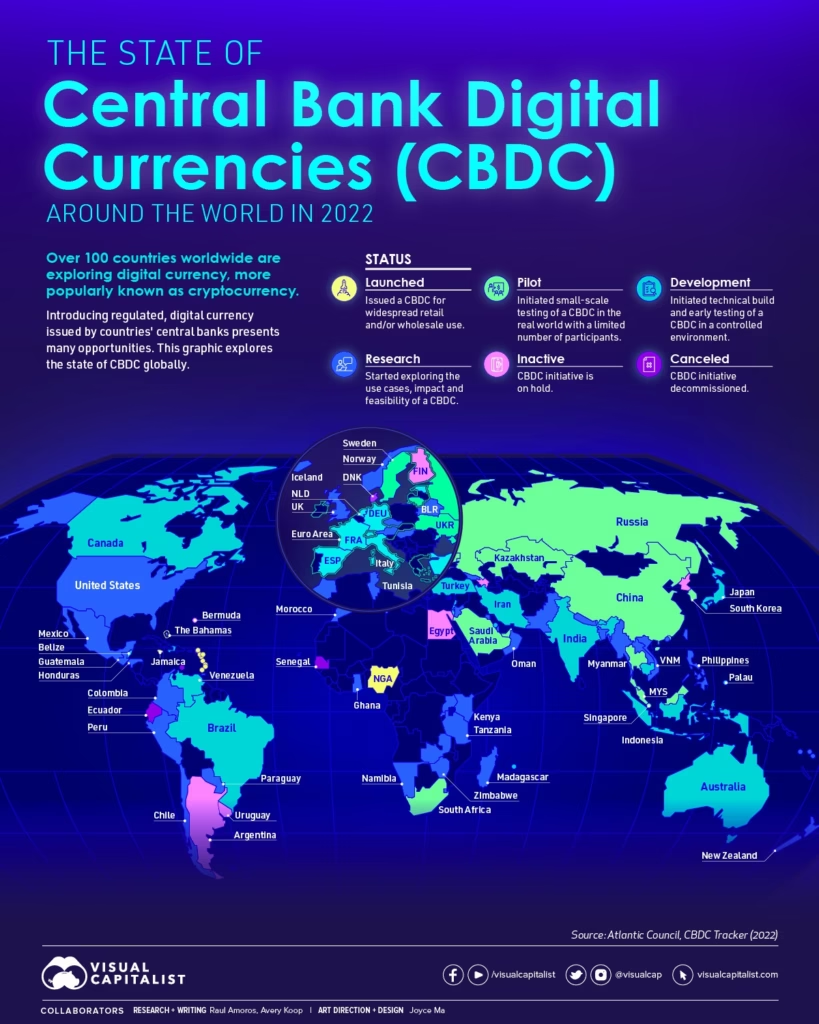

Central Bank Digital Currencies (CBDCs) are no longer theoretical experiments buried in policy papers. As of 2025, over 130 countries representing more than 98% of global GDP researching, piloting, or rolling out state-backed digital currencies. From China’s digital yuan to pilot programs in India, Brazil, Nigeria, and the European Union, governments are racing to modernize money itself.

With this acceleration comes an unavoidable question:

If governments issue digital money, does cryptocurrency still have a role to play?

