Pi Network’s announcement of $10 million in strategic funding from OpenMind represents more than capital injection—it exemplifies the sophisticated due diligence and selective investment approach that now characterizes institutional crypto funding. As venture capital deploys nearly $300 billion toward blockchain projects over the next year, Pi Network’s funding structure and allocation strategy offer insights into how institutional investors evaluate long-term viability in an increasingly mature cryptocurrency ecosystem.

Strategic Capital Allocation: Beyond Speculative Investment

OpenMind’s $10 million commitment to Pi Core Team reflects rigorous evaluation process that prioritizes sustainable development over speculative market positioning. The funding structure demonstrates institutional recognition that successful blockchain projects require multi-year development timelines and sustained capital commitment rather than quick deployment strategies.

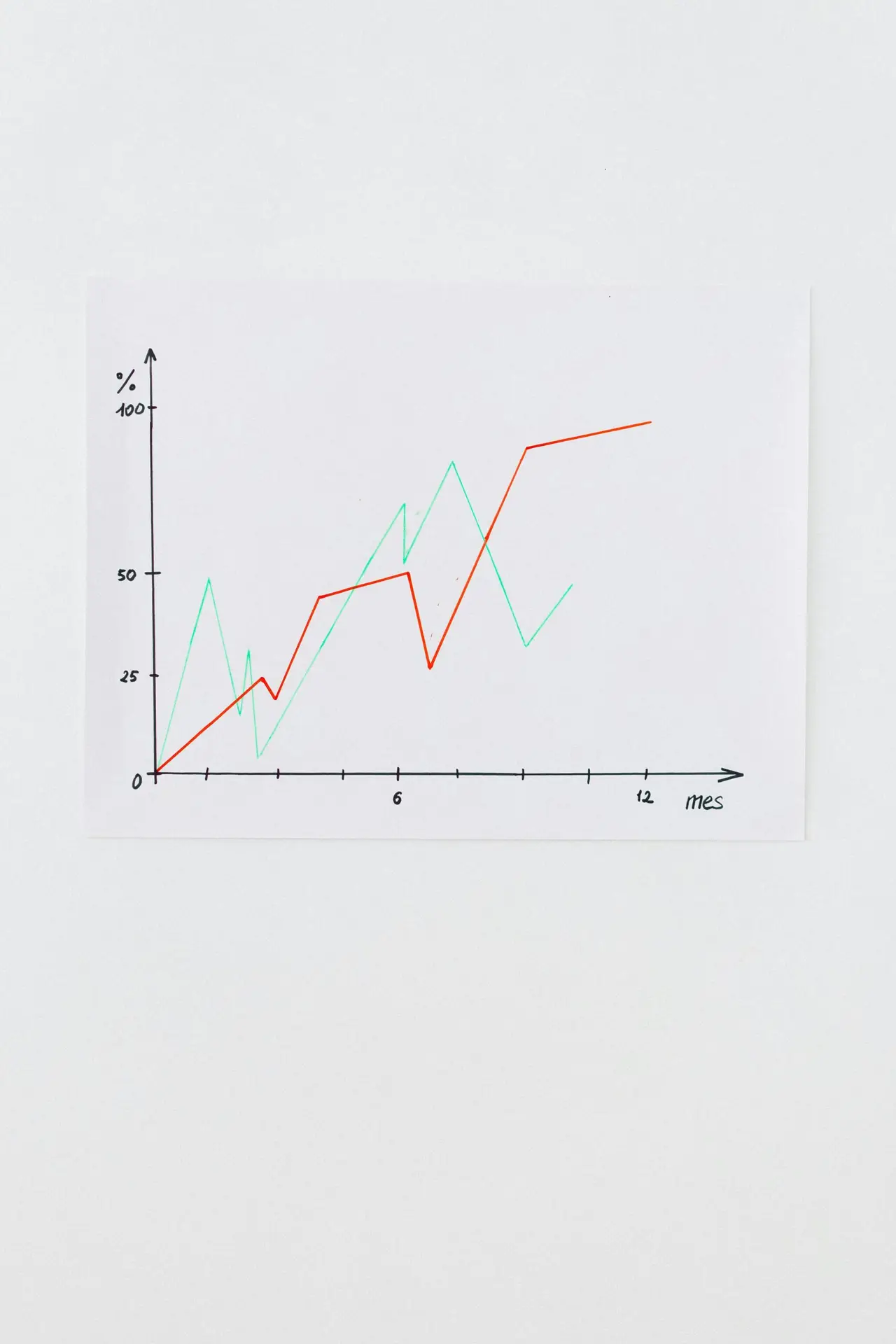

Pi Network’s strategic funding allocation prioritizes development and engineering at 42%, signaling focus on technical advancement

