milestone in the company’s European crypto expansion strategy. The authorization, announced Thursday, October 23, 2025, enables Revolut to provide fully regulated cryptocurrency services across all 30 countries in the European Economic Area (EEA), covering a potential market of over 450 million people.

The landmark approval positions Revolut among the first major fintech firms to secure comprehensive authorization under the EU’s groundbreaking MiCA regulatory framework, which came into full effect across the bloc in 2024. The license strengthens Revolut’s compliance-focused approach to digital assets and validates the company’s regulatory standards in the eyes of European financial authorities.

“Securing the licence reflects CySEC’s trust in our regulatory standards,” said Costas Michael, CEO of Revolut Digital Assets Europe, in an emailed statement Thursday. “MiCA gives us the clarity to deliver trusted, next-generation crypto products for Europe’s growing digital finance community”.

MiCA Framework: Europe’s Comprehensive Crypto Regulation

The Markets in Crypto Assets (MiCA) regulation represents the European Union’s first comprehensive regulatory framework for cryptocurrency markets, establishing unified standards for crypto asset service providers across the 27 EU member states plus three European Free Trade Association (EFTA) countries like Iceland, Liechtenstein, and Norway.

Revolut’s MiCA license enables crypto services across 30 EEA countries covering 450 million people, with 40 million current European customers

The regulation aims to enhance consumer protection, establish market integrity standards, and create transparency requirements for exchanges, wallet providers, and other crypto service platforms operating within the European market. By securing a MiCA license through Cyprus, Revolut can now legally market and provide its full suite of crypto products under a single regulatory framework across all EEA markets.

Emil Urmanshin, Director of Crypto & New Bets at Revolut, emphasized the strategic significance: “Crypto is a big part of our belief in banking without borders, and securing our MiCA licence is a critical milestone”.

Revolut Crypto 2.0: Expanded Platform Launch

Concurrent with the MiCA license announcement, Revolut unveiled plans to launch “Crypto 2.0,” a next-generation platform significantly expanding the company’s digital asset offerings across Europe. The enhanced platform represents a substantial upgrade from Revolut’s existing crypto services, which the fintech first introduced to its customer base in 2017.

Revolut Crypto 2.0 Platform Features:

- Token Selection: 280+ cryptocurrencies available for trading

- Staking Services: Zero-fee staking with annual rewards up to 22% APY

- Stablecoin Conversion: Direct 1:1 stablecoin-to-USD conversion with no spread

- Trading Fees: 0.00%-0.09% through Revolut X platform (among lowest in Europe)

- Wallet Integration: Direct connection with MetaMask and Ledger via Revolut Ramp

- Payment Cards: Crypto-enabled Visa/Mastercard cards for seamless on/off-ramping

- Mobile Access: Full functionality on iOS and Android platforms

- Regulatory Compliance: Complete MiCA framework adherence across all 30 EEA markets

The platform’s zero-fee staking feature offering yields up to 22% represents a particularly competitive offering in the European market, while the 1:1 stablecoin to USD conversion with no spread addresses a common pain point for crypto users transitioning between digital and traditional currencies.

“When paired with crypto-enabled Revolut Visa/Mastercard cards, seamless on/off-ramping tools, and Revolut X’s low trading fees (0.00%-0.09%), the platform delivers one of the broadest and most cost-effective crypto experiences in Europe,” Revolut stated in its announcement.

Cyprus Hub Strategy and European Operations

Revolut has strategically designated Cyprus as its central operational hub for all EEA crypto activities under the new MiCA license. The Mediterranean island nation has emerged as an attractive jurisdiction for fintech and crypto firms seeking to establish EU-compliant operations, offering a combination of regulatory sophistication, favorable business environment, and strategic geographic positioning.

The Cyprus-based structure will oversee Revolut’s crypto service expansion across all 30 EEA markets, ensuring consistent regulatory compliance and unified operational standards throughout the European footprint. This centralized approach allows Revolut to efficiently scale its crypto offerings while maintaining the transparency and user protection requirements mandated under MiCA.