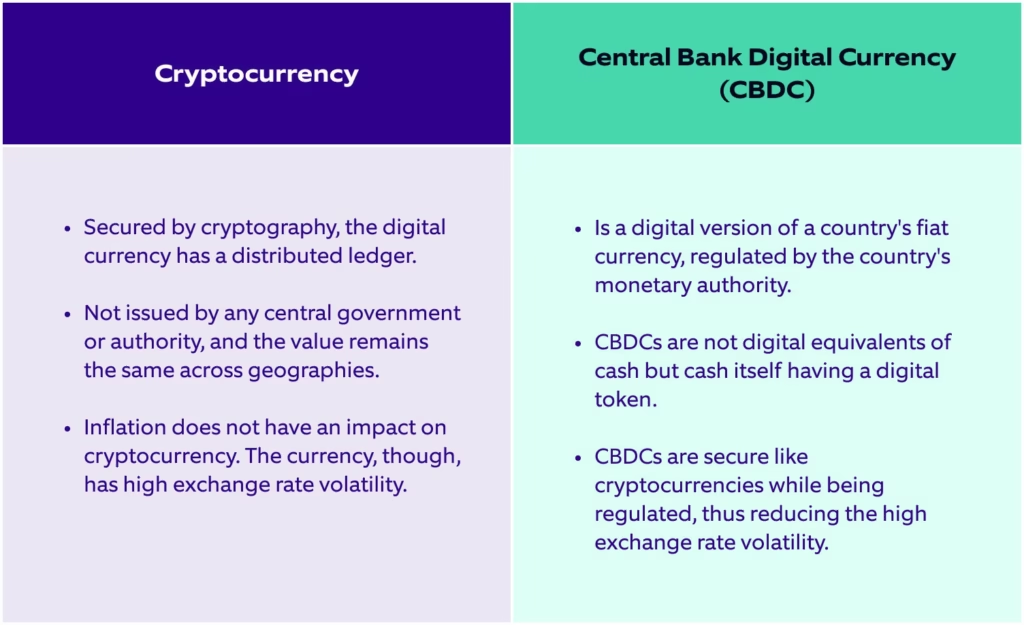

At first glance, CBDCs appear to offer everything crypto promised digital payments, speed, lower costs without volatility. But beneath the surface, CBDCs and cryptocurrencies are built for very different purposes. Understanding those differences is essential to understanding the future of money.

What Are CBDCs, Really?

A Central Bank Digital Currency is a digital representation of a nation’s fiat currency, issued and governed directly by a central bank. Unlike cash, which is anonymous and physical, CBDCs are programmable, traceable, and fully integrated into the state’s financial system.

Importantly, CBDCs are not new money. They do not change the monetary base or introduce scarcity. They simply digitize existing fiat currencies rupees, dollars, euros within a new technological wrapper.

Think of CBDCs as:

- A digital upgrade to cash

- A settlement layer for modern economies

- A policy tool for central banks

They are not designed to be speculative assets, open financial platforms, or alternatives to state authority.

Why Governments Are Pushing CBDCs So Aggressively

The global CBDC push is driven by strategy, not curiosity.

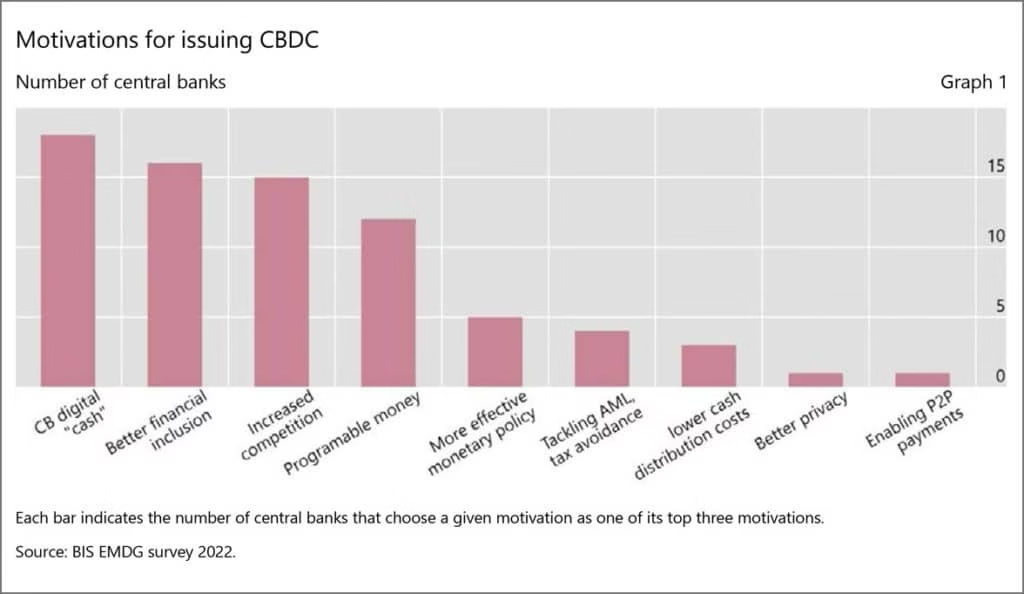

1. Modernizing Payment Infrastructure

Traditional banking rails are slow, fragmented, and expensive, especially across borders. CBDCs promise:

- Near-instant settlement

- 24/7 availability

- Reduced dependency on intermediaries

For governments, this means more efficient economies.

2. Defending Monetary Sovereignty

Stablecoins like USDT and USDC already function as shadow digital dollars across emerging markets. From a state’s perspective, this is unacceptable. CBDCs are a way to reassert control over money creation and circulation.

3. Enhanced Monetary Policy Tools

CBDCs could allow:

- Direct stimulus payments

- Programmable spending (time-limited funds)

- Negative interest rate enforcement

This level of control is impossible with physical cash.

4. Financial Inclusion (In Theory)

CBDCs are often marketed as tools to bank the unbanked. Whether this works in practice depends heavily on digital infrastructure, trust, and governance.