The investment allocation reveals strategic priorities: $4.2 million (42%) dedicated to development and engineering, $2.1 million (21%) for marketing and partnerships, and $1.8 million (18%) for security and compliance. This distribution emphasizes technical excellence and operational infrastructure over promotional activities that characterized previous crypto funding cycles.

OpenMind’s investment thesis centers on Pi Network’s unique approach to cryptocurrency accessibility through mobile device mining capabilities. Unlike energy-intensive proof-of-work systems or capital-intensive proof-of-stake mechanisms, Pi Network’s consensus algorithm enables broader participation without specialized hardware requirements.

The funding timing coincides with growing institutional interest in blockchain projects that address real-world accessibility challenges rather than purely speculative applications. As cryptocurrency adoption expands beyond technical enthusiasts, projects like Pi Network that prioritize user-friendly interfaces attract institutional attention.

Due Diligence Evolution: From Speculation to Fundamentals

The rigorous evaluation process preceding OpenMind’s investment reflects broader transformation in crypto venture capital approaches. Unlike 2021-2022’s speculative funding environment, current institutional investors demand detailed technical audits, regulatory compliance assessments, and sustainable tokenomics models before capital deployment.

Pi Network’s ability to secure funding despite operating without traditional token trading demonstrates institutional recognition of alternative value creation models. The project’s focus on building functional ecosystem before token monetization appeals to investors seeking sustainable business models rather than speculative trading opportunities.

OpenMind’s investment committee reportedly conducted six months of due diligence including technical architecture review, regulatory compliance assessment, and market analysis. This timeline reflects institutional investors’ increased sophistication in evaluating blockchain projects beyond superficial metrics.

The funding also validates Pi Network’s community-centric development approach, which has attracted over 47 million engaged users globally. Institutional investors increasingly recognize that sustainable blockchain projects require genuine user adoption rather than speculative trading volume.

Institutional Funding Trends: Quality Over Quantity

The broader crypto funding landscape has experienced dramatic transformation from peak speculation to selective institutional investment. According to PitchBook data, blockchain startup funding declined 68% by volume but increased 34% in average deal size, indicating institutional preference for mature projects with proven capabilities.

Venture capital firms report receiving 10 times more blockchain project pitches than they fund, with acceptance rates falling below 2% for new projects. This selectivity reflects institutional recognition that most crypto projects lack sustainable business models or technical differentiation necessary for long-term success.

OpenMind’s Pi Network investment aligns with institutional preferences for projects demonstrating: established user bases, regulatory compliance preparation, technical innovation addressing real problems, and experienced development teams with track records of execution.

The funding environment particularly favors projects addressing financial inclusion, which Pi Network targets through accessible cryptocurrency infrastructure. Institutional investors recognize that cryptocurrency’s greatest potential lies in serving underbanked populations rather than speculative trading among affluent investors.

Global Regulatory Alignment and Compliance Focus

Pi Network’s funding success partially reflects its proactive approach to regulatory compliance across multiple jurisdictions. As institutional investors face increasing regulatory scrutiny, they prefer blockchain projects that anticipate rather than react to regulatory requirements.

The project’s emphasis on know-your-customer verification, anti-money laundering compliance, and transparent development processes appeals to institutional investors operating under fiduciary responsibility standards. Unlike projects that struggle with regulatory uncertainty, Pi Network has invested heavily in compliance infrastructure.

OpenMind’s investment includes specific allocations for regulatory compliance and legal framework development, recognizing that successful blockchain projects must navigate complex international regulatory environments. This compliance-first approach distinguishes institutional-backed projects from speculative alternatives.