Costas Michael noted that the Cyprus authorization “becomes part of the foundation for the Fintech firm’s business strategy in digital finance,” positioning Revolut to compete effectively with both traditional financial institutions expanding into crypto and crypto-native platforms launching traditional financial services.

Massive Revenue Growth Driven by Crypto Trading

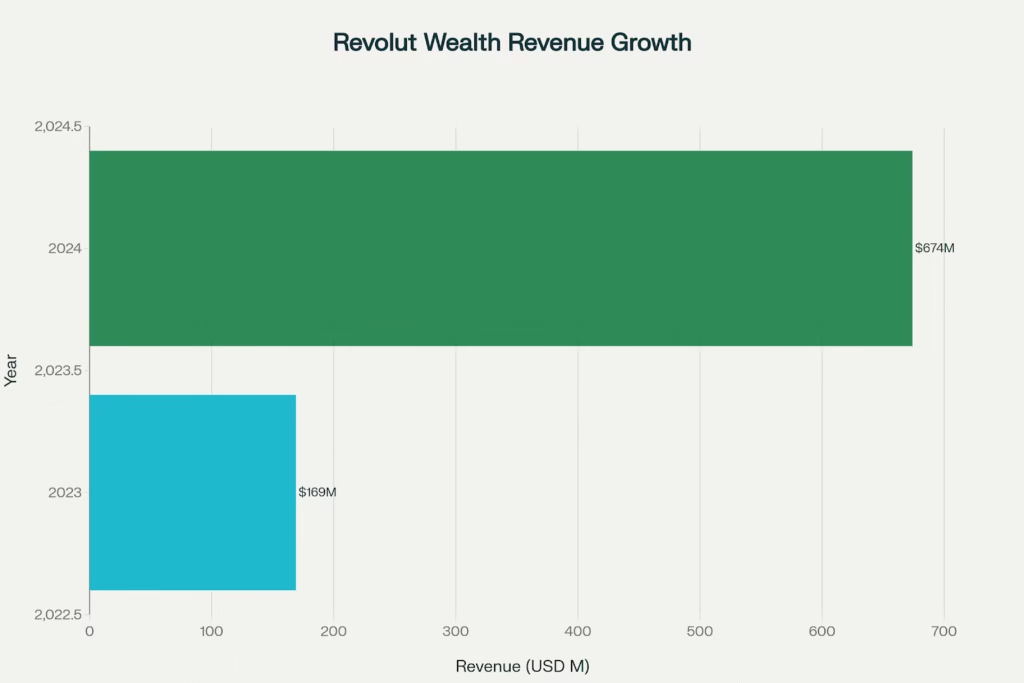

Revolut’s strategic emphasis on cryptocurrency services has delivered substantial financial returns, with the company’s wealth business segment which includes crypto products and trading activity experiencing explosive growth throughout 2024.

Revolut’s wealth business revenue surged 298% year-over-year to $674 million, driven by crypto trading boom

Revolut Wealth Business Performance:

- 2024 Revenue: $674 million

- 2023 Revenue: $169 million

- Year-over-Year Growth: +298%

- Primary Driver: Surging cryptocurrency trading activity

- Customer Base: 65 million globally, 40 million in Europe

- European Crypto Users: 14 million actively trading digital assets

The nearly 300% revenue surge reflects both increased crypto adoption among Revolut’s existing customer base and the platform’s success in attracting new users specifically for digital asset services. The wealth segment’s performance has made crypto a cornerstone of Revolut’s overall business model, justifying continued investment in regulatory compliance and product development.

The MiCA license now provides Revolut with regulatory certainty to further accelerate this growth trajectory across the European market, with analysts suggesting the expanded Crypto 2.0 platform could drive significant additional revenue in 2025 and beyond.

Competitive Positioning in European Crypto Market

The MiCA authorization positions Revolut to compete directly with major crypto-focused platforms and traditional financial institutions that have expanded into digital assets. Fintech now operates on equal regulatory footing with established crypto exchanges while leveraging its broader banking relationship with millions of European customers.

Key Competitors in European Crypto Market:

- Crypto-Native Exchanges: Coinbase, Kraken, Binance (all seeking or holding MiCA licenses)

- Traditional Finance: PayPal, Robinhood expanding crypto services in Europe

- Banking Giants: BlackRock, Fidelity offering crypto investment products

- Fintech Rivals: Stripe, other digital banks adding crypto capabilities

- European Challengers: Local fintech firms building crypto-first platforms

Revolut’s advantages include its established customer base of 40 million Europeans, integrated banking services that enable seamless fiat-to-crypto transitions, low-fee structure through Revolut X, and first-mover status among major fintechs under the new MiCA framework.

However, the company faces intense competition from both crypto-native platforms with deeper technical expertise and traditional financial giants bringing institutional credibility and massive capital resources. The ability to execute effectively on the Crypto 2.0 platform rollout while maintaining regulatory compliance across 30 jurisdictions will be critical to Revolut’s success.

Industry Implications and Regulatory Trends

Revolut’s MiCA license represents a broader trend toward regulatory clarity and legitimization of cryptocurrency services within the European Union, contrasting with the more fragmented approach in other major markets including the United States.

The EU’s comprehensive MiCA framework provides crypto firms with regulatory certainty absent in many other jurisdictions, potentially making Europe an attractive destination for digital asset innovation and investment. By establishing clear rules around consumer protection, market manipulation prevention, and operational transparency, MiCA aims to foster sustainable growth of the crypto industry while mitigating systemic risks.

“MiCA approval cements Revolut as a top EU fintech crypto leader,” noted analysis from Coin Central, highlighting the strategic importance of early authorization under the new framework. Companies securing MiCA licenses ahead of competitors gain significant first-mover advantages in establishing market share and customer relationships under the unified regulatory regime.

The Cyprus regulator’s approval of Revolut’s application also signals CySEC’s willingness to support major fintech firms entering the crypto space, provided they meet stringent compliance standards. This regulatory openness, combined with Cyprus’s strategic positioning as a European crypto hub, could attract additional firms seeking MiCA authorization.

Crypto’s Role in Digital Banking

The successful authorization comes as Revolut continues expanding globally, having recently secured full banking approval in Mexico making it the first independent digital bank to complete the licensing process from scratch in that market. The dual regulatory victories in Europe and Latin America underscore Revolut’s strategy of prioritizing compliance and regulated expansion in major markets.

For the broader cryptocurrency industry, Revolut’s MiCA license and Crypto 2.0 launch represent validation of crypto’s integration into mainstream financial services. The ability of a $75 billion fintech serving 65 million customers to offer comprehensive, regulated crypto services across 30 European countries marks a significant evolution from crypto’s earlier perception as a fringe technology.

As additional firms secure MiCA authorizations throughout 2025, Europe is positioned to emerge as one of the world’s most developed regulated crypto markets, potentially setting standards that influence regulatory approaches in other regions. For consumers, this regulatory clarity should translate into greater confidence, enhanced protection, and more competitive service offerings as established players like Revolut compete with crypto-native platforms.

Key Takeaways:

- Regulatory Milestone: Revolut secures comprehensive MiCA license from Cyprus CySEC for all 30 EEA countries

- Market Reach: Authorization covers 450 million Europeans; Revolut currently serves 40 million European customers

- Crypto 2.0 Platform: Launches with 280+ tokens, zero-fee staking (up to 22% APY), 1:1 stablecoin conversions

- Revenue Growth: Wealth business surged 298% YoY to $674M driven by crypto trading boom

- Strategic Hub: Cyprus designated as operational center for European crypto services

- Competitive Position: Positions Revolut to compete with Coinbase, Kraken, PayPal, Robinhood in European market

- Industry Impact: Validates crypto integration into mainstream banking; demonstrates MiCA framework effectiveness

Risk Considerations: Cryptocurrency investments involve substantial risk including potential loss of principal. Staking rewards are not guaranteed and may vary based on network conditions. Users should understand the terms, conditions, and risks associated with crypto services before participating. The information presented is for educational purposes only and does not constitute financial advice. Regulatory frameworks continue to evolve and may impact service availability.