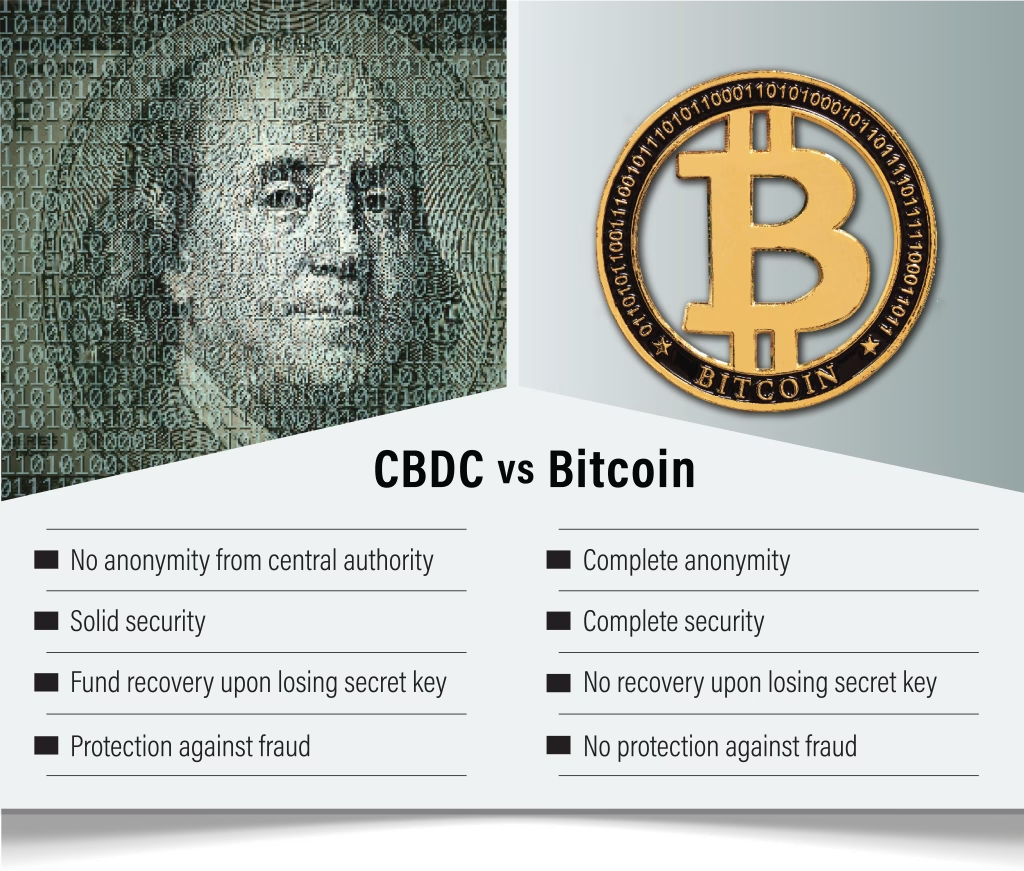

CBDCs vs Cryptocurrencies: The Fundamental Differences

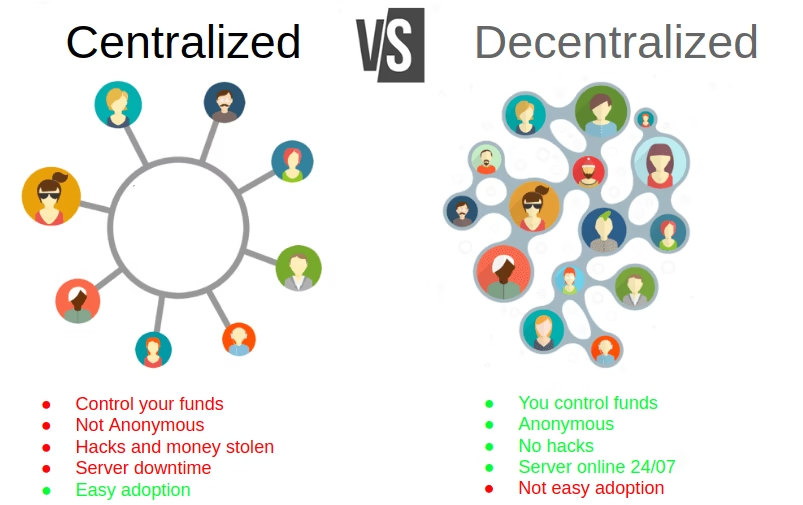

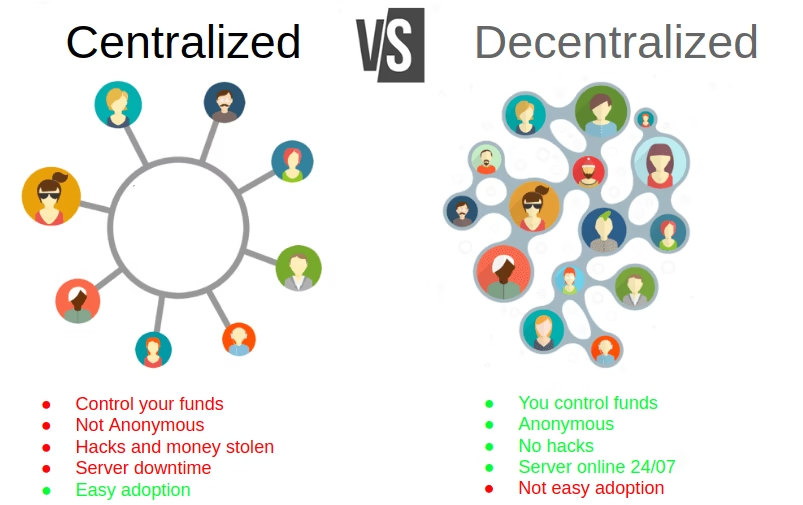

Despite surface similarities, CBDCs and crypto are philosophically and structurally opposed.

| Dimension | CBDCs | Cryptocurrencies |

| Control | Central bank & government | Decentralized networks |

| Supply | Fully discretionary | Algorithmic / capped |

| Privacy | Minimal to none | Varies (from pseudonymous to private) |

| Access | Permissioned | Permissionless |

| Censorship | Possible by design | Resistant by design |

| Programmability | State-controlled | Open & composable |

| Use cases | Payments, policy | DeFi, NFTs, DAOs, savings |

This is not a technical distinction. It is an ideological one.

Can CBDCs Replace Crypto?

Technologically: No

Cryptocurrencies operate on open, public networks where no single authority can rewrite rules, freeze funds, or alter supply. CBDCs are explicitly built to enable control, compliance, and oversight.

Replacing crypto with CBDCs would require removing the demand for:

- Censorship resistance

- Self-custody

- Permissionless innovation

History suggests that demand is only growing.

Functionally: Partial Overlap, Not Substitution

CBDCs may compete with crypto in payments, particularly domestic transactions. A digital rupee or euro could make everyday transfers cheaper and faster.

But crypto has evolved far beyond payments:

- DeFi enables lending, borrowing, and yield without banks

- NFTs enable digital ownership and royalties

- DAOs enable programmable governance

- Bitcoin serves as a non-sovereign store of value

CBDCs are not designed or politically allowed to support these functions.

The Privacy Question: Where CBDCs Face Resistance

Privacy is the fault line where CBDCs face their strongest opposition.

Most CBDC designs allow authorities to:

- Monitor transactions in real time

- Freeze or reverse funds

- Restrict spending categories

- Enforce compliance instantly

For authoritarian regimes, this is a feature.

For democratic societies, it raises profound civil-liberty concerns.

Cryptocurrencies,especially privacy-preserving ones,remain the only viable alternative for users who want financial autonomy in a digital world.

The Real Challenges Facing CBDCs

CBDCs are not guaranteed success.

| Challenge | Why It Matters |

| Infrastructure gaps | Many countries lack reliable digital access |

| Public distrust | Citizens fear surveillance |

| Cybersecurity | Centralized systems are high-value targets |

| Cross-border friction | Interoperability is unresolved |

| Political misuse | Programmable money can be abused |

These challenges slow adoption and open space for decentralized alternatives.

What the Future Likely Looks Like (2025-2030)

Rather than replacement, the future points to coexistence.

A realistic monetary stack:

- CBDCs for regulated, domestic payments

- Stablecoins for global commerce and fintech rails

- Decentralized crypto for savings, innovation, and financial sovereignty

Ironically, the rise of CBDCs may accelerate crypto adoption, as users seek alternatives to increasingly programmable and surveilled money.

Conclusion: Control vs Choice

CBDCs represent the digitization of state power over money.

Crypto represents an opt-out from that power.

These systems are not enemies, but they are not substitutes.

CBDCs will modernize payments.

Cryptocurrencies will preserve choice.

The future of money is not about one winning over the other. It is about individuals understanding the trade-offs and choosing deliberately where to place their trust, value, and autonomy.

Related Articles

- Crypto taxes made simple: how to report, calculate, and file your crypto gains without costly mistakes

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level

- Beginner’s guide: how to earn real passive income from DeFi lending without blowing up your capital

- 10 common crypto scams and exactly how to avoid losing your money to them

- How crypto is transforming everyday life and financial freedom in developing countries

- Ethereum vs Solana: which smart contract platform really wins on speed, cost, and ecosystem strength?