The funding structure also accommodates potential regulatory evolution, with flexible deployment mechanisms that can adapt to changing legal requirements across Pi Network’s global user base. This adaptability reduces regulatory risk that concerns institutional investors.

Technical Innovation and Scalability Solutions

Pi Network’s mobile-first mining approach addresses fundamental scalability and accessibility limitations that constrain other blockchain networks. The project’s consensus mechanism enables smartphone participation without battery drain or computational intensity that typically limits mobile cryptocurrency engagement.

The technical architecture supporting millions of simultaneous mobile miners represents significant engineering achievement that attracted institutional attention. Unlike blockchain networks requiring specialized hardware or substantial capital stakes, Pi Network democratizes participation through devices users already own.

OpenMind’s technical due diligence reportedly included stress testing Pi Network’s consensus mechanism, security audit of mobile mining protocols, and scalability analysis supporting projected user growth. The positive evaluation results contributed significantly to funding approval.

The project’s ability to maintain network security and consensus integrity while supporting massive mobile participation demonstrates technical sophistication that institutional investors seek in blockchain infrastructure investments.

Community Building and Network Effects

Pi Network’s 47 million user community represents one of the largest engaged blockchain user bases globally, providing network effects that institutional investors recognize as crucial for sustainable cryptocurrency adoption. Unlike projects dependent on speculative trading, Pi Network has built genuine user engagement.

The community growth occurred organically through referral mechanisms and word-of-mouth adoption rather than expensive marketing campaigns or token incentives. This organic expansion appeals to institutional investors seeking evidence of genuine user demand rather than artificially stimulated activity.

OpenMind’s investment thesis includes specific recognition of Pi Network’s community development capabilities and potential for additional user acquisition through improved infrastructure and feature development. The funding enables community expansion while maintaining engagement quality.

The strong community foundation provides institutional investors confidence that Pi Network can sustain long-term development cycles necessary for complex blockchain project maturation. Community support reduces project abandonment risk that concerns institutional investors.

Market Position and Competitive Differentiation

Pi Network’s positioning within the broader cryptocurrency ecosystem offers unique value proposition that attracted institutional investment. Rather than competing directly with established cryptocurrencies like Bitcoin or Ethereum, Pi Network addresses accessibility gaps that limit mainstream adoption.

The project’s focus on mobile accessibility, energy efficiency, and user-friendly interfaces creates differentiated market position that doesn’t require displacing established cryptocurrencies. This complementary approach reduces competitive risks while expanding cryptocurrency’s addressable market.

OpenMind’s competitive analysis reportedly concluded that Pi Network’s approach addresses genuine market needs that other blockchain projects overlook or inadequately serve. The differentiated positioning reduces market risk while offering substantial upside potential.

The investment timing reflects institutional recognition that cryptocurrency adoption requires diverse approaches serving different user segments and use cases. Pi Network’s mobile-first strategy addresses mainstream adoption barriers that limit other blockchain projects.

Future Development and Strategic Roadmap

The $10 million funding enables Pi Network to advance development roadmap including mainnet launch, ecosystem application development, and international expansion. These milestones provide concrete progress indicators that institutional investors use to evaluate ongoing investment success.

Pi Network’s strategic roadmap emphasizes sustainable development over rapid token deployment, appealing to institutional investors seeking long-term value creation rather than short-term speculative gains. The measured approach reduces execution risk while building sustainable foundations.

OpenMind’s funding includes performance milestones tied to technical achievements, user growth, and regulatory compliance progress. This structured approach ensures capital deployment aligns with strategic objectives while providing investor oversight capabilities.

The funding positions Pi Network for potential additional institutional investment rounds as development milestones are achieved. This progressive funding approach reduces dilution risk while enabling sustained development across multi-year timelines required for blockchain project maturation.

As institutional capital increasingly flows toward blockchain projects demonstrating genuine utility and sustainable development approaches, Pi Network’s funding success illustrates the evolution from speculative crypto investment toward sophisticated venture capital deployment that could define the next phase of cryptocurrency ecosystem development.

URL: /funding/pi-network-10-million-institutional-validation-crypto-investment-evolution

[…] The $10 Million Validation: How Pi Network’s Funding Signals Crypto’s Institutional Evolution